Revolut is one of the most recognisable fintechs in existence today, already serving over 40 million customers in its relatively short tenure.

Chances are, you’ve already heard of them, or may have even used one of their other banking services.

Still, the question remains, are they a good choice for international money transfers?

There are hundreds of options out there today, and with Revolut being just one of them, it can be difficult to know which one to choose.

With this in mind, I’ve taken a deep-dive into Revolut and evaluated their performance across key money transfer metrics.

I’ll get under the hood of their security, costs, customer feedback, and the overall quality of their services and features.

I’ve then scored them out of 5 for each category, giving me a final TopMoneyCompare rating.

What is Revolut?

Revolut is a mobile banking app that has been at the forefront of the fintech revolution.

It is often compared to Wise as it is in the same niche and about the same scale.

Nowadays, they offer a whole range of financial services including things like insurance, interest-bearing accounts and even the ability to buy and sell shares, cryptocurrencies and commodities.

But, money transfers, and the ability to conduct these internationally at fair exchange rates, is still a core part of what they do.

Revolut's rates are almost always much better than those offered by traditional banks.

In fact, when they first launched, Revolut was known for passing on the actual interbank exchange rate. That’s the best possible rate you can achieve.

This has changed now but costs are still low. I’ll explain more about this in our rates section.

Just be aware that Revolut strictly operates as a money transfer app. There is no online platform.

It’s a largely DIY service, done in 3 simple steps:

- Open an account

- Choose your currencies, destination and amounts

- Confirm the trade with one click

To support international transfers, Revolut also provides useful features like a multi-currency account, and travel card.

The company has grown rapidly since its inception, and is now available in over 35 countries.

The company’s latest funding round suggests an overall valuation around $24 billion.

- Still a cheap service on weekdays

- Multi-currency account and debit card available

- Possible to earn interest on your funds

- Various other financial services can be accessed

- Monthly plans have market-leading benefits

- ‘Fair usage fees’ on free account plan

- 1% weekend fee

- Bad telephone support with lengthy delays

Is Revolut safe?

Revolut is a safe digital bank that millions of customers continue to use and trust on a daily basis.

They’re authorised by some of the most prominent financial regulators around the world and have recently been granted a UK banking licence.

