When sending money abroad, the amount of options available can be overwhelming.

They all largely do the same thing, but what differs is the cost to you and level of service provided.

One option that’s available to you is Key Currency.

In this review of Key Currency, I’ve taken the magnifying glass out to see just how great they are and what’s enabled them to grow so fast.

I’ll talk about how safe they are, if their exchange rates are good, what their customers think of them and the level of service they provide.

I’ve then scored Key Currency out of 5, based on their safety, cost, customer reviews and service, giving an overall TopMoneyCompare rating.

Finally, I’ll discuss whether they’re a good fit for you and if an alternative would be better suited.

Key Currency is a UK-based currency broker, specialising in high-volume international money transfers.

They provide an old-fashioned, service-orientated brokerage service, conducting all of their business via telephone and email.

Once registered, you are assigned an account manager who will keep you updated on the markets, assist with any enquiries and conduct transactions on your behalf.

To book a transaction, you agree the rate and amounts on a recorded telephone line.

Key Currency, alongside close neighbours TorFX, is operated out of Cornwall.

But it’s not just for the beaches and pasties…

As you can expect, it’s a lot cheaper to run a business in the South West than in London.

By passing these savings onto their customers, they can give significantly better rates.

They have won awards for every year since incorporation:

- Best Currency Provider, Online Personal Wealth Awards - 2016, 2017

- Best Currency Exchange Service, ADVFN Awards - 2018, 2019, 2020, 2021, 2022, 2023

The chairman of the company, Clive Cooke, was previously the CEO of the well established Forex and CFDs company ‘City Index’.

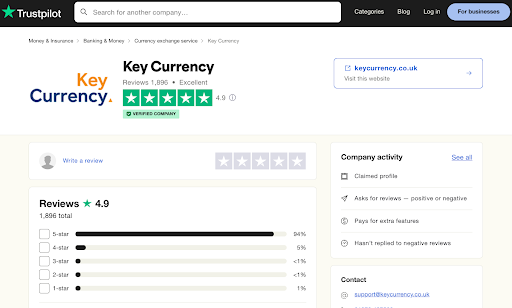

- Positively reviewed online - 4.9/5 stars on Trustpilot

- Very small FX margins, meaning a better rate for you

- Impeccable service - they pick up the phone almost instantly, no holding

- Will keep you updated on the markets every step of the way to time your exchange

- 7 years of experience handling large money transfers and house sales

- No online platform or mobile app

- No exotic currencies available

- No way of viewing rates

Is Key Currency safe to use?

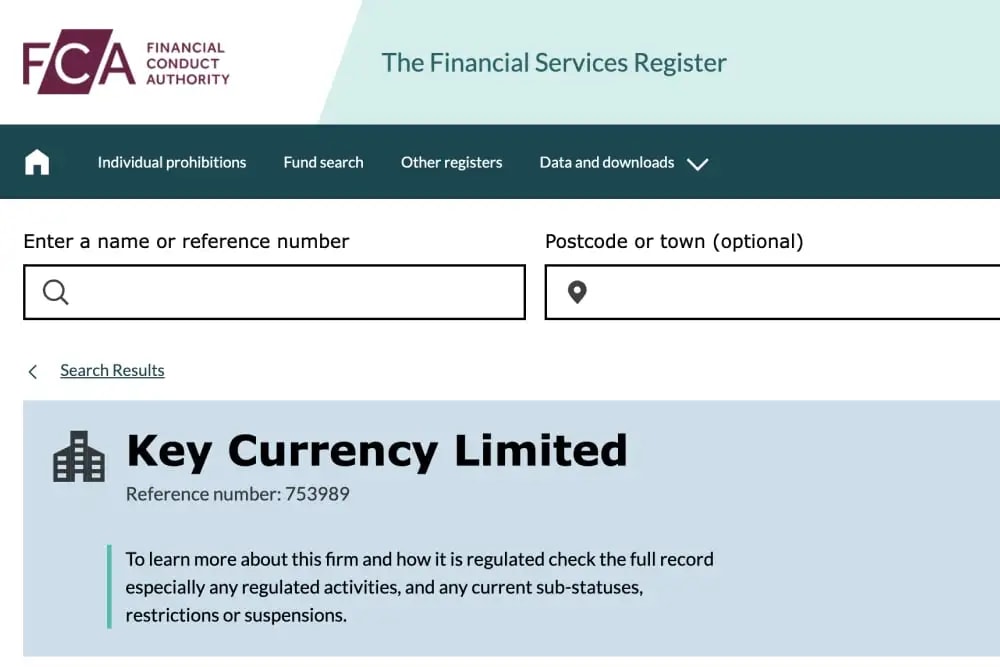

Key Currency is authorised and regulated by the Financial Conduct Authority (FCA) as an Authorised Payment Institution (Financial Services Register No. 753989).

