When it comes to sending money abroad, there are is no shortage options out there to choose from.

Identifying the most suitable option can be a challenging task.

In this review of moneycorp, I’ll take a deep dive into just how good they are and what’s driven them to the forefront of the foreign exchange industry for 40+ years.

I’ll take a look at just how safe they are, their exchange rates and fees, customer reviews and the features available.

I’ve then scored moneycorp out of 5 for each category, giving them an overall TopMoneyCompare rating.

Finally, I’ll explain when moneycorp aligns with your needs, and when exploring alternatives might be the better option.

Finally, I’ll explain when moneycorp aligns with your needs, and when exploring alternatives might be the better option.

What is moneycorp?

Moneycorp is a leading provider of foreign exchange and international money transfer services, with headquarters in London.

Established in 1962, they started offering foreign exchange services in 1979, making it one of the pioneering entities in the non-bank foreign exchange industry.

As of today, moneycorp boasts an expansive network, with 22 offices spread across various continents, underscoring its commitment to global accessibility and market penetration.

The company employs over 800 individuals worldwide, serving more than 2.5 million customers and handling an annual transaction volume exceeding £70 billion.

From their original roots as a bureau du change, moneycorp has evolved significantly, now facilitating transfers through one of the most sophisticated online platforms and mobile apps on the market.

They’ve been granted a banking licence in Gibraltar, were the first non-bank member of the Federal Reserve’s Foreign Bank International Cash Services, and even acquired 100% ownership of a Brazilian bank in 2022.

It’s been quite the journey for moneycorp and the group continues to thrive under the ownership of Bridgepoint, an international private equity group.

Traditional values remain however, and customers are appointed their own account manager that they can meet or contact at any time by phone or email.