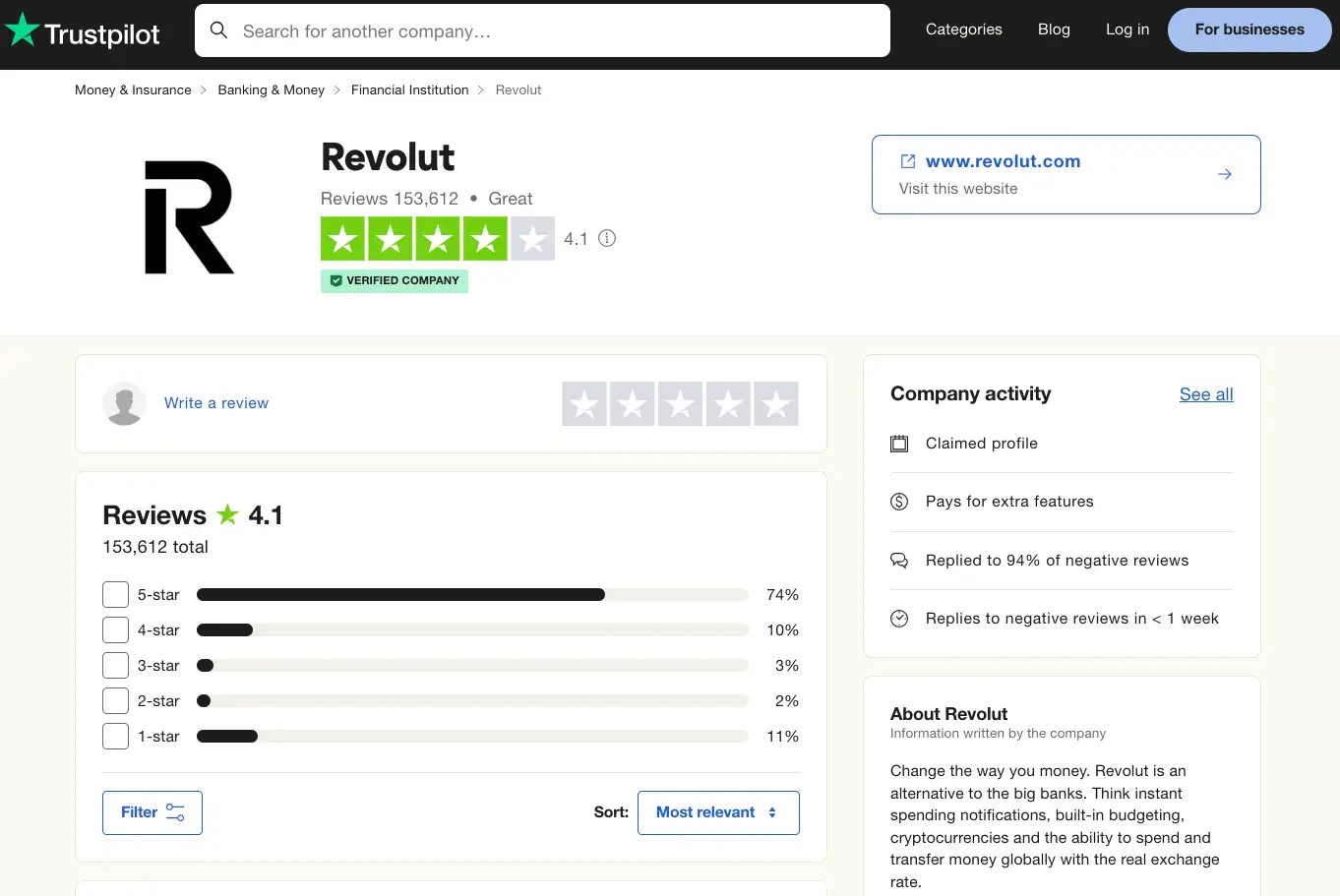

They also have over 150,000 reviews on the popular review platform, Trustpilot.

In terms of history, Revolut is slightly younger than notable fintech competitor Wise, and they can’t compete when it comes to heritage to the likes of moneycorp and Western Union.

I’ve scored Revolut a 4.2/5 for safety as there are a couple of concerns that we’ll get to.

Is Revolut legit?

Revolut is authorised and regulated in the following countries:

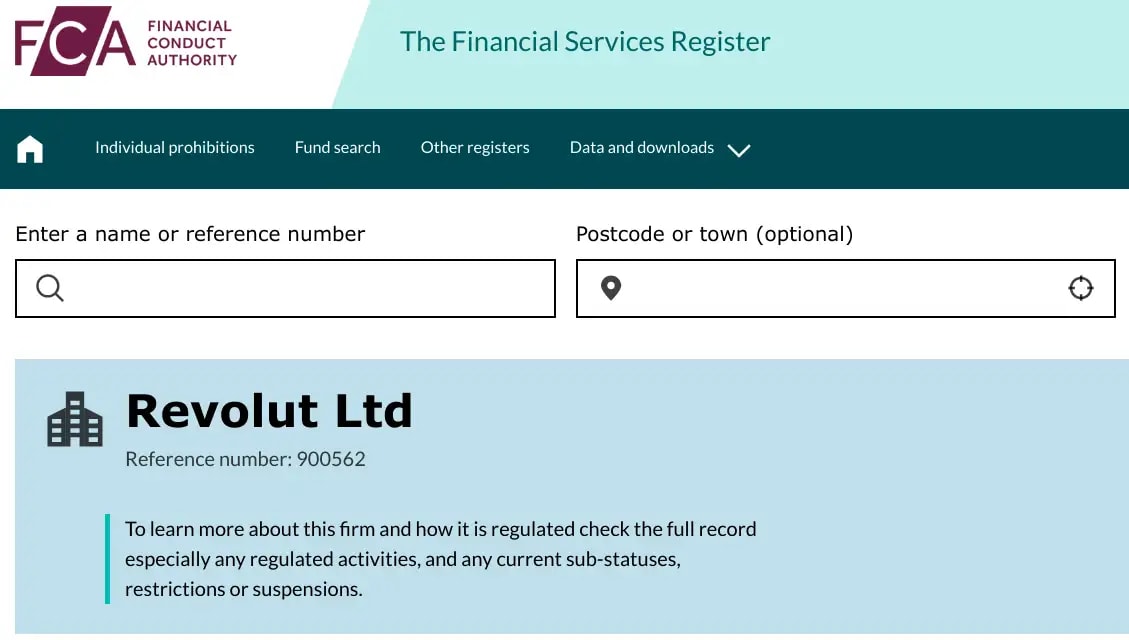

- Financial Conduct Authority (FCA) in the United Kingdom

- Bank of Lithuania (covers the European Economic Area with full banking licence)

- Dutch Central Bank in Netherlands

- Financial Crimes Enforcement Network (FinCEN) in the United States

- Australia Securities and Investments Commission (ASIC)

- Reserve Bank of India (RBI)

- Kanto Local Financial Bureau in Japan

- The Monetary Authority of Singapore

And, most recently -

- Prudential Regulation Authority (PRA) in the United Kingdom

You’d struggle to find many other companies with a similar level of regulation.

