There are many options available for sending money abroad, which can be confusing.

They all do the same thing, but some are cheaper and provide better service than others.

One available option is XE.

In this review, we'll look at how safe XE is, whether their exchange rates are good, what their customers think of them and what their service is like.

I’ll give XE a score out of 5 based on safety, cost, customer reviews, and service, giving a final TopMoneyCompare rating.

Finally, I’ll talk about whether they're a good choice for you, or if there's a better alternative.

What is XE Money Transfer?

XE is an online and mobile money transfer app and currency converter tool.

They were founded in 1993 out of a basement in Ontario, Canada, by two friends.

XE allows you to convert and transfer money internationally for cheaper than a bank.

Initially, XE was a collection of different tools and data feeds before launching their transfer service in 2002.

Euronet, one of the world's biggest transfer providers, acquired XE in 2015 for $380 million.

In 2023 alone, Euronet processed a massive 161 million money transfers.

Transferring with XE is simple:

- Open an account

- Verify yourself

- Select your currencies, amounts and destination

- Click transfer

XE are known for their transparency by displaying mid-market rates on their conversion tool.

However, you actually get a slightly worse rate when performing a transfer.

- 100+ different currencies available

- Owned by a NASDAQ traded company

- Includes their famous currency converter tool

- 30 years old - an industry veteran

- 64000+ reviews on Trustpilot

- May experience long wait times for customer service

- Rates can get worse for smaller amounts

- Opening an account can sometimes be slow

Is XE safe?

XE is one of the safest money transfer companies available.

Here’s why:

- Owned and operated by Euronet, a NASDAQ company

- Authorised and regulated in 6 countries

- 64k reviews and a 4.3/5 rating on Trustpilot

- Over 1m customers

- $115 billion transferred by Euronet for clients annually

Euronet is an American provider of global payments and automated teller machines.

You may have seen one of their many thousands of ATMs across the world.

For safety, I’ve scored XE a perfect 5/5.

Is XE legit?

XE is authorised and regulated in the following countries:

- United Kingdom

- Netherlands (covering all of the EU)

- Australia

- New Zealand

- Canada

- United States (4 states only)

In 2019, Euronet made the decision to merge XE with its UK sister company, HiFX.

All operations are now under the XE brand.

In the UK, HiFX Europe Limited (trading as XE), is regulated by the Financial Conduct Authority (FCA).

Any company that is regulated by the FCA is heavily monitored and reviewed for their safety.

They make sure that all funds are handled securely, clients are treated fairly and all information is kept encrypted.

So, with XE also being regulated in Europe, North America and Oceania, their customers are protected around the globe.

Is your money protected with XE?

As a regulated company, XE is required to keep their clients' funds separate from their own.

Client funds are held in what’s called “ring-fenced and safeguarded” accounts.

These accounts can’t be touched.

They can’t be used for investments or to pay other creditors.

All UK banks are covered by the Financial Services Compensation Scheme, which guarantees up to £85k in case the bank fails.

However, if you have more than that amount, you may not get it back.

But with money transfer companies like XE, there is no upper limit on the amount that is safeguarded.

The only time customers might not receive all their money back is if the costs associated with the liquidation exceed funds held by the business.

In this scenario, the liquidator has the ability to recover their costs from the pool of client funds.

Therefore, depending how you view this, they’re arguably safer to use.

Is XE trustworthy?

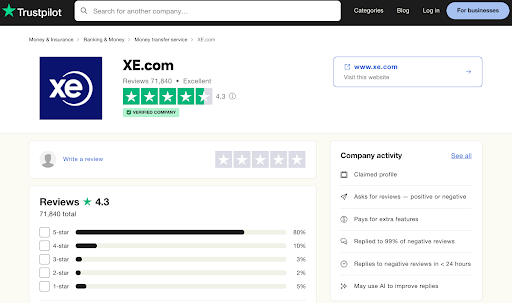

XE has a great rating on Trustpilot with a large number of reviews.

I’ve also taken a look at Euronet’s investor relations page to get a good idea on their numbers:

- Revenue of over $3.7 billion in 2023

- $619 million profit before tax

- Nearly 10,000 employees

I have no issue trusting XE with my money knowing that they’re owned by Euronet.

