Most people use their bank to transfer money, getting stung by extortionate rates and fees along the way.

Money Transfer Apps have helped solve this problem.

In this article, I have picked out my top 5 money transfer apps, highlighting what makes them great, and when you’re better off using an alternative. I will start off by rounding them up, and delve into more detailed reviews of the pros and cons of each app.

Best Money Transfer Apps

These are the best apps that you could use to send and receive money internationally, with lesser costs, and better overall experience than legacy options:

Which Transfers Can I use an App For?

An international money transfer, or currency transfer, is sending money abroad.

If the receiving country uses a different currency, you’ll have to do a currency conversion.

There are lots of ways to perform a currency transfer.

Some are expensive, hard work and take a long time.

For example, using a bank is known to be costly and time consuming.

Nowadays, there’s lots of cheaper, more technologically advanced, options.

Money transfer apps (digital providers) are on the rise. Companies like Wise which was established in 2011 have already positioned themselves as multi-billion dollar companies that help millions transfer money abroad.

A money transfer app is exactly what you think it is.

It’s an app that allows you to transfer money.

Usually, in a different currency and to a different country.

You can download these apps straight to your mobile phone.

Or, if you prefer, you can use their desktop version instead.

Most are free to use, and available 24/7, 365.

Should You Use a Money Transfer App to Transfer Large Amounts?

Currency brokers are another method of sending money internationally.

They provide a hands-on, personalised service over the telephone.

Now, some people like this kind of service.

However, brokers are usually used for large volume transfers.

We’ve found that most brokers provide a worse exchange rate for transfers under £5000, compared to digital-only services (apps).

So if you’re trying to decide whether to use a broker or an app, ask yourself:

- How much am I transferring?

- What kind of service do I like?

If it’s under £5k, money transfer apps are best.

For transfers larger than £5k, currency brokers can potentially provide better rates, and give the type of hands-on service people transferring large volumes would expect.

The main reason for that, beyond the fact brokers offer bespoke quotes which can be cheaper than digital "fixed" quotes or fees, is that people appreciate and oftentimes, need, direct and immediate cost to an expert (when sending large amounts).

Money Transfer App Features

Features are usually limited for money transfer apps.

Their primary function is to convert and send money.

Unlike brokers, money transfer apps do not provide:

- Forward contracts

- Limit orders

- Stop losses

(There is one exception, mentioned just below.)

However, some apps provide additional useful features.

Multi-Currency Account (Wise, Revolut)

This is one account that holds multiple currencies.

You can have as many currencies as you need.

Wise will provide you with the country’s standard account details for each account.

This could be an IBAN and BIC, account number and sort code, etc.

You can convert money between your different accounts using Wise’s conversion service.

This feature is great for frequent travellers and for people who send money abroad often.

Wise Debit Card

With the Wise multi-currency account comes a debit card.

You only get one card, which is linked to all of your currency accounts.

Wherever you are in the world, Wise will know which currency account to debit when you swipe your card.

You can withdraw cash up to 200 GBP equivalent every month, with no charge.

XE Business Account

You can open a business account with XE.

They provide the same money transfers, with risk management solutions too.

These accounts are available to businesses of any size.

Sole traders, small-medium businesses or even massive enterprises.

XE provides forward contracts, limit orders and stop losses for business customers.

This allows you to hedge your risk against currency fluctuations.

Ultimately, protecting your bottom line.

How Do Money Transfer Apps Make Money?

There’s two main ways:

- Fees per transaction

- Exchange rate markup

Fees can be charged at a fixed rate or a % of the transfer amount.

Here’s a quick table showing who charges fees and who doesn’t:

However, fees aren’t everything.

Companies could charge a small or no fee, and have a huge markup on the rate.

This could cost you just as much money.

For example, even though XE doesn’t charge a fee, they’re still more expensive than Wise.

This is because Wise provides better rates of exchange.

The difference between the rate the company buys at and the rate they sell at is their profit.

The bigger that gap, the more it’s going to cost you and the more money the company makes.

Why Use a Money Transfer App Instead of a Bank?

In 2022, it’s basically common sense now.