They also transferred a whopping £2 billion for their clients in 2022.

It wasn’t a difficult task to score them high with 4.5/5 for safety.

Is Key Currency legit?

The FCA is the same regulatory body that oversees the big high-street banks.

They give the highest level of protection for your funds.

The FCA doesn’t hand out these badges to just anyone, though.

You have to prove that you are responsible and safe when handling large amounts of money.

You are then assessed to see if you meet the standard criteria for reliability, protection and quality.

Alongside the FCA, Key Currency is also registered with the Bank of Spain.

As far as legitimacy goes, you can’t get better than that.

Is your money protected with Key Currency?

Being regulated by the FCA requires you to separate client money from company money.

These accounts are what's called ‘ring-fenced and safeguarded’.

This means that Key Currency can’t touch your funds for any reason other than how you instruct them.

They can’t be used to pay other creditors should they ever fold, as client funds get first priority.

The only scenario to be aware of is if the costs of liquidation exceed the cash held by Key Currency.

If this happens, the excess amount can be deducted from client funds.

The advantage of safeguarding is that it has no maximum limits on the amount covered.

If you compare this to the banks, who will only give you up to £85k back (under the Financial Services Compensation Scheme), Key Currency is arguably safer.

This is the case for all FCA-regulated money transfer companies.

Is Key Currency trustworthy?

Taking a look at Key Currency’s Trustpilot page, I can see that they’re scored very highly with a good number of customer reviews.

Further down, I’ve written a section on their customer reviews.

- They made a healthy £7m profit in the FY2022/23 and continue to grow, year on year

- They have nearly 60 employees

- They are holding £25 million of customer funds in safeguarded accounts

Here’s a rundown on the how safe Key Currency is:

- Regulated by the FCA and registered with the Bank of Spain

- Holds all client money in safeguarded accounts

- Has a large number of positive online customer reviews

- Company accounts show growth and stability

All in all, Key Currency is very safe to use. I would use them myself and recommend them to family and friends.

Key Currency exchange rates

Key Currency consistently provides some of the best exchange rates on the market.

I asked for quotes on £5k, £50k and £200k from the UK to Spain to get a good idea on their spreads.

The ‘spread’, or ‘margin’ is the difference between the rate the provider receives when buying the currency, and the rate they give to you when they sell. In other words, it’s the profit they make on the transaction.

Here is a table with my findings, with the transfer volume and the estimated spread:

As you can see, the higher the amount transferred, the better the rate you’ll receive.

If you compare these spreads to what the high street banks offer, you’re on course to save thousands on a large transfer.

As a reference point, Barclays international transfers offer spread between 3% and 4%, which is about on par with other banks.

On a transfer of £200,000, you’d save around £6,000 (which is crazy).

See how Key Currency compares to other brokers.

To obtain a rate, you have to phone Key Currency. They don’t display their rates online unlike some competitors.

Key Currency transfer fees

Key Currency does not have any transfer costs, hidden fees or commissions.

They only charge a £10 fee for transfers under £500.

This is simply to cover their costs.

Considering their great rates and no transfer fee policy, I scored Key Currency a 4.6/5 for cost.

Key Currency reviews

On Key Currency’s Trustpilot page, they have just over 1500 reviews, boasting a rating of 4.9/5.

94% of their reviews are 5 stars.

To put that into perspective, most other companies average out at around 85%.

Evidently, they provide a great service that’s worth writing about.

I scored them a 4.9/5 for customer satisfaction.

Key Currency positive reviews

Here are some comments from their 5 star reviews:

- Great exchange rates

- No transfer fees

- No hold times or switchboards when called

- Account managers are prompt, informative and friendly

- Transfers are processed quickly

The one thing that stood out the most was the level of service provided.

Customers loved the idea of calling in and speaking to a human within seconds.

With Key Currency there is no holding, telephone switchboards or robots.

And when you speak to a human, they are friendly and informative.

Key Currency negative reviews

Here are some negative comments:

- Compliance issues holding up payments

- Payment took longer to arrive due to a banking issue

- Rate of exchange wasn’t as favourable

Being a FCA regulated institution, they have to adhere to strict compliance procedures.

Unfortunately, this can sometimes be hard to understand for the customer who just wants their money.

