If you’re trying to find the cheapest method to transfer money abroad, you’ve probably come across Atlantic Money.

However, you’ll probably have a few more names on your list as well.

It’s hard to truly know which company is going to cost the least, while fitting your requirements and providing the best service too.

In this review of Atlantic Money, I’ve taken a closer look at their safety, cost, customer reviews and service.

I’ve then scored them out of 5 for each category, giving me an overall TopMoneyCompare score.

Finally, I’ll talk about if they’re right for you, if they aren’t, and what alternatives might be available.

What is Atlantic Money?

Atlantic Money is a new mobile-only money transfer app.

They launched in March 2022, with the aim to disrupt the money transfer industry.

With other providers like Wise and Revolut offering very cheap transfers, Atlantic Money is looking to one-up them even more.

They’re doing this by offering their customers the mid-market rate, with a fixed £3 fee.

This, undeniably, makes them the cheapest on the market (for transfers above £700).

With Atlantic Money, you can transfer up to £1 million to a select number of currencies.

As ridiculous as it sounds, you will only be charged £3 on a million pound transfer.

Founders Neeraj Baid and Patrick Kavanagh were early employees of US-based trading platform Robinhood.

They’ve received a lot of investment so far, with Amplo & Ribbit Capital leading their $4.5m seed funding round.

Vlad Tenev and Baiju Bhatt, the founders of Robinhood, & Anquan Wang, founder of Webull, have also invested.

- They provide the mid-market rate of exchange

- Only a £3 transfer fee for every transfer, of any amount

- Smooth, intuitive mobile app

- Authorised and regulated by the Financial Conduct Authority

- Instant transfers are available (for a higher fee)

- No online platform, mobile only

- They're a new company, so little online reviews

- Limited number of currencies

Is Atlantic Money safe?

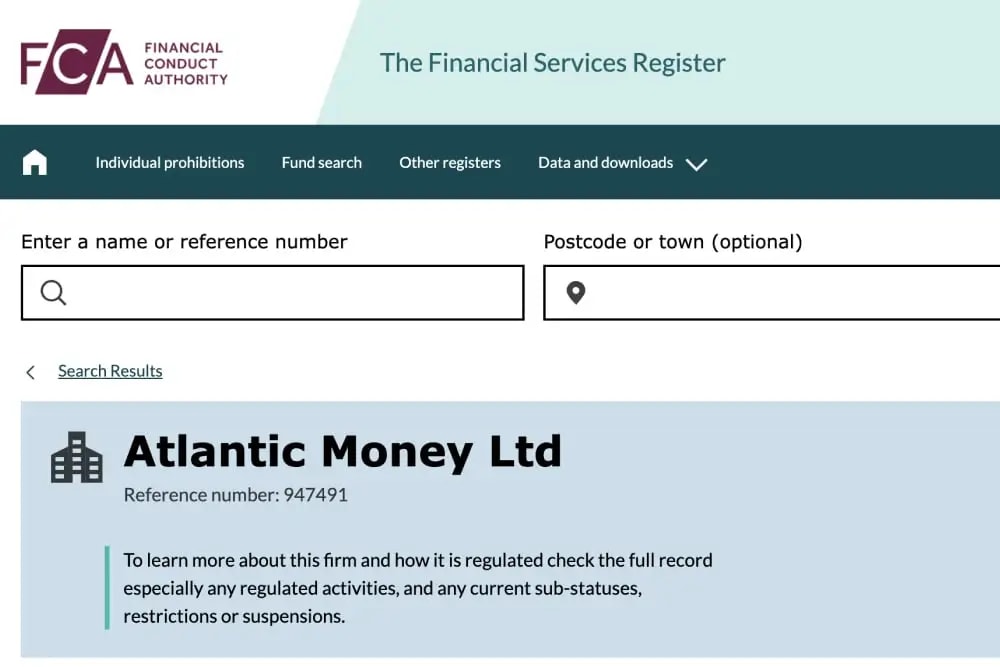

Atlantic Money is authorised and regulated by the Financial Conduct Authority (FCA) as a payment institution.

Any company regulated by the FCA is safe to use.

Atlantic Money has been audited, examined and scrutinised to see exactly how their systems work and how they keep their customers safe.

They’ve then been given the green-tick to say that they’re a safe company.

For the customer, it’s a must have level of protection.

