When it comes to sending money abroad, there are quite a few options out there to choose from.

It can be difficult to really know which one is right for you.

In this review of Currencies Direct, I’ll take a deep dive into just how good they are and what’s given them the first-class reputation they hold.

I’ll take a look at how safe they are, their exchange rates and fees, customer reviews and features available.

I’ve then scored Currencies Direct out of 5 for each category, giving them an overall TopMoneyCompare rating.

Finally, I’ll discuss whether they’re a good fit for you and if an alternative might be better.

What is Currencies Direct?

Currencies Direct is an international money transfer provider and currency brokerage headquartered in London.

Founded in 1996, they were the first non-bank money transfer provider in Europe.

As of 2024, they have 25 offices around the globe, covering nearly every continent.

Their push to make their service available globally has led to their dominance of the FX market over the last 28 years.

When originally founded by Mayank Patel, they provided a simple over-the-phone service.

Now, you can book deals of up to £25k using their online platform or mobile app.

They employ over 750 people across the world, with 500k+ clients and an annual volume of £10 billion.

In 2011, Mayank Patel, through his holding company Azibo Group, acquired rival firm TorFX for a multi-million pound sum.

After 19 years of trading, Currencies Direct was acquired in 2015 by Palamon Capital and Corsair Capital for over £200 million.

In 2022, Currencies Direct received a further £140 million in funding from Blackstone.

Both Currencies Direct and TorFX now operate under the new group umbrella brand ‘Redpin’. An entity specifically designed to provide payment solutions to the international real estate market.

- Positively reviewed online - 4.9/5 stars on Trustpilot

- Great savings compared to the high-street banks

- Impeccable service with helpful and patient account managers

- Extensive product list including options, risk management and multi-currency accounts

- 25+ years of experience handling large money transfers and house sales

- Limited availability for African currencies

- No cash pick-ups - only bank transfers

- Rates can get poor when transferring smaller amounts

Is Currencies Direct safe?

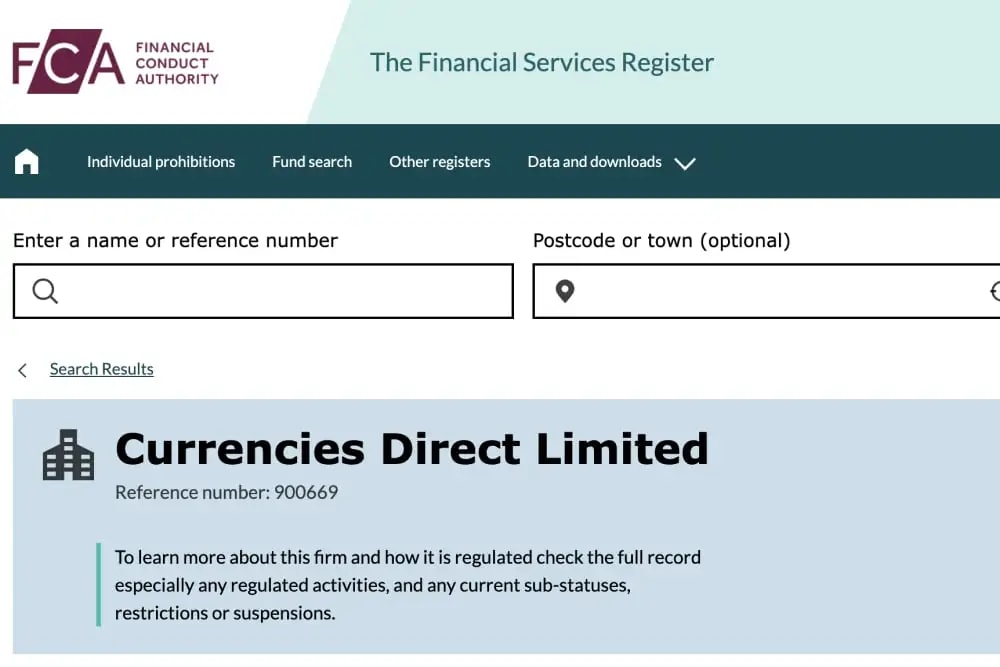

Currencies Direct Ltd is authorised by the Financial Conduct Authority as an Electronic Money Institution under the Electronic Money Regulations 2011.

On average, they transfer over £10 billion of client funds each year.