Banking issues are largely out of the control of Key Currency.

Given how complex (and antiquated) the worldwide payments systems are, it’s not crazy to expect some issues every now and again.

With the exchange rates, the overwhelming majority of customers were pleased.

So, it’s surprising to see that some weren’t. At the end of the day, you can’t keep everyone happy.

To summarise, Key Currency customers love their service.

Key Currency service, features and availability

Key Currency provides an over-the-phone brokerage service.

This is in contrast to companies like Atlantic Money or Wise, who make you do everything on a mobile app.

However, there are a few things you can do on Key Currency’s platform, which I’ll go into just below.

Key Currency can only receive your funds via a bank transfer. They are unable to accept card payments or cash.

While Key Currency might lack a few features, they more than make up for it in their level of personal service.

That’s why we’ve scored them a 4.9/5 for service, features and availability.

Which types of transfers does Key Currency offer?

Key Currency offers a few different types of transfers:

- CHAPS payments (GBP only)

- Faster Payments (GBP only, limited to select customers)

- SEPA transfers (EUR only)

- SWIFT transfers

There’s no option for mobile money or airtime, however.

As for contract types, here is what they offer:

- Spot contracts

- Forward contracts

- Limit orders

- Stop losses

With competitors like Currencies Direct offering risk management products and options contracts, there’s definitely more they can add to their selection.

How long does an international transfer with Key Currency take?

For common currencies like GBP, EUR and USD, you can expect same-day payments if they receive your funds in time.

Here’s how long these payments should take to arrive in your account:

Key Currency will always send your funds via the default payment network for that currency and country.

Just remember, there are some countries that they can’t send to.

These are called “extremely high-risk” countries. If in doubt, just ask your account manager.

