If you’re looking to send money abroad, you’ve probably come across Remitly in your research.

You’ll most likely have come across a bunch of other companies too.

To the naked eye, they all look like clones of one another.

But actually, they all offer varying exchange rates, features and levels of customer service.

In my review of Remitly, I’ll explore if they’re safe to use, how much they cost, what their customers are saying about them and what features / payout options they have.

I’ve then scored them out of 5 for each category, giving me a final TopMoneyCompare rating.

Finally, I’ll discuss whether Remitly is the right company for you, if they aren’t, and any alternatives that might be better.

itly is an international money transfer and remittance company.

They’re primarily used by expats and travellers who want to send money home.

This might be repatriating a salary, or just supporting loved ones abroad.

Remitly was founded in the USA in 2011 by Matt Oppenheimer and Josh Hug.

They sought to provide U.S. immigrants with a quick and cheap method to send money home.

As of 2024, they have 7 offices around the world and provide their services internationally.

Before going public, Remitly received a significant $505 million from major private investors.

They included:

- QED Investors

- Threshold

- Stripes

- PayU

- Visa

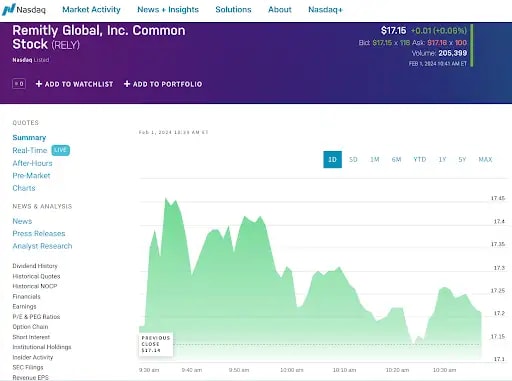

In 2021, they went public on the NASDAQ, valued at $6.9billion.

This followed in Wise’s footsteps, who IPO’d just 3 months prior.

- Publicly traded on the NASDAQ

- Offer the ability to send to 100+ countries

- Cash collection and home delivery are offered

- Their mobile app is the highest rated of competitors

- Lots of ways to pay for your transfer

- Rates are worse than competitors

- Some major countries aren't included

- Fees can get expensive with the most exotic countries

Is Remitly safe?

Remitly is a very safe company and can be trusted with your money.

In a summary, here’s why:

- Authorised and regulated in multiple countries

- Publicly listed on the NASDAQ

- Client money is held in separate, protected accounts

- Tens of thousands of Trustpilot reviews

- A number of known investors

However, there is one indicator that you need to watch out for.

I’ll explain in more detail below.

I’ve scored Remitly a 4.3/5 for safety.

Is Remitly legit?

Remitly is authorised and regulated by the following entities:

- Financial Conduct Authority (UK)

- Central Bank of Ireland (EU)

- US Dept. of Treasury

- ASIC (Australia)

- Monetary Authority of Singapore

Getting regulated is no easy task.

You must prove that you’re safe and reliable with client money over a period of time.

This includes having all of the necessary departments and procedures in place to ensure client safety.

To have regulation in 5 different jurisdictions shows how safe they are as a company.

Alongside their regulation, they’re also publicly listed on the NASDAQ.

I think it goes without saying that any publicly listed company is legitimate.

Is your money safe with Remitly?

A requirement of their regulation is to keep client money separate from company money.

These separate accounts are what’s called “ring-fenced and safeguarded”.

The money in these accounts cannot:

- Be invested

- Earn interest

- Be used to pay debts

So, if Remitly became insolvent (went bust), they can’t use your money to pay other creditors.

There’s just one scenario that your funds are at risk.

If the liquidators own costs to redistribute client money exceed the cash held by Remitly, they’re entitled to claim this back from the pool of client funds.

In the UK, high-street banks are bound by a scheme called the Financial Services Compensation Scheme (FSCS).

This scheme entitles customers of the bank to up to £85k of their money back, if the bank went under.

Anything over £85k will be lost.

This is why the wealthy like to spread their money across different institutions.

With any regulated money transfer company, including Remitly, there is no limit on the amount you can claim back.

Therefore, I’d say that they’re arguably safer to use than your UK bank.

Is Remitly trustworthy?

