While researching international money transfers, you would have undoubtedly come across Wise.

However, you will have come across a large list of other money transfer companies, too.

It’s difficult to know what each company does and which one is right for you.

In this review, I’ve dissected Wise and analysed how they perform against key money transfer metrics.

I’ll talk about how safe they are, how much they cost, what other customers are saying and how good their service and features are.

I’ve then scored them out of 5 for each category, giving me a final TopMoneyCompare rating.

Finally, I’ll discuss when Wise is right for you, when they aren’t, and any better suited alternatives.

What is Wise?

Wise, formerly known as TransferWise, is an online and mobile money transfer app.

Wise is used to send money abroad in different currencies.

They’re known for charging small fees and providing a tight rate of exchange.

They have a largely DIY service, done in 3 simple steps:

- Create an account

- Pick currencies, destination and amounts

- Agree trade with one click

After you’ve paid, Wise will then send the currency to your designated account.

They also provide useful features like a multi-currency account, debit cards and investment options.

Wise is what’s known as a ‘FinTech’ (Financial Technology) company.

Since their launch in 2010, Wise has received heavy investment from individuals and companies all over, including Richard Branson.

In July 2021, Wise became the first FinTech company to float on the London Stock Exchange.

This took its market value to over £11 billion.

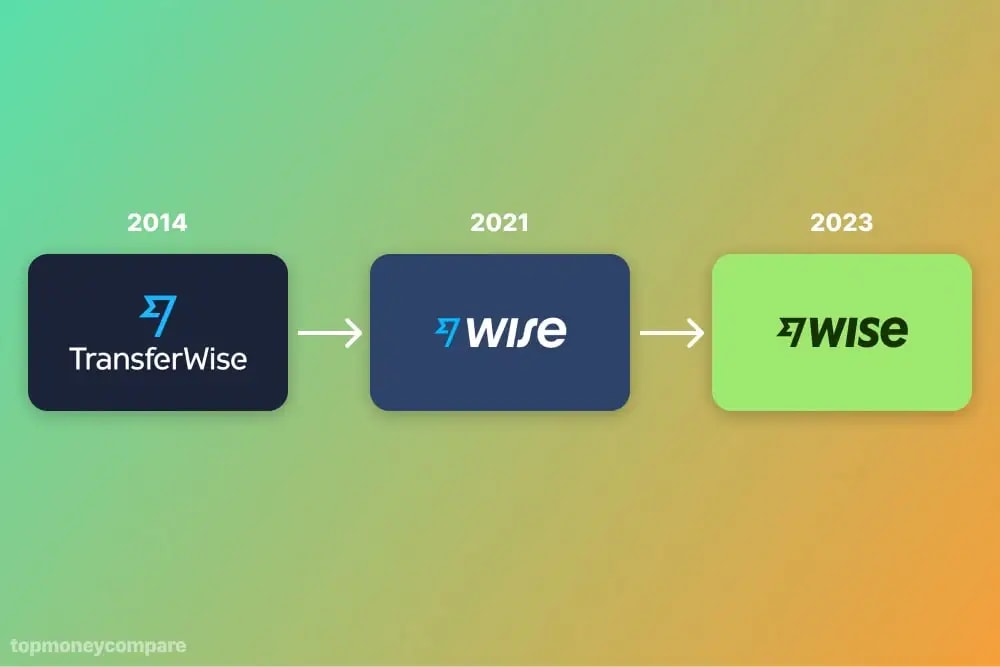

What is TransferWise?

TransferWise is what Wise used to be called.

They removed the “transfer” in 2021 to better reflect their full range of services.

Basically, they do more than just transfer money nowadays.

As you’ll read, there’s a host of other features available to customers now.

Although their name and logo changed, the service remained entirely the same.

- Extremely cheap service

- Multi-currency account and debit card available

- Over 50 different currencies

- Earn interest on account balances

- Publicly traded on the London Stock Exchange

- Transparent - all fees are visible right from the start

- Poorly reviewed customer service

- Customers have reported delayed transfers

- No cash transfers - only bank to bank

Is Wise safe?

Wise is arguably the safest money transfer company available.

Here’s why:

- Authorised and regulated in 14 countries

- Listed on the London Stock Exchange

- 220k+ reviews on Trustpilot

- 16 million customers

- £108 billion in client funds transferred per year

Wise is one of 3 money transfer companies that are publicly traded.