- Reputable and well-known brand

- Safe and regulated

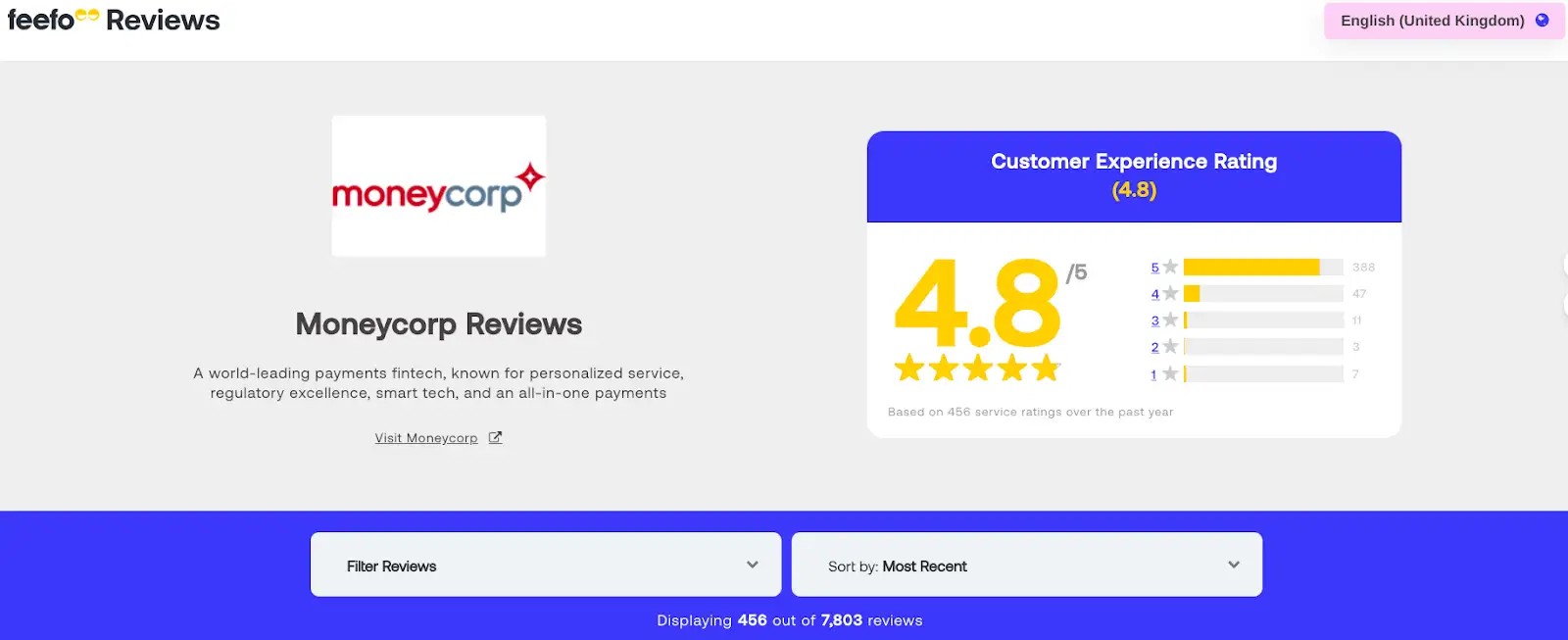

- 10 Years of Excellence Award by Feefo

- Impeccable service with helpful and professional account managers

- Extensive product list including options, risk management and mass payments

- 40+ years of experience handling currency exchange

- Poor app ratings

- No cash pick-ups - only bank transfers

- Worse rates on smaller amounts

Is moneycorp safe?

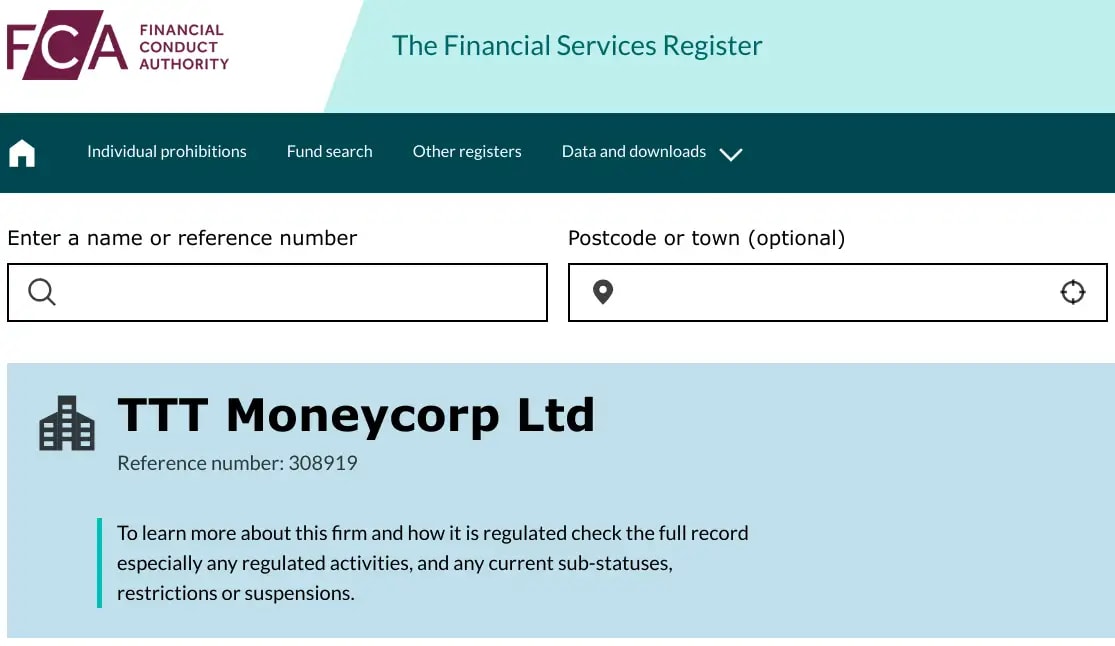

Moneycorp is regulated by the Financial Conduct Authority (FCA) as an Electronic Money Institution, under the Electronic Money Regulations 2011.

They’ve been trading in foreign exchange since 1979 and transferred over £70 billion in client funds in 2022 (still their most recent annual report as of today).

With over 14,000 reviews across Feefo and Trustpilot, netting a 4.8/5 and 4.4/5 rating respectively, this also attests to their safety and reliability.