Some of their regulations, like that in Singapore, also allows them to operate in countries such as Sri Lanka and Macao.

If you’re from the UK, you’ll know of the Financial Conduct Authority (FCA).

All of the reputable non-bank money transfer companies have this type of regulation.

However, things are about to change at Revolut because the firm has finally secured a UK banking licence.

The application had become something of a saga that plagued the company over recent years, raising questions over their compliance protocols and operational standards.

But, in welcome news for investors, customers and Revolut, the fintech can now enter the ‘mobilisation’ stage of becoming a fully fledged bank.

Is your money protected with Revolut?

It's a regulatory requirement for Revolut to keep company funds separate from client funds.

Client funds are kept in accounts that are known as "ring-fenced and safeguarded".

In the unlikely event Revolut goes bust, client funds get first priority over any other creditors.

What’s more, there is no limit on the amount you can get back.

There is, however, a scenario to be aware of.

If the costs of liquidation exceed the funds held by Revolut, the liquidator can recover their own expenses from the pool of client funds.

Given the huge customer base of Revolut, this should only mean a minor deduction from each customer's funds if such a situation occurs.

But, this differs from the more familiar FSCS (Financial Services Compensation Scheme), where UK banks guarantee up to £85,000 of your money if they fail.

So, if you had £150,000, you could lose £65,000.

With Revolut, there is currently no cap on the amount you can get back.

Depending on how you view these two scenarios, you can make a case for either to be the safer option.

Just keep in mind, as Revolut moves through its ‘mobilisation’ stage, customer accounts will transition to full UK bank accounts and will then be protected under FSCS.

Is Revolut trustworthy?

Looking at the positives, Revolut has a huge number of costumes and a significant number of customer reviews on Trustpilot, with a “great” rating.

I’ve written a section on Revolut’s Trustpilot page here.

They’re also backed by some major private equity investors, enjoying a company valuation of over $24 million.

Like many fintechs however, profit remains a struggle

Here are some of the key stats from their 2023 financials:

- £18.2bn in customer deposits - 38% increase YoY

- £1.8bn in revenue - 95% increase YoY

- £438 million profit (versus a pretax loss of £25.4 million in 2022)

It’s worth noting that Revolut has twice had to apply for an extension to publish their accounts.

They did, however, easily make the 2024 deadline.

You can see Revolut’s financial statements here (opens in a new tab).