The other two are OFX and Remitly.

I’ve scored Wise a perfect 5/5 for safety.

Is Wise legit?

Wise is authorised and regulated in the following countries:

- Financial Conduct Authority (FCA) in the United Kingdom

- Nation Bank of Belgium (covers the European Economic Area)

- Financial Crimes Enforcement Network (FinCEN) in the United States

- Australia Securities and Investments Commission (ASIC)

- Financial Transactions and Reports Analysis Centre of Canada (FINTRAC)

- Type 1 Transfer Licence in Japan (New in FY2024)

- Customs and Excise Department (CCE) in Hong Kong

- Reserve Bank of India (RBI)

- Kanto Local Financial Bureau in Japan

- Bank Negara Malaysia

- Department of Internal Affairs in New Zealand

- The Monetary Authority of Singapore

- Central Bank of Brazil

- Bank Indonesia

- Abu Dhabi Global Market (ADGM) Financial Services Regulation Authority (FSRA)

You won’t find a company with heavier regulation.

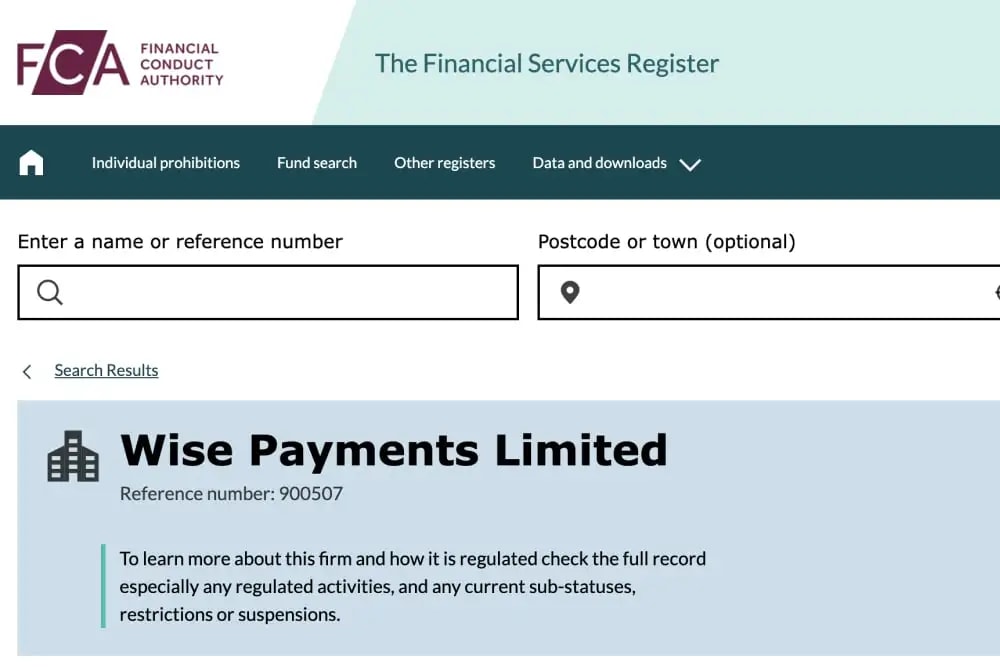

If you’re in the UK, you’ll probably have heard of the Financial Conduct Authority (FCA).

Wise Payments Limited is authorised as an Electronic Money Institution (EMI) by the UK Financial Conduct Authority with registration number 900507.

This is the same type of regulation that the most reputable non-bank money transfer companies have.

Is your money protected with Wise?

A requirement of Wise’s regulation is separating company funds from client funds.

These client funds are held in accounts that are “ring-fenced and safeguarded”.

If Wise were to become insolvent, you should receive the full amount of funds back that you were holding with them.

Wise can’t touch them to pay off their debts.

The only time you might not is if the costs associated with the liquidation exceed any funds held by the business.

If this happens, the liquidator has the ability to recover their costs from the pool of client funds.

Given the number of customers that hold money with Wise, this would translate to a small amount deducted from each customer, should this scenario actually ever unfold.

If you’re in the UK, you probably have heard of the FSCS (Financial Services Compensation Scheme).

All UK banks are bound by the scheme, and it entitles their customers to up to £85k of their money back if the bank goes bust.