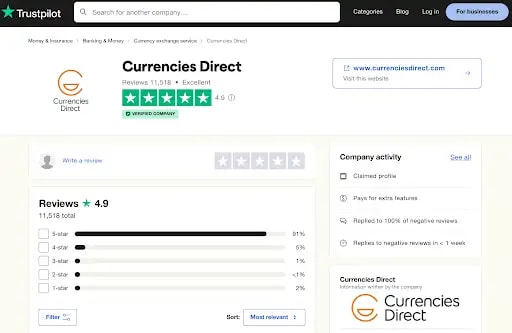

They have over 11,000 reviews on Trustpilot.

So, Currencies Direct are worthy of their 4.5/5 safety score.

Is Currencies Direct legit?

As I’ve just mentioned, Currencies Direct is authorised and regulated by the FCA.

Not only that, but they’re authorised and regulated by:

- South African Reserve Bank (SARB) #2011/117232/10

- Financial Transactions and Report Centre of Canada (FINTRAC) #M08690900

- Bank of Spain #6716

- Financial Crimes Enforcement Network (FinCEN), having licences in 11 states

As you can see, they are heavily regulated globally.

Getting regulated by one body is difficult enough, let alone five.

Most UK currency brokers are only regulated by the FCA.

Currencies Direct have had to prove that they are responsible and safe with large amounts of money.

Across 3 continents, too.

Is my money protected with Currencies Direct?

One part of their regulation is that they have to segregate client funds from company funds.

These are accounts that are “ring-fenced and safeguarded”.

This basically means that Currencies Direct can’t touch client money, for any reason (other than to convert and send it where you instruct them).

If Currencies Direct ever goes into administration, it’s highly likely you will receive the full amount of your funds back.

Client funds are returned back to the underlying clients as first priority to all other creditors.

The only exception to this is if the costs associated with the liquidation exceed any funds held by the business.

If this is the case, the liquidator can recover their costs from client funds.

This will be the case with all FCA-regulated money transfer companies.

Depending on how you view this, Currencies Direct could actually be considered safer to use than your bank, where you will only be covered up to £85k.

This is because high-street banks operate with the Financial Services Compensation Scheme, and don’t have client safeguarded accounts.

Is Currencies Direct trustworthy?

On Currencies Direct’s Trustpilot page, they’re scored extremely well with a large number of reviews.

Read my section on their customer reviews here.

Here’s a summary of their parent company’s most recent accounts:

- Over £130 million in revenue

- £37.6 million profit after tax

- Over 750 employees

- £460 million of client funds held in safeguarded accounts

To conclude on safety, Currencies Direct is very trustworthy:

- Regulated by institutions around the world

- All client funds are held in safeguarded accounts

- Trustpilot page has thousands of positive reviews

- Company accounts show that they’re a very large company with a lot of assets

I wouldn’t hesitate to recommend Currencies Direct to my friends and family.

Currencies Direct exchange rates

Currencies Direct’s exchange rates are some of the best available (for larger transfers).

The bigger your transfer, the better the rate you’ll get.

I asked for quotes on different amounts to see how they compared:

To note, these were the quotes I was given for a GBP/EUR transfer.

For more exotic currencies or countries, the spread may vary to account for risk and volatility in the rates.

The ‘spread’, or ‘margin’ is the difference between the rate the provider receives when buying the currency, and the rate they give to you when they sell. In other words, it’s the profit they make on the transaction.

If you compare these rates to those offered by most high-street banks, you’ve got the potential to save thousands.

For example, HSBC international transfers offer spreads between 1.5% - 3%.

On a transfer of £200k, you’ll save between £2k to £5k using Currencies Direct.

For transfers up to a million, you could be saving tens of thousands…

See how Currencies Direct compares to other brokers.

Currencies Direct transfer fees

Currencies Direct does not charge any transfer fees, costs or commissions.

The quote you get is the amount you’ll receive in your bank account.

Some transfers are subject to an intermediary fee, which is outside of Currencies Direct’s control.

This is simply a small charge (usually £15 - £20, or equivalent) taken by the intermediary bank, in exchange for facilitating the payment.

For more information and whether you’ll be subject to a fee, ask your account manager.

For their great rates and no fee policy, I scored Currencies Direct a 4.2/5 for cost.

Currencies Direct reviews

On Currencies Direct’s Trustpilot page, they have an ‘Excellent’ 4.9/5 score with 11,000+ reviews.