They’re one of the biggest payments conglomerates going.

XE exchange rates

XE provides competitive exchange rates, however they aren’t the best in the industry.

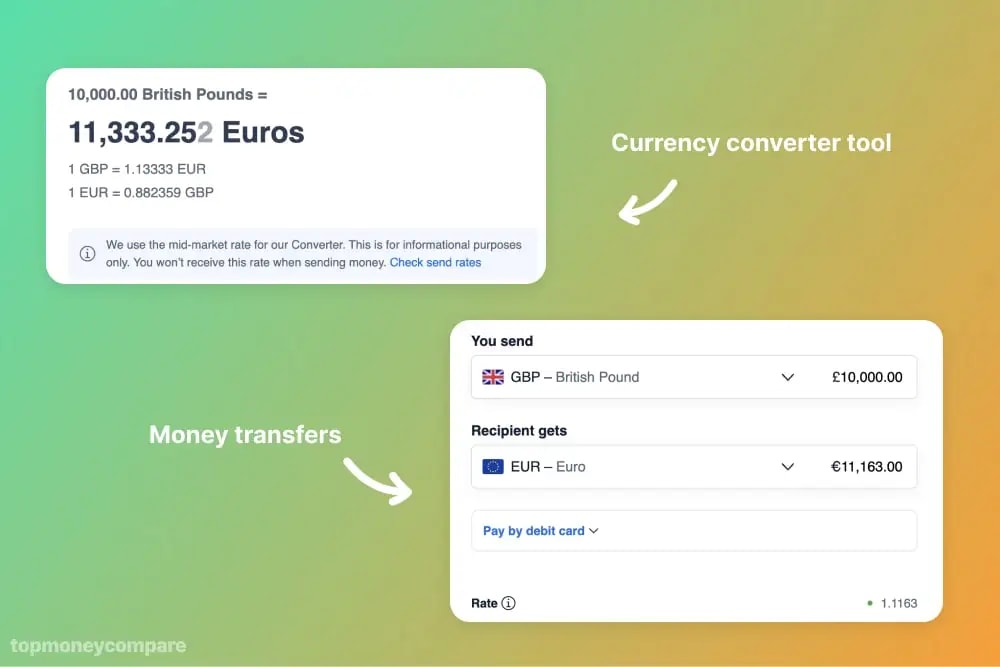

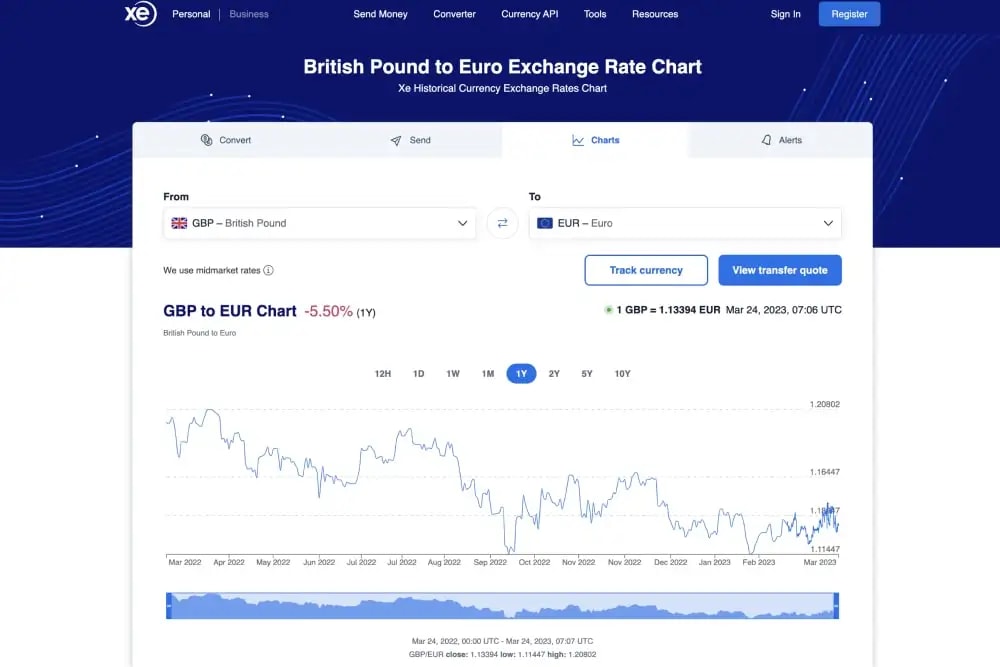

On their website, they have a currency converter tool which displays mid-market rates.

