Whether over the phone or in branch, transferring large sums of money abroad can be stressful.

After the money has left your account, it can be an anxious wait for the money to reach the other side.

Exactly how does the bank safely transfer your money to another country?

Most of the time, the SWIFT network is used.

In this article, I’ll explain exactly what a SWIFT transfer is and how they work.

You’ll also learn about how long they take, how much they cost and what information you’ll need.

What is SWIFT?

SWIFT is an acronym for The Society for Worldwide Interbank Financial Telecommunication.

Essentially, it’s a messaging system for banks.

Banks use it to communicate safely and securely across a number of different financial services.

There are hundreds of different types of SWIFT messages and, as you can imagine, many of these relate to sending or receiving international transfers.

There are also recipient bank fees for intermediaries.

All SWIFT messages start with an ‘MT’ standing for ‘message text’.

But, what about the history of the network?

SWIFT, as a cooperative utility, was founded in 1973 by 239 banks across 15 countries.

They all came together to solve a common problem on how to securely communicate with international transfers.

As of today, there’s over 11,500 institutions connected to the SWIFT network, across over 200 countries.

What is a SWIFT transfer?

A SWIFT transfer is an international money transfer made using the SWIFT network.

Nowadays, nearly all banks will use SWIFT to send international transfers.

It’s the most secure method available.

Any bank connected to the SWIFT network will have a SWIFT code (sometimes called a BIC code).

Banks use these codes to communicate with one another, a bit like an email address.

Once you instruct your bank to make the transfer, they will send a “SWIFT message” to the receiving bank, using their SWIFT code.

This message includes all of the information and instructions about the transfer and the sender.

These messages can only be read by the sending and receiving parties.

SWIFT is not responsible for the physical transfer of the money, but only the instructions.

When the transfer instructions have been acknowledged, the money is transferred.

How long does a SWIFT transfer take?

SWIFT transfers, on average, take between 1-4 working days to complete.

This varies with the destination country, time zones and banking infrastructure.

For example, a SWIFT transfer from the USA to the UK usually takes around 1 working day.

On the other hand, a transfer to the UAE can take 3-5 working days.

Put it this way, as things stand, SWIFT transfers aren’t instant.

On top of this, any international transfer can be subject to anti-fraud and anti-money laundering checks.

This can also delay the transfer.

But, it’s not all bad news.

I’ll explain later how SWIFT transfers might finally be catching up with the times and getting to their destination quicker.

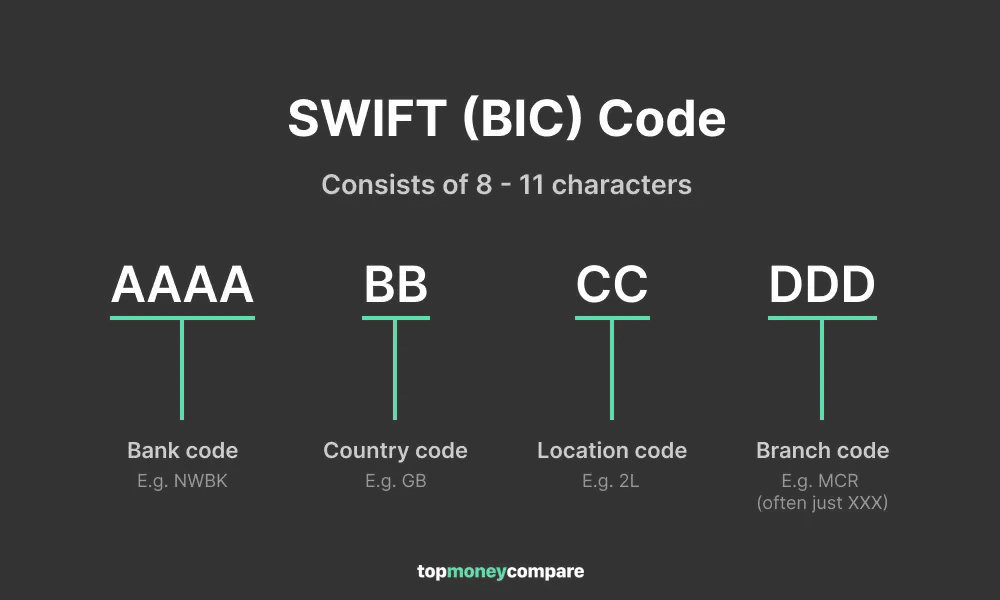

What is a SWIFT code?

A SWIFT code, also known as a BIC code, is a unique identifier given to member institutions.

It works in the same way as an email address.

If a bank wants to communicate with another bank, they use their SWIFT code to do so.

A SWIFT code is 8-11 characters long, and contains information about the bank:

- Bank code (4 characters)

- Country code (2 characters)

- Location code (2 characters)

- Branch code (3 characters)

These different codes then come together to form the SWIFT code.

