As an alternative, Currency Brokers are specialists in the foreign exchange industry and can save you between 3-5% on your conversion.

For this write-up, we've researched and vetted the industry leaders to seek out who provides the best rates and service.

In the article we'll compare our top 5 providers, covering what a currency broker is, how they work and how to maximise your exchange while simultaneously getting a smooth transfer.

Best Currency Brokers

The above represents a small, hand picked, selection out of hundreds of currency brokers in the UK.

They all charge no fixed fees per transfer, have excellent customer reviews, and are amongst the best known in their domain.

The reason Currencies Direct comes in at #1 is that they are a familiar name in the industry, and

I have personally spoken to their dealing team, finding them highly professional.

Additionally, they offer competitive rates for large transfers, and have great customer reviews. Here is a snapshot of my Currencies Direct review:

What is a Currency Broker?

Currency brokers are companies specialising in converting currency for customers and transferring it internationally.

They’re sometimes called currency exchange companies, money transfer companies or foreign exchange brokers.

They all do the same thing.

They can provide extra features and products too, but I’ll get to that further down.

What is the Difference Between Currency Brokers and Money Transfer Apps?

Currency brokers are specialists in large international transfers.

On the other hand, money transfer apps are best for smaller, quicker and more frequent transfers.

With a broker, you’ll be able to phone in and speak to an account manager.

They’ll be able to help you with any issues or questions you might have, and guide you through the process.

You won’t get this kind of service with apps.

When transferring large sums abroad, you’ll need guidance and assurance that the transfer is going smoothly.

That’s why old-fashioned brokers are the best for large transfers.

Are Currency Brokers the Same as Forex Brokers?

No.

The term ‘Forex’ is used to refer to the speculation of currency movements for profit, not deliverable transfers.

Forex Brokers provide platforms for customers to do this.

If you call up a Forex Broker and ask them to transfer money abroad, they’ll tell you to go away.

Bear that in mind when doing your research.

What do Currency Brokers Do?

Currency Spot Contract

Spot contracts are the most common of exchanges.

Essentially, you book the deal for immediate settlement.

In the finance industry, ‘spot’ means you have up to 2 business days to settle your deal.

However, brokers will give you the option to settle on the same day or the next day.

Once they’ve received your money, they will convert it to the currency you requested.

Currency Forward Contract

A forward contract is an exchange you book to be settled in the future.

Let’s say you needed to convert some GBP into EUR in 6 months time, and the rate has shot up in your favour today.

But right now, you don’t have the funds available to make the exchange at the improved rate.

So, you book a forward contract to be settled by you on the date in which you need the Euros.

The improved rate is locked in and you’ve gotten yourself a good deal.

If in 6 months the rate is considerably worse, you made the right choice because you’ve still got the good rate.

However, if it’s even better than the booked rate, then you’ve lost out compared to if you’d have waited.

Exchanging currencies is always a game of chance.