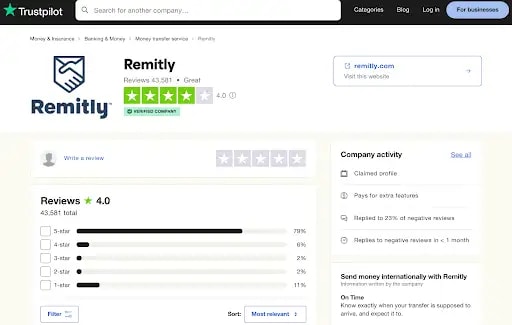

Remitly has gathered over 56k reviews on Trustpilot.

While maintaining an excellent rating, too.

I’d say you could trust your money with a company that has that many reviews.

However, you do need to look at what the comments are saying.

I’ve analysed their Trustpilot page here.

I’ve also taken a look at their company accounts to see how healthy they are.

Here’s some key points from 2023:

- Total transfer volume of nearly $40 billion, up by 34%

- Total revenue of $944m, up by 44%

- Net loss of $118 million

These numbers are similar to that of close competitor WorldRemit, who also made significant losses.

Despite Remitly making a heavy loss, they’re still on a good growth trajectory.

Just like WorldRemit, they’ve got some notable investors, so they can take the hit.

However, I’m not sure if their shareholders will stick around if they keep making heavy losses.

Overall, Remitly is a very trustworthy company, but it would be a good idea to keep an eye on their figures if you plan to use them long term.

Remitly exchange rates

Remitly offers some good exchange rates and some that are not-so-good.

You’ll get better rates with Remitly compared to your bank, but sometimes there are other money transfer providers who are better.

Remitly’s rates vary based on:

- Send and receive countries

- Amount transferred

- Payout method

It’s typical for the more exotic (less common) countries to have worse exchange rates.

However, there’s no real consistency.

It may come down to the currency needed, with Remitly’s banking partners offering different spreads with different currencies.

You’ll also find that you’ll get a better rate with larger transfers.

When I say a “better rate”, I mean Remitly applying less of a markup (A.K.A ‘spread’ or ‘margin’) to the mid-market exchange rate.

The ‘spread’, or ‘margin’ is the difference between the rate the provider receives when buying the currency, and the rate they give to you when they sell. In other words, it’s the profit they make on the transaction.

Overall, I’ve worked out Remitly’s markup to be between 0.5% and 2.5%.

Again, this varies based on the points listed above.

Remitly transfer fees

Remitly offers transfer fees that vary from 99p to £3.99, depending on the currency and payout method.

Although seemingly small, these fees can stack up when making frequent transfers.

You have the choice between an ‘economy’ fee and an ‘express’ fee.

Express transfers are quicker than economy, and so have a higher cost.

Here’s a quick table with some examples:

Remitly's flat fee structure means that the same fee applies, regardless of the transfer amount.

Wise, on the other hand, charges a percentage fee between 0.3% and 0.45% of the transfer volume.

For example, a £2,000 transfer with Wise will cost roughly £8, and between 99p and £3.99 with Remitly.

For smaller amounts, Wise may charge a lower fee, while Remitly’s fee may be smaller for larger amounts.

The catch is that Remitly applies a mark-up on their exchange rates, while Wise does not.

So, although Wise may charge a higher fee, they may still be cheaper overall.

After looking at Remitly’s exchange rates and transfer fees, I’ve scored them a 2.3/5 for cost.

Remitly reviews

Remitly has over 56k reviews on their Trustpilot page, with an average rating of 4.5/5.

I’ve been monitoring Remitly’s rating and it’s improved significantly from their 4.0/5 rating in 2022.

That’s no mean feat, and suggests a far greater portion of 5* reviews in recent years.

80% of their reviews are 5 stars, and 10% are 1 star.

Their 4.5 rating is much better than WorldRemit’s 3.5, and slightly better than XE’s 4.3.

I’ve scored Remitly a 4.5/5 for customer satisfaction.

Remitly positive reviews

Here are some positive things that people have to say about Remitly:

- Very quick transfer speed (some in minutes!)

- Easy to use mobile app

- Friendly and informative customer service

Nearly all of their good reviews mention a very speedy transfer time.