91% of their reviews are 5 stars.

They’re one of the best in the industry for a reason.

When you focus on providing great rates and impeccable service, customers will want to write about their experience.

I scored Currencies Direct a 4.9/5 for customer satisfaction.

Currencies Direct positive reviews

Here are some comments from their 5 star reviews:

- Account managers are helpful and patient

- Quick and easy process

- Online platform and mobile app are easy to use

- Competitive rates of exchange

Not only do they provide a brilliant human-to-human service, customers love their DIY technology as well.

Currencies Direct negative reviews

Here are some negative comments:

- Not receiving funds in timely manner

- Accounts not being opened

- Platform and mobile app issues

If any currency broker declines your account, there is always a good reason.

At the end of the day, they want your business.

Part of their regulations is obtaining specific information and documentation around the client’s activities to determine the risk level.

If documentation isn’t provided, isn’t credible or determines the client is high-risk, an account cannot be opened.

This is to prevent things like money laundering and terrorism financing.

Currencies Direct service, features and availability

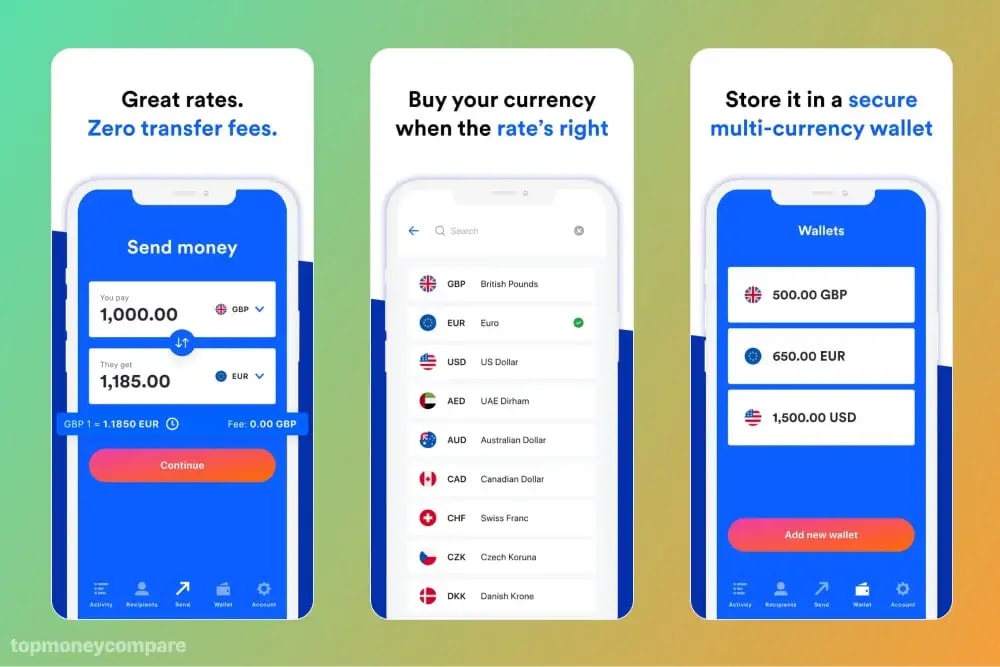

While Currencies Direct is predominantly an over-the-phone brokerage, you can perform transfers via their platform and mobile app, too.

This is in comparison to Key Currency, who do everything over the phone, and companies like Wise who only have an app and no one to speak to.

Currencies Direct meets them in the middle.

Here’s a list of the services and features that Currencies Direct offers:

- Spot contracts

- Forward contracts

- Limit orders

- Options contracts

- Stop losses

- Rate alerts

- Market analysis

- Online platform

- Mobile app

- Multi-currency card (personal)

- Multi-currency collection accounts (business)

Products like a forward contract and limit order are a game-changer.

Particularly if you’re making frequent, or large, overseas transfers.

Correct use of these products can protect you when the rate moves against you or help you when the rate moves in your favour.

Basically, they could bag you with more currency at the end of your transfer.

With Currencies Direct, you can use a forward contract to secure today’s rate for up to a year in the future.

Individuals most often use a forward contract with Currencies Direct when buying property overseas. Providing certainty over the budget.

Businesses use this solution from Currencies Direct for any number of reasons, and also have access to options contracts.