However, when you go to make a transfer, you’ll notice that you won’t get the same rate.

In the above example, the GBP/EUR mid-market rate was 1.13333.

However, when you go to make a transfer, you actually get 1.1163.

On a £10,000 transfer, that’s a difference of €170.25.

Having these two quotes makes it quite easy to work out their exchange rate spread:

As you can see, XE’s spread gets better the more you transfer.

The ‘spread’, or ‘margin’ is the difference between the rate the provider receives when buying the currency, and the rate they give to you when they sell. In other words, it’s the profit they make on the transaction.

See how XE compares to other brokers.

While XE might not be as competitive as other money transfer companies, they’re still a lot better than the banks.

For example, Santander Bank has an exchange rate spread of between 2-4%.

On a transfer of £100,000, XE will be cheaper by around £2,500!

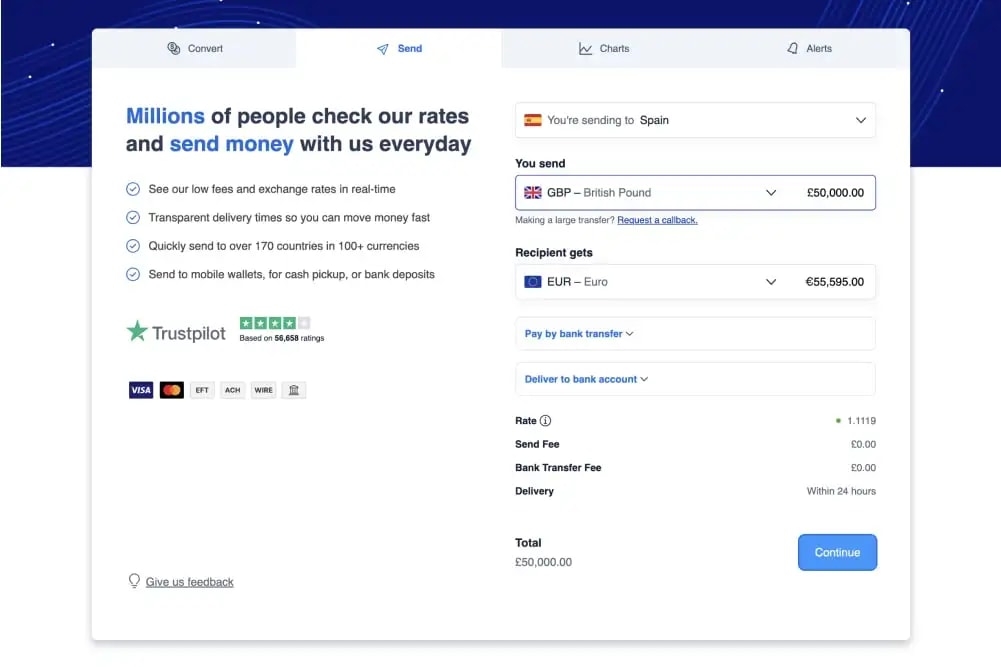

XE for large amounts

What I haven't realised at first as I was writing this Xe review is that the company offers a broker-like function.

That means that for transfers of £50,000 you would get everything you would expect from a currency broker.

It means personal care and service, and also that you would get a bespoke rate for your transfer.

On a large transfer like that, rates could be a lot better than what I've demonstrated above.

XE transfer fees

If you pay by bank transfer, it’s unlikely that XE will apply any fee. Even if you’re sending a smaller amount.

If you pay by card for smaller transfers, XE may apply a £1.99 fee.

Taking both their exchange rates and fees into account, I’ve scored XE a 3.5/5 for cost.