Moneycorp is arguably the safest non-bank money transfer provider there is.

Such is their legacy that Western Union is the only specialist money transfer provider we’ve reviewed which actually has a richer heritage.

Is moneycorp legit?

As I’ve just highlighted, moneycorp is authorised and regulated by the FCA.

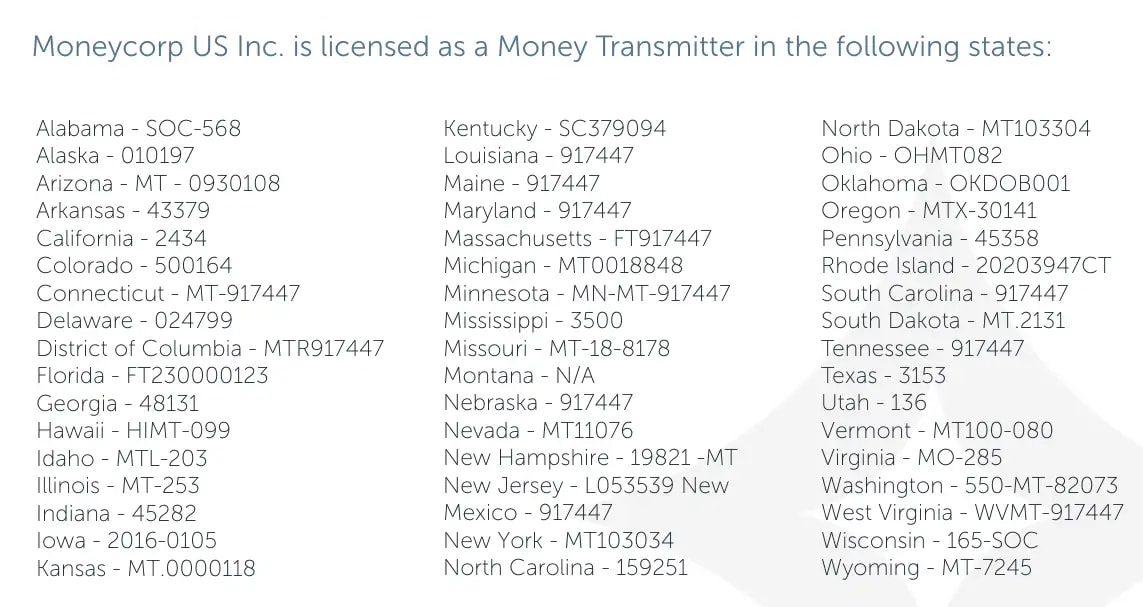

Not only that, but moneycorp is also regulated by multiple international bodies, including:

- The Financial Crimes Enforcement Network (FinCEN) in the United States, with licences across several states

- The Australian Securities and Investments Commission (ASIC)

- The Central Bank of Ireland for operations within the EU

- The Dubai Financial Services Authority (DFSA)

- The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)

As you can see, they are heavily regulated globally.

Getting regulated by one body is difficult enough, let alone the five I’ve mentioned above and many more.

Most UK currency brokers are only regulated by the FCA.

Moneycorp has demonstrated it can safely handle large amounts of money for almost half a century.

To over 190 countries, too.

Is my money protected with moneycorp?

One component of their regulation is the requirement to segregate client funds from company funds.

Client funds are what’s known as “ring-fenced and safeguarded”.

Essentially, this means that moneycorp is prohibited from utilising customer funds for any purpose (except to exchange and forward them as you direct).

Should moneycorp face the unlikely event of insolvency, there’s no limit to the amount you can get back and it's very probable that you would recover the entirety of your funds.

Customer funds are reimbursed to the original clients as a primary obligation over any other debtors.

The only deviation from this rule occurs if the expenses arising from liquidation surpass the company's available assets.

Under such circumstances, the liquidator may cover their own costs by using customer funds.

This is the case with all money transfer companies regulated as either an electronic money institution or authorised payment institution.

Depending on your perspective, moneycorp could actually be considered safer to use than your bank, where you have guaranteed cover up to £85k through the Financial Services Compensation Scheme, but no more.