So, if you had £100k in your account, you’d potentially lose £15k.

With money transfer companies like Wise, there is no limit on the amount you can receive back.

Therefore, they’re arguably safer.

Is Wise trustworthy?

Wise has an emphatic number of customer reviews on Trustpilot, with a great overall score.

I’ve written a section on Wise’s Trustpilot page here.

I’ve also taken a look at Wise’s latest company accounts to get an overall health check:

- Over 16 million customers

- £118 billion transfer volume in FY2024 (up from £103bn in FY23)

- £1,173 million in revenue

- £481 million in profit

- Customers, transaction volume and profit are growing

As a publicly traded company, all of their figures are easy to find and simple to read.

See Wise’s Investor Relations page (opens in a new tab).

One potential concern is the proportion of revenue that Wise derives from its deposits.

As interest rates fall, this will have a direct impact on the revenue stream.

Wise exchange rates

Wise offers the mid-market exchange rate for all transfers.

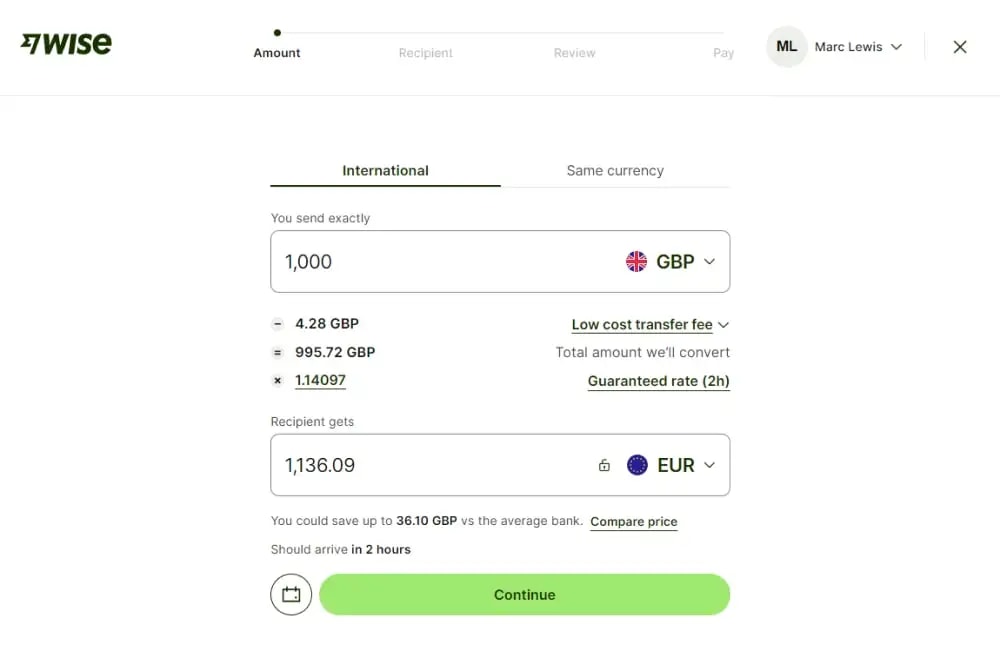

I’ve taken screenshots from my Wise app for a GBP to EUR transfer, for varying amounts.

As you can see, they’re all offering 1.13850, which was near enough the mid-market rate at around 07:30 on the day.

The above screenshot from XE (mid-market rate tracker) shows 1.13882 at a peak, so it checks out.

By offering and displaying the mid-market rate, it shows that Wise is committed to absolute transparency and trying to provide the cheapest service possible.

You may notice the ‘Guaranteed exchange rate’ notice next to the rate.

This means that for the amount of time provided, that exchange rate will be locked for your transfer.

In other words, that’s the amount of time you have to transfer your funds to Wise before the rate changes.

You have 2 hours for smaller amounts, and between 24-48 hours for larger amounts.

It depends on the currency, too.

So, while Wise doesn’t make any money on the exchange rate, they charge varying fees.

Wise transfer fees

Wise charges a set fee per transfer, which is a percentage of your total transfer volume.

Again, this is absolutely visible and transparent to you when making the transfer.

This is unlike some other money transfer apps, where you can only see the rate.

When Wise has changed prices in the past, they’ve even emailed me explaining how this would affect my costs, based on my previous trades.

Trust me, you don’t get this kind of transparency with other companies.

