There are various money transfer companies out there who can help you transfer money home.

However, each varies in terms of costs, features, and quality of service.

It can be difficult to pin your choice down to one that’s best for you.

One top contender is Western Union, a globally-renowned industry leader of remittance services.

I’ve closely examined Western Union and tested their service, sharing my observations in this review.

I’ll cover how safe they are, how much they cost, what their customer reviews say and their features / payout methods.

Ultimately, I’ll tell you when Western Union is the company for you, when they aren’t, and any alternatives that might be better suited.

Western Union is a renowned global leader in money transfer and remittance services.

The company was established way back in 1851.

In 1871, Western Union used its continent-spanning telegraph network to process the world’s first ever money transfers between Boston, New York, and Chicago.

Over their long history, they’ve continued to adapt to technological advancements and expand their offerings.

They primarily serve customers needing to make frequent, smaller payments across international borders.

This clientele predominantly includes migrants who need to transfer money to their home countries or support relatives overseas.

Western Union is distinguished for its extensive global network, reaching countries and regions often not served by other transfer services.

They are even the provider of international money transfers for the post office.

- You can send to 200 different countries in a number of currencies

- Huge global network to collect cash

- Operating since 1851

- Very safe - regulated around the world

- Lots of payout options

- Well-reviewed money transfer app

- Worse spread for collecting cash

- Limits on the amount you can send

- Cheaper and better options for transfers to major destinations

Is Western Union safe to use?

Being the oldest of its kind, Western Union is as safe as they come.

There are four companies in the money transfer industry which are publicly traded - Wise, OFX, Remitly and Western Union.

With a market cap of $12.5bn, Western Union has the highest value of them all.

The main safety concern is actually more to do with Western Union’s agents.

If you plan to send cash, be aware of the potential for fraud, and only use an approved agent that is listed on the Western Union website.

I’ve scored Western Union a 4.7/5 for safety.

Is Western Union legit?

Western Union is authorised and regulated in more countries than any other provider.

These are just some of the major countries:

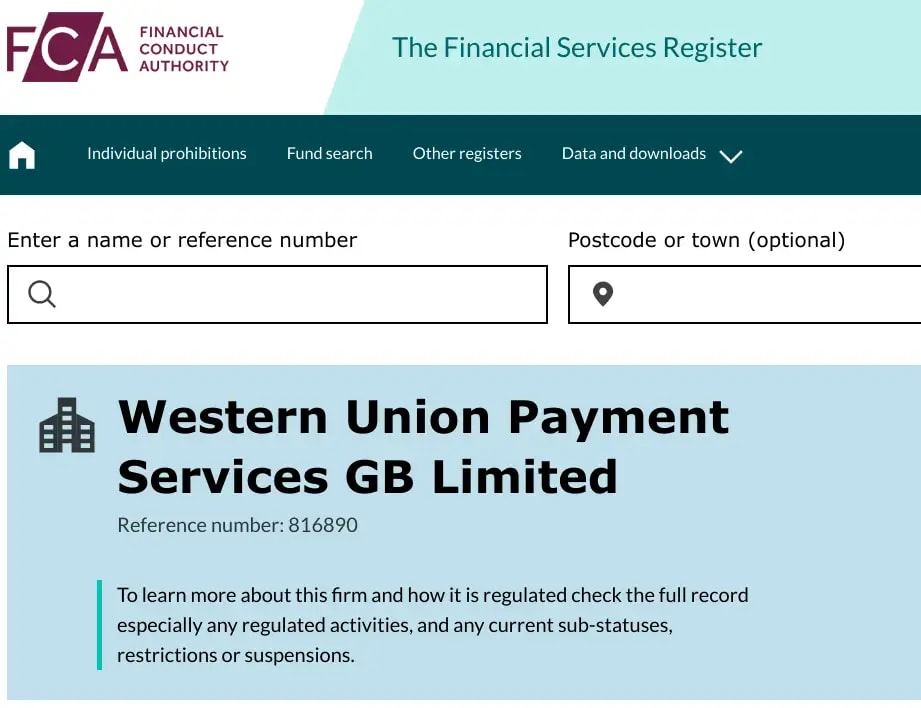

In the UK, Western Union is regulated by the Financial Conduct Authority (FCA).

This gives a great level of protection, for you, the user.

It’s the highest level of protection there is.

Getting regulated by the FCA is not easy.

You have to prove that you’re secure and safe with people's money, over a lengthy period of time.

Few companies have handled money transfers for as long as Western Union.

They’ve spanned three different centuries!

I’ll talk about how this regulation affects you below.

Is your money safe with Western Union?

As a regulated company, Western Union is required to separate client money from their own.

These separate accounts are what is called ‘ring-fenced and safeguarded’.

This means that the money in the accounts can’t be invested, used to earn interest or pay company debts.

Your money can only be moved according to your instructions.

If Western Union were to go out of business (however improbable), you are very likely to get your funds back in full.

In the event of insolvency, client funds get first priority over all other creditors.

The only scenario client money is at risk is if the costs associated with the liquidation exceed the cash held by Western Union.

If this happens, the liquidator is entitled to recover their own costs from the pool client funds.

There is no limit applied to the amount you can claim under safeguarding.

In the UK, high-street banks will only give you back up to £85k if they go bust.

Depending on how you view these two scenarios, Western Union is arguably safer to use than your bank.

Is Western Union trustworthy?