It affects you in 2 ways:

- If Atlantic Money was ever guilty of gross-negligence regarding your money, you can complain to the Financial Ombudsman and potentially receive compensation

- If Atlantic Money were to go into administration after you have sent them money, you should receive all of it back

With UK banks, if they go bust, you will only receive up to £85k back (as part of FSCS).

Under safeguarding regulations for payment institutions, there is no limit on the amount you can receive back.

The only time you are at risk is if the costs associated with the liquidation exceed any funds held by the business.

In this scenario, the liquidator has the ability to recover their own costs from the pool of client funds.

Because of this, it’s arguably safer to use a regulated money transfer firm than your bank.

This is because regulated firms must “safeguard” all client money, meaning it is separate from company money and cannot be touched.

Basically, all client money is held in “ring-fenced and safeguarded” accounts, while company money is held in a regular business account.

The funds in the ring-fenced accounts can’t be invested nor used to pay other creditors.

In a nutshell, Atlantic Money is safe to use. I’ve scored them a 4.1/5 for safety.

Atlantic Money exchange rates

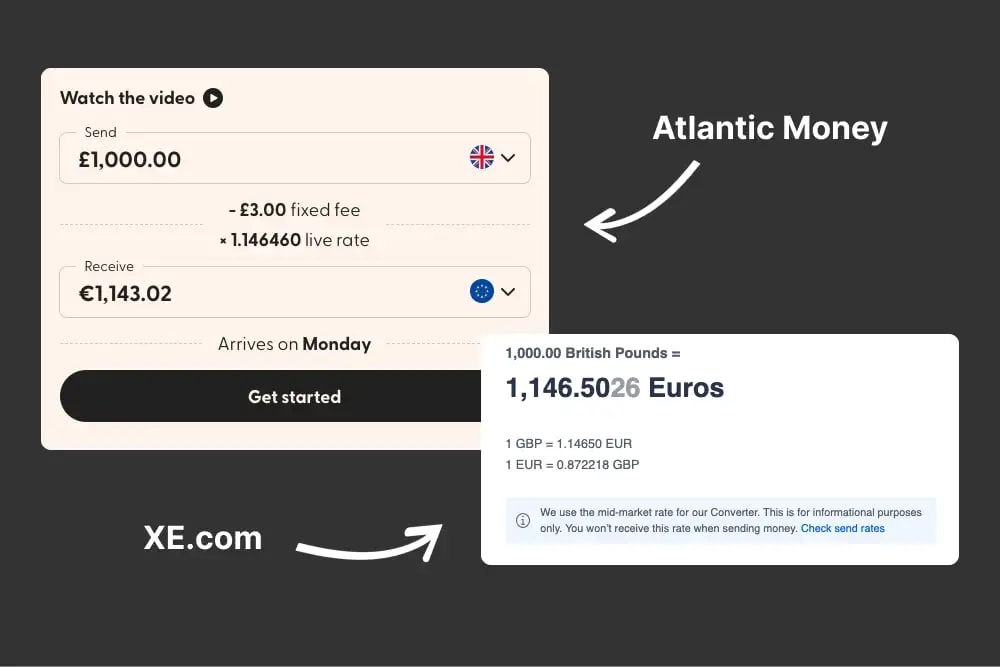

Atlantic Money provides the mid-market exchange rate for all transfers.

Or at least, they pass on the same wholesale rate they themselves get from financial institutions with a wafer-thin margin.

In effect, it’s the best possible rate you can get at any given time.

They don’t make any money by applying a margin or spread onto the rate, unlike most other companies.

As you can see, the rate provided by Atlantic Money is basically the same as the mid-market rate on XE.

(Give or take half a pip)

Atlantic Money generates their revenue via the transfer fees.

Atlantic Money transfer fees

Atlantic Money charges £3 for every transfer, to any currency and of any size.

A £200 transfer to Spain will cost £3.

A £500,000 transfer to the USA will also cost £3.

If you’re transferring from Euros, you will be charged €3 (roughly £2.60).

Atlantic Money is by far the cheapest provider on the market.

I just hope this business model is sustainable…

Atlantic Money reviews

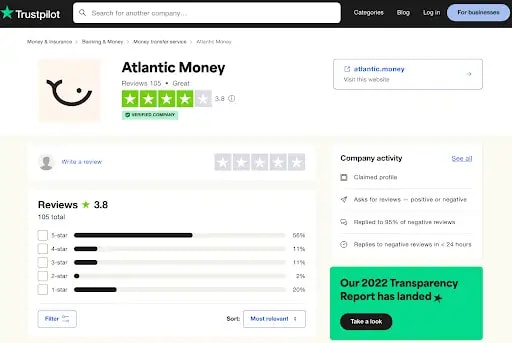

As a startup, Atlantic Money does not have many online reviews yet.