With a large portion of Remitly’s transfers going through cash pickup, mobile money and airtime, this is to be expected.

These transfer types are usually instant.

Remitly negative reviews

Here are some negative comments about Remitly’s service:

- $300 transfer put on hold, bank statements requested

- Accounts ‘flagged’ after a certain number of transactions

- “Insurmountably bad service”

Unfortunately, the first two points are often unavoidable.

Remitly is authorised and regulated in multiple countries, alongside being on the NASDAQ.

Thus, they have a much higher level of compliance to adhere to.

This might mean holding payments to request more information, or just closing accounts all together if they can’t justify legitimacy.

A lot of Remitly’s business operates in ‘high-risk’ countries, so they have to be diligent.

Just be prepared for Remitly to ask for more information at some point.

I also read a couple of reviews regarding their customer service.

Very long hold times, promised callbacks that weren’t fulfilled, unhelpful agents…

This is a common theme with a lot of companies nowadays.

They grow so big so quickly, and can’t handle the demand.

Not everyone had this experience, however.

Some customers have left 5 star reviews about the customer service.

You’ll just have to roll the dice and hope you get lucky.

Remitly service, features and availability

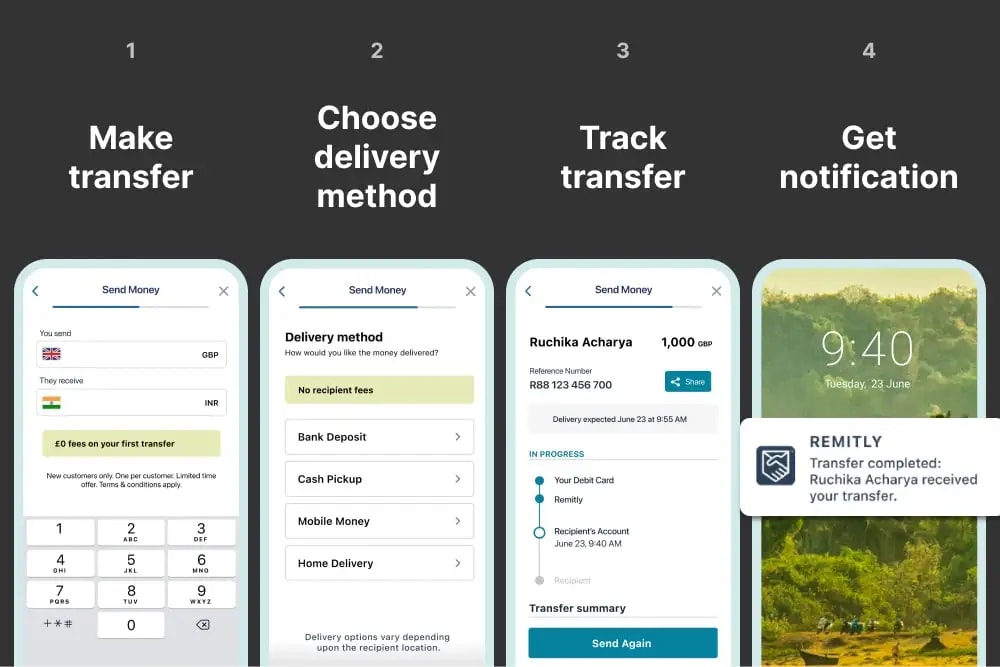

Remitly offers varied delivery methods and an extremely popular mobile app.

However, their currency hedging solutions are lacking, and there are reports of poor customer service.

So, while they’ve got some good technology for instant transfers, they need to work on the human element of their service.

The ability to set limit orders, or book forward contracts, would also allow customers to hedge their currency risk, or even take advantage of positive movements in the exchange rate.

Overall, I’ve scored Remitly a 2.6/5 for service, features and availability.

Remitly mobile app

Remitly’s mobile app has over 1.3 million ratings on the App Store, and over 750k ratings on the Google Play Store.

Even with this insane amount of ratings, they still maintain a score of 4.9/5 and 4.8/5 respectively (near perfect).

Personally, I’d have to agree with the consensus.

It’s a really tidy, easy to use app, built with all the necessary features.

Here’s what you can do using the Remitly mobile app:

- Make transfers using debit card, credit card or bank transfer

- Add and manage recipients

- Track your transfers

There’s nothing you can’t do on the app that you can on their website.