Here are the main reasons why you shouldn’t use a bank:

- They provide terrible rates of exchange

- They charge extortionate fees

- Service isn’t great unless you have a personal account manager

- They don’t specialise in currency or transfers

The only thing going for the banks is their perceived “safety”.

Nowadays, most apps and brokers are just as safe as a bank.

All of the companies listed on TopMoneyCompare.com are regulated by the FCA.

This is basically a stamp of approval from the financial regulators.

Any company regulated by the FCA is trustworthy and safe to use.

I could go on all day about why to not use a bank.

But, to put it simply, money transfer apps do everything better.

They provide better rates, lower fees and intuitive mobile apps.

How to Compare Money Transfer Apps

At a glance, it might seem like they all do the same thing.

However, each provides different costs, features and level of service.

Here are the four main things to consider.

Exchange Rates

As I mentioned before, some companies provide worse rates than others.

It’s important to distinguish between them.

The worse the rate, the more it’s going to cost you to purchase your currency.

There’s a simple way to check the competitiveness of each provider.

Get a quote from each at the same time, for the same amount.

You’ll quickly see who’s charging you the most, and the least.

To save you some time, here’s the % markup each of our recommended companies give:

As you can see, Atlantic Money and Wise are the cheapest and Remitly will probably cost the most.

However, as you keep reading, you’ll understand that it’s not all about the rates.

Fees

Further up, I gave you the fees for each provider.

For WorldRemit and Remitly, their fees largely depend on the currency and destination.

If you’re sending through a less common corridor, it’s going to cost the company more to process it.

In turn, they’ll charge you a higher fee.

And vice versa.

This is because of the relationships the companies have with the receiving country’s banks.

If they pass more volume through, it will cost them less.

This is called economies of scale.

For example, sending PHP to the Philippines is one of, if not the most common remittance corridor.

Therefore, it’s going to cost the company less to process these transactions.

You’ll then find that your fees are smaller.

When comparing the overall cost for each provider, make sure to factor in the fees too.

Features

It’s important to know what each company provides and if it fits your needs and wants.

So, always factor this into your comparisons.

I’ll keep this bit short as I’ve already talked about features.

- Need a business account? Use Wise or XE.

- Want a debit card? Use Wise.

- Want to hedge your currency exposure? Use Currencies Direct.

- Need to send via mobile money or airtime? Use Remitly or WorldRemit.

- Need cash? Use WorldRemit or Remitly.

- Want home delivery? Use Remitly.

Have a think about the specifics of your transfer and then see if a company is a good fit.

Available Countries

Some companies offer to send to some countries, some don’t.

Wise will send to pretty much every major country, and some more exotic countries too.

However, there are lots of currencies and countries that they don’t provide.

This is where Remitly and WorldRemit step in.

They’ve come in and covered that gap.

However, they don’t provide transfers to major countries.

XE, on the other hand, covers the whole lot.

Here’s a quick summary:

Before signing up, double check to see if they can send to your receiving country.

If you’re really stuck, consider Western Union.

They’re the most global transfer provider in the world and will allow you to send money to virtually every country there is.

Are Money Transfer Apps Safe?

The safety of your money is most important.

The overwhelming majority of companies are safe to use.

But, there’s a checklist you should use for each company to be doubly sure.

Are They Regulated?

This is the main thing to consider.

Most apps you’ll come across are regulated in many different countries.

If a company is regulated, it means that they’re constantly under watch for how safe they are.

This comes in the form of full audits, random spot checks and customer feedback.

This means more protection for you.

For companies that aren’t regulated, it’s basically the wild west.

So, it’s best to avoid them.

To find out if a company is regulated, scroll to the very bottom of their website.

They should have a bit of text outlining their regulation and numbers.

If you can’t see it, you might have to do some more digging or even call them up and ask.

Are My Funds Protected?

To give a bit of context, if your bank went bust you’d only receive up to £85k of your money back (UK).

This is part of the FSCS scheme.

However, transfer companies regulated by the FCA are required to safeguard their clients' money.

This is different from the FSCS.

When you transfer your money to a regulated company, they must keep it separate from their own money.

These separate accounts are called “ring-fenced and safeguarded” accounts.

If the transfer company fails, there’s no limit on the amount you can get back and your money cannot be used to pay off company debts.