However, they are slowly building up their Trustpilot page.

As of me writing this, they are sat on 105 reviews with a “Great” 3.8/5 rating:

In comparison, providers like Wise and XE have garnered 200,000 and 65,000 reviews respectively.

Atlantic Money still has a long way to go in that department.

Their 3.8 rating is also worse than the 4.1 and 4.3 that Wise and Xe receive, respectively.

Atlantic Money positive reviews

Here are some positive comments about Atlantic Money:

- £3 fee is a game-changer and unbeatable

- Transfers going through hassle-free

- Can open an account and make a transfer within 2 minutes

- Customer support replying quickly

As expected, customers are raving about the low fees.

It’s undoubtedly the cheapest way to transfer money internationally.

People are loving the app and how easy it is to make transfers, too.

One thing I didn’t expect people to like was the customer support…

I’ll talk about that further down.

Atlantic Money negative reviews

20% of the reviews for Atlantic Money rate the provider 1/5.

That’s a really high proportion.

Here’s a summary of what these people had to say:

- Asking for extensive and confidential personal documents

- Only accepts bank transfers

- Not honouring their referral scheme

- Moving the rate of exchange when it’s convenient for Atlantic Money

The first point about documentation is basically null and void.

When transferring large amounts internationally, any regulated money transfer provider will ask for documentation.

It’s simply to prove that you acquired this money legitimately and not via illegal activities.

Essentially, it’s to stop people from using these companies to launder money.

There’s no way around it.

As for accepting wire transfers, this is an unfortunate consequence of providing a cheap service.

Wire transfers cost more, and thus would cut into Atlantic Money’s already slim profit margins.

Regarding the referral scheme, it looks like some individuals tried to abuse the scheme to make a quick buck.

Customers coming through a certain referral link were not paid, which is fair enough.

Others simply had to wait for their referral to be fully verified before they could be paid.

The last point is interesting, as a number of the negative reviews are about this issue.

To summarise it, they’re saying that even though their funds arrived with Atlantic Money after their lock-in period, the rate remained the same.

Even though the rate had improved dramatically.

They’re saying that Atlantic Money wouldn’t have an issue giving you a worse transfer rate if the mid-market rate had dropped after the lock-in period, however they wouldn’t improve your transfer rate if it went up.

“Moving the rate as and when it’s convenient for them”.

Whether this is true or not remains to be seen.

As an FCA-regulated institution, engaging in underhanded black-hat tactics wouldn’t be taken lightly by their regulators, so I doubt it.

Atlantic Money service, features and availability

Atlantic Money currently only provides money transfers via their iOS and Android apps.

They don’t provide any additional features like forward contracts, limit orders and stop losses.

They also do not have a web platform. It’s all done via your phone.

Atlantic Money provides a limited set of currencies, and customer support over text message.

Bear in mind though, they are still a very new company.

They’re releasing new currencies and features frequently.

So while they may be lacking now, there’s no reason to say they will be in the future.

I’ve scored Atlantic Money a 2.9/5 for service, features and availability.