Revolut exchange rates

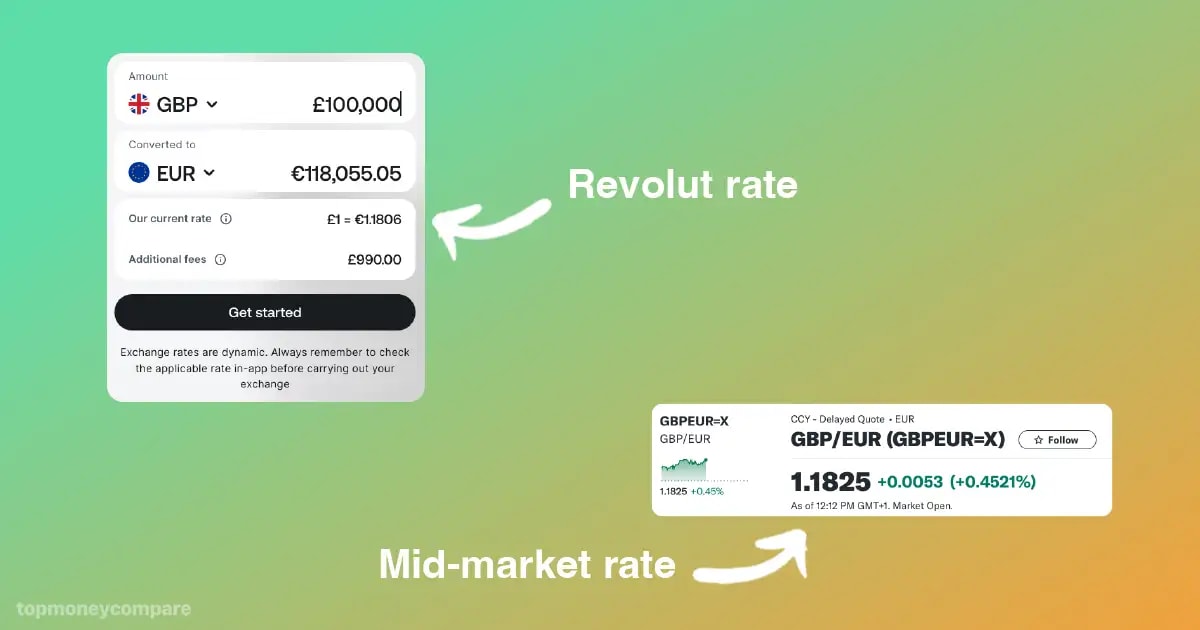

Revolut used to offer the mid-market exchange rate for major currency trading.

But, offering this rate is simply not a sustainable business model, as you’re quite literally making nothing on the foreign exchange.

It was probably a marketing move to drive registrations and generate some publicity.

They now offer the ‘revolut exchange rate’ and there’s no real explanation of how this is calculated.

The lack of transparency is a bit grating but it has to be said, by my calculations, it’s still a very good FX rate that’s only a shade off the mid-market rate.

I’ve taken screenshots from the Revolut currency converter for a GBP to EUR transfer.

The ECB requires money transfer providers to show how far their rate is off the ECB rate for EUR transfers.

The thing is, the ECB has a multiple-day delay in the rate it provides.

There’s nothing Revolut can do about that, they just work off the latest rate available.

It’s much better to work off the live interbank rate at the time.

Above, there’s a screenshot from Yahoo finance displaying the mid-market rate, plus another one showing the Revolut exchange rate.

This shows a Revolut rate of 1.1808 vs the mid-market rate of 1.1825.

That’s just a 0.14% margin on the currency exchange. Very good.

Unfortunately though, there are other fees to consider.

Weekend Fee

Revolut is the only provider that I’m aware of to add a ‘weekend fee’ to its currency exchange.

This additional 1% fee takes Revolut from one of the cheapest solutions to one of the more expensive.

This fee is applied regardless of your plan.

Revolut ‘Fair-usage fees’

In addition, Revolut applies a ‘fair-usage fee’ to the currency exchange on its entry-level accounts when certain thresholds are breached.

The standard account has an exchange limit of £1,000 per month. After this sum, a fair usage fee of 1% applies.

The plus account has an exchange limit of £3,000 per month. After this sum, a fair usage fee of 0.5% applies.

No fair usage fee is applied to Premium, Metal and Ultra accounts.

Revolut transfer fees

Revolut has switched its transfer fee model to be more akin to that of Wise.

But, unlike Wise, they don’t give you the mid-market rate.

This means you have to pay a variable payment fee (i.e. a fee calculated as a percentage of the overall transfer) but it does at least have a maximum cap.

Here are the fees charged by Revolut on some example currency routes:

As you can see, the fee percentage gets higher for more exotic currencies.

In fairness, a 0.15% fee, capped at £250, is applied to the majority of currencies by Revolut.

I’ve included the Uzbekistani sum just to demonstrate the maximum percentage which is charged. A 2% fee, capped at £500.

It’s a little tricky to trackdown on your own but you can see the latest Revolut international payment fees here.

There are no fees for EUR transfers into the SEPA region and discounts on international transfer fees are possible through paid plans:

- Premium: 20% discount

- Metal: 40% discount

- Ultra: 100% discount (no transfer fees*)

The cheapest money transfers are possible through Atlantic Money, who provide mid-market rates with a £3 (or €3) fee for every transfer, no matter the amount.

Considering Revolut is more expensive than it used to be, I have scored them a 4.2/5 for cost.

Revolut reviews

Check out Revolut’s Trustpilot page, and you’ll see they have a ‘Great’ rating of 4.1/5, and a hefty 150k reviews.

It’s first worth pointing out that Revolut has one of the highest number of Trustpilot reviews in the industry.

Of the companies I’ve reviewed, only Wise has more.