There’s just one scenario that your funds are at risk.

If the liquidator’s own costs exceed the cash held by the business, they can deduct their fees from the pool of client funds.

So, always check if they safeguard client funds.

As a regulated firm, they should do.

Customer Reviews

It’s great to know what other customers think.

It gives a good perspective of what you can expect.

Most companies use Trustpilot to collect client reviews.

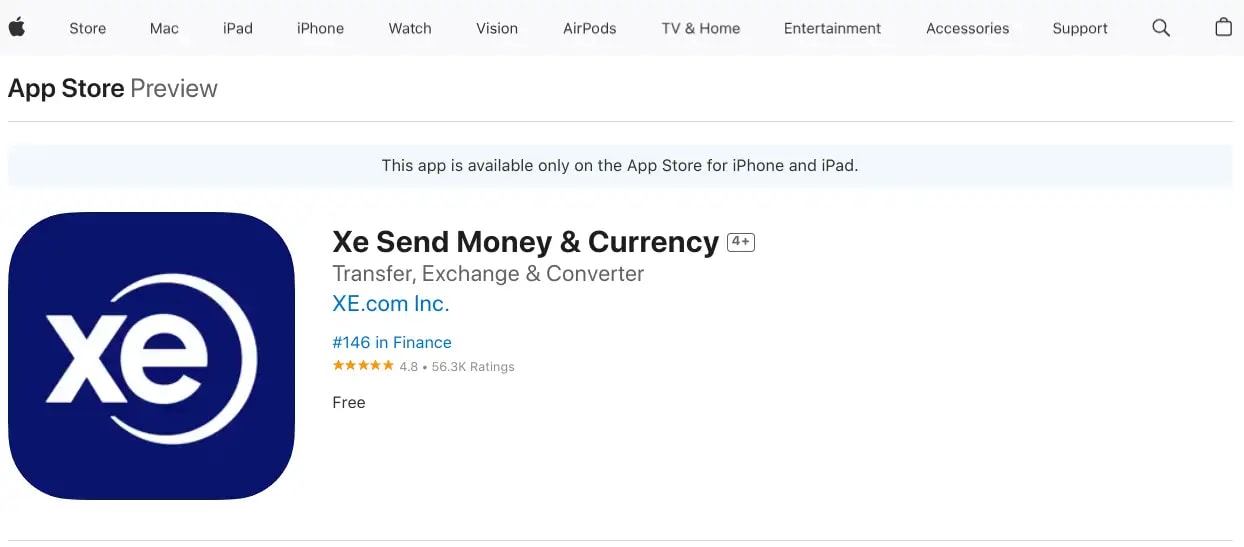

As you can see, XE has over 50k reviews.

Search for the company and take a look about what people like and don’t like.

To help, you can filter their reviews by the star rating.

If a company doesn’t have many reviews, I’d avoid them.

App Reviews

As you’d expect, app reviews will give you a more specific understanding of how well the provider’s app performs.

You’ll see just how easy it is to navigate, what functions they have and how often it goes wrong.

They won’t, however, provide as much detail as to the overall level of service provided.

To make things easy, I’ve collated the App reviews for my most recommended money transfer apps.

All of our recommended apps enjoy an excellent rating on the App store. Only Currencies Direct has a considerably worse rating on the google play store, indicating some app bugs on android.

How To Make a Money Transfer Using an App

Here’s a simple step-by-step guide to getting started.

Pick a Provider

That’s what we’re here for, and what this article is about.

Have a think about the amount you’re transferring and where it’s going.

Then choose a provider based on what you’ve read here.

Register an Account

Every provider will require you to register an account.

This is to prevent things like money laundering and terrorism funding.

You’ll fill out a form with your details and specifics about your transfer.

Then, you’ll probably be asked to prove that you are who you say you are.

This means sending them:

- Proof of ID, e.g. passport or driver's licence

- Proof of address, e.g. a utility bill

- A selfie

A selfie is a strange request, but should be the last step of verification.

Now you just have to wait for the company to approve your account.