Atlantic Money mobile app

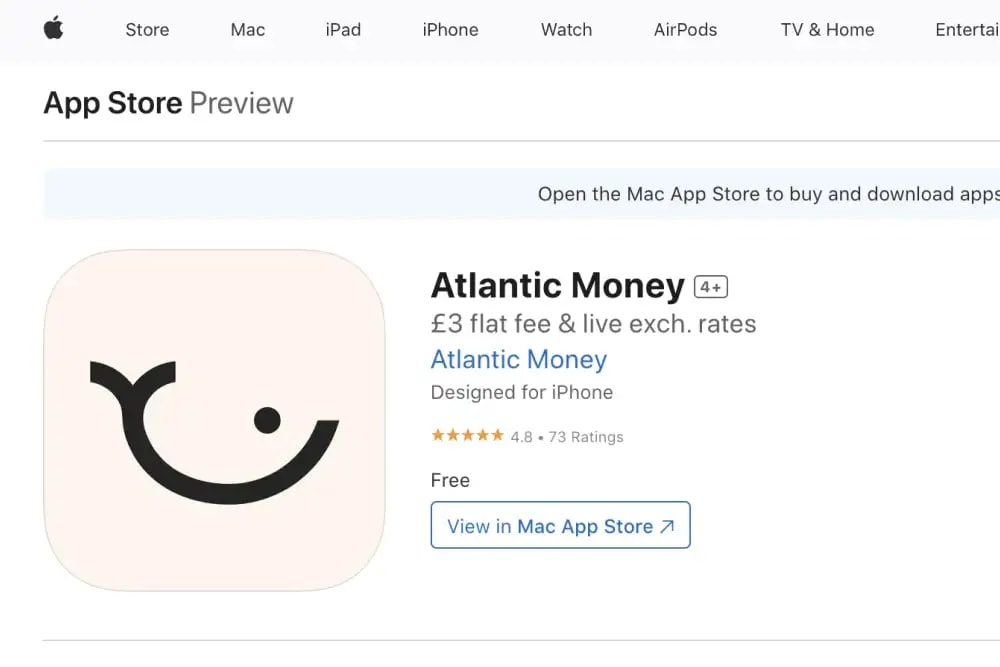

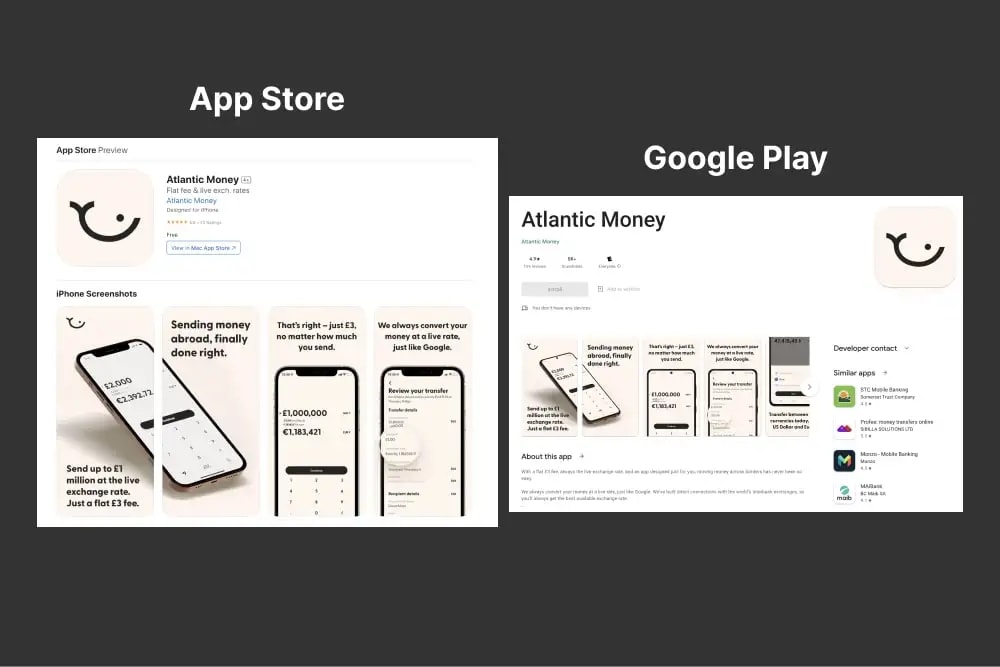

Atlantic Money’s iOS app currently has 73 reviews on the App store, averaging a 4.8 rating.

Out of those 73 reviews, only a small percentage is 1 star.

Atlantic Money’s iOS app currently has 132 reviews on the App store, averaging a 4.8 rating.

Out of those 132 reviews, only a small percentage are 1 star.

As I write this, it has the same 4.8 / 5 rating on Android but has received a slightly higher 258 reviews.

With both apps, you can do the following:

- Sign up for an account

- Make transfers

- Add and edit beneficiaries

- Check transfer limits

Looking at the app reviews, there’s a few recurring comments:

- Easy to use

- Good amount of notifications to keep you informed

- Helpful customer service

- Smooth user interface

I’ve posted some more screenshots from my test transfer below, to give you an idea on how the app works.

