TorFX is one of many money transfer companies available to you when it comes to international money transfers.

It’s because there are so many options that it’s so important that you compare and shop around.

By the end of this review of TorFX, you’ll know whether they’re a good fit for you.

I’ll talk about how safe they are to use, whether their exchange rates are good, what their customers are saying and what features are available.

I’ve then scored TorFX out of 5 for their safety, cost, customer reviews and service, giving an overall TopMoneyCompare rating.

I’ll also discuss when they aren’t a good fit and if any alternative companies might be better suited for you.

What is TorFX?

TorFX is an international money transfer provider and currency brokerage.

They were founded in 2004 out of the seaside town of Penzance, Cornwall.

A stone’s throw away from rivals Key Currency, who are in Truro (30 miles away).

TorFX is a leading money transfer company, focusing on providing the best possible service and experience for their clients.

You can book deals over the phone or via their online platform and mobile app.

Being in Cornwall allows TorFX to have significantly lower wages and overheads compared to their London competitors.

In turn, they can pass these savings onto their clients to give superior exchange rates.

TorFX have won a number of awards over the last decade:

- Best European Currency Broker, Overseas Living Magazine (2010, 2011)

- Best Customer Service, MoneyFacts (2016, 2017, 2019, 2020, 2021, 2022)

- Best Money Transfer Provider, MoneyFacts (2016-2022)

On top of their award cabinet, they also maintain a Level 1 Credit Rating with Dun & Bradstreet.

TorFX was acquired in 2011 by Azibo Group, an investment firm founded by Mayank Patel, who also founded Currencies Direct.

- Rated 4.9 on Trustpilot based on 4000+ reviews

- Online platform and mobile app available to registered clients

- Bank-beating exchange rates on large transfers

- Exemplary service - frequently mentioned within their 5 star reviews

- More than 100 traders within the organisation

- Not available to customers in the United States

- Exchange rate can be uncompetitive with smaller amounts

- No cash pick-ups - only bank transfers

Is TorFX safe?

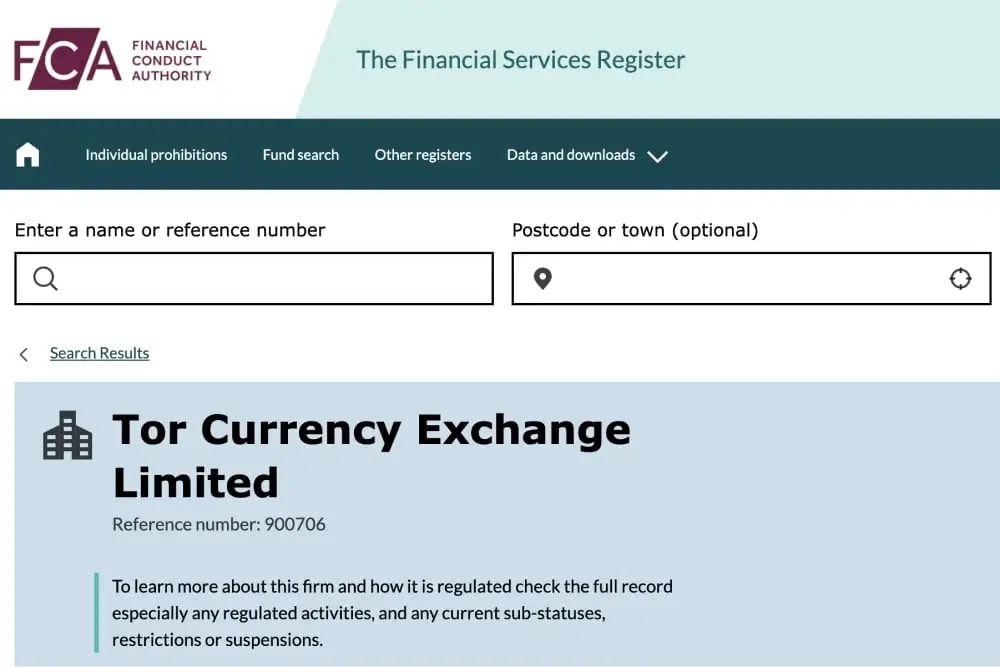

TorFX is authorised and regulated by the Financial Conduct Authority as an Electronic Money Institution (Financial Services Register No. 900706).

They’re also owned by notable industry-leaders Currencies Direct.

So, TorFX is very safe to use, with a safety score of 4.5/5.

Is TorFX legit?

The FCA is the same body that regulates the UK high-street banks.

Being regulated provides the highest level of protection and safety for customers.

You can’t just incorporate a company and get regulated, either.

Regulated firms must show that they can handle large amounts of money both safely and responsibly, giving consideration to the law and anti-money laundering regulations.

If you meet the criteria for reliability, protection and quality of service, you can apply to be authorised and regulated.

As I’ve previously mentioned, TorFX is owned and operated by Currencies Direct, who are registered and authorised by the Bank of Spain.

This regulation is also passed down to TorFX.

Is your money protected with TorFX?

Being regulated by the FCA requires you to segregate client money from company money.

These are accounts that are ‘ring-fenced and safeguarded’.