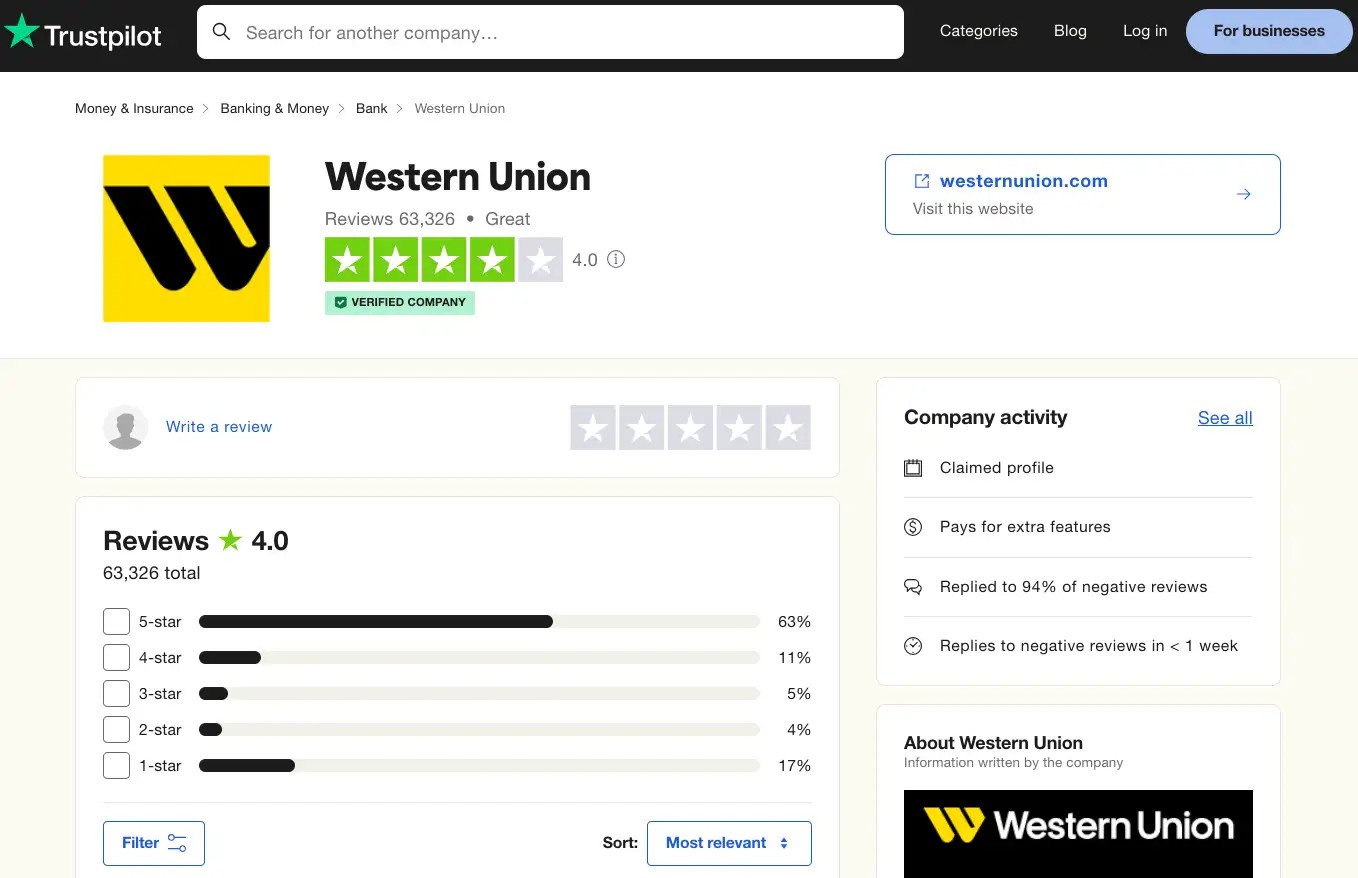

Western Union has gathered 10s of thousands of customer reviews on Trustpilot.

However, while their rating is good, it isn’t the best in the industry.

Western Union has a strong brand and all the required regulations, but there are customer comments questioning the quality and speed of their services.

I’ve written a section on their Trustpilot page here.