Here are the fees charged by Wise on my GBP/EUR test transfer:

As you can see, the fee percentage gets lower the more you transfer.

Even at £100, a 0.94% fee is excellent and you’ll struggle to get better.

With £100,000, 0.35% is still great, however you can get cheaper.

For example, Atlantic Money provides mid-market rates with a £3 (or €3) fee for every transfer, no matter the amount.

So while Wise is cheaper on transfers up to £750, Atlantic Money is cheaper for anything above.

However, they don’t have nearly as many features available as Wise.

Also note that Wise’s fees will vary for different currencies and countries.

In their latest 2024 pricing change, a number of corridors became more expensive, but GBPEUR transfers became even cheaper.

Take a look at the Wise fee calculator tool to be absolutely sure.

For their transparency and low fees, I have scored Wise a 4.7/5 for cost.

Wise reviews

On Wise’s Trustpilot page, they have an ‘Great’ rating of 4.3/5, with a whopping 220k reviews.

Firstly, this is by far the largest number of reviews that any money transfer company has.

No matter how good or bad your customer experience was, they’ll ask you to leave a review.

It’s a big part of their mission for complete transparency.

For maintaining a great rating with such a large number of reviews, I have scored Wise a 4.4/5 for their customer reviews.

Wise positive reviews

Here are some positive comments about Wise:

- User interface on both platform and app are great

- The debit card feature is top-notch and makes life easier

- Reliable - payments are quick and easy to track

- Exchange rates are brilliant

It seems as though their customers are in love with the whole package and how it all works together.

From the initial conversion right down to making the transfer or spending using the debit card.

Personally, I have to agree with these reviews.

Everything about Wise is so easy.

Wise negative reviews

Here are some negative comments about Wise:

- Account deactivated for no reason

- Customer service seems reliant on artificial intelligence

- Requested documentation not being processed in a timely manner

- Funds being held by Wise with no end in sight

If I’m honest, it’s quite scary reading the negative reviews.

They nearly all mention compliance issues and Wise holding your money.

As an FCA-authorised and publicly traded company, they’ve got to adhere to a lot of regulations and procedures.

This could mean Wise asking more questions, or requesting documents to back up your story and where the funds came from.

It’s simply to prevent people from using Wise to launder money or fund terrorist activities.

This is standard across the industry.

What isn’t, however, is holding people's money for weeks on end until the issues are resolved.

You’re almost guaranteeing a lost customer and a negative review.

While 99% of transactions go through problem-free, if you’re faced with an issue, you could be waiting a while.

Wise service, features and availability

What makes Wise stand out is its features available.

It’s not just currency conversion and money transfers.

However, their human customer support is lacking.

For this, we’ve scored Wise a 3.9/5 for service, features and availability.