Let’s take NatWest bank in the UK, for example:

- Bank code: NWBK (NatWest Bank)

- Country code: GB (United Kingdom)

- Location code: 2L

- Branch code: None (head office)

This comes together to form NWBKGB2LXXX.

The ‘XXX’ is simply a placeholder for the branch code, if there is none.

If there isn’t a branch code, this means that the SWIFT code pertains to the banks’ head office.

A head office SWIFT code can be used for any transfer to that bank, to any branch.

However, if you wish to specify the branch, you must include the 3 characters that are specific to that branch.

Take NatWest’s Manchester branch; their SWIFT code is NWBKGB2LMCR.

The MCR replaces the XXX, identifying the NatWest branch in Manchester.

When making international transfers, your bank must know the receiving bank's SWIFT code.

Therefore, it’s important to know how to find it.

How to find a SWIFT code?

A SWIFT code can be found on your bank statement, online banking or the bank’s website.

Remember, SWIFT codes are not personal information.

They identify the bank, not the person.

If you know who the receiving bank is, navigate to their website and get it from there.

Or, you’ll find the SWIFT code on any bank statement you might have.

So, if you’re sending money to someone who isn’t yourself, ask them to take a look there.

If all fails, try Googling it by typing “NatWest swift code” (replace NatWest with the relevant bank).

Or contact the bank directly and ask.

If you’re nervous about providing incorrect information, a currency broker can help.

How do SWIFT transfers work?

There’s 4 simple steps to a SWIFT transfer:

- You initiate the transfer in-branch or over the phone

- Your bank communicates with the receiving bank via SWIFT

- The money is physically transferred from your account to the beneficiary

- The beneficiary receives the money and is converted into the local currency (if necessary)

If the beneficiary account is under a different currency to the sending account, the funds will be converted by the bank accordingly.

Probably at a bad rate, too.

I would recommend using a currency broker to help with your conversion, instead.

They’ll perform the conversion in the middle of the transfer, rather than letting the bank do it.

You’ll receive a much better rate and great service along the way.

What information will I need?

Different countries around the world require different bank details to receive money.

You will always need the SWIFT code of the beneficiary bank.

Here’s a general summary of what you’ll need to make an international transfer:

It would take me a long time to write out what each individual country requires, so this is a brief summary.

Always double check with the beneficiary to know what details you need.

Are SWIFT transfers safe?

SWIFT is a highly safe and reliable payment network that’s been used for over 40 years.

Over half of all international payments are sent using the network.

However, SWIFT is just a messaging system.

You need to make sure that your bank or money transfer company is also safe.

Because at the end of the day, they’re the ones who handle your money.

You can do this by checking if they’re regulated by the Financial Conduct Authority (FCA).

Having that regulation is vital as it dictates how firms must handle your money and how it should be protected.

Without the regulation, your money is as good as gone.

To check if you’re protected, type the company’s name into the Financial Services Register.

How do I track a SWIFT transfer?

Typically, you’ll only be able to track a transfer if the money has not arrived within the expected timeframe.

To track a transfer, you need to ask your bank or money transfer company to perform a ‘trace’.

They will then send a message via the SWIFT network to the beneficiary bank asking them to locate the transfer.

For example, if the wrong account number was used for the transfer, the bank will reply via SWIFT stating that they cannot locate the account and will return the funds.

Money cannot go missing. That’s the beauty of the SWIFT network.

Any missing funds will always be being held somewhere.

Whether it’s because of incorrect or missing details, or compliance checks.

In my experience, banks are not very helpful when it comes to missing funds.

The customer-facing employees usually don’t have the training or knowledge to help with this kind of issue.

However, when I’ve used a money transfer specialist in the past, they always know what to do if your money doesn’t arrive.

They’ll put your mind at ease and get you the help you need.

That’s why I would always recommend a currency broker for large transfers.

You can expect a stress-free experience when transferring things like your life savings or house sale proceeds.

How do I provide proof of a SWIFT transfer?

Sometimes your beneficiary might ask for proof that you’ve sent a transfer.

When this happens, ask your bank or money transfer specialist for a copy of the MT103.

This provides proof the payment has been instructed.

All banks and payment companies which make payments via SWIFT will have an MT103 for every payment.

It includes all payment details such as the date, amount, currency, sender and recipient.

SWIFT transfer fees

Your bank will charge you a fee for SWIFT transfers, however they won’t label it as such.

They’ll simply call it an “international transfer fee” or something similar, instead.

Usually, the fee for you will be between £20 - £25.

However, that’s not the only charge…

The recipient might receive the money with a slight deduction.

This could either be an intermediary bank fee, or a beneficiary bank fee.

Again, this will usually be between £20 - £25 (or currency equivalent).

I think you get the idea. There’s lots of fees.

Most money transfer companies don’t charge transfer fees, at all.

How to get a better exchange rate

If you are making a transfer to a foreign currency account, a currency conversion has to take place.