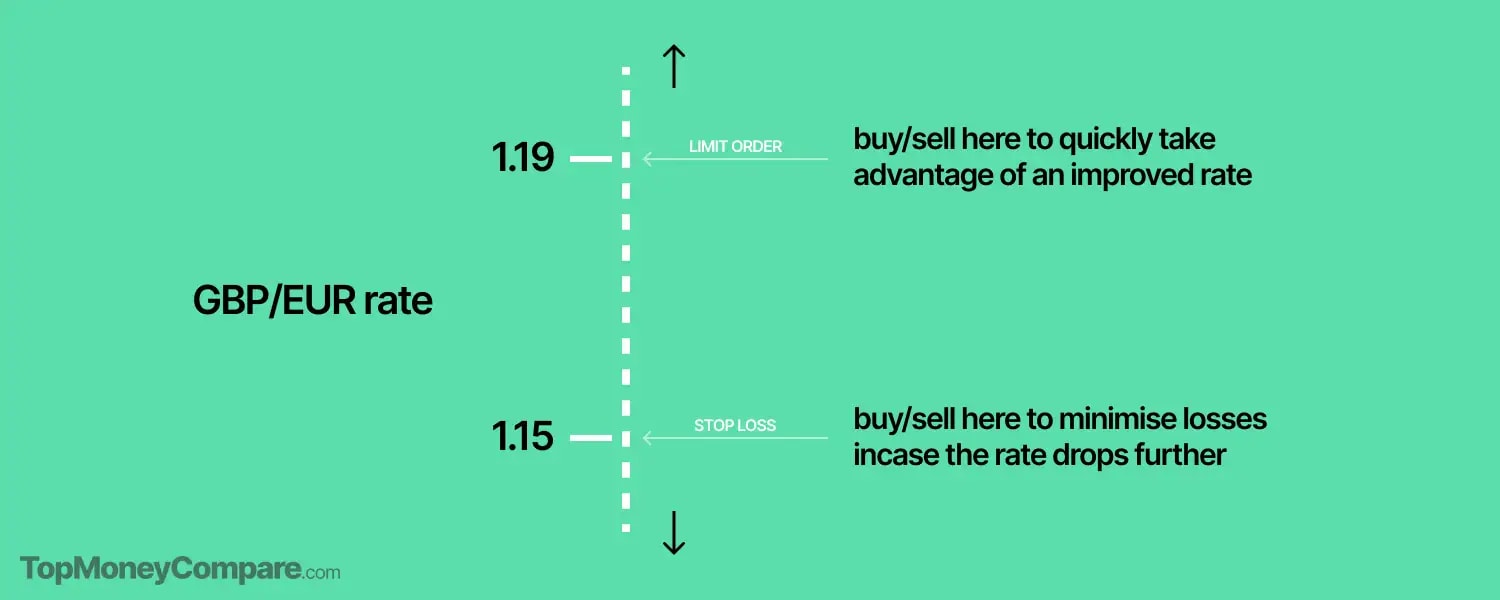

Limit Order

If you want to book a deal when the market reaches a specific rate, you set a limit order.

This means at the exact time the market hits your desired rate, the broker buys your currency and the rate is locked in.

Limit orders can protect you against situations where the market rises but you are unable to capitalise on it before it drops again.

You set the amounts and currencies to buy and sell when you book the limit order.

Again, if the rate continues to rise after your limit has triggered, you can’t then change the rate or buy more currency.

If you want to buy more after the limit order is met, you’ll have to book a spot contract.

Stop Loss

A stop loss is the opposite to a limit order.

An exchange is automatically booked when the rate falls to a certain figure.

This is to protect you against severe market drops, to minimise losses.

Let’s say you want to buy a property abroad and know you have a fixed budget that you can’t exceed. A stop loss order will ensure you don’t miss out.

How Do Currency Brokers Make Money?

There are two ways a broker can make money:

- Fees

- Exchange rates

Brokers cannot earn interest on your funds. It's against the FCA regulation.

Fees

Charging fees doesn’t really need explaining.

They’ll either charge you a flat fee or a % of your transfer volume, per transfer.

Our recommended brokers don’t charge fees.

Exchange Rates

All of the money is in the exchange rate.

Currency brokers buy and sell currency in big amounts every day.

Because of this, their banking partners give them access to the best possible rates.

Then, they give clients a slightly worse rate than the one they bought it for.

It’s like how supermarkets work.

They buy the products for less, sell them for more.

This difference is called the ‘margin’, and is kept as profit.

The higher the margin, the worse the rate you are getting.

All currency brokers have different margins, meaning some will give you more value for your money and some less.

The margin is usually a % of the transfer volume, and is determined by the broker before the deal is booked.

Some brokers have fixed margins, meaning that the % is the same for any amount.

On the contrary, some will give you better rates the more you transfer.

Our job is to point you in the right direction to get you the best possible rate (lowest margin).

So far, we’ve found that Key Currency offers the best rates, varying between 0.2 - 0.5% margin.

Why use a Currency Broker Over Your Bank?

Firstly, the banks are known for their rip-off rates.

While Key Currency can charge 0.2 - 0.5%, your bank will charge between 4 - 6%.

That’s 20 - 30x more.

For example, let’s say you’re looking to move from the UK to Spain and have found a house for €100,000.00.

Assuming an interbank rate of 1.19 GBP/EUR, that will cost £84,286.47 with Key Currency.

Your bank will ask for £89,397.46.

That’s over £5k more expensive…

I needn’t say more.

On top of the expensive exchange rate, some banks add transfer fees, too.

As previously mentioned, most brokers don’t charge any fees.

Another important aspect of maximising your transfer is timing it correctly.