XE reviews

On XE’s Trustpilot page, they have over 60,000 reviews with a 4.2/5 average rating (as of writing).

Their rating is lacking a little compared to the 4.9 rating for Key Currency but beats the 4.3 rating for Wise.

Ultimately, 64k reviews is a large number and to still maintain a relatively good rating means that their customers must like the service.

Based on their customer comments and overall rating, I’ve scored XE a 4.3/5 for customer satisfaction.

XE positive reviews

Here are some positive comments left by XE customers:

- Rates are competitive

- No transfer fees is great

- Transfer process is quick and easy

- Customer support is helpful

It’s of no surprise that their customers love the no fee policy.

Although some clients like the rates, they’re probably unaware of cheaper alternatives.

There’s a lot of comments on how smooth and easy the sign up and transfer process is.

This includes initial onboarding, filling out details and finalising the transfer.

A few customers have praised their customer support team, even naming some employees who have stood out.

This bodes well for XE as, in my opinion, good customer service is paramount in the financial services industry.

XE negative reviews

Here are some negative comments about XE:

- Customer support not helpful with issues

- Exchange rates aren’t competitive

- Accounts being closed without explanation

While some customers like the exchange rates and have experienced helpful customer service, others don’t think so.

But that’s the same with any company.

No matter what, you’ll get people who have high standards which aren’t met.

Maybe the one advisor they had wasn’t as particularly helpful as another could have been.

The ‘uncompetitive exchange rates’ comments are strange though, because you can see exactly what rate you are getting before you commit.

If you don’t like it, you can simply use a cheaper company instead.

There are multiple comments on accounts being closed without reason.

XE is a heavily regulated company owned by a publicly traded firm, so their compliance is strict.

It is industry-standard to not give reasons for account closures.

This is to stop fraudsters from circumventing their compliance and audit procedures.

If someone committing fraud knew how to get around policies and procedures, they would probably do so.

XE service, features and availability

XE has a number of tools available to help you maximise your exchange.

This includes:

- Currency converter tool

- Currency charts

- Rate alerts

- Historical rates

- Mobile app

However, they’re customer support isn’t the best.

While they do have humans that you can talk to, instructions and availability are not immediately clear.

And while some customers have commented on their support being helpful, others have claimed the opposite.

For this, I’ve scored XE a 3.3/5 for service, features and availability.

XE currency converter

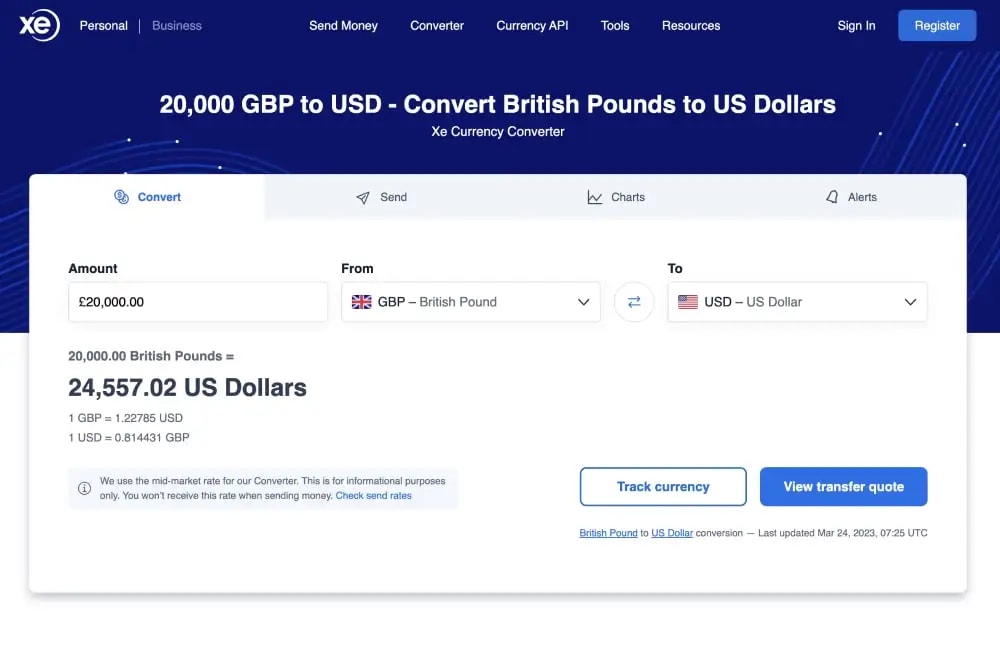

XE’s currency converter tool attracts over 200 million users a year.