Is moneycorp trustworthy?

Customers certainly seem to think so. On moneycorp’s Trustpilot and Feefo pages, they’re scored extremely well with a large number of reviews.

Read my section on their customer reviews here.

Here’s a summary of their most recent accounts:

- £73.3 billion in trading volume

- £220 million in revenue

- £70.4 million EBITDA

To conclude on safety, moneycorp is one of the safest choices you can make:

- Overseen by regulatory bodies globally

- Customer funds are kept in safeguarded accounts

- Trading FX since 1979

- Thousands of positive customer testimonials on trusted review sites

- Financial statements demonstrate they’re a very large company with a lot of assets

I would happily recommend moneycorp to my friends and family.

Moneycorp exchange rates

Moneycorp’s exchange rates improve with the more that you send.

Basically, the bigger your transfer, the better the rate you’ll receive.

You should achieve a better rate on more ‘vanilla’ currencies too.

For more exotic currencies, the spread may widen to account for higher risk, less liquidity and greater volatility in the rates.

The 'FX spread' or 'margin' refers to the difference between the exchange rate a provider secures when acquiring the currency themselves and the rate they quote to you upon sale.

Essentially, it represents the provider's earnings from the deal.

When you compare these rates against those proposed by typical high-street banks, the savings potential is immense.

For example, NatWest Bank offers spreads between 2% - 5%.

On a transfer of £200k, you could save between £2k to £8k by using moneycorp.

For transfers up to a million, you could be saving tens of thousands.

Moneycorp transfer fees

Moneycorp does not charge any transfer fees, costs or commissions.

The quote you get is the amount you’ll receive at the end of your transfer.

Sometimes, SWIFT transfers are subject to an intermediary fee, which is outside of moneycorp’s control.

This is a small charge (usually £15 - £20, or equivalent) taken by intermediary banks in exchange for helping to facilitate the payment.

For more information and whether you’ll be subject to a fee, just speak with your account manager.

For their competitive rates and no fee policy, I scored moneycorp a 4.0/5 for cost.