Currency brokers can keep you updated on the market news and trends, helping you pull the trigger at the right moment.

Banks will not do this.

They will just transfer it when you ask to, with no helpful advice.

Currency exchange is just one of the many branches of operation within a bank.

Therefore, it is not their priority and nor are you.

With currency brokers, it’s their bread and butter.

You’ll get much better rates and service by avoiding your bank.

How to Compare Currency Brokers

We’ve established that you shouldn’t use a bank for your large international transfer.

But, how do you pick a currency broker out of the many out there?

They’re all different and provide different types of service.

You just have to know which one is right for you.

Let’s look over the main points:

Level of Service

Firstly, think about what kind of journey you want.

Would you like to speak to someone?

If yes, a traditional broker like Key Currency or TorFX is best.

You can call them to book exchanges or get helpful advice very quickly.

On the other hand, some brokers offer an app and online trading platform too.

Currencies Direct and OFX have some great technology, allowing you to perform a wide variety of tasks.

Exchange Rates

It goes without saying that you’ll want to get a good rate of exchange.

In this industry, you pay for the service.

TorFX has an overall better level of service and human touch than most.

This is why they’re more expensive.

So, you have to find that middleground between the exchange rates and service that suits you.

Take a look at TorFX’s customer reviews and you’ll see that customers appeared more than happy to trade at the rate they did, in return for an exceptional service.

Quickly gathering a few quotes from different brokers is the best way to identify the most competitive.

Products

The majority of brokers will offer a vanilla selection:

- Spot contracts

- Forward contracts

- Stop losses

- Limit orders

Usually, this is all you’ll need to perform your transfers.

However, some offer some more advanced products.

Currencies Direct offers batch payments, risk management solutions, options products and multi-currency accounts.

Most of these products won’t be needed by everyday customers.

However, if you’re looking to make business money transfers, they can be very useful for cutting expenses and improving cash flow.

Online Platforms and Mobile Apps

If you would like access to an online platform or app, make sure you check that the broker offers one before proceeding.

Currencies Direct has both a platform and app, while Key Currency has neither.

Every company has a different offering.

These bits of tech are expensive to build and maintain.

To compensate, you might get a worse rate.

Are Currency Brokers Safe?

The safety of your funds is probably the most important aspect when making a transfer.

Most brokers are completely safe.

But there are some smaller companies out there which don’t offer the same level of protection.

It’s important to know what to look for and how to identify the unsafe brokers.

Are They FCA Regulated?

The Financial Conduct Authority (FCA) is the government regulatory body that oversees major financial institutions.

This includes all high-street banks, most currency brokers and other financial services companies.

Their job is to make sure that these companies are fully protecting and prioritising customers and their funds.

This comes in the form of full audits, random spot checks and customer feedback.

If a broker is regulated by the FCA (“on the register”), you’ll usually see a bit of spiel at the bottom of their website, listing their registration number.

If you can’t see it, then it’s important to ask them if they are regulated.

If they aren’t, or are using a “white-label” regulated company to perform their exchanges, avoid them.

It’s just not worth the risk.

All of our recommended brokers are regulated by the FCA.

How Well Are Your Funds Protected?

Part of being regulated by the FCA is separating client funds from company funds.

Basically, in separate bank accounts at all times and never mixing.

The accounts holding client funds should be “ring fenced and safeguarded”.

This means that they can’t be touched by the company, for any reason other than to convert them for you.

If they fold, your funds are reimbursed to you as a primary obligation over any other creditors.

The only exception under the FCA legislation is if the expenses arising from liquidation surpass the company's available assets.

Under such circumstances, the liquidator may cover their own costs by using customer funds.

It’s important to ask your broker if they have this level of protection (if they’re regulated, they should do).

Customer Reviews

This is usually the best indicator of quality for brokers.

Most will advertise their reviews clearly on their website.

Look for a Trustpilot link or logo, and click it.

It’s a red flag if they aren’t clearly advertising their reviews.

Make sure their overall rating is at least 4/5, preferably higher.

Also check the number of reviews they have.

If it’s a low number (above 1000 is a good benchmark), then look elsewhere.

Take a look at what people love about the broker, and also what people didn’t like.

You’ll know pretty quickly if they’re not a trustworthy company.

But it will also give you a good indication of what they’re good at, not so good at and whether they’re right for you.

Which Currency Broker has the Best Customer Rating?