A 4.1/5 rating is by no means the best.

It’s easily beaten by Currencies Direct’s 4.9/5 rating, but given the number of reviews, it’s still pretty impressive.

With this in mind, I have scored Revolut a 4.1/5 for their customer reviews.

Revolut positive reviews

The positive comments about Revolut touch on:

- Very cool benefits on the paid plans

- Great exchange rates

- App is quick, clear and transparent

- Transfers are almost always smooth

It seems that most customers, particularly those who have opted for the paid plans, absolutely love the whole Revolut offering.

As a paid-user myself, I have to agree with these reviews.

The Revolut app is so easy-to-use and they’re a trusted companion wherever in the world you’re visiting or sending money to.

Revolut negative reviews

There are also a number of negative comments about Revolut.

- High commission when you exceed fair-usage limits

- Poor at resolving fraud cases/scamming issues

- Slow and unhelpful customer service

- Users getting locked out of their accounts

Being frank, some of the negative reviews, particularly around fraud cases, are really off putting and make me think twice.

Revolut have their own subreddit on Reddit, and while most cutomers are happy with the service, some are truly disgruntled.

Many of the fraud complaints relate to chargebacks.

Here’s the thing. It’s actually the card networks like Visa and Mastercard who set the chargeback rules.

I’ve noticed that fintechs are much more likely to follow these chargeback rules to a tee.

Banks, for their many faults, do tend to be a bit more accommodating to their long-standing customers in cases of fraud.

So that’s definitely something to consider if you plan to use the revolut card, or hold money in your Revolut account.

If you just plan to make international transfers, and fund these instantly, this is not as much of an issue.

Bad customer support is unfortunately quite common with app-only services.

You simply don’t want to resolve all matters over an in-app chat.

Revolut’s telephone support is very hard to access, unless you have paid for the most expensive account.

That’s when a specialist currency broker like TorFX can be much more helpful.

You’re assigned your own dedicated account manager.

Revolut service, features and availability

This is where Revolut differentiates itself from the rest of the market.

You can do much more than currency conversion and money transfers.

However, as many of the reviews have already pointed out, their customer support is really lacking.

Given how important customer support is if something goes wrong with a money transfer, I’ve scored Revolut a 3.9/5 for service, features and availability.

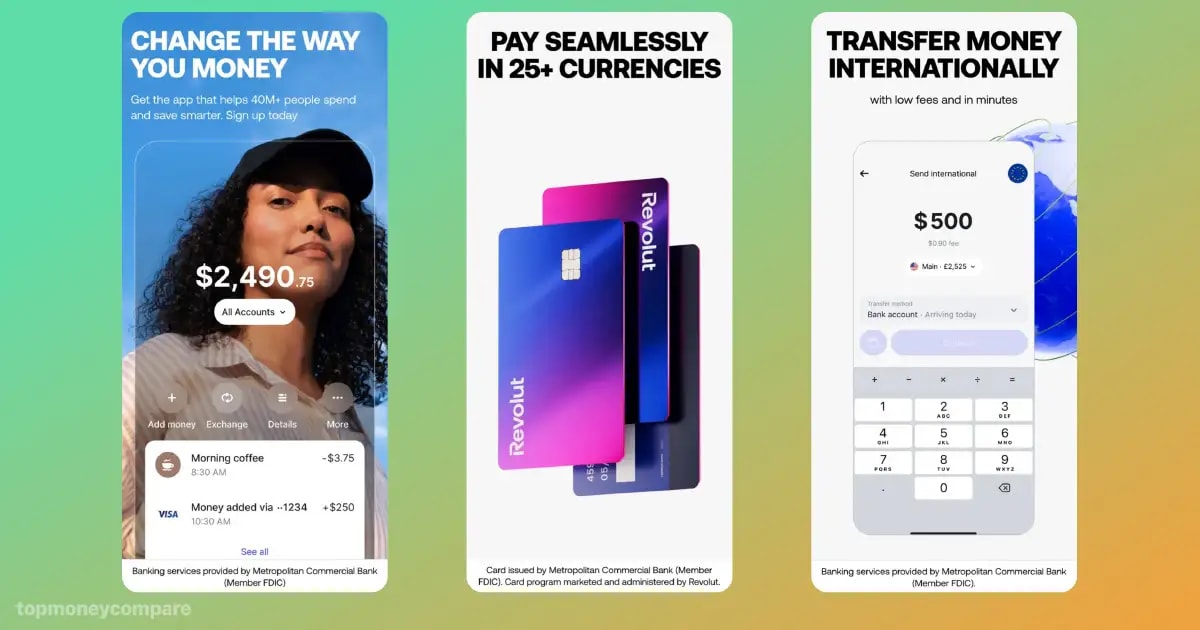

Revolut mobile app

The Revolut mobile app has just over 720k reviews on the App Store and a whopping 2.8m reviews on the Google Play Store.