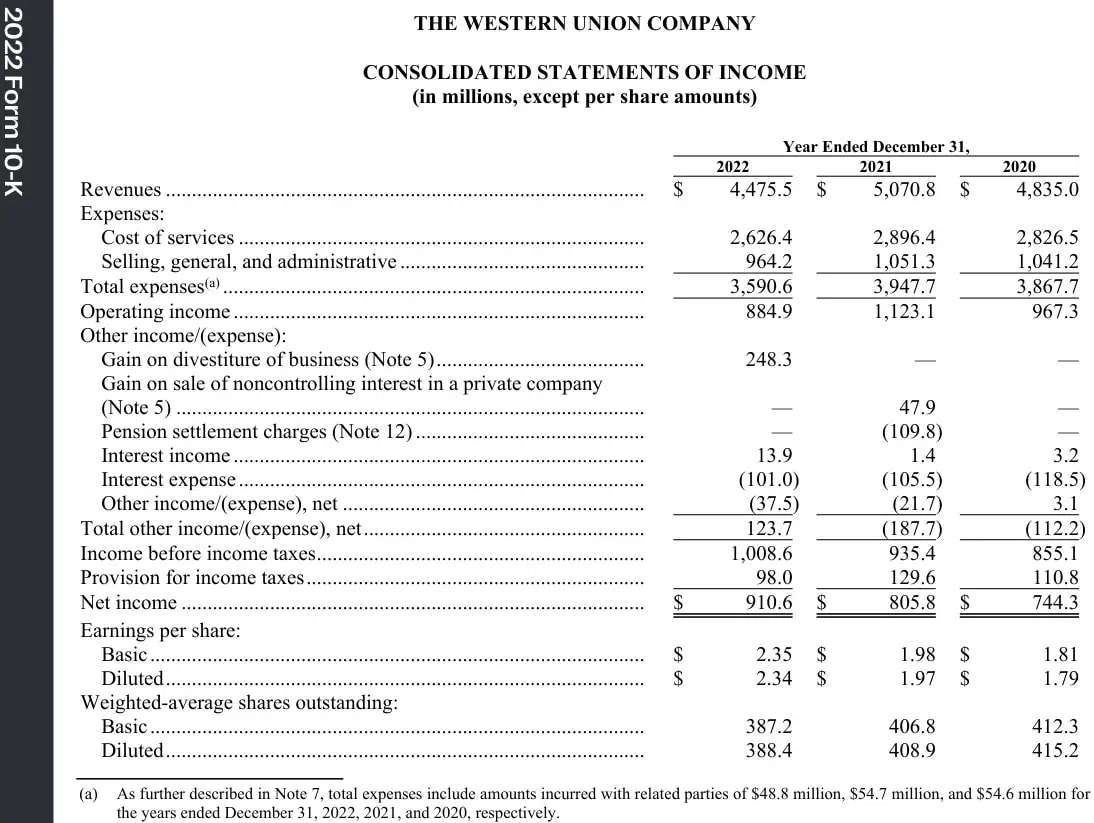

Financially, Western Union is very stable.

By taking a look at their company accounts, we can see they continue to make good profits.

A net income of $910 million in their latest accounts, to be exact.

While their 2022 revenue reduced slightly ($4.4bn - down 12% from FY 2021), their net income increased ($910m - up 13% from FY 2021).

That marks three years of strong, steady performance.

So as far as trustworthiness goes, it’s a double-edged sword.

They’re a global giant, with good profits and more than enough financial backing, but there are companies out there that can be more ‘trusted’ to deliver a better service.

Western Union exchange rates

Western Union, like other remittance services, offer good (but not the best) exchange rates.

Western Union’s exchange rates get better or worse depending on a few things:

- Currency pair

- Destination country

- Payout method

- Transfer volume

In general, the less exotic the currency and country, the better the rate you’ll receive.

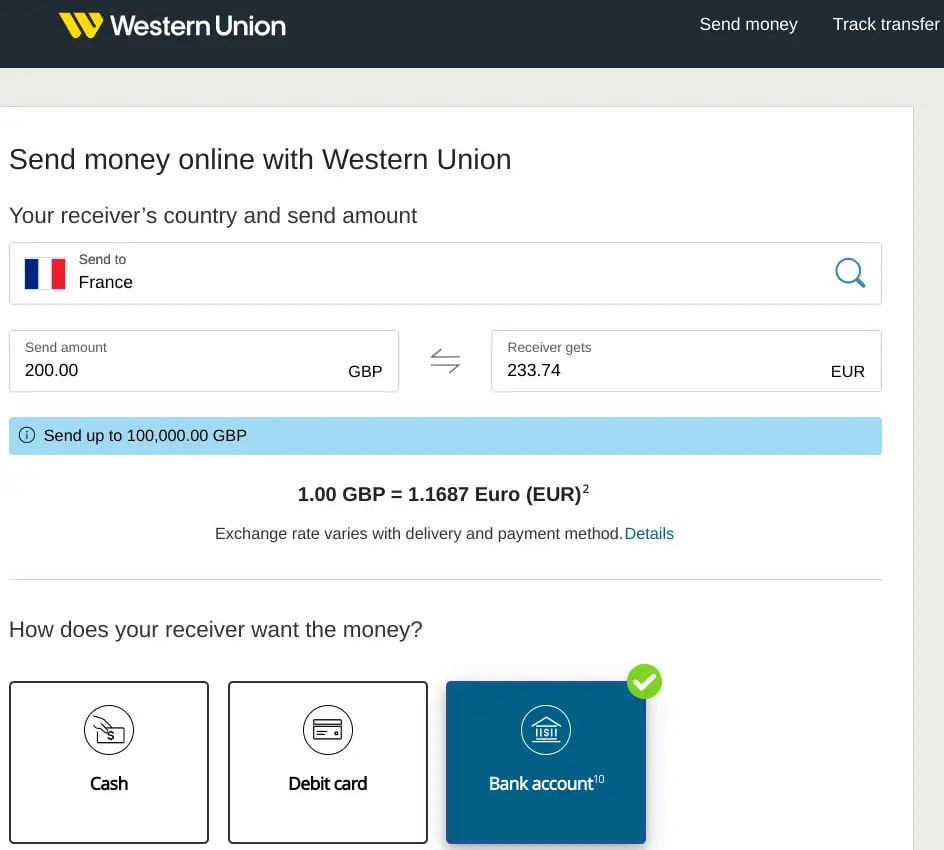

You’ll also get improved rates for larger amounts and digital transfers.