As I just mentioned, customer ratings on platforms like Trustpilot offer valuable insights into user satisfaction and service quality.

3 of our top 5 recommended currency brokers enjoy a 4.9/5 rating.

Believe me, this isn’t common, and it’s one of the main reasons they make it into our top 5 currency brokers.

But our no.1 recommended provider – Currencies Direct – achieves the rating from over 12,000 reviews. That’s more than any other currency broker.

Even OFX’s 4.3/5 customer rating is deemed as ‘Excellent’ by Trustpilot.

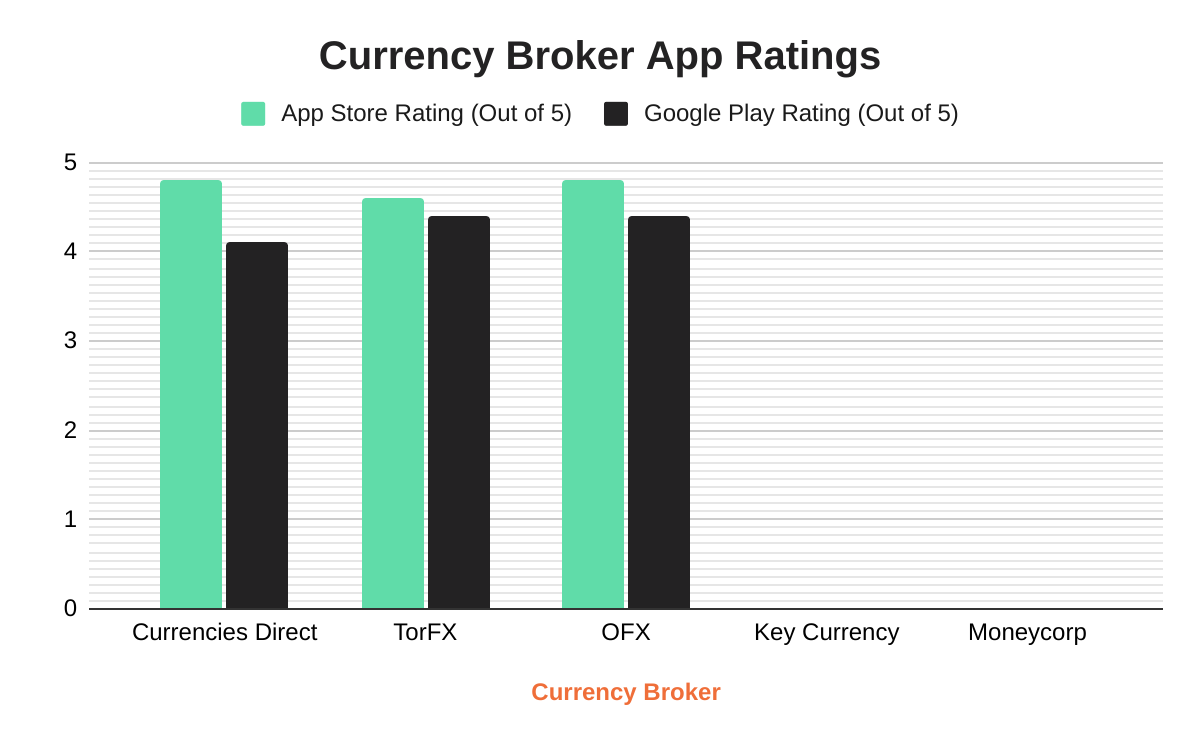

Which Currency Broker has the Best App?

Relying solely on a currency broker's app will result in missing out on some of their most important benefits.

Nevertheless, apps provide a great way to manage your trades on the move.

Currencies Direct and OFX both achieve a 4.8 rating on the App Store, showing strong user satisfaction among iOS users.

But, Currencies Direct's 4.1 Google Play rating suggests a slightly larger disparity in user experience.

While OFX has a slightly lower Trustpilot score, it enjoys the best-rated app of all currency brokers.

Notably, Key Currency and Moneycorp do not offer a mobile app, so it’s worth keeping in mind if this is a must-have feature.