To be honest, it’s very good.

It shows you the mid-market rate for any currency pair, quickly.

You can enter an amount and get a converted figure as well.

For example, you can see the GBP/USD mid-market rate above (24th March 2023).

It’s very useful for seeing exactly where the market is in comparison to a transfer rate you are getting (from any company).

We’ve also built our own currency converter tool, which gives you a quick way to get comparison quotes as well.

XE currency charts

Alongside their conversion tool is their charts tool.

It allows you to track the historical movement of a currency pair on a line chart.

You can see movement in increments of hours, days, months and years.

Again, another useful tool for seeing how a currency pair has moved over time and the trajectory it’s on.

You also have the option to ‘track’ the currency, by receiving email alerts when there is significant movement.

XE mobile app

XE has a highly reviewed mobile app in which you can do many things:

- Check live rates

- Check transfer rates

- See currency charts and set up rate alerts

- Sign up for an account

- Add and manage beneficiaries

- Send transfers

- Track transfers

Basically, you can do everything on the app that you can do on their website.

The power of XE in your pocket.On the App Store, the XE app has over 16k ratings with an average score of 4.7/5.

On the Google Play Store, the app has 140k ratings, scoring 4.8/5.

Overall, you have to say it’s widely used and rated very positively.

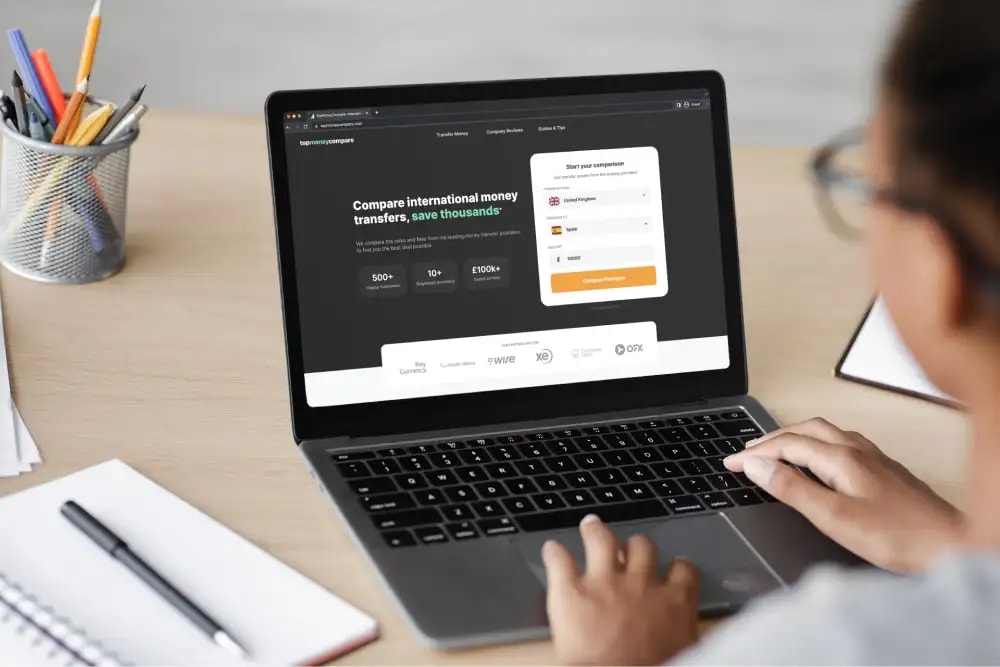

1. Check XE’s rates compared to competitors

You can use TopMoneyCompare’s comparison engine to check out how XE’s rates stack up against their competitors.

You can see the amount and rate you'll receive, transfer fees, and speed.

This way, you can get a clear picture of how they compare and decide if XE is the right option for you.