Options are more advanced hedging solutions, offered through Currencies Direct Financial Markets Ltd.

On top of all this, you can also pay for your transfer using your debit card.

You’ll find that some brokers don’t offer the card option, but will only take bank transfers.

Most recently, Currencies Direct has even launched its own multi-currency card, allowing you to spend and withdraw cash in 200+ countries, wherever Mastercard is accepted.

I scored Currencies Direct a 4.1/5 for services, features and availability.

How long does an international transfer with Currencies Direct take?

If Currencies Direct receives your funds in time, you should receive your converted funds on the same day.

This is the case for common currencies like GBP, EUR, USD and CAD.

However, for currencies like AUD, NZD, SEK, NOK and DKK, you might not receive your transfer until the next working day.

Here’s how long their payments should take to arrive in your account:

Currencies Direct will always use the default payment network for the transferred currency and receiving country.

Does Currencies Direct have an online platform or mobile app?

Once registered, you have access to an online platform and mobile app where you can make transfers of up to £25k.

If you want to convert more, you’ll have to give them a call.

The app and platform provide the following features:

- Process transfers

- Track transfers

- Hold currencies in wallets

- Manage your multi-currency card

- Manage recipients

- Forward buying

- Rate alerts / notifications

- Market updates

You can download the Currencies Direct app for free on the App Store and Google Play store.

Does Currencies Direct accept international clients?

Currencies Direct can onboard clients from any country, with a few exceptions.

You may need some documentation to prove who you are and where you live.

This will likely be a proof of identity and address, such as a passport and utility bill.

If you live in a ‘high-risk’ country and don't have residence anywhere else, Currencies Direct may not open an account for you.

Unlike most other brokers, you can open an account and transfer funds if you live in a select few states in the U.S.A:

- California (CA)

- Florida (FL)

- Georgia (GA)

- Illinois (IL)

- New Jersey (NJ)

- North Carolina (NC)

- Pennsylvania (PA)

- Rhode Island (RI)

- South Carolina (SC)

- Texas (TX)

- Washington (WA)

If you are unsure, you can always ask to find out if you’re eligible for an account.

1. Compare Currencies Direct’s rates

Using TopMoneyCompare’s comparison engine, you can check just how good Currencies Direct’s rates are compared to other providers.

You can see the amount and rate received, transfer fees and speed.

This way, you can get an idea on how they compare and if they’re right for you.

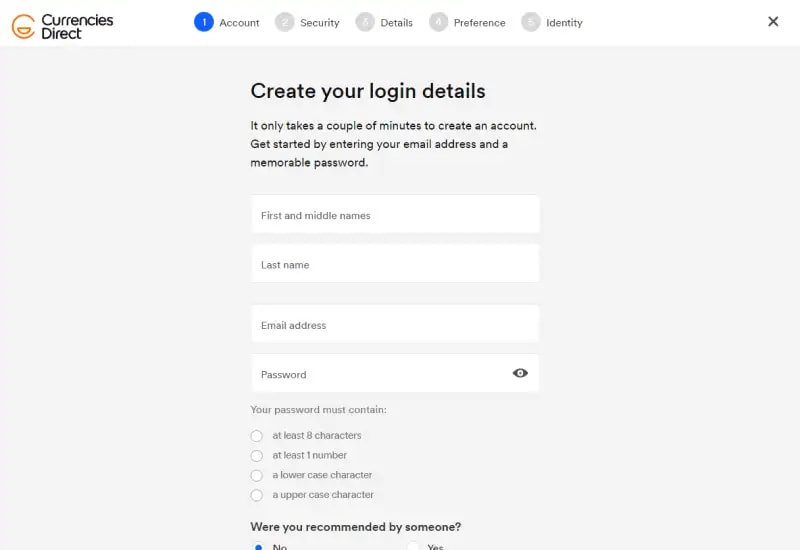

2. Sign up for an account with Currencies Direct

If you want to use Currencies Direct for your international transfer, the next step is to sign up for an account.

Click here to open a Currencies Direct account (opens in a new tab).

Fill out all of your details and submit the form, and someone will be in contact to finalise your application.

You may need to complete some additional checks if they can’t verify your details.

This may include sending them some documents like a passport and utility bill.

3. Lock in your exchange rate and transfer your funds

Once your account is open, your account manager will discuss rates with you and the best times to transfer.