Remitly’s app is the most popular money transfer app on the App Store (if you exclude PayPal).

They currently sit at 28th in the Finance category overall.

Remitly delivery methods

Remitly offers four delivery methods for transferring money internationally:

- Bank transfer

- Cash pickup

- Mobile money

- Airtime top up

Let's take a closer look at each of these options.

Bank transfer

This method involves depositing the funds directly into the recipient's bank account.

The recipient can then withdraw the money as cash or use it for payments or bank transfers.

However, this option may not be available for some exotic currencies and countries.

Cash pickup

With cash pickup, the recipient can collect the transferred money in cash from one of Remitly's partner locations.

The funds can usually be picked up instantly after the transaction is completed, making this a popular option for African currencies.

Mobile money

This method allows you to send money directly to a mobile money wallet.

While mobile money accounts aren't as common in Europe, over half of Remitly's transfers are sent to mobile money accounts, especially in Africa and Asia.

Airtime top up

With airtime top-up, you can add credit to someone's phone for calls, texts, data, and other services.

This can be done through Remitly's select airtime partners, and is a convenient way to help your loved ones stay connected.

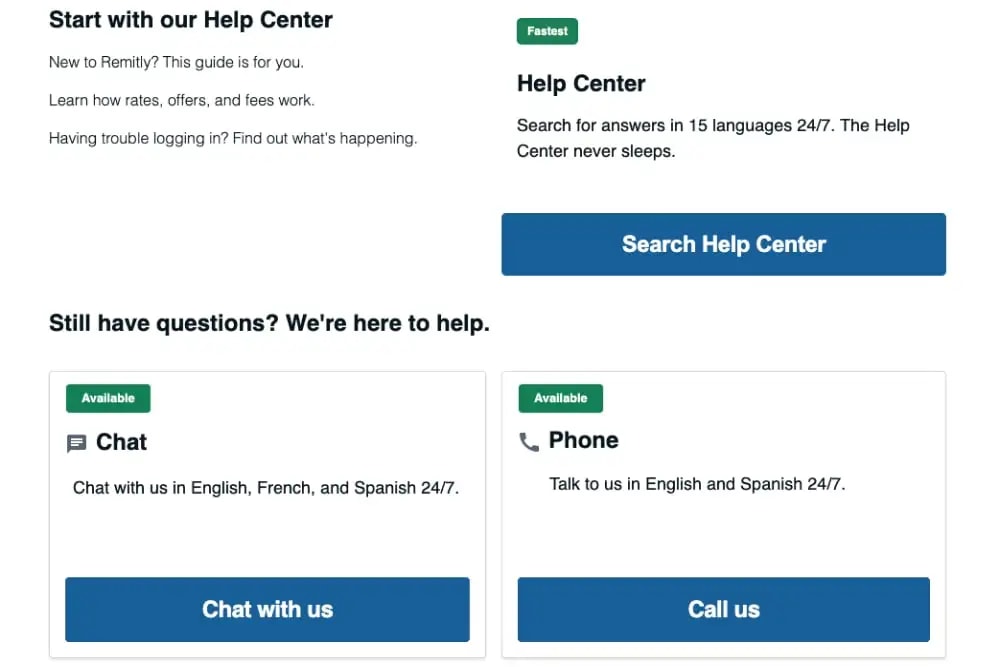

Remitly customer service

Remitly makes it easy to get help, whether it be via:

- Help centre (FAQs and documentation)

- Live chat (24/7, English, French and Spanish)

- Phone (24/7, English and Spanish)

You simply go to the bottom of any page on their website, and click ‘Contact us’.

Here’s what their contact page looks like:

Although that part might be easy, actually getting the help is where some people get stuck.

There’s a lot of negative reviews about their phone support.

Most notably the hold times, calls dropping, and unhelpful advisors.

Not everyone has a bad experience though.

My favourite thing is the 24/7 coverage.

No matter what time of day it is, if you’ve got an issue you can give them a call.