When I say “improved” rates, I mean Western Union applying less of a spread (or ‘margin’) to the mid-market rate.

The ‘spread’, or ‘margin’ is the difference between the rate the provider receives when buying the currency, and the rate they give to you when they sell. In other words, it’s the profit they make on the transaction.

By "improved" rates, I’m referring to Western Union imposing a smaller spread (or 'margin') to the mid-market rate.

This 'spread', or 'margin', represents the difference between the rate at which the provider buys the currency and the rate they offer to you upon selling. Essentially, it's the earnings they gain from the exchange.

So, it’s hard for me to pin down an exact percentage markup.

However, some sources claim they can be anywhere from 0% and 6%.

I’ve calculated them to be between 1.5% and 2.5% away from the mid-market rate, when you’re making a bank-to-bank transfer.

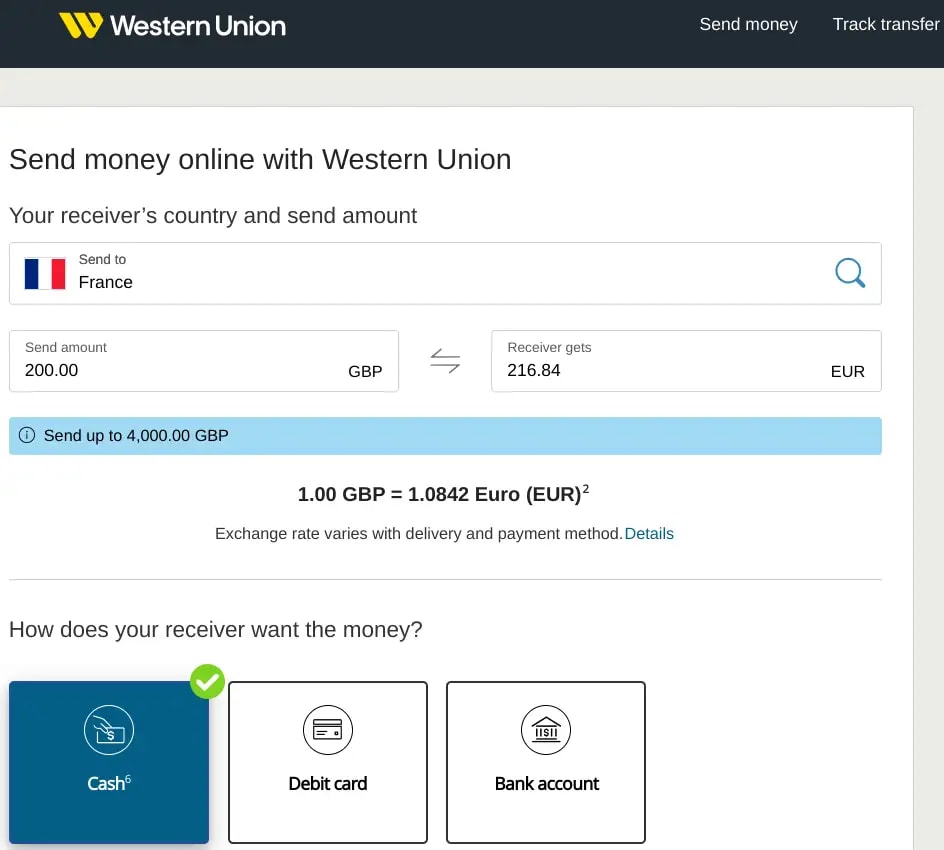

The 6% seems to be more accurate when the beneficiary is picking up cash.

In fact, by my calculations, the rates are even worse than 6% if the beneficiary is picking up cash and you want to pay in cash!

In this scenario, they’re more like 10%.

The rate is much better on bank transfers.

Western Union also charges transfer fees, as I’ll get into below.

Western Union transfer fees

Western Union charges varying transfer fees, ranging from nothing at all, right through to a staggering £75.90.

Here’s a quick table with some examples:

The bank transfer fees are reasonable, particularly when you consider they’re to some quite remote destinations.

Though, while they might not seem like a lot, they’ll add up if you’re making regular transfers.

Where the fees can really get extortionate is when the beneficiary is picking up cash.

To be fair, the high fees are only when you also want to fund the transfer by cash, at a Western Union agent.

If the beneficiary wants cash and you still fund the transfer by debit card or bank transfer, the fees are either zero or pretty minimal.

All in all, the fixed fees for digital transfers are actually rather similar to those charged by Remitly and WorldRemit.

Through Wise, however, you’ll pay a variable fee that’s roughly 0.5% of your transfer volume.

So for small transfers, in the hundreds of pounds, you’ll pay less of a fee with Wise.

Anything above this, you’ll likely pay more.

The crux here is that Wise doesn’t mark up their exchange rates, but Western Union does.

Despite a larger fee by Wise, they might still be cheaper overall.

After looking at their rates and fees, I have scored Western Union a 3.0/5 for cost.

Western Union reviews

Western Union’s Trustpilot page has over 60k reviews, with an average rating of 4.0/5.

As I previously mentioned, this is a “great” rating, but it isn’t the best.

In comparison, it’s way behind a currency broker like Currencies Direct, who receives a 4.9/5 rating.

It’s also below more similar companies like Xe, who has a 4.3/5 rating, and Wise, who has a 4.2/5 rating.