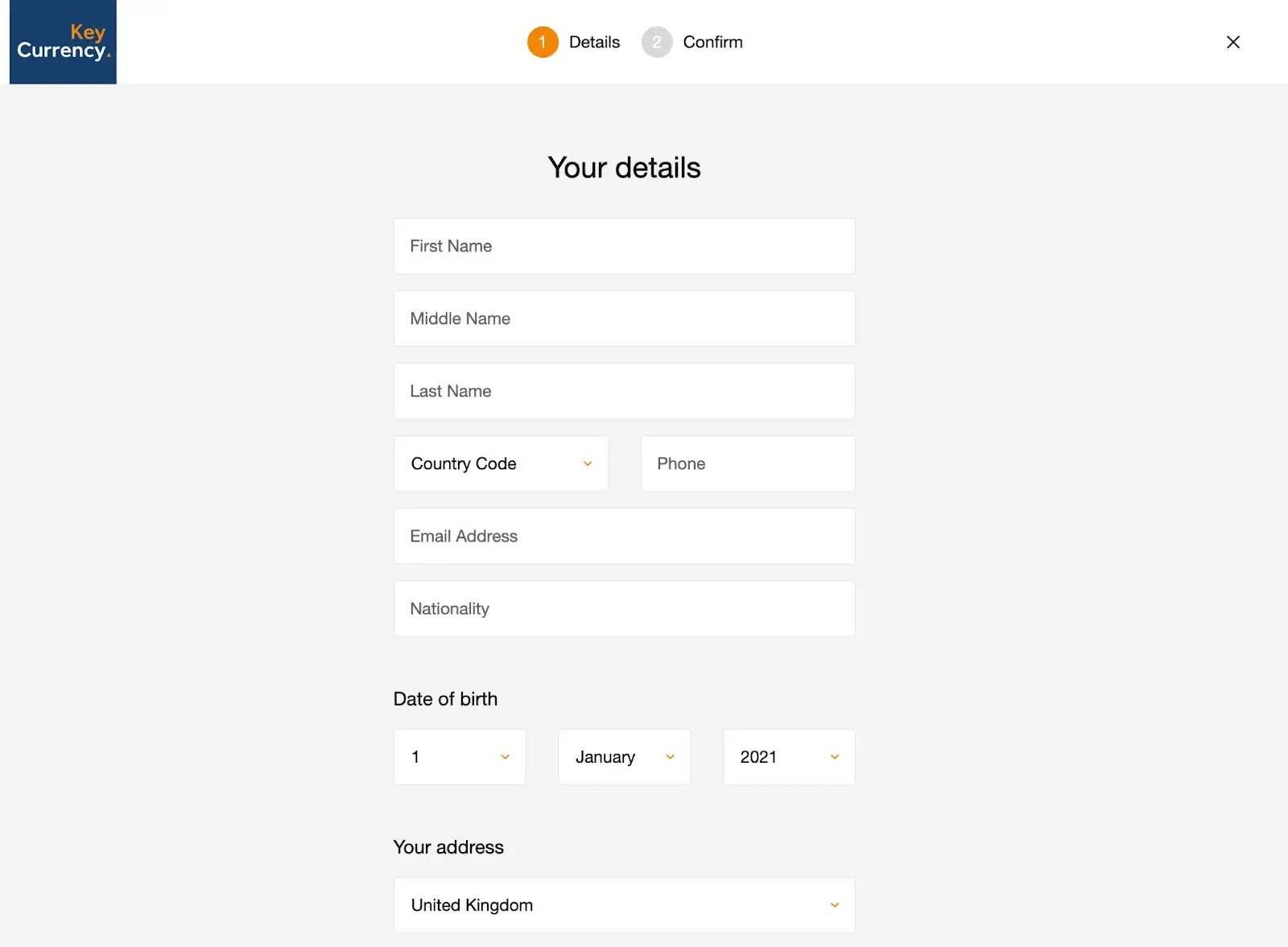

Does Key Currency have an online platform or mobile app?

Key Currency doesn’t have an online platform or mobile app in which you can make transfers.

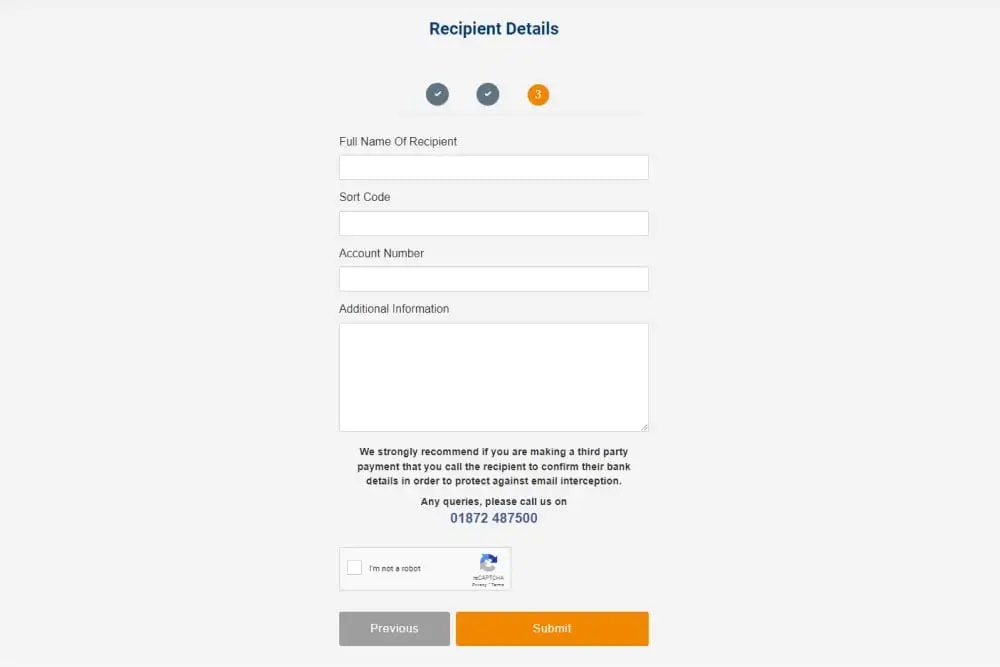

However, there are a few things you can do on their website:

- Open an account

- Submit beneficiary details

So, while these options are limited, they claim that this enables them to give better rates of exchange.

This is because these platforms and apps cost a lot of money to build and maintain.

You need developers, designers and a bunch of tech to make them work.

By skipping these costs, they can pass the savings onto their customers.

There’s no reason to say they won’t develop new products in the future, though.

Above is a screenshot from their ‘Open an account’ page.

Does Key Currency accept international clients?

Key Currency can onboard clients from most countries.

You just need to prove that you are who you say you are and that you live at your address.

This is standard practice industry-wide to comply with anti money laundering regulations, so don’t worry.

If you only have a residential address in a ‘high-risk’ country and not anywhere else, you will struggle to open an account with Key Currency.

Their banking partners will simply reject the funds.

If you are unsure, you can always ask to find out if you’re eligible for an account.