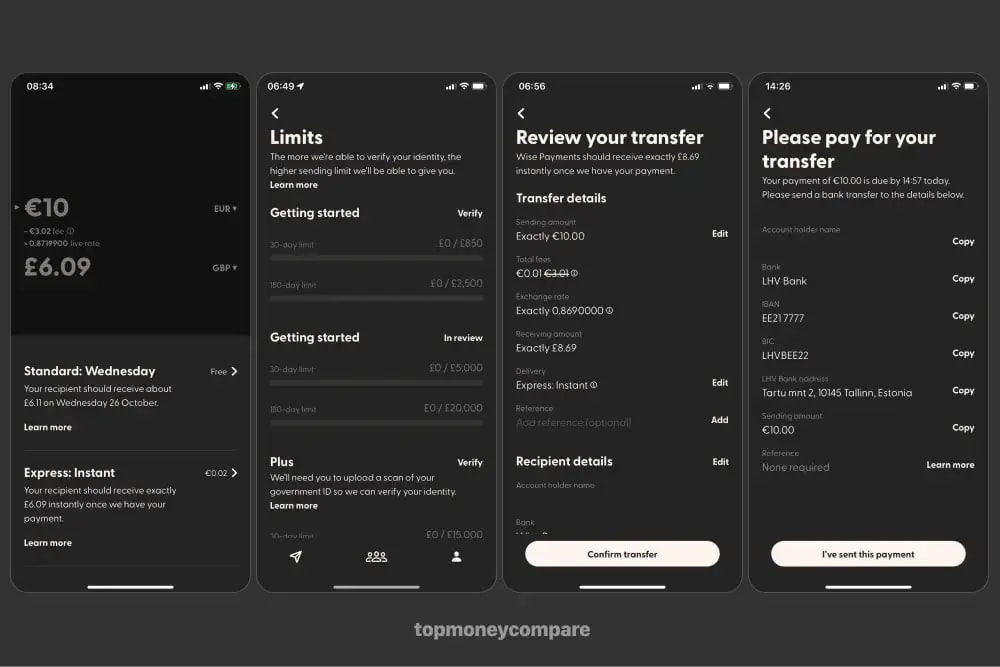

From left to right:

- Setting up a transfer and choosing delivery method

- Checking out my transfer limits

- Reviewing my transfer details

- Atlantic Money providing my bank details for the transfer

I also describe step-by-step how to get started with Atlantic Money, with images (further down).

Atlantic Money currencies

With Atlantic Money, you can only convert from Pounds or Euros and only convert to 9 other currencies.

These currencies are:

It’s safe to say that your options are pretty limited, but that’s to be expected from a startup.

As they grow, they’ll offer more transfer options and currencies.

It seems to be taking a while, but soon you’ll be able to convert from USD.

I guess Atlantic Money not only has to find an operational solution, but one that fits into their unique pricing model.

Sending from USD tends to be more expensive.

Atlantic Money customer support

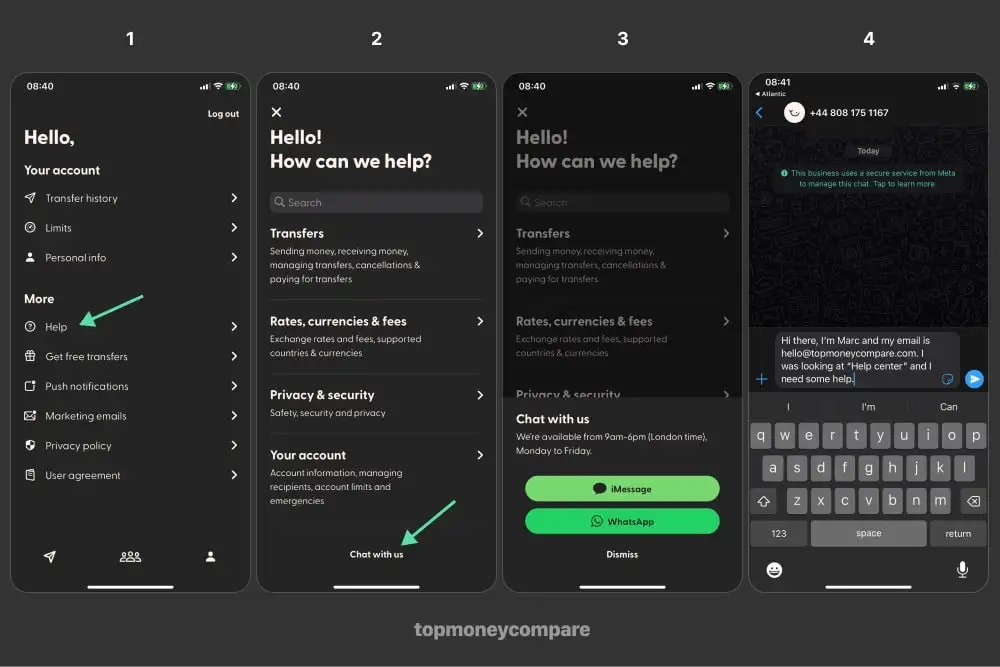

Atlantic Money provides their customer service through iMessage or WhatsApp.