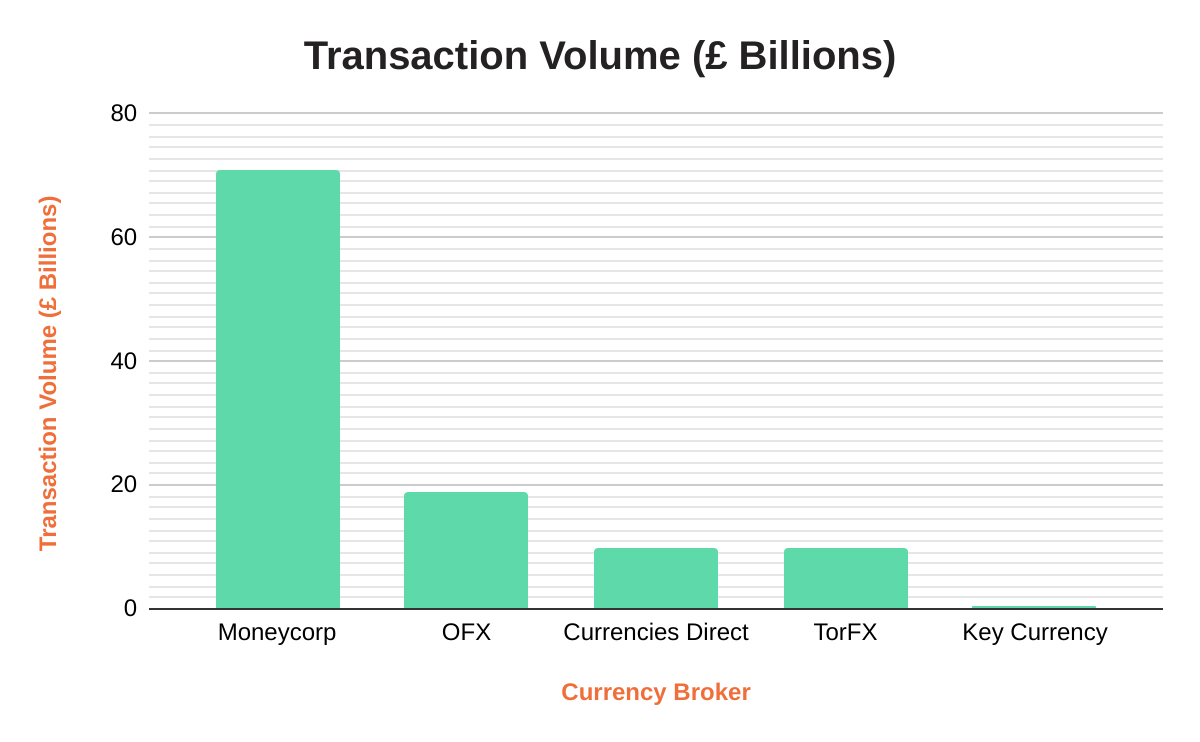

Which Currency Broker Processes the Highest Volumes?

When assessing currency brokers, transaction volumes serve as a good indicator of market presence and client trust.

Of the top 5, Moneycorp leads with a substantial £71 billion in transactions, highlighting its significant market share and experience in the industry.

OFX’s figures are reported in their annual accounts in AUD but convert to roughly £19 billion at the time of writing.

Currencies Direct and TorFX still reflect a high customer base and market share.

Key Currency, with £0.6 billion, represents a more specialised niche, but helps to demonstrate their tailored offering.