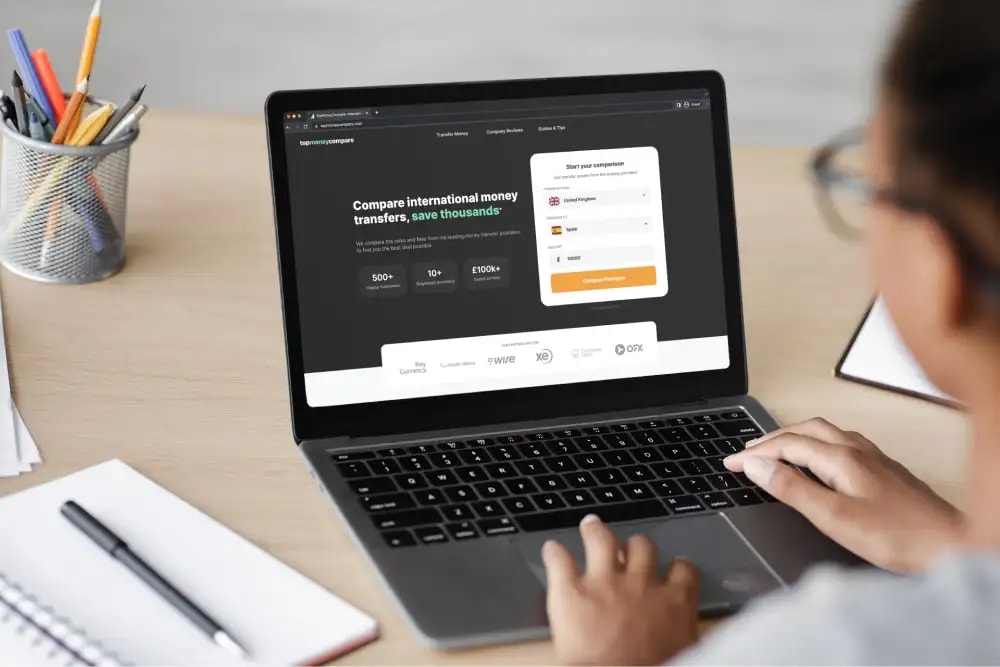

1. Check Remitly’s rates compared to competitors

You can use TopMoneyCompare’s comparison engine to check out how Remitly’s rates stack up against their competitors.

You can see the amount and rate you'll receive, transfer fees, and speed.

This way, you can get a clear picture of how they compare and decide if Remitly is the right option for you.

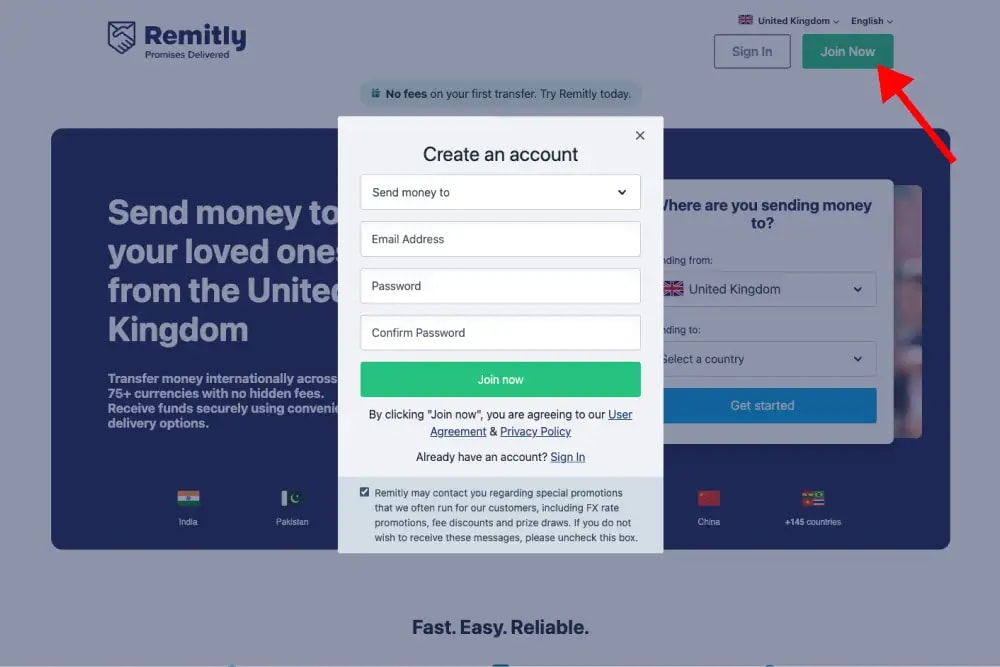

2. Sign up for an account with Remitly

To use Remitly for your international transfer, you'll need to sign up.