There’s a very impressive 4.9/5 score on Apple but a slightly worse 4.4/5 rating on Android.

In my opinion, the app is so simple and easy-to-use.

It definitely simplifies the whole process of making a money transfer or converting one currency balance to the next.

Here are some of the things you can do on the mobile app:

- Convert currency and make transfers

- Manage recipients

- View transaction history

- Open and hold currencies in digital accounts

- Track transfers

- Check exchange rates

- Generate virtual and real debit cards

- Invest in shares

- Buy cryptocurrencies

- Buy commodities like gold and silver

It’s one of the most complete mobile banking apps there is.

I don’t know of any other fintech to offer such a wide range of functionality.

Revolut's mobile app enjoys excellent ratings

Revolut multi-currency account

Through Revolut, you can open multi-currency accounts in a matter of clicks.

You can then convert between your different balances in a matter of clicks, too.

In total, there are around 30 currencies you can hold, but only two of these have local account details:

This is some way behind the market-leader Wise.

Still, it’s a great solution for your traveIs.

If I’m visiting Portugal, I can load up my GBP wallet, and convert to Euros whenever I need to, or when the rate is in my favour.

Revolut debit card

You can also apply for a Revolut debit card.

This links to your whole Revolut account and you can spend from any of your available balances.

Use your card abroad and Revolut will first look to spend from the appropriate currency.

Let’s continue with my Portugal example.

If I use my card at the supermarket, Revolut will know to pay in Euros and will then take the money from my Euro wallet.

But, if I don’t have a Euro balance, Revolut will convert the money from my GBP balance at the Revolut exchange rate.

The same applies for withdrawing money at an ATM.

It’s an excellent feature, and one that I use myself.

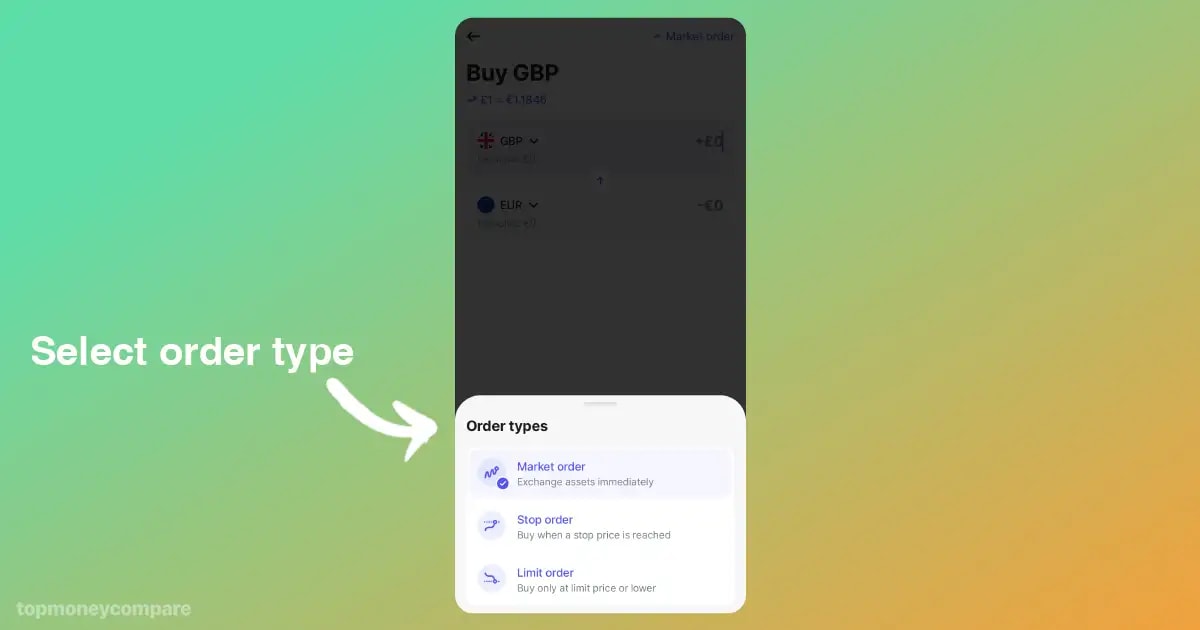

Market Orders

Revolut allows you to set up market orders and stop-loss orders on your currency exchange.