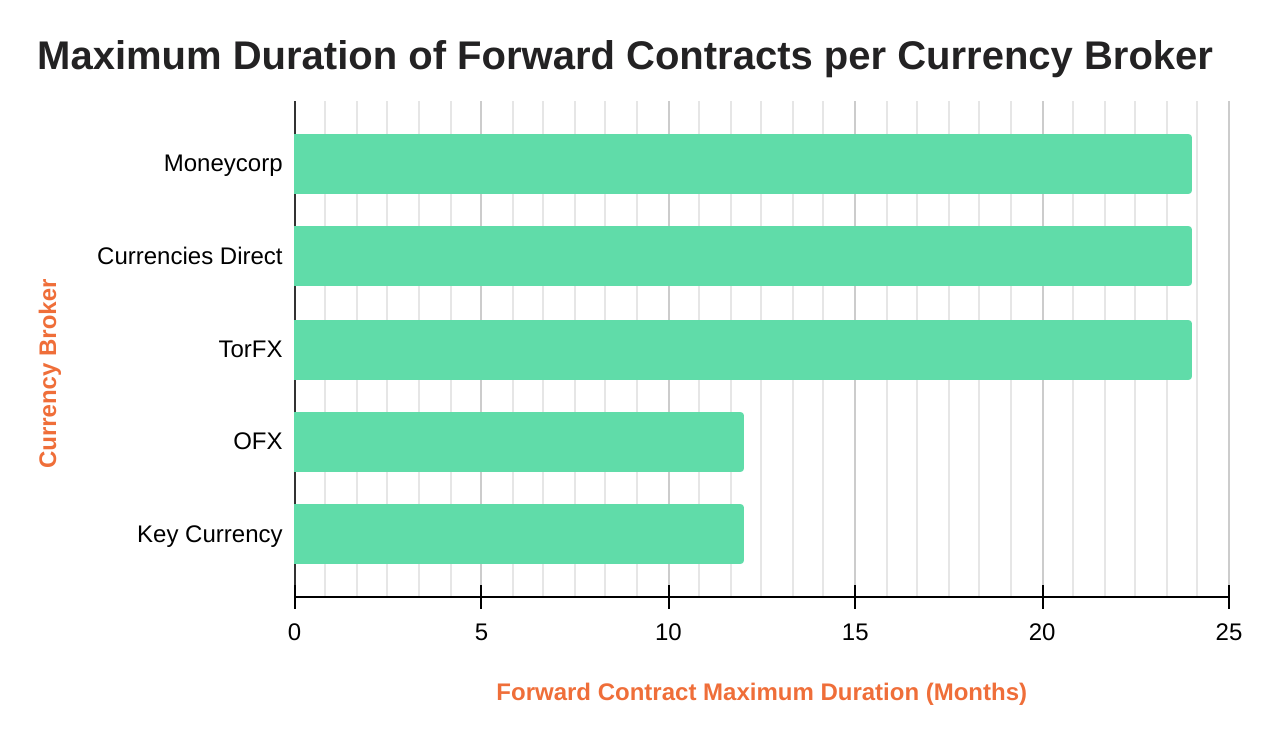

Which Currency Broker Offers the Longest FX Forward Contracts?

Sometimes, individuals – and particularly businesses – need to plan further into the future.

While the standard maturity date for currency forward contracts is typically 12 months, some of the top-rated brokers offer the option to extend this period.

Moneycorp, Currencies Direct and TorFX each offer currency forward contracts with a market-leading maximum duration of up to 24 months.

That means you can lock in an exchange rate for up to two years into the future.

OFX and Key Currency provide FX forward contracts with durations up to 12 months, so are still suitable for the majority of use cases.