Click here to sign up for a Remitly account (opens in a new tab).

Create your login details and click ‘Join now’.

Then fill out the details about yourself and your requirements.

Keep in mind that additional checks may be required if your details can't be verified.

This might include sending them some documents to prove that it’s really you.

This could be a drivers’ licence or passport, and a utility bill or bank statement.

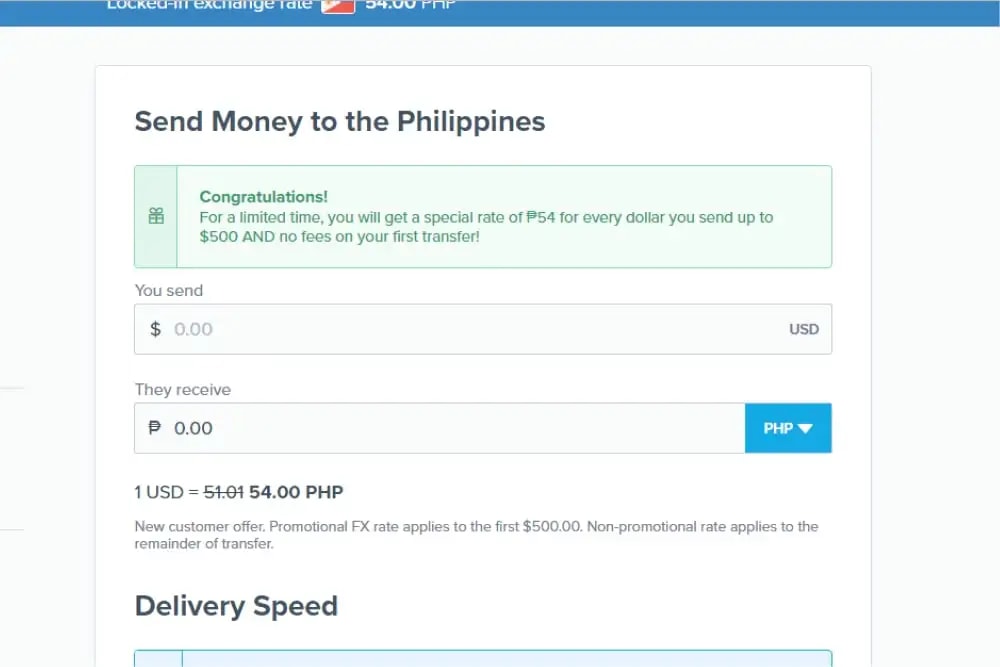

3. Initiate a transfer

Once your account is open, you can log in to the platform or mobile app and make your transfer.

First, choose your destination country.

Then enter in your amount, check the rate and fees, delivery method and transfer speed, and click continue.