The 3.6/5 score is however on par with another remittance company, Remitly, and beats the 3.8/5 score of WorldRemit.

So, all things considered, not bad.

I’ve scored Western Union 4.0/5 for customer satisfaction.

Western Union positive reviews

Here are some nice things that customers had to say about Western Union:

- Safe and secure option

- Money transfers are fast and easy

- Great for paying remote countries around the world

- App is intuitive

- Customer support quickly resolves login issues

- Have used Western Union for years or even decades

Overall, the feedback on the entire service is generally positive.

It's encouraging that clients received efficient service from Western Union when they needed to troubleshoot certain system issues.

One thing I stick with, however, is using a currency broker for large transfers.

You’ll get top-notch support for system issues, but, more importantly, also for any complications that may arise.

With significant sums, any problem can become quite alarming and cause a lot of anxiety.

As we’ll see from the bad reviews, Western Union's customer service isn’t geared towards this.

Their limits don’t even allow for significant transfers.

Western Union negative reviews

Here are some less-than-positive things that people had to say about Western Union:

- Paused the ability to earn Western Union points

- Not meeting expected transfer times

- Kicked out of online chat when Western Union didn’t respond

- Couldn’t get support in English from certain countries

Unfortunately, the consistency of service has the unpredictability of a coin toss.

Sometimes it leaves you riding high, and other times, simply disillusioned.

But this is the same with any company.

It seems that some customers were on the bad side of Western Union’s customer service.

Steering people to an online chat, even in emergency situations, is lousy. Even more so when you time out due to Western Union not replying.

Regarding point 2, the delays are mostly compliance related and often unavoidable.

As a regulated payments institution, Western Union has a duty to prevent money laundering and illegal activities.

This might mean requesting additional documents to prove the legitimacy of the funds, or just straight up closing an account.

Very frustrating though when you’ve been incorrectly flagged and you have a perfectly legitimate and legal reason for transferring your money.

Western Union service, features and availability

Western Union offers a variety of different payout methods.

While customer service can be a let down, Western Union excels when it comes to features and availability.

In terms of availability, no other money transfer company is as accessible as Western Union.

They’re present in virtually every country in the world.

Whether you’re paying a bank account in France or the beneficiary needs to collect cash on a Samoan island, Western Union has you covered.

They also provide a heavily reviewed and popular mobile app.

I’ve scored Western Union a 4.0/5 for service, features and availability.

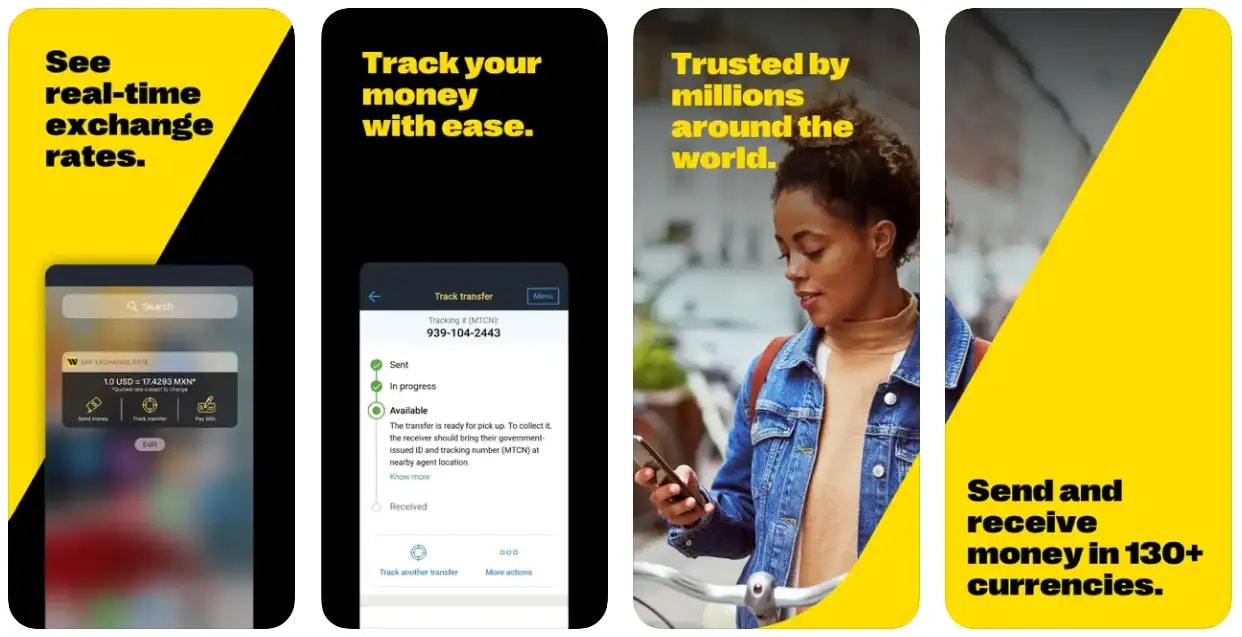

Western Union mobile app

Western Union’s mobile app has nearly one million ratings across the App Store and Google Play Store.

They’ve managed to maintain an excellent rating of 4.8/5 and 4.6/5 respectively.

Their customers love it.

Here’s what you can do on the Western Union app:

- Set exchange rate alerts

- Add and save beneficiaries

- Check transfers fees and

- Make and track transfers

There’s nothing you can’t do on the app that you can on their website.