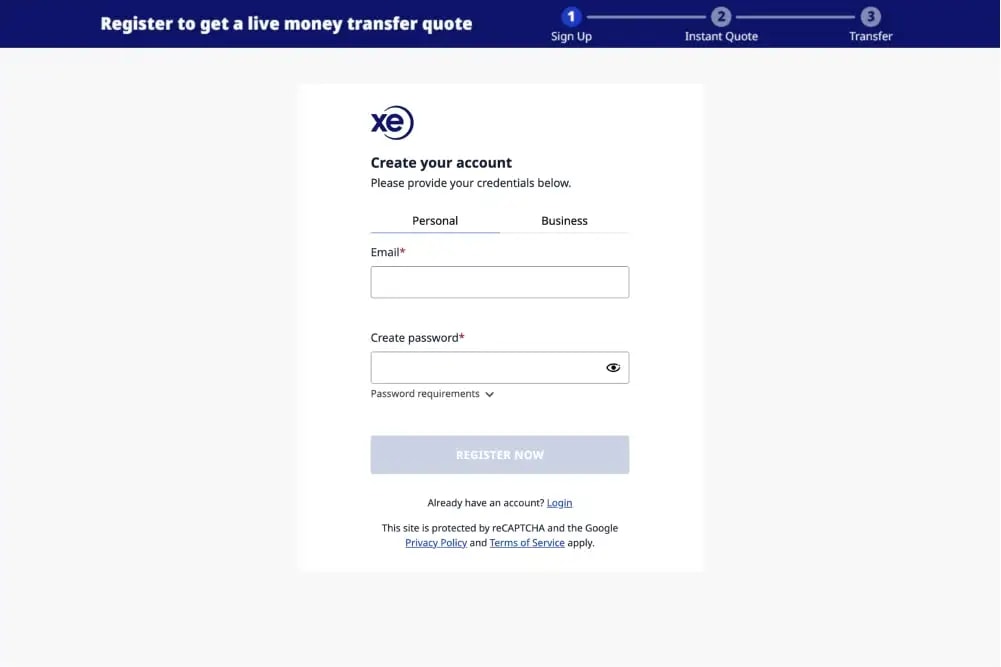

2. Sign up for an account with XE

To use XE for your international transfer, you'll need to sign up.

Click here to sign up for a XE account (opens in a new tab).

First, create your login details.

Then fill out details about yourself and your transfer, and submit the form.

You’ll be asked to take a picture of some ID (drivers licence or passport), and maybe a utility bill or bank statement too.

This is to make sure it’s really you signing up.

Keep in mind that additional checks may be required if your details can't be verified.

3. Go to ‘Send’, enter your amounts and continue

Once your account is open, you can log in to the platform or mobile app and make your transfer.

Enter in your amounts, check the rate, fees (if any) and transfer time, then click continue.

For small amounts, they can take payment via card or bank transfer.

For larger amounts, you’ll only be able to make a bank transfer.

XE will let you know how long you have to get your money to them before the rate changes.