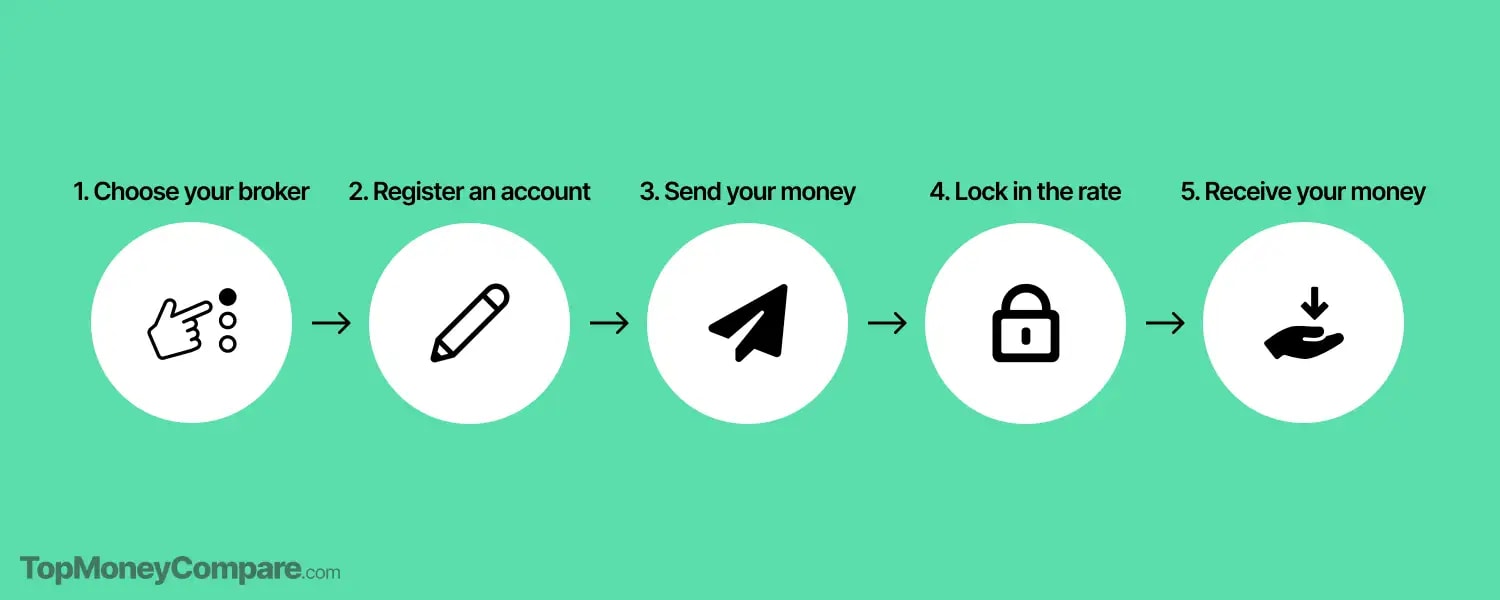

How Does a Money Transfer Work?

It comes down to a simple 5 step process.

Choosing a Broker

That's what we're here for.

It can be hard to pick a broker out of the many available.

We've picked our top 5 and written detailed, unbiased reviews about each.

This way, you can see which broker is really right for you.

After picking your broker, you need to register with them.

Registering an Account

If you’re looking to compare, we recommend signing up with multiple brokers.

This involves giving a few details about yourself, your situation and your requirements.

You may be asked for documents to prove that you are who you say you are, and you live where you say you live.

This is to satisfy the FCAs anti- money laundering regulations, and is standard practice industry-wide.

You may be declined an account if you live in a high-risk country.

Once registered, you need to send them some money.

Sending Money

All brokers will accept bank transfers.

However, only a select few will allow debit/credit card payments.

Currencies Direct and OFX are two that take cards.

Bank transfers are cheaper and quicker anyway, and we recommend using this facility to send funds.

If you have or will sell a house in Spain, your lawyer will issue you with a bankers draft.

Spanish banks will charge you a lot to deposit this into your account.

If you’re looking to repatriate, Key Currency is able to deposit your cheque into their account (not yours) free of charge, ready for conversion.

So you’ll not only save on banking fees, you’ll get a great rate of exchange too.

Locking in Your Exchange

After your broker has received your funds, it’s time to lock in the rate.

Most brokers can hold your funds indefinitely if you wish to wait for the market to move before exchanging.

You can either call through to your account manager or just use their platform/app if they have one.

Get your quote, and ask them to lock the rate in if you like it.

Remember, it’s important to compare multiple providers to make sure you’re getting the best rate.

I’ll talk about comparing a little further down.

Once the rate is locked in, provide them with your beneficiary details (where they will send the funds to).

Receiving Money

Most brokers can send you your money on the same day of exchange.

They can be sent anywhere around the world, except a few countries.

These are countries that are considered ‘extremely high-risk’ to fraud and money laundering.

This includes, but isn’t limited to: Syria, Iran, Iraq, North Korea, Somalia.

Your broker should check where the money is going before locking anything in.

Brokers will use the cheapest and fastest method to send you your money.

These methods vary for currency and country:

- SEPA - sending EUR from a European account to another, 0 - 2 hours delivery time

- Faster Payments - sending GBP from a UK account to another, instant delivery time

- Single ACH - all other payments, 24 - 48 working hours delivery time

It’s essential to ask your broker for all the time frames so you’re well informed.

Summary

Using a currency broker is the best way to move large amounts of money abroad.

They beat the banks in almost every way.

You just have to compare the different options and choose the provider for you.

Just remember to consider:

- Service

- Safety

- Functionality

- Rates

All of the companies reviewed on TopMoneyCompare.com are at a minimum FCA regulated.

If you're transferring under £5k, consider checking out our Best Money Transfer Apps instead.

On that low of an amount, you'll get better rates and a quick, DIY service.

Just below, you can get a quote and compare rates from our recommended currency brokers.

-min.webp)