Moneycorp reviews

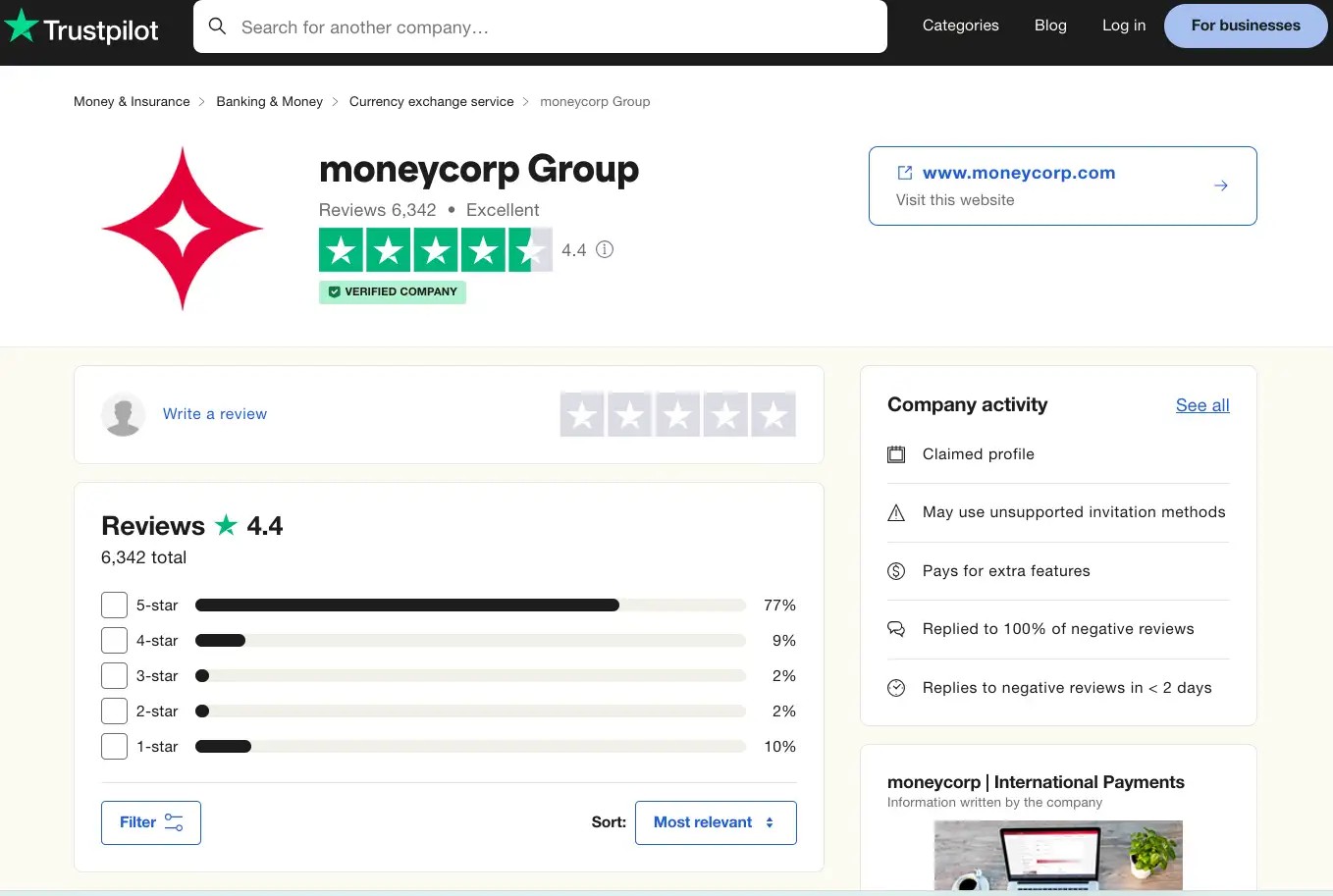

On moneycorp’s Trustpilot page, they have an ‘Excellent’ 4.4/5 score with 6000+ reviews.

On moneycorp’s Feefo page, they have an ‘Excellent’ 4.8/5 score with 7500+ reviews.

Few providers have such a collection of reviews across both Feefo and Trustpilot.

They’re one of the most recognised names in the industry for a reason.

Most customers share the same story of a “professional” and “exceptional” service.

I scored moneycorp a 4.6/5 for customer satisfaction.

Moneycorp positive reviews

Here are some comments from their 5 star reviews:

- Account managers are recognised for a personal and professional service

- Good rates that beat the bank

- Take time to run you through the process

- No fuss, mostly hassle free

Beyond offering excellent customer service, their online platform also receives high praise from users.

Moneycorp negative reviews

Here are some negative comments:

- Difficult to get money returned

- Challenges with frozen accounts

- Some unhelpful members of staff

If your account is frozen, or you aren’t able to make a transaction, it's typically for a compliance-related reason.

Ultimately, they do want your business, but need to adhere to their own compliance policies and procedures.

They establish these policies to fight financial crime like money laundering.

In the event your account is flagged, certain details and documents related to your transfer may have to be shared.

Even if you aren’t making an illegal transfer, it might simply be beyond their risk remit.

Moneycorp service, features and availability

Moneycorp primarily positions itself as a professional, telephone-trading brokerage that will come to understand your specific currency needs.

You can, however, still perform transfers via their online platform and app, too.

UK brokerage Key Currency does everything over the phone, while Wise has a digital-only offering when it comes to booking transfers.

So you could say, moneycorp meets them in the middle.

But so do leading competitors Currencies Direct and OFX.

See this list of services and features on offer at moneycorp:

- Spot contracts

- Forward contracts

- Limit orders

- Stop losses

- Options contracts

- Rate alerts

- Market analysis

- Mass payments

- Online platform

- Mobile app

Instruments such as forward contracts and limit orders significantly alter the landscape, especially for those engaged in regular or substantial international transactions.

Utilising these tools effectively can shield you from unfavourable shifts in exchange rates or even capitalise on favourable movements.

Essentially, they have the potential to yield a greater amount of currency at the end of your transaction.