Western Union's mobile app receives great ratings

Overall, Western Union’s mobile app is right up there when it comes to the best money transfer apps.

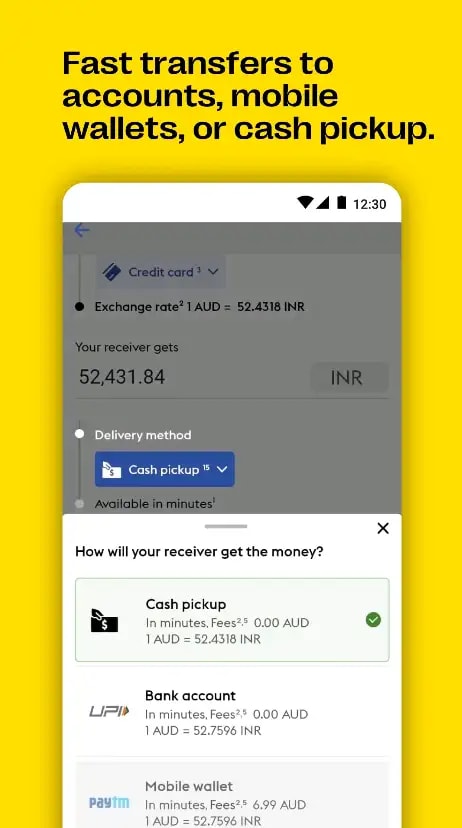

Western Union delivery methods

Western Union has 6 different delivery methods:

- Bank transfer

- Pay debit/credit card

- Cash pickup

- Mobile money

- Airtime top up

- Bill pay

Not all methods are available for all countries and currencies.

Let’s have a look at each method and how they work.

Bank transfer

Selecting this option ensures that the funds will be transferred directly into the recipient's bank account.

Once received, they can then withdraw the money as cash, or use it for payments of their own.

The bank transfer method isn’t available for the more exotic currencies and countries.

Pay a debit or credit card

Choose this method if you want to pay off a friend or family member’s credit card, and/or credit someone’s account by paying their debit card.

Through a partnership with Visa and Matercard, it’s now possible to send a transfer just by knowing the card details of the beneficiary.

Cash pickup

This method allows the recipient to pick up the currency in cash, from one of Western Union’s agents.

Usually, the funds can be picked up instantly after the transaction is completed.

Cash pickup is popular amongst the Latin American, African and Asia Pacific currencies.

Mobile money

You can send money to a mobile money wallet using Western Union.

Although not a popular type of account in Europe, a significant number of mobile money transfers are made to Africa and Asia.

Airtime top up

Airtime top up is essentially ‘credit’ for telephone use (calls, texts, data etc.).

Using Western Union, you can top up someone's phone, whether it be yours, family or a friend.

This is done through Western Union's select Airtime partners.

Bill pay

Western Union lets you search for a particular biller and initiate a payment.

Find the biller, type in the amount and your relevant account details, and you can initiate a transfer online.