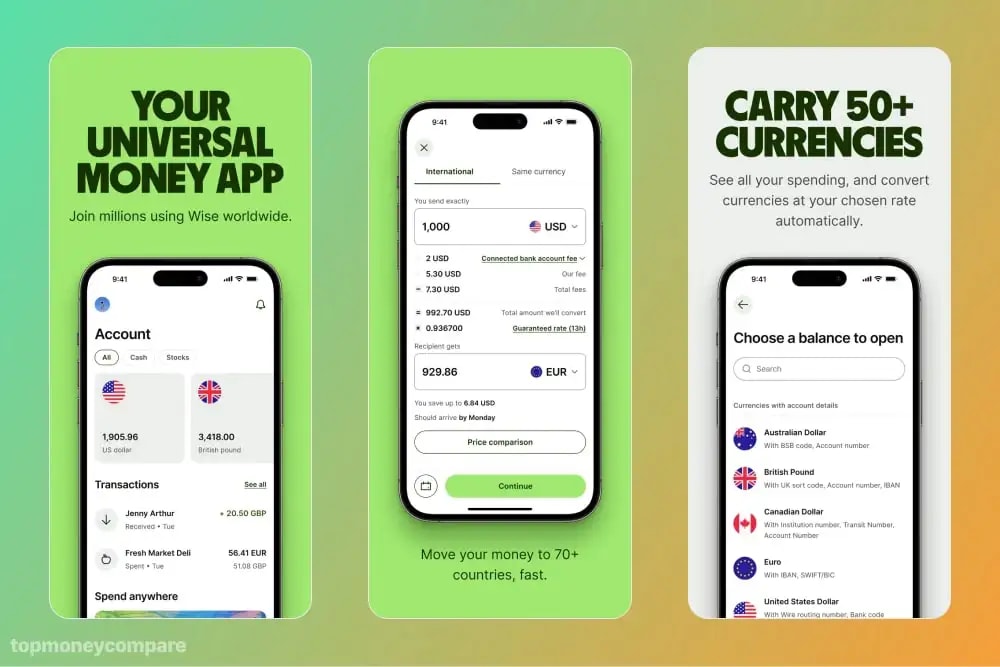

Wise mobile app

Wise’s mobile app has 66k reviews on the App Store and 900k reviews on the Google Play Store, with an average rating of 4.6/5.

In my opinion, the app is fantastic and does everything it needs to do.

Here is what you can do using the Wise mobile app:

- Convert currency and make transfers

- Manage recipients

- See transactions

- Open and hold currencies in wallets

- Track transfers

- Check exchange rates

- Manage debit card

- Invest in stocks

I don’t think there’s anything you can’t do on the app.

It’s got a clean design and is easy to use, too.

Wise multi-currency account

With Wise, you can open different currency accounts in a matter of clicks, all held under your name.

You can then convert between the accounts in the same amount of clicks, too.

You’ll receive a unique set of details for 9 different accounts and can hold balances in up to 40 currencies.

The three most important currencies are covered:

You can even earn an impressive interest rate on your balances in these accounts.

As of June 2024, you can get a return of 4.66% on GBP, 5.04% on USD and 3.65% on EUR.

What’s more, there’s no limitations on withdrawing funds. Just take money out or spend from the balances when you want.

The solution is also perfect if you work abroad or are frequently travelling.

I personally use it for holidays.

Let’s say I’m going to Spain; I load up my GBP wallet, and convert to Euros whenever I need to.

Or, if I’m getting paid for some freelance work in USD, I’ll send them my USD account details and convert the money back to GBP when I’m ready.

For its ease-of-use, currency variety and interest-earning potential, I think it’s the best multi-currency account on the market today.

To top it all off, all of your currency accounts are linked to your Wise debit card, which I’ll explain below.

Wise debit card

Every multi-currency account comes with a Wise debit card.

This card is linked to your whole Wise account and all the different currency accounts you might have.

When you use it to pay for something, it will check the currency used and take the money from that currency account.

So, if you’re in France and use your card in a restaurant, Wise will know that the restaurant wants Euros.

They will then take the money from your Euro wallet.

It’s the same if you’re in the USA or Australia, it will debit your USD or AUD account respectively.

This allows you to track and budget your spending in different currencies, accurately.

It’s my favourite feature about Wise, and I take my card wherever I go.

I even pay for my hotels with it, and end up saving a lot of money on my travels.

1. Check Wise’s rates compared to competitors

You can use TopMoneyCompare’s comparison engine to check out how Wise's rates stack up against their competitors.

You can see the amount and rate you'll receive, transfer fees, and speed.

This way, you can get a clear picture of how they compare and decide if Wise is the right option for you.

2. Sign up for an account with Wise

To use Wise for your international transfer, you'll need to sign up.

Click here to sign up for a Wise account (opens in a new tab).

Just fill out your details and submit the form.

You’ll be asked to take a picture of some ID (drivers licence or passport), and a selfie.

This is to make sure it’s really you signing up.

Keep in mind that additional checks may be required if your details can't be verified.

3. Go to ‘Send’, enter your amounts and continue

Once your account is open, you can log in to the platform or mobile app and make your transfer.

Enter in your amounts, check the rate, fees and transfer time, then click continue.

For small amounts, they can take payment via card or bank transfer.

For larger amounts, you’ll only be able to make a bank transfer.

Wise will let you know how long you have to get your money to them before the rate changes.