With moneycorp, it's possible to lock in the current exchange rate for future transactions up to two years ahead. This is one of the longest in the industry. Opt for Currencies Direct and it’s only possible to book forwards up to one year ahead.

These forward contracts are frequently used by businesses but anytime you want to accurately forecast future cash flows, it’s a forward contract that provides the guaranteed rate.

For this reason, they’re also very common among individuals buying a property abroad.

It’s even possible to book options contracts through Moneycorp Financial Risk Management Limited, a separately, more strictly regulated subsidiary.

As the name suggests, options give you the right, but not the obligation, to exchange currency at a specified rate in the future.

These business-focused solutions, coupled with incredibly professional account managers, make moneycorp our top-rated provider for business money transfers.

I rated moneycorp 4.8/5 for services, features and availability.

How long does an international transfer with moneycorp take?

If moneycorp gets your funds on time, you should receive your converted currency within 1-2 business days.

Some currencies like GBP, EUR, USD and CHF you can receive same-day.

However, for currencies like AUD, NZD, HKD, JPY and THB, you might not receive your transfer until the next working day.

It’s not just about the liquidity of a currency but the timezones and distance involved in making a transfer.

You can use this as a rough guide for how long payments should take to arrive in your account:

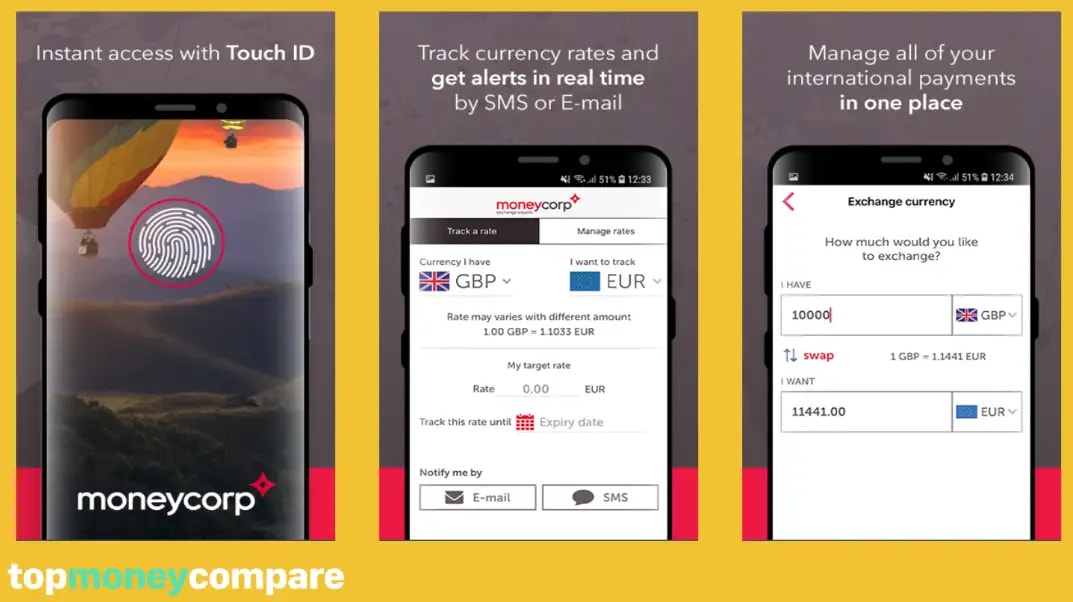

Does moneycorp have an online platform or mobile app?

Once registered, you have access to an online platform and mobile app where you can make transfers of up to £100k in 30+ currencies.

If you want to exchange more, you’ll need to give them a call.

The money transfer app provides the following features:

- Secure log-in with touch ID (app)

- Initiate transfers 24/7

- Manage recipients

- View account balances

- Receive rate alerts / notifications

- View real-time exchange rates

With moneycorp online, you can also:

- Initiate mass payments to multiple people at once

- Import payment/beneficiary details

- Synchronise with account software like Xero

In my experience, and based on other customer reviews, moneycorp’s online platform is far superior to its app.