It’s very easy to get chatting:

- Open the app, tap the bottom right and then tap ‘Help’

- You can read through their documentation or tap ‘Chat with us’ at the bottom

- Select either iMessage or WhatsApp

- Type your message

Atlantic Money’s customer support is operational Monday to Friday, 9am - 6pm (London time).

When iMessage or WhatsApp opens, the message above is already typed for you.

Here are comments left by users about their customer support:

- “Super responsive”

- “Helpful customer service team”

- “Quick and polite, but responses were quite cagey and generic”

I think using iMessage and WhatsApp for their customer support is a great idea.

They’re familiar platforms, and can make getting help a smoother process.

If you have an urgent issue, you’ll want to be able to speak to someone over the phone rather than through text.

Which Atlantic Money can’t help with.

If you want customer support via phone, try a currency broker instead (best for transfers over £25k).

There’s 5 simple steps to making your first transfer with Atlantic Money:

- Check whether Atlantic Money can help and how much they cost

- Download the app on your iPhone or Android

- Sign up (takes 30 seconds)

- Add a beneficiary

- Process the transfer

Let’s take a look at each step in more detail.

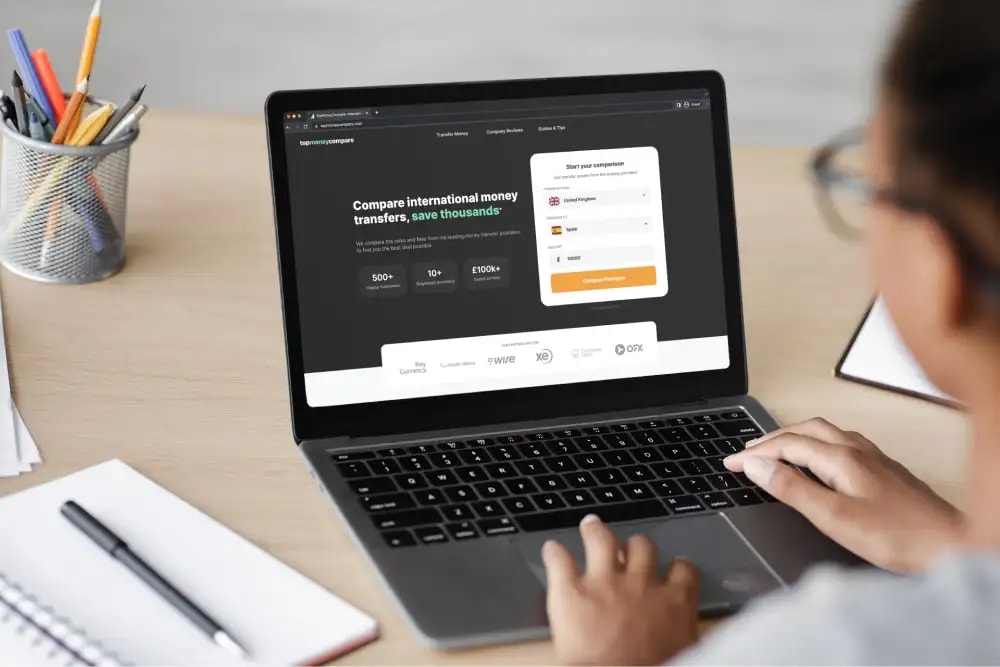

1. Use TopMoneyCompare to check whether Atlantic Money can help and if they’re the cheapest

Even though we know that Atlantic Money provides mid-market rates and a £3 fee, it’s always good to check how they compare for different amounts and whether they can support your transfer route.

For this, you can use TopMoneyCompare’s comparison engine.

Simply select your sending and receiving countries, your amount, and hit the button.

You’ll then see a comparison.

2. Download the app on your iPhone or Android

If you want to use Atlantic Money, then great.

Simply head to the App Store or Google Play Store depending on what phone you have, search for “Atlantic Money” and download the app.