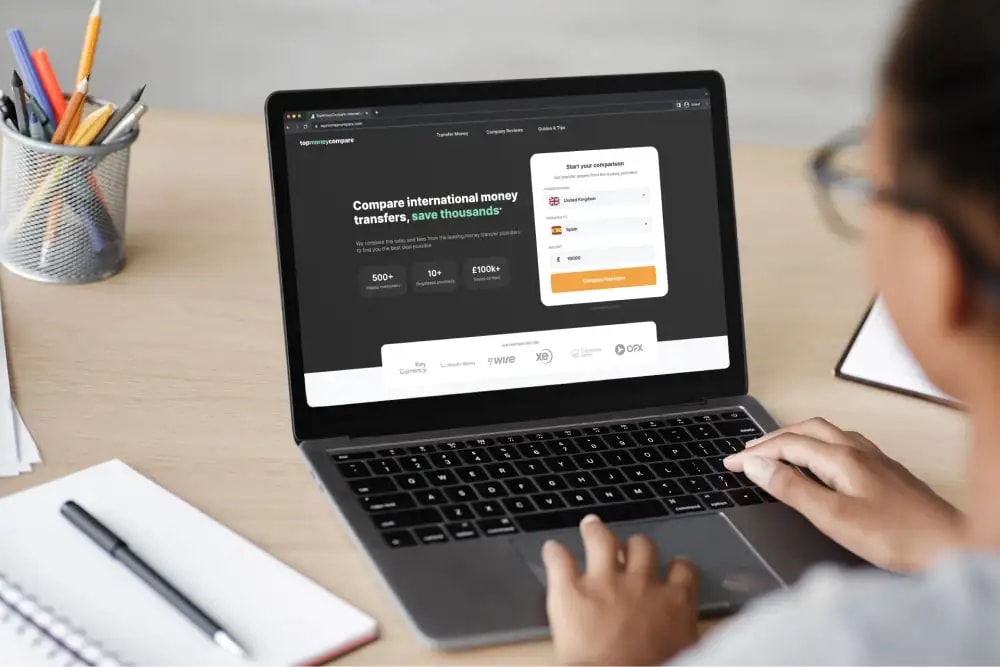

1. Check Key Currency’s rates compared to competitors

Using TopMoneyCompare’s comparison engine, you can check just how good Key Currency’s rates are compared to their counterparts.

You can see the amount and rate received, transfer fees and speed.

This way, you can get an idea on how they compare and if they’re right for you.

2. Sign up for an account with Key Currency

If you want to use Key Currency for your international transfer, the next step is to sign up.

Fill out all of your details and submit the form, and someone will be in contact to finalise your application.

You may need to complete some additional checks if they can’t verify your details.

3. Lock in your exchange rate and transfer your funds

Once your account is open, your account manager will discuss rates with you and the best times to transfer.

When you’re happy, they’ll read a verbal script and lock in the transfer and rate.

You then need to make a bank transfer of the quoted amount to Key Currency.

To note, they may ask you to transfer your funds before they lock in the rate.

4. Add a beneficiary

The next step is to submit the details of where you want your converted funds transferred to.

The information you’ll need will depend on the receiving country.

Here’s an idea of what you might need:

Other countries might require different details.

If in doubt, ask your account manager. They’ll know what you need.

5. Funds transferred and transaction complete

Once Key Currency has received your funds and the rate locked in, they’ll then make the transfer to your chosen beneficiary(s).

My verdict: is Key Currency for you?

While Key Currency is one of the best options for international money transfers, there are some cases where an alternative is a better fit.

When Key Currency works

If you match any of the below, Key Currency is a great option for you:

- You’re transferring over £25,000 (or equivalent)

- You like a personal service (i.e., a personal account manager)

- You want help achieving the best rate possible

When Key Currency doesn’t work

There are some cases where you might need an alternative instead:

- You’re transferring under £25,000 (or equivalent)

- You want to use an online platform or mobile app

- You need an exotic currency

Key Currency alternatives

If your transfer amount is less than £25,000, I recommend that you use a money transfer app instead.

As Key Currency is a currency brokerage, their rates tend to get worse with smaller amounts.

(Brokerages tend to specialise in high-volume transfers)

While they’re still good rates, a money transfer app like Wise or Atlantic Money can provide better rates on small amounts.

If you want to use an online platform or mobile app, I recommend Currencies Direct, TorFX or OFX.

They work in the same way to Key Currency, except you have access to a platform and app too.

However, their service isn't as bespoke as Key Currency's, being larger companies with more customers.

If you need an exotic currency, XE, WorldRemit and Remitly are some good options.

Unfortunately, Key Currency only deals in the more common currencies.

Check with an advisor to see if they provide your required currency.

-min.webp)