Set Up Your Transfer

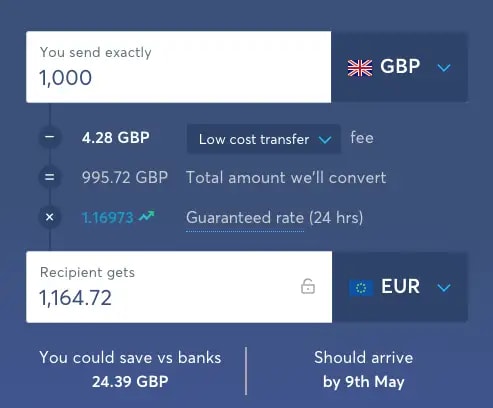

Select your currencies, amounts and destination.

You’ll then get a rate.

If you’re happy, proceed with the transfer.

Most companies will lock the rate for 24-48 hours, to give you time to pay for it.

However if the mid-market rate moves more than 5% before you’ve paid, it may get cancelled.

Now it’s time to pay for the transfer.

Pay For Your Transfer

There are lots of possible ways to pay for your transfer:

- Bank transfer

- Debit / credit / prepaid card

- Poli

- Interac

- iDEAL

- Klarna

- Apple Pay

- Trustly

- Mobile Money

However, different providers offer different options.

Not only that, availability also depends on the currency, amount and destination.

You can simply pay via a bank transfer nearly all of the time.

This is often the quickest and cheapest method.

However, if that isn’t an option, there’s usually at least one other method available.

It’s best to pay for your transfer as quickly as possible in order to keep the rate locked in.

Remember, paying with a credit card will have additional charges and may affect your credit score.

(I learnt this the hard way).

Receiving the Money

Provide the company with the recipient’s bank details.

If this is yourself, then great, simply type in your details.

If it’s someone else, they’ll have to give them to you.

What you need depends on where the money is going:

Once your transfer is paid for, the money will be sent.

How Long Do Money Transfers Take?

Again, this depends on the recipient country.

Different countries use different payment methods.

For example:

There are more, but those are the main ones.

Now, it isn’t guaranteed that your provider will use the quickest method available.

Often, they will use whatever is the cheapest for them.

Unless you pay for a quicker payment of course.

Most GBP, EUR and USD payments will be available on the same day.

For AUD and any other currency, it might take a day or two.

Always double check, as all providers have different timelines.

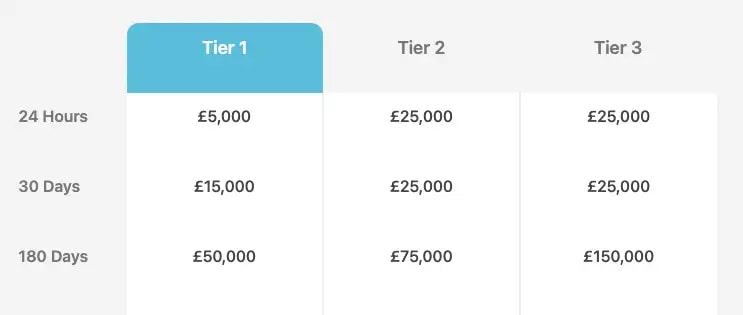

How Much Money Can You Send?

Typically, there isn’t a lower limit to how much you can send.

However, all Money Transfer Apps provide different upper limits.

With Wise and XE, you have to call their team to transfer more.

Which Money Transfer App is Right For Me?

In a nutshell, I’d consider 3 things:

- Where you’re sending to

- How much you’re transferring

- The type of delivery you need

If you’re sending to an exotic country, first check to see whether each company provides it.

Sending to a major country? Use Wise or XE.

An exotic country? Use Remitly or WorldRemit.

Need cash or home delivery? Use Remitly or WorldRemit.

Once you’ve narrowed it down, simply check how much each will cost.

Then, sign up with the cheapest or the one you have the most confidence in.

Deep-Drill: Best International Money Transfer Apps, Reviewed

Learn more about my top 5 apps, complete with some helpful knowledge and pros & cons.

1. XE

XE logo

XE is an app-based money transfer company and currency conversion tool, with a supporting currency brokerage service and account management team.

They were founded by two friends out of a basement in Canada, in 1993.