This means Revolut will automatically convert your currency for you, when a certain preferred rate is achieved, or when a lower rate is breached that you can’t afford to go below.

This is unique for a money transfer app. Usually you need to go through a broker.

1. Check Revolut’s rates against the competition

Utilise TopMoneyCompare’s comparison engine to see how Revolut’s rates stack up against the rest of the market.

Our tool will show the amount you'll receive, transfer fees, and estimated transfer speed.

This helps you make an informed decision on whether Revolut meets your needs.

2. Register for a Revolut account

To start using Revolut for international transfers, you need to create an account.

You can only do this on mobile.

Simply provide some basic details about yourself and continue through the process.

You’ll need to provide a picture of your ID (passport or driver’s licence) and a selfie for identity verification.

Keep in mind that some additional checks may also be required.

It’s quick and painless to create an account.

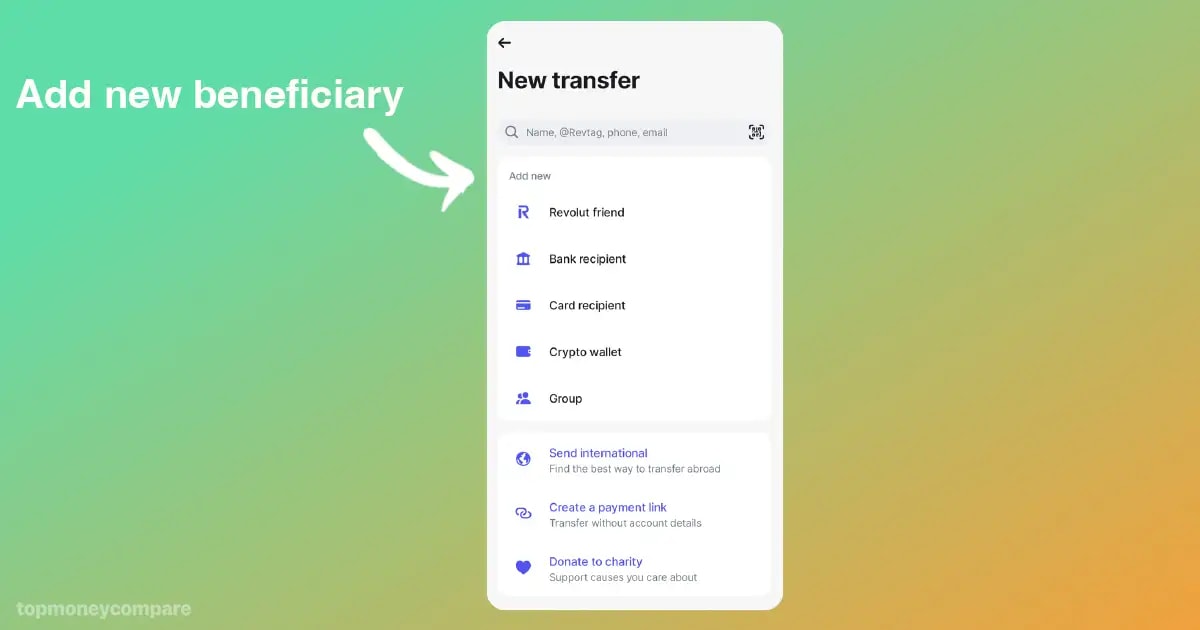

3. Add recipient details

Once your account is active, open your mobile app to initiate a transfer.

With Revolut, you’ll need to provide the beneficiary’s details first.

The required information varies by country but generally includes:

- UK - account number and sort code

- Europe - IBAN

- USA - account number and routing number

Other countries might require different details.

Revolut does quite a good job of explaining these when you select a country, but contact their in-app chat if any confusion remains.

If the recipient has a Revolut account, simply input their Revolut tag, or other Revolut details.