When you’re happy, they’ll read a verbal script and lock in the transfer and rate.

You then need to make a bank transfer of the quoted amount to Currencies Direct.

They may ask you to transfer your funds before they lock in the rate.

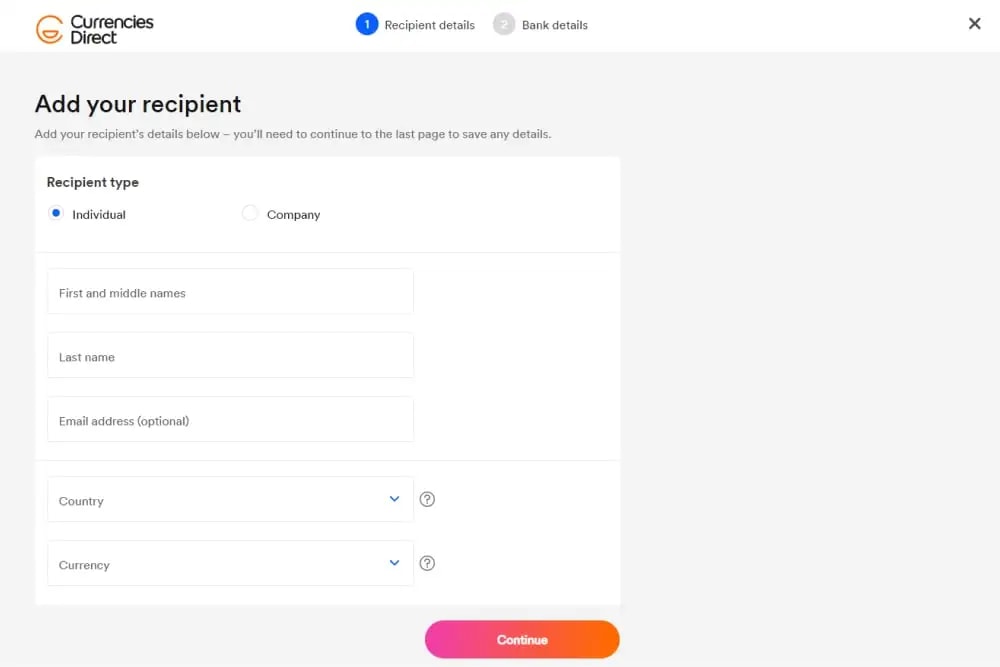

4. Add a beneficiary

The next step is to submit the details of where you want your converted funds transferred to.

The information you’ll need will depend on the receiving country.

Here’s an idea of what you might need:

Other countries might require different details.

If in doubt, ask your account manager. They’ll know what you need.

5. Funds transferred and transaction complete

Once Currencies Direct has received your funds and the rate locked in, they’ll then make the transfer to your chosen beneficiary(s).

My verdict: is Currencies Direct for you?

Currencies Direct is one of the leaders in the money transfer industry.

However, there might be a company out there that is better suited for you and your requirements.

When Currencies Direct works

If you match any of the below, Currencies Direct is a great option for you:

- You’re transferring over £25,000 (or equivalent)

- You like a personal service (i.e., a personal account manager)

- You want help timing your exchange

- You want the option of using a platform or mobile app

- You’re a US citizen (in select states)

When Currencies Direct doesn’t work

There are some cases where you might need an alternative instead:

- You’re transferring under £25,000 (or equivalent)

- You need to make b2b payments

- You need to do hedge

- You require a bespoke service for a complicated payment

- You want access to a full service multi-currency account

Currencies Direct alternatives

For transfers of under £25,000, I recommend using a money transfer app.

While Currencies Direct are able to process smaller transfers, you won’t get as good a rate.

Providers like Wise, Atlantic Money and XE specialise in smaller amounts, and provide much better rates for them.

With more exotic currencies, you may find that Currencies Direct is unable to assist.

They deal with the more common and frequently traded currencies.

Take a look at WorldRemit and Remitly if you require a less common currency.

Check with an advisor to see if Currencies Direct provides your required currency.

Currencies Direct offers a multi-currency wallet for individuals (to spend from with a matching multi-currency card) and currency collection accounts for business (which are for receiving only).

If you want to be able to make and receive transfers into currency accounts, you’re better with Wise, or HSBC Expat for offshore banking.

-min.webp)