In 2015, XE was acquired by Euronet, a Nasdaq company, for $380 million. The move has allowed Xe to offer a whole range of currency services including bank-to-bank transfers, cash delivery and currency hedging. Making it one of the most complete currency apps on the market.

IS XE SAFE?

Xe is one of the world's best known currency brands.

They are regulated by the FCA, as well as a whole host of other large regulators in the U.S, Australia, New Zealand, Canada and Europe.

Not to mention they have been successfully running for 30+ years and are owned by Euronet, a Nasdaq company.

XE RATES & FEES

XE's spread is usually between 1-2% for smaller volumes.

For higher volume transfers, or large requirements on an annual basis, you can be referred to a private account manager for a tailored quote.

XE AVAILABILITY

XE offers the full suite of currency tools, for privates, small businesses and corporations.

Their app allows you to research foreign exchange rates, utilise a currency converter and send money to over 200 countries.

By leveraging other Euronet-owned companies, the XE app will even allow you to send cash and make transfers to mobile wallets, in addition to the usual bank-to-bank transfers that can be made with any app listed in this guide.

IS XE FOR ME?

If your primary goal is to make app transfers, then yes, XE is an excellent choice.

The app boasts exceptional ratings and offers one of the most comprehensive sets of services available.

It's an intriguing and unique blend of a currency broker (formerly HiFX), a remittance company (Ria), and the XE brand (a well-known currency website and app).

XE PROS

4.8/5 rating on both the app store and google play

Market-leading forex updates and currency charts available in app

98 different currencies available

XE CONS

Not great on tablet

Misses some of the features that you can access online

Opening an account can sometimes be slow

2. Wise

Wise (formerly known as TransferWise), is an online and mobile money transfer app.

They’re known in the industry for being one of the cheapest providers.

In 2021 they IPO’d on the London Stock Exchange, making it the first of its kind to do so.

This saw Wise valued at over £11 billion.

IS WISE SAFE?

Being a publicly traded company, Wise is very safe.

They’re also fully regulated in 14 countries.

Nearly a million people have reviewed Wise across the app store and google play.

WISE RATES & FEES

Wise is one of the cheapest options for transferring money abroad.

This is shown in their prices, charging anywhere from 0.4% and up.

Technically, they offer interbank rates with the 0.4% being a variable fee. This just makes their fees much more transparent compared to hiding costs in the exchange rate.

WISE AVAILABILITY

You can use the Wise app to make international transfers but where Wise really stands out from the crowd is with its multi-currency account and debit card.

I’ve personally used this feature and I must say, it is brilliant for travelling.

You can open a new currency account in the Wise app in a few clicks and then hold multiple different currencies at any given time.

You can then spend from your balances, using only one card for all currencies.

Wise knows which currency to debit based on where you are in the world.

It’s also easy to find other users on the Wise platform and make near-instant transfers to their Wise account.

IS WISE FOR ME?

If you’re travelling or going on holiday and want to manage your currency on the move with a slick app, then yes.

If you’d like to run balances in various currencies and spend from these with a matching debit card around the world for fair prices, then also yes.

If your transfer is large, or you want to hedge your currency exposure, then know that Wise does not offer that possibility.

If you need to make a bank transfer to a more exotic destination, or get the beneficiary to collect cash, XE might be a better bet.

WISE PROS

App available in a variety of languages

Manage your multi-currency accounts and debit card in the app

Publicly traded company

WISE CONS

Question marks over customer service if you experience issues with the app

Some customers have reported difficulties with the new app design

No cash transfers

3. WorldRemit

WorldRemit is a digital cross border remittance and currency conversion app.

They specialise in small, frequent payments through less common corridors, such as Africa and Asia.

If you have family abroad or are working overseas, WorldRemit could be for you.

WORLDREMIT PROS

Most users report the app to be fast and easy

New UI on the app is intuitive

Lots of ways to pay for your transfer

WORLDREMIT CONS

Number of bug reports following a 2024 app update

They charge transfer fees

Some users encounter delays to their transfer

4. Currencies Direct

Currencies Direct was founded in 1996 out of London. They were the first non-bank money transfer provider in Europe.

In 2016, Currencies Direct launched a mobile money transfer app, combining slick technology with their traditional account management service.

As of 2021, they have 20 offices around the globe covering nearly every continent.