Moneycorp’s online platform is intuitive, multi-functional and secure.

When I’ve tested the batch upload functionality in the past, I’ve encountered significantly fewer errors with moneycorp compared to competitors like WorldFirst. Things like creating new beneficiaries just seemed more intuitive too.

However, moneycorp is not known for having one of the best-rated money transfer apps.

In fact, it’s very poorly reviewed by customers. Multiple users report it’s pretty hit and miss as to whether you can even log in, and once logged in the app seems to regularly crash or automatically log users out.

In a way it makes sense.

Moneycorp is a traditional brokerage which focuses on close customer service and a sophisticated online trading platform.

The app appears to get little development priority as they’re not really targeting individuals who send small amounts overseas.

If that’s what you want, you’re much better off with Wise.

You can download the moneycorp app for free on the App Store and Google Play store, but it received poor ratings from users.

Does moneycorp accept international clients?

Moneycorp can onboard customers from virtually any country, with a few exceptions.

Australia and New Zealand are perhaps the most notable territories where you can’t register for an account.

When registering, you’ll need to provide documentation that proves you are who you say you are and the address that you reside.

This usually involves a passport or driver’s licence and a utility bill.

If you live in a ‘high-risk’ country and don't have residence anywhere else, moneycorp may not onboard you.

Unlike most other brokers, you can open an account and transfer funds in virtually all states in the U.S.A.

If you’re unsure if moneycorp onboards customers from your country, reach out to a member of the moneycorp team.

1. Compare moneycorp’s rates

Using TopMoneyCompare’s comparison engine to assess the competitiveness of moneycorp’s exchange rates against other market players.

It allows you to view the exchange rate and amount received, alongside any transfer fees and proposed transfer times.

You’ll get a quick glance of the provider’s that support your currency pair and help in determining if they’re the right fit for your needs.