There’s 3 options you can choose from:

- Your bank makes the conversion

- The receiving bank converts the funds

- You use a money transfer specialist to handle the conversion

The first two options will cost you the most money, period.

Most banks like to take between 4-6% of your money in order to convert it.

When transferring £100k+, that’s thousands of pounds lost.

The alternative is taking the third option.

A money transfer specialist can charge as low as 0.2% for conversions.

You simply sign up, get verified, lock in an exchange rate and send them your money.

They’ll then send your converted funds to the destination account.

SWIFT innovation and alternatives

Some SWIFT transfers can now reach their destination much faster than before.

Let’s look at the different SWIFT initiatives driving this.

SWIFT GPI

SWIFT GPI is the latest payment initiative launched by SWIFT in 2017.

It stands for 'Global Payment Initiative'.

The initiative acts as a framework of governing rules for participating members that improve the speed and transparency of international payments.

This includes things like fee transparency, confirmation of receipt of funds and end-to-end payment tracking.

Around 4,400 SWIFT members participate in SWIFT GPI.

Payment specialists Revolut, Western Union, Wise and Xe, whom I’ve already reviewed, are some of them.

A report from the Bank of International Settlements found the median processing time of SWIFT GPI transfers to be under two hours.

However, payment speeds continued to vary markedly depending on the payment route.

Some took less than five minutes, while others still took over two days.

Crucially, it still doesn’t solve the need for correspondent and intermediary banks to be involved in the process.

Payments from one GPI member to another could be faster, but there’s no guarantee that the banks handling the transfers in-between are also part of the scheme.

Fintech collaboration

SWIFT has partnered with Wise to provide an international payment solution for domestic banks that do not currently have one.

Banks that adopt the solution will then benefit from Wise’s technology and their participation in SWIFT GPI.

Transfers to Europe

According to SWIFT, international transfers to Europe can reach beneficiaries in seconds and be made 24/7.

This is down to a new seamless connection with the European Payment Council’s Instant Credit Transfer scheme.

Remember, this requires your bank or payment provider to be participating in the new scheme.

It’s early doors and still likely to be a while until this is fully rolled out.

We’ll have to see if banks will charge a premium for the service too.

SWIFT alternatives for the unbanked

An easy way to send money to somebody without a bank account is through a remittance company.

If you arrange for the beneficiary to receive cash, there’s no use of the SWIFT network, or any payment network at all.

Once you deposit the money on your end, the remittance company simply updates their records, and it’s immediately available for collection by the beneficiary, wherever they are in the world.

Western Union is the best known and most global remittance company.

They have over 500,000 agents where you can deposit or collect cash, operating in nearly 200 countries.

Newer fintechs are disrupting the remittance market too.

Both Xe and Remitly provide cheaper cash delivery services than Western Union, and have agents in hundreds of countries.

Project Nexus

A new initiative named ‘Project Nexus’ has been launched by the Bank for International Settlements.

Its goal is to standardise the way that real-time payment systems operating on a domestic basis can connect on an inter-county basis.

So rather than a local payment network building custom connections for every new country it connects to, they make just one connection to the Nexus platform.

The initiative is set to be trialled between India, Malaysia, the Philippines, Singapore and Thailand.

Singapore and India have already privately linked two of their own real-time gross settlement systems.

Blockchain technology the future?

Blockchain technology is what powers all of the cryptocurrencies that we know today.

A blockchain is a decentralised (or distributed) ledger of digital transactions, operating across a peer-to-peer network.

So rather than relying on multiple payment networks across the world, everything could run through one.

As you can imagine, this has huge potential for international transfers.

However, banks are still a little hesitant to fully adopt the technology, with privacy concerns around a distributed ledger, and scalability concerns about moving every international onto such a blockchain.

Here’s the other thing, participants can confirm transactions themselves on the network, without the need for a central clearing authority.

For Bitcoin transfers, you may have heard this referred to as ‘Bitcoin mining’.

This could remove the need for banks and central banks to have any role in the transfer at all, and one has to wonder if they’re simply protecting the centralised role they play in transfers today.

But, as we’ve already seen with Bitcoin, it does raise very serious concerns about financial crime, and some sort of centralised governance will be required.

One existing solution, the Ripple network, has been adopted by a select number of banks, on a select number of routes, but has still failed to get widestream adoption.

Summary

In this article, I’ve outlined what SWIFT is and how to make a SWIFT transfer.

You’ve then learnt about SWIFT codes and how to find them.

To summarise the main points:

- SWIFT is a messaging network for international payments, used by banks

- Over half of all international transfers are sent via SWIFT

- SWIFT transfers usually take between 1-4 days

- Banks use SWIFT codes to communicate

- SWIFT transfers are very safe

- SWIFT transfer times are improving, but there are faster SWIFT alternatives

- Use a money transfer company to save money on SWIFT transfers

Just below, you can get a quote from the leading money transfer providers and compare their rates.

-min.webp)