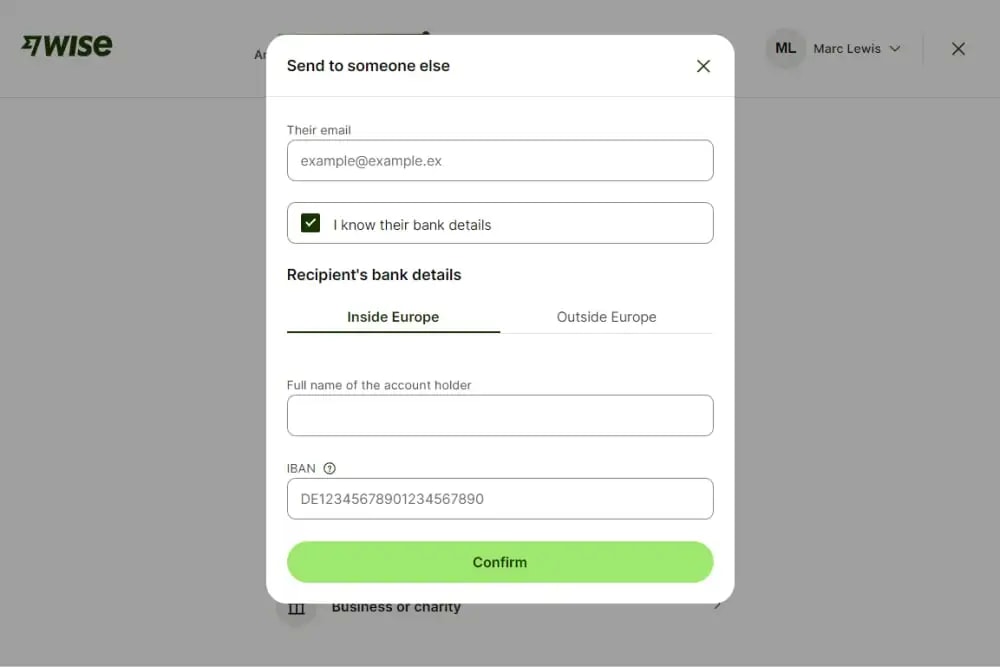

4. Add a beneficiary

The next step is to add the details of where you want your converted funds transferred to.

The information you’ll need will depend on the receiving country.

Here’s an idea of what you might need:

- UK - account number and sort code

- Europe - IBAN

- USA - account number and routing number

Other countries might require different details.

If in doubt, call customer support. They’ll know what you need.

If your recipient has a Wise account, you can simply enter their email and Wise will take care of the rest.

5. Confirm the transfer and send your funds to Wise

Once you’ve confirmed the transfer, it’s time to send your money to Wise.

If you opted for the debit card option, they’ll take the money from your card and make the transfer instantly.

(Provided the card transaction went through)

If you went for the slightly cheaper bank transfer, you must now transfer your funds to the details provided by Wise.

You can do this via online banking, mobile banking, telephone banking or go into a branch.

When Wise receives your money, they’ll then make the transfer.

You can then track your transfer via the platform or app.

My verdict: Is Wise for you?

Wise is the one of, if not the most popular money transfer service.

They provide excellent rates of exchange, some great extra features and an intuitive app.

However, sometimes there’s another company out there which is more suited for you and your requirements.

Here’s some examples of where Wise is for you, when it isn’t, and some alternative providers.

When Wise works

If you match any of the below, Wise is a great option for you:

- You’re transferring under £25,000 (or equivalent)

- Safety and peace of mind is important to you

- You want to use a platform or mobile app

When Wise doesn’t work

There are some cases where you might need an alternative instead:

- You’re transferring over £25,000 (or equivalent)

- You want quick and reliable customer support from a human

- You need cash delivery, airtime or mobile money

- You want the best rate available

Wise alternatives

If you’re transferring over £25,000 or want quick and reliable human support, I thoroughly recommend using a currency broker instead.

With a currency broker, you’ll be assigned a personal account manager who will:

- Watch the rates and markets to help you time your transfer

- Assist you with any enquiries you might have

- Solve issues promptly

Usually, you can call in and speak to them within minutes (this varies from company to company).

They offer the peace of mind that you just don’t get with web chats and generic customer support.

Which, when you’re transferring large amounts of money, is very important.

Our recommended currency brokers are Key Currency, Currencies Direct and TorFX.

If you require cash delivery, airtime or mobile money, Wise can’t help.

Two alternatives for this transfer type are WorldRemit and Remitly.

If you’re after the cheapest possible transfer, there is one provider who beats Wise on most transfers.

This is Atlantic Money.

They charge £3 for every transfer, no matter the size.

Wise is cheaper for transfers under £750, anything above that and Atlantic Money comes out on top.

However, their features and currencies are very limited.

-min.webp)