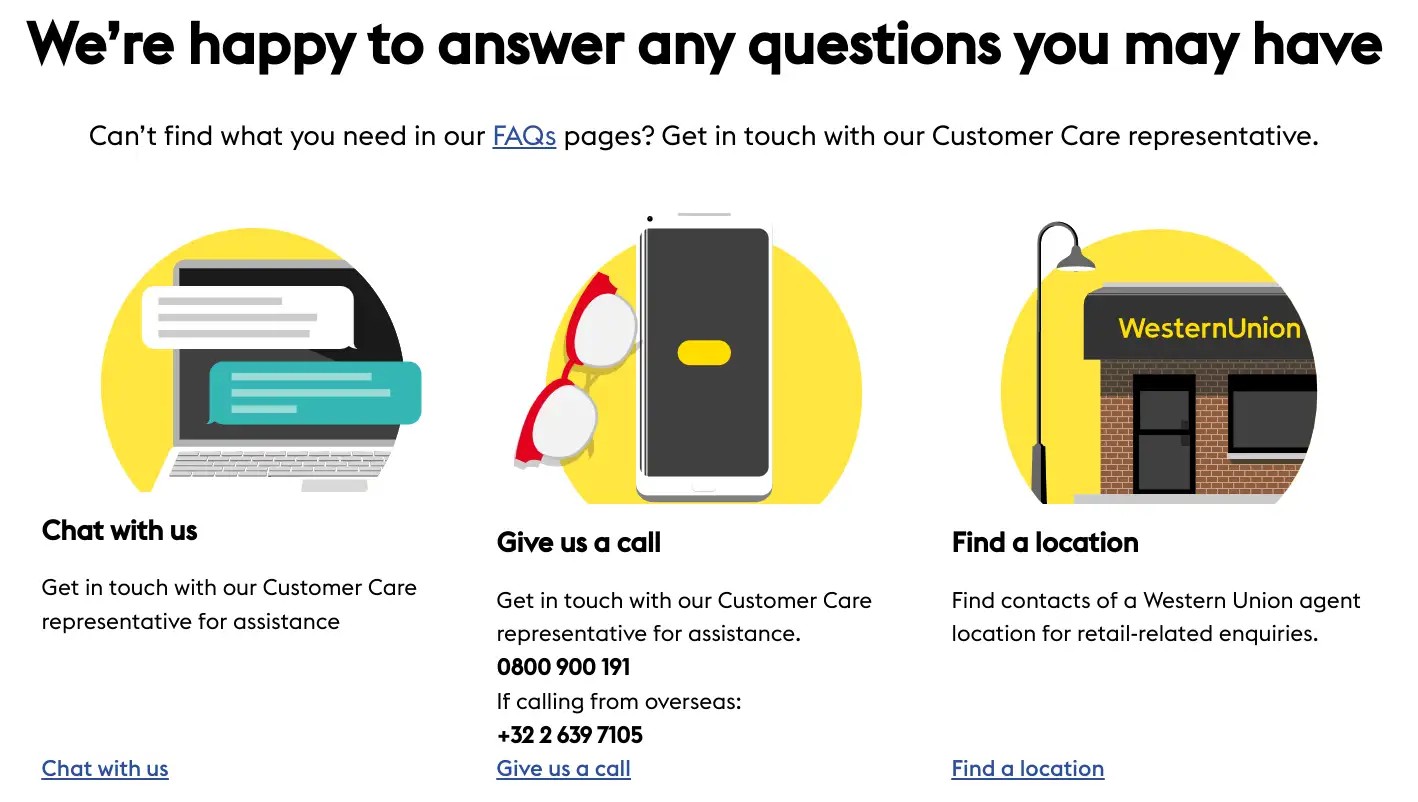

Western Union customer service

Most customers praise Western Union's customer service, although some have expressed their grievances.

It’s really easy to find out how to contact them.

Simply:

- Scroll to the bottom of any page on the Western Union website

- Click on ‘Contact us’

Western Union is very transparent with their contact information

On the ‘contact us’ page, you should find Western Union’s phone number for your region.

If you’ve got a generic question, you can always check out their FAQs instead.

Customers have generally written positive reviews about telephone support but seem less keen on the helpfulness of the online chat.

1. Check Western Union’s rates compared to competitors

Utilise TopMoneyCompare’s comparison engine to evaluate Western Union’s rates against others in the market.

You can see the amount and rate you'll receive, including transfer fees and speed.

This provides a clear comparison, helping you determine if Western Union suits your needs.

Compare international money transfers with TopMoneyCompare

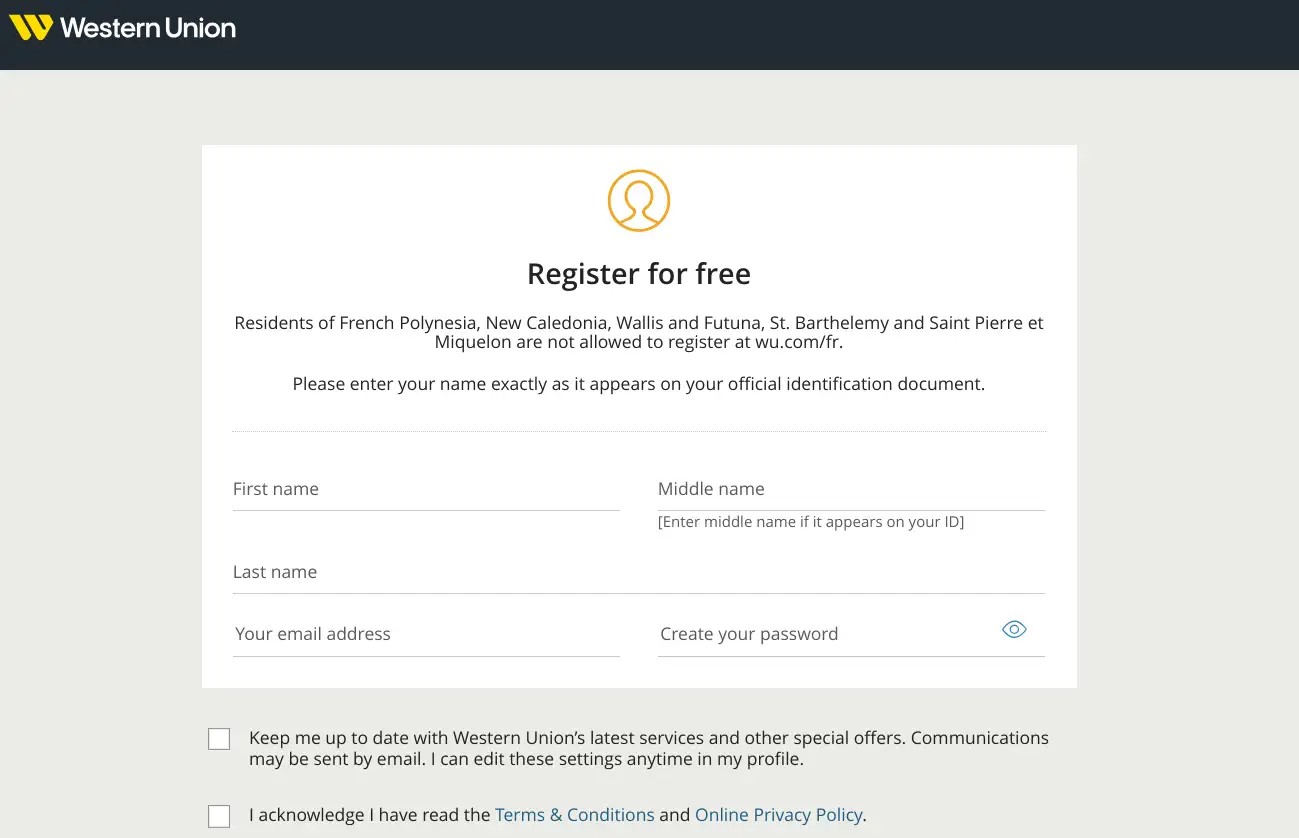

2. Sign up for an account with Western Union

To use Western Union for your international transfer, you'll need to sign up.