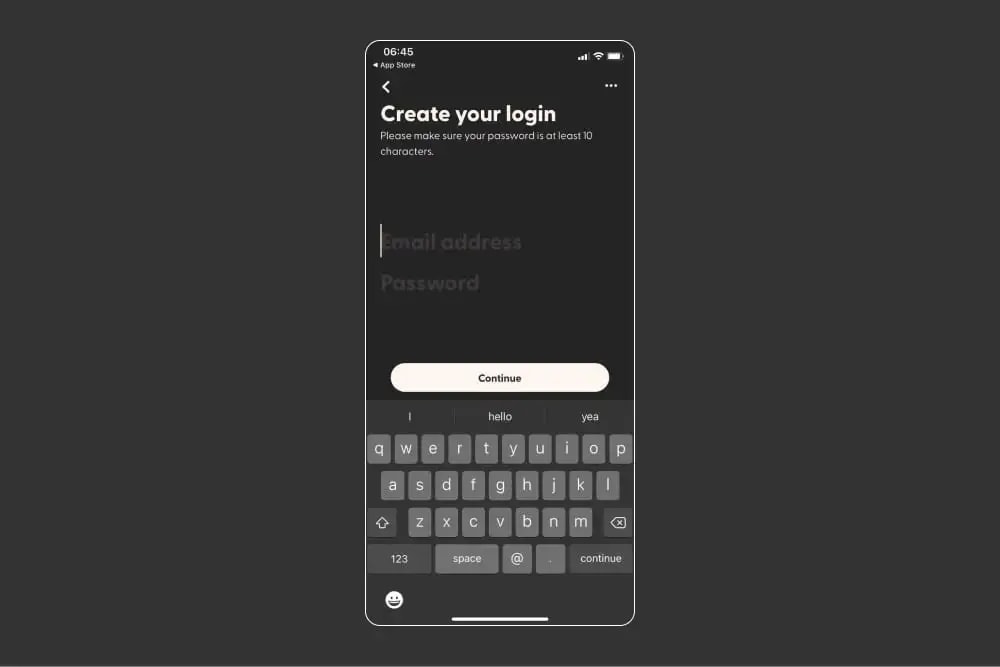

3. Sign up for an account

Atlantic Money has created a seamless and easy sign up process.

You create a login, then enter some personal details.

Atlantic Money may require some additional documents to verify your account.

This is usually a picture of your driver's licence and a selfie.

This is industry-standard and is to verify that you are who you say you are.

My verification process took about 2 minutes (very quick!).

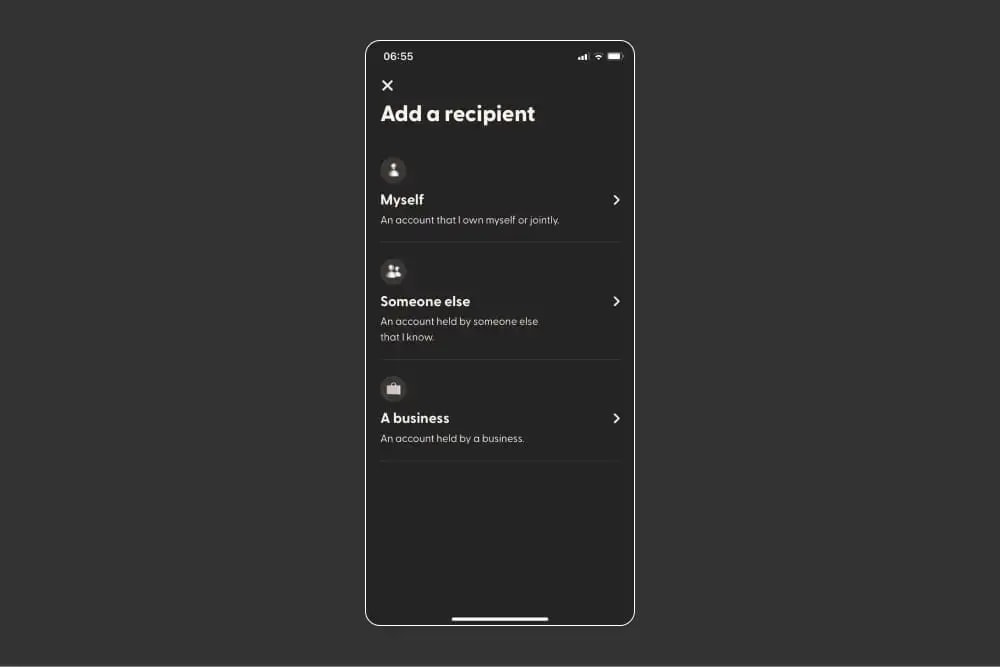

4. Add a beneficiary

Next step is to add your recipient details.

You can add details for an account that belongs to you, someone else or a business.

The details that you need to provide will depend on where you’re sending money to.