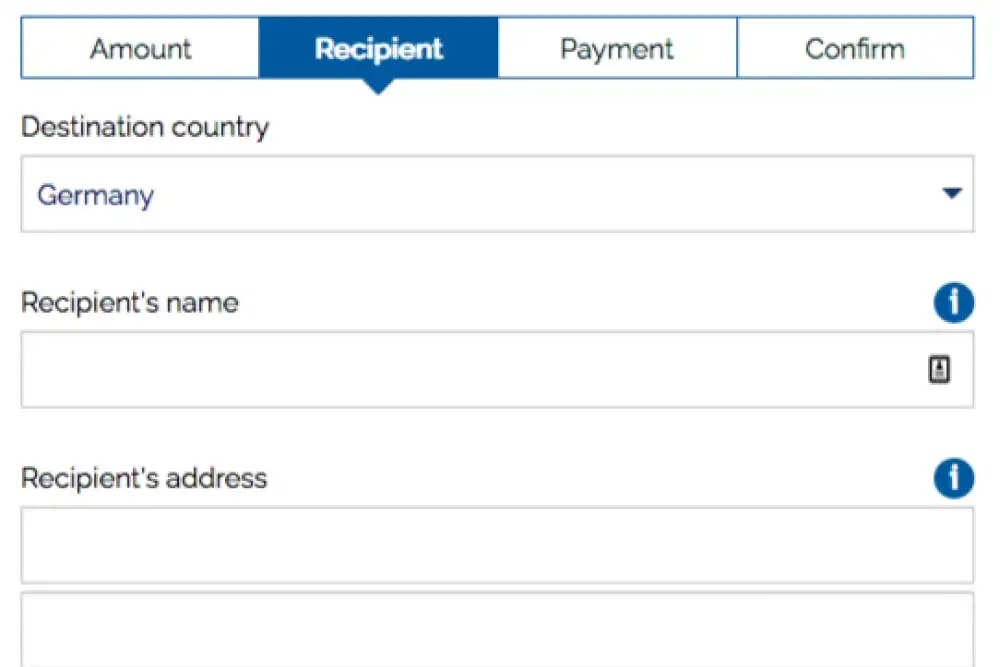

4. Add a recipient

The next step is to add the details of where you want your converted funds transferred to.

The information you’ll need will depend on the receiving country.

Here’s an idea of what you might need:

- UK - account number and sort code

- Europe - IBAN

- USA - account number and routing number

Other countries might require different details.

If in doubt, call customer support. They’ll know what you need.

5. Confirm the transfer and send your funds to XE

Once you’ve confirmed the transfer, it’s time to send your money to XE.

If you opted for the debit card option, they’ll take the money from your card and make the transfer instantly.

If you went for the bank transfer option, you must now transfer your funds to the details provided by XE, using the unique reference number they gave you.

You can do this via online banking, mobile banking, telephone banking or go into a branch.

When XE receives your money, they’ll then make the transfer.

You can then track your transfer via the platform or app.

My verdict: Is XE for you?

XE is one of the most popular tools on the internet for checking out rates of exchange and trends.

Their money transfer service is also quite popular, but is relatively basic.

There are providers out there who provide better rates and more features.

Let’s take a look at when XE is a good choice for you, when it isn’t, and some good alternatives.

When XE works

Here’s when XE online is a good idea for you:

- You’re transferring under £25,000 (or equivalent)

- Safety and peace of mind is important to you

- You want to use a platform or mobile app

Here’s when XE's premium service works:

- You’re transferring under £25,000 (or equivalent)

- Rates are important for you

- Safety and peace of mind is important to you

With XE being owned by a NASDAQ company, you can rest assured that they’re safe to use.

This peace of mind is valuable to some, who just want to know that their money is safe.

On the lower end of transfers, Xe can be a little more pricey than competitors as per our comparison.

For the higher end of transfers, a bespoke quote from Xe can compete with any other broker or company in this space.

When XE doesn’t work

Here’s when XE isn’t a good idea, and you should consider an alternative:

- You’re transferring less than £25,000 (or equivalent)

- You want the best exchange rate possible

- You need a mobile money transfer or airtime top up

XE doesn’t provide mobile money or airtime transfers.

Just below, I’ll give you the names of two companies that do.

XE alternatives

If you’re transferring over £25,000, I recommend considering a currency broker instead.

You’ll be assigned a 1-on-1 account manager who’ll guide you through the whole process.

Transferring large amounts internationally comes with additional stress and worry.

Having a human there who knows you and your situation can help reduce this anxiety.

Not only that, they’ll be quick to assist with any questions or issues you might have.

Some provide better rates than XE, too.

My currency broker, other than XE premium, are are Key Currency, Currencies Direct and TorFX.

If you’re looking for the best exchange rate possible for your small transfer, I would recommend Revolut / Wise.

They both provide mid-market rates.

Wise, however, charges a fee of around 0.4% of your transfer, while Atlantic Money charges £3 for all transfers.

Wise has more currencies and features than Atlantic Money, though.

If you need a mobile money transfer or an airtime top up, XE won’t be able to help.

You can arrange a cash pickup with XE, but if you need to make an airtime top up, XE won’t be able to help.

However, WorldRemit and Remitly both provide these transfer options.

-min.webp)