Click here to sign up for a Western Union account (opens in a new tab).

Enter your login information and select ‘Continue’.

Complete the form with your personal and transfer details.

Note that further verification may be needed if your information is not immediately verified.

This may involve submitting ID like a driver’s licence or passport, and a utility bill or bank statement.

Creating an account shouldn't take more than a few minutes

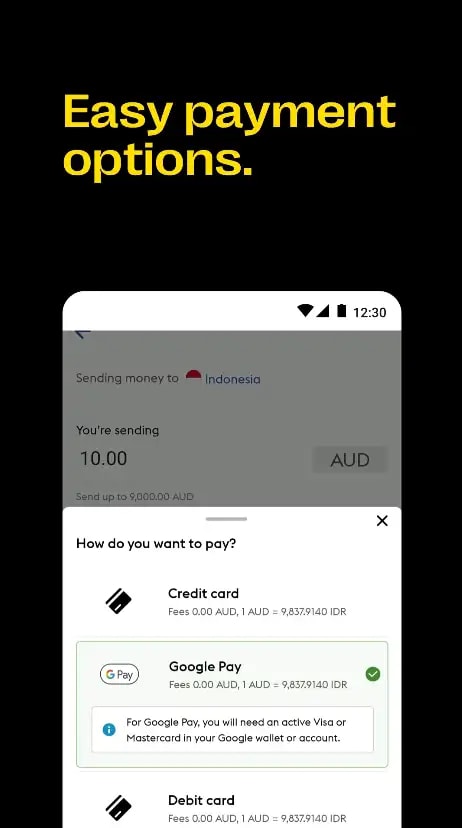

3. Initiate a transfer

With your account set up, access the Western Union online platform or app to begin your transfer.

Start by selecting your destination country.

Input the amount, review the rate and fees, choose a delivery method and transfer speed, then proceed.

4. Add your recipient details

Next, provide the details for the recipient of your transferred funds.

Required information varies based on the destination country and chosen delivery method.

Typically, the recipient's name and address are a must.

For bank transfers, here's what you might need:

- Europe - IBAN

- USA - account number and routing number

- Most African & Asian countries - account number and BIC

Other countries have different requirements.

If you choose mobile money or airtime top up, you will need the recipient’s phone number.

For cash pickups, provide the recipient’s name, and they must present ID at the collection point.

If in doubt, call customer support. They’ll know what you need.

5. Confirm and pay for your transfer

Once you’ve checked the details and confirmed the transfer, it’s time to pay for it using your preferred method.

For debit card payments, the amount is deducted immediately from your card.

The same applies for the rather unique capability to pay by google or apple pay.

For bank transfers, manually transfer the amount to Western Union through your bank.

Once Western Union receives your money, they’ll make the transfer.

Track the progress of your transfer through the platform or app.

My verdict: Is Western Union for you?

Western Union is arguably the leading remittance company, assisting millions of individuals worldwide in sending money back home.

They’re the oldest money transfer company in the world and are definitely regarded as safe.

They’ve kept up with the times and have an excellent mobile app and various payout options.

If you’re sending money to a very remote destination, Western Union might even be your only option.

However, there are some scenarios where you should look at using another company instead.

Here’s some examples of when Western Union is good for you, when they aren’t, and some alternatives.

When Western Union works

Here’s when using Western Union is a good idea:

- You’re sending funds to an exotic country

- You need options like cash pickup, mobile money, or airtime top up

- You’re transferring amounts less than £5,000

- You like to stick to the bigger, better-known brands

An exotic country is a country that isn’t a 1st world country, or has a thinly traded currency.

When Western Union doesn’t work

Here’s when Western Union isn’t for you:

- You’re transferring over £5,000 (WU limits don’t allow for much more)

- You want the best possible exchange rate

- You’re transferring money through a common corridor

When I say common corridor, I mean from one common country to another.

For example, the UK to France, Germany to Spain, or the USA to Australia.

There are better options on common routes.

Western Union alternatives

If you are transferring over £5k, I recommend using a currency broker instead.

You’ll receive personalised 1-on-1 service from an account manager to guide you through the process.

When sending significant sums, problems are the last thing that you need.

Having an expert assist you offers invaluable peace of mind.

What’s more, you’ll get a better rate too.

My recommended currency brokers are Key Currency, Currencies Direct and TorFX.

Bear in mind that there are some countries they won’t send to, so make sure to check.

If you are looking to make a smaller transfer through Western Union but want the best rate possible, it’s worth comparing them to some alternatives.

Western Union’s rates are decent, but not the best.

They get a lot worse when you’re sending for cash pickup.

One alternative offering better rates on bank transfers and cash pickup is Xe.

They still offer capabilities to send some 100 currencies to over 500,000 cash pickup locations around the world.

If you’re transferring a smaller amount through a more common corrido, and you only require a bank transfer, then you may as well go with a cheaper provider.

Wise provides better rates, with some additional features too.

You can open a multi-currency wallet with Wise, allowing you to receive payments, run balances, and even spend from these with a linked currency card.

-min.webp)