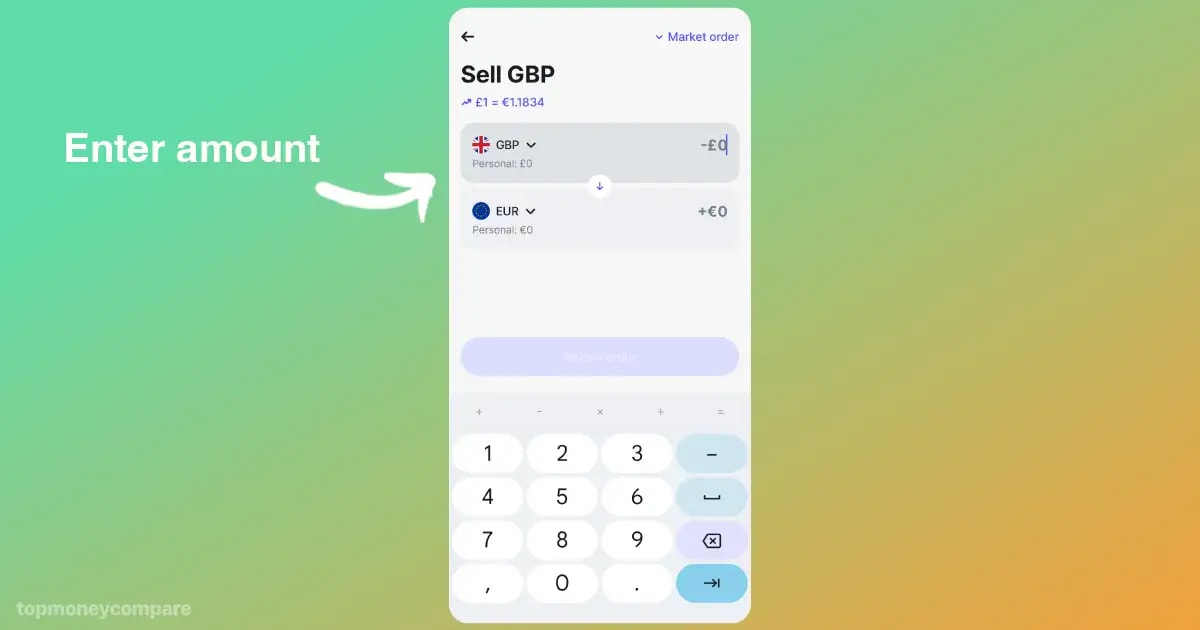

4. Enter your payment details and check the rate

Next, input the amounts, review the exchange rates, fees, and transfer times, then proceed.

You can fund your account via debit/credit card or a bank transfer, plus some other local methods relevant to your country.

5. Confirm your transfer

End by confirming your transfer.

Seeing as you have to pre-fund your Revolut account before making a payment, the transaction should be initiated instantly.

You don’t have an account manager to help you out, so be doubly sure that all of your details are absolutely correct.

Once initiated, you can then track your transfer via the app.

My verdict: Is Revolut for you?

Revolut is a versatile banking app, offering good exchange rates, a wide range of features, and user-friendly functionality.

However, it may not be the perfect fit for everyone.

Here’s when Revolut works best and when you might want to consider alternatives.

When Revolut works

If you match any of the criteria below, Revolut is a good option for you:

- You’re transferring under £10,000 (or equivalent)

- You want to access additional financial services

- You prefer using a mobile app

When Revolut doesn’t work

In certain situations, you’ll be better off looking for alternatives:

- You’re transferring over £10,000 (or equivalent)

- You need fast and reliable customer support

- You need cash delivery, airtime top up or mobile money

- You want the best possible rate

Revolut alternatives

If you’re transferring over £10,000 or want quick and reliable human support, I thoroughly recommend using a currency broker instead.

With a currency broker, you’ll be assigned an account manager who will:

- Watch the rates to help you time your transfer

- Provide personalised assistance and market insights

- Solve issues quickly

It’s different from company to company, but you should be able to call your account manager at any time during working hours.

A more hands-on approach is exactly what you need when you’re transferring large amounts of money.

The currency brokers that I’d recommend most are Key Currency, Currencies Direct and TorFX.

Revolut doesn’t offer cash delivery or mobile top up.

For that you need a company like WorldRemit or Western Union.

If you’re after the cheapest possible transfer, Atlantic Money can beat Revolut on transfers of most sizes.

They charge £3 for every transfer, no matter the amount.

However, their features and currencies are very limited and they’re still relatively new.

Their fee model is basically what Revolut had to move away from, in order to make a profit.

-min.webp)