IS CURRENCIES DIRECT SAFE?

Currencies Direct is authorised and regulated in multiple countries.

This includes the UK, Spain, USA, Canada and South Africa.

They also have over 10k customer reviews on Trustpilot.

I don’t think they could be safer.

CURRENCIES DIRECT RATES & FEES

Currencies Direct’s spread is typically between 0.5% and 1%, but can reach well under that if you have a large enough inquiry.

This means that for every £10000 you transfer, they make about £50 profit.

To put it into perspective, most big UK banks set their margin between 3-4%.

So, you’re making big savings.

Currencies Direct doesn’t charge any fees, either.

Banks would charge £20 or £30, typically, in the UK.

CURRENCIES DIRECT AVAILABILITY

As you’d expect, the Currencies Direct mobile app can be used to track exchange rates, set rate alerts and make straightforward international transfers.

However, their services go far beyond this and it’s also possible to arrange batch payments, forward contracts and market orders through your account manager or the online platform.

IS CURRENCIES DIRECT FOR ME?

Currencies Direct can help you with all transfers of any size.

With a leading online money transfer platform, and an app, Currencies Direct are the most well-rounded money transfer company option for the majority of our readers.

However, their large team of personal account managers make them a great option for large volume transfers.

CURRENCIES DIRECT PROS

4.8/5 rating on the app store

Veteran company - 25+ years experience

No transfer fees

CURRENCIES DIRECT CONS

Not such a good app rating on Android

Not all features available through the app

Smaller amounts can cost more

5: Atlantic Money

Atlantic Money is a new, mobile-only money transfer app.

They launched in March 2022, with the aim to disrupt the money transfer industry.

With other providers like Wise and Revolut offering very cheap transfers, Atlantic Money is looking to one-up them even more.

They’re doing this by offering their customers the mid-market rate, with a fixed £3 fee.

IS ATLANTIC MONEY SAFE?

Atlantic Money is authorised and regulated by the FCA as a payment institution.

Any company regulated by the FCA is safe to use.

Atlantic Money has been audited, examined and scrutinised to see exactly how their systems work and how they keep their customers safe.

They’ve then been given the green-tick to say that they’re a safe company.

For the customer, it’s the highest level of protection you can receive.

ATLANTIC MONEY RATES & FEES

Atlantic Money provides a wholesale rate which is just marginally off the mid-market exchange rate for all transfers.

In theory, it’s the best possible rate you can get at any given time.

They pass on the same rate they get from the banks and don’t make any money by applying a margin or spread onto the rate, unlike most other companies.

Atlantic Money charges £3 for every transfer, to any currency and of any size.

ATLANTIC MONEY AVAILABILITY

Atlantic Money currently only provides money transfers via their iOS and Android apps.

They don’t provide any additional features like forward contracts, limit orders and stop losses.

They also do not have a web platform. It’s all done via your phone.

Atlantic Money currently only provides 10 currencies.

IS ATLANTIC MONEY FOR ME?

Atlantic Money can perform transfers of up to £1m.

However, I’d only recommend using them for smaller transfers.

Their customer service is only provided via text message.

WIth larger transfers, you'll need a 1-on-1 account manager to give that comfort and peace of mind.

ATLANTIC MONEY PROS

Only a £3 transfer fee for every transfer, of any amount

Simple app design that makes it easy to use

Authorised and regulated by the Financial Conduct Authority

ATLANTIC MONEY CONS

Low number of app ratings

Some users encountering transfer delays

Limited number of currencies for now

Summary

Money Transfer Apps are a great way to transfer small amounts abroad, quickly.

They do everything better than the banks.

This is because they’re specialised services, compared to the banks who do lots of different things.

Great rates, cheaper fees and additional features are the main benefits.

Most times, you can be signed up and making your first transfer within a day.

Just remember:

- Check if they provide what you need

- Check if they’re safe

- Check their rates and fees

All recommended companies on TopMoneyCompare.com are FCA regulated.

As always though, I’d recommend that you use a currency broker for anything more than £5k.

They’ll give a much better, personalised service, tailored for high volume transfers.

Just below, you can get a quote and compare rates from our recommended providers.

-min.webp)