Here’s an idea of what you might need:

Other countries might require different details.

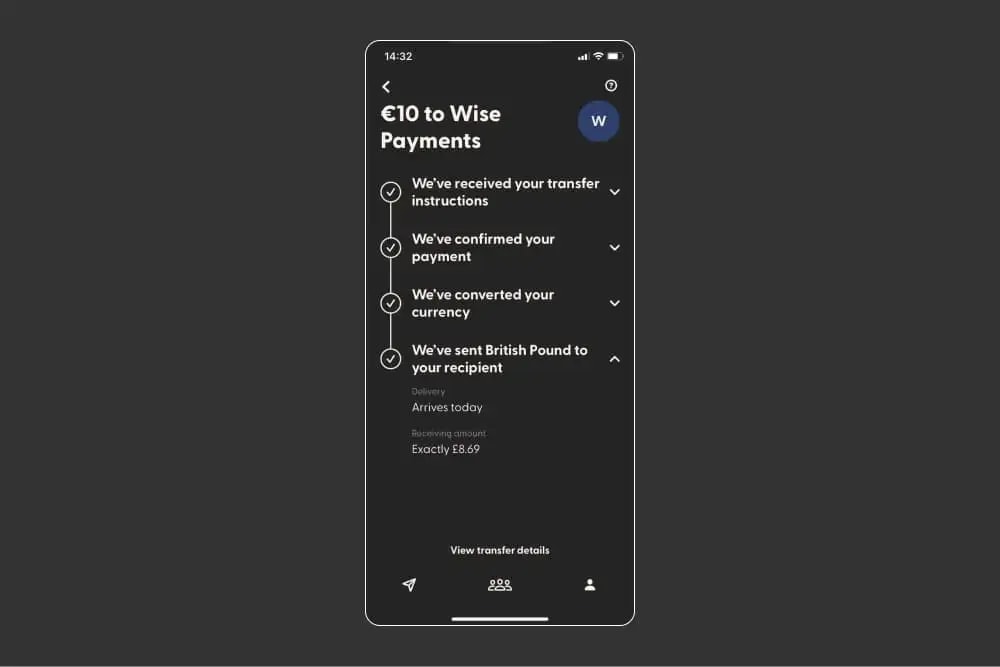

5. Process the transfer

Once you’ve gone through all the previous steps, it’s time to make the transfer.

Simply pick your currencies and enter your amounts.

Then, pick your transfer speed.

You have two options:

- Standard speed (1-2 days)

- Express (instant)

Choosing ‘Express’ will add an additional fee of 0.1% of your transfer volume.

On a £1k transfer, this is £1 (so £4 in total).

You review your transfer to make sure it’s all correct, and then it’s time to transfer your funds.

Atlantic Money will provide you with your account details to transfer to.

You can only make a bank transfer. There is no debit or credit card option.

Once they’ve received your funds, they’ll make the onward payment to your recipient.

My verdict: is Atlantic Money for you?

Atlantic Money is a new company, with limited features and services.

However, they’re undisputedly the cheapest money transfer provider available right now.

If you want straightforward money transfers for next to no cost, Atlantic Money could be a smart choice.

However, there are reasons as to why you might want to use another company.

Let’s take a look at when Atlantic Money is a good choice, when it isn’t, and some alternatives.

When Atlantic Money works

If the below sounds like you, Atlantic Money is a good choice:

- You’re transferring less than £25,000

- You want the cheapest possible money transfer

- You don’t require any additional features or services

- You like to use a mobile app

When Atlantic Money doesn’t work

If you match any of the below, we recommend an alternative:

- You’re transferring over £25,000

- You prefer customer support over the phone instead of text

- You need cash delivery, mobile money or airtime top up

Atlantic Money alternatives

If you’re transferring over £25,000, I recommend using a currency broker instead.

In my opinion, larger transfers require a more personal service.

With a currency broker, you’ll be assigned a one-on-one account manager who will:

- Guide you through the transfer

- Watch the markets and help you achieve the best possible rate

- Assist promptly with queries and issues

My recommendations are Key Currency, Currencies Direct and TorFX.

If you would prefer to speak to customer support over the phone, Atlantic Money isn’t for you.

They only provide support over iMessage and WhatsApp.

Here are some similar companies who provide phone support:

If you require cash pickup or delivery, mobile money or an airtime top up, there are other companies who can provide this for you.

I suggest that you check out WorldRemit and Remitly, who offer varied payout options.

-min.webp)