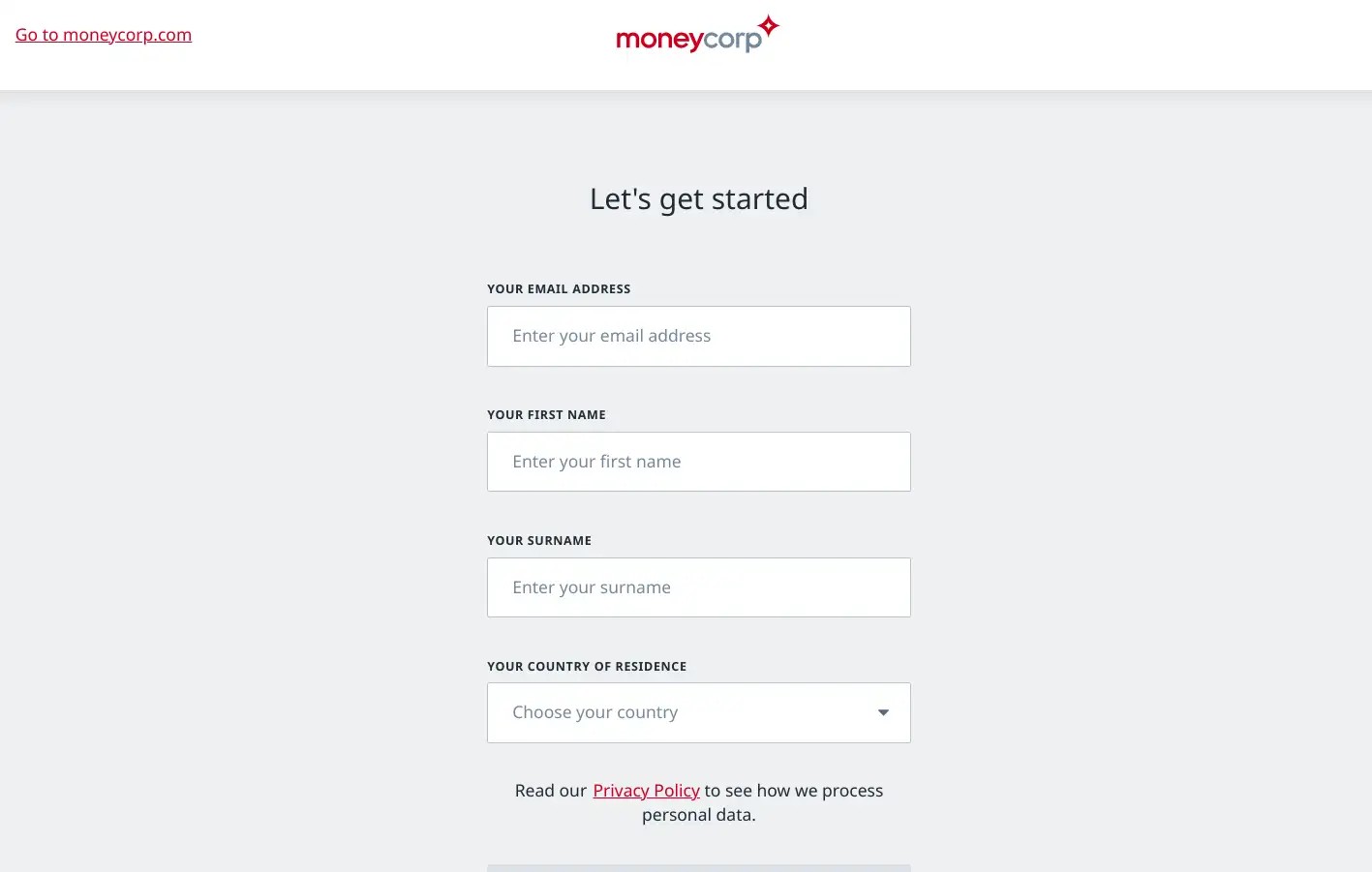

2. Sign up for an account with moneycorp

If you want to use moneycorp for your international transfer, you then need to register for an account.

Click here to open a moneycorp account (opens in a new tab).

Complete the required fields with your information and submit the application, after which a representative will reach out to complete the process.

Remember, additional verification may be necessary if your information cannot be immediately confirmed, potentially requiring documents such as a passport and a utility bill.

3. Lock in your exchange rate and transfer your funds

Upon account activation, your account manager will chat you through the transfer process, discussing recent exchange rate movements and optimal transfer timings.

If you trade over the phone, your contact will confirm the details and secure the exchange rate.

You can then fund the deal with moneycorp, usually via local bank transfer.

4. Add a beneficiary

The next phase involves providing the details for the recipient of your transferred funds.

The required information varies by destination country, but here’s an idea of what you might need:

Other destinations may have different requirements.

Should there be any uncertainty, your account manager is available to clarify the necessary details.

5. Funds transferred and transaction complete

After moneycorp has received your funds and the rate is locked in, they’ll make the transfer to your chosen beneficiary(s).

My verdict: is moneycorp for you?

Moneycorp is one of the biggest names in the money transfer industry.

However, they’re not the best fit for absolutely every requirement to transfer money overseas.

When moneycorp works

If you match any of the below, moneycorp is generally an excellent choice:

- You’re transferring over £25,000 (or equivalent)

- You like a professional, dedicated service (i.e. your own account manager)

- You want help timing your exchange or using a new currency product

- You are a business

- You’re a US citizen

When moneycorp doesn’t work

There are some scenarios you’ll want to consider an alternative instead:

- You’re transferring under £25,000 (or equivalent)

- You’re from Australia or New Zealand

- You want to transfer money through an app

- The recipient is to collect the money in cash

Moneycorp alternatives

For transactions below £25,000, I suggest opting for a money transfer app.

Even though moneycorp can handle smaller transactions, the rates offered may not be as favourable.

Services like Wise, Atlantic Money and XE are tailored for lesser amounts, and offer more competitive rates for these transactions.

What’s more, they have slick apps that rarely encounter issues.

Ideal for when you’re sending smaller volumes and you’re less worried about having a dedicated account manager to contact, should anything go wrong.

Moneycorp will not help you with “remittance transfers”, i.e. sending money for cash collection. Take a look at WorldRemit and Remitly if you require this.

-min.webp)