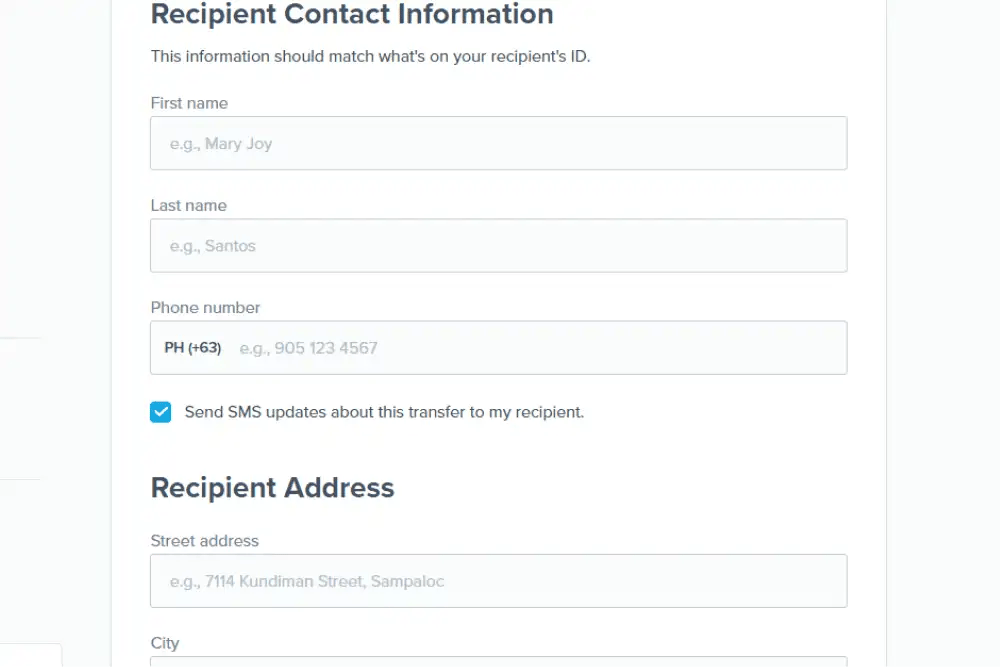

4. Add your recipient details

The next step is to add the details of where you want your converted funds transferred to.

The information you’ll need will depend on the receiving country and delivery method.

You’ll nearly always need the recipient's name and address.

If you choose the bank transfer method, here’s an idea of what you might need:

- Europe - IBAN

- USA - account number and routing number

- Most African & Asian countries - account number and BIC

Other countries might require different details.

If you choose mobile money or airtime top up, you will need the recipient’s phone number.

For cash delivery, you’ll need the recipient’s name, and they will need to bring some ID to the pickup location.

If in doubt, call customer support. They’ll know what you need.

5. Confirm and pay for your transfer

Once you’ve checked the details and confirmed the transfer, it’s time to pay for it using your preferred method.

If you opted for the debit card option, they’ll take the money from your card and make the transfer instantly.

If you went for the slightly cheaper bank transfer, you must now transfer your funds to the details provided by Remitly.

You can do this via online banking, mobile banking, telephone banking or go into a branch.

When Remitly receives your money, they’ll then make the transfer.

You can then track your transfer via the platform or app.

My verdict: Is Remitly for you?

Remitly helps millions of people send money home, with a secure platform and user-friendly mobile app.

They offer various payout options, and are a very safe company.

While they're reliable for most transfers, sometimes an alternative provider may be better.

Here are some examples of when Remitly is a good fit and when it may not be, with possible alternatives to consider.

When Remitly works

Here’s when using Remitly is a good idea:

- You’re sending money to an exotic country

- You require cash pickup, mobile money or airtime top up

- You’re transferring under £25,000 (or equivalent)

An exotic country is a country that isn’t a 1st world country, or has a thinly traded currency.

When Remitly doesn’t work

Here’s when Remitly isn’t for you:

- You’re transferring over £25,000 (or equivalent)

- You want the best possible exchange rate

- You’re transferring money through a common corridor

A common corridor is a transfer route from one common country to another.

For example, the UK to France, the USA to the UK, or the UK to Australia.

Remitly typically only supports transferring from a common country to an exotic country.

Simply check on their website to see if they provide the route you want.

Remitly alternatives

If you're transferring more than £25k, a currency broker is a better option.

With a broker, you'll receive one-on-one guidance from an account manager who’ll offer personalised service to ensure a smooth transaction.

This is especially important when transferring large amounts, where any issue can create unnecessary stress.

In addition to offering peace of mind, a currency broker will typically offer a better exchange rate than Remitly.

My top recommendations for brokers are Key Currency, Currencies Direct, and TorFX.

However, be sure to check if there are any limitations on countries they serve.

If you're looking to transfer money using Remitly but want the best exchange rate possible, you may want to look at a different company.

While Remitly's rates are decent, they're not the best.

My recommendation for getting the best rate is Atlantic Money, which offers mid-market rates with a flat fee of £3.

However, keep in mind that Atlantic Money's currencies and payout options are limited and may not be suitable for you.

If you're transferring money through a more common corridor (not an exotic country), and only require a bank transfer, there isn't much point in using Remitly.

You should just opt for a cheaper provider instead.

Wise and XE are two options that provide better rates and additional features.

Wise, for example, offers a multi-currency wallet, while XE provides popular conversion and chart tools.

-min.webp)