Basically, this means that TorFX can’t touch your money for any reason other than for what you instruct.

Your money can’t be used to pay other creditors should they fold.

If TorFX goes into administration, you should get the full amount of your funds returned to you.

Client funds get first priority over all other creditors.

The only exception to this is if the costs associated with the liquidation exceed the cash held by the business.

In this scenario, the liquidator may recover their costs from client funds.

However, to counteract this, TorFX has processes designed to ensure that the value of client funds is calculated and checked against actual cash held on a daily basis.

This is how all money transfer companies who are regulated as an Electronic Money Institution operate.

In contrast, all high-street banks operate under the Financial Services Compensation Scheme.

This scheme only entitles you to up to £85k of your money back if the bank went under.

Compare that to TorFX, where all your funds are safeguarded, and you could argue they’re actually safer than a bank.

Is TorFX trustworthy?

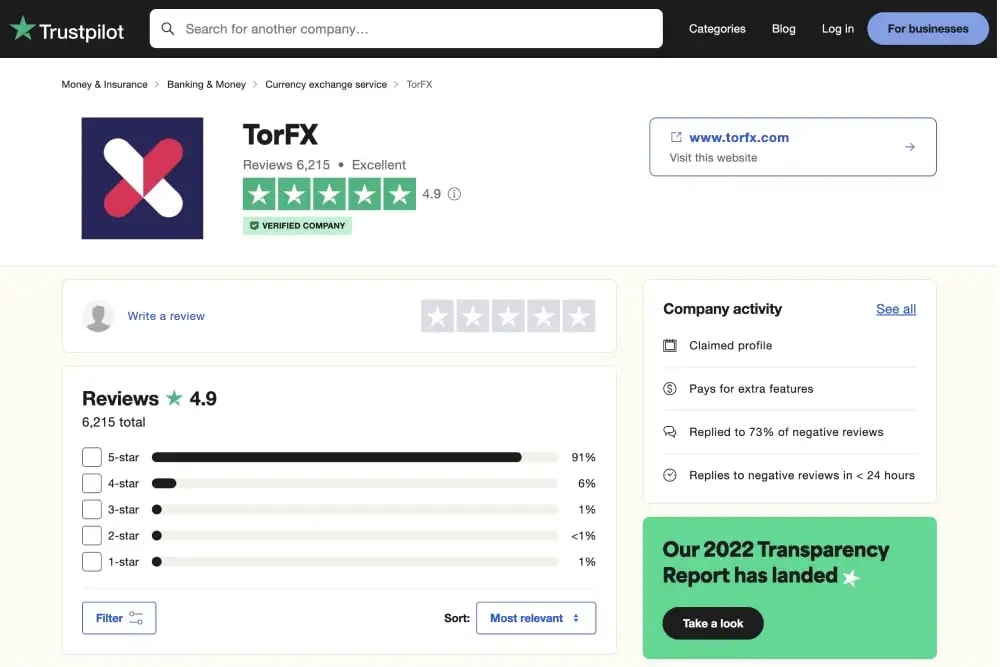

On TorFX’s Trustpilot page, they have an ‘Excellent’ rating with a large number of reviews.

You can read my section on their customer reviews here.

To get a good idea on their trustworthiness, I took a look at their most recent company accounts:

- They made just under £17 million in profit

- Over 70 employees

- Over £90 million of client funds held in safeguarded accounts

Here’s a summary on TorFX’s safety:

- Regulated by the FCA and authorised by the Bank of Spain (via Currencies Direct)

- All client funds are held in safeguarded accounts

- Owned and operated by Currencies Direct

- Trustpilot page has a very high rating and a large amount of reviews

In conclusion, TorFX is very safe and reliable to use.

TorFX exchange rates

TorFX provides great exchange rates which are usually better than most high-street banks.

However, you could probably get better rates with a different company.

In this industry, you get what you pay for.

TorFX delivers an impeccable level of service, of which you’ll receive if you don’t mind getting a slightly worse rate.

I asked for quotes on different amounts for a UK to Spain money transfer to see how their spread compares:

Like with most companies, the more you transfer, the better the rate you’ll get.

The ‘spread’, or ‘margin’ is the difference between the rate the provider receives when buying the currency, and the rate they give to you when they sell. In other words, it’s the profit they make on the transaction.

See how TorFX compares to other brokers.

If you’re wondering just how much money you could save with TorFX compared to a bank, let me show you.

With a NatWest international transfer, for example, you’ll get charged roughly 3% - 5%.

On a transfer of £200,000, you’ll be saving roughly £5k - £8k by using TorFX instead of NatWest.

Mind-boggling, right?

To summarise, you’ll make great savings with TorFX compared to your bank, coupled with top notch service.

But you could get a slightly better rate elsewhere (in exchange for worse service) if it’s important to you.

I’ll discuss relevant alternatives for you at the end of the article.

TorFX transfer fees

TorFX does not charge any transfer costs, hidden fees or commissions.

The amount you are given on the platform or by your account manager is the amount you’ll receive in your account.

I scored TorFX a 4.1/5 for cost.

TorFX reviews

On TorFX’s Trustpilot page, they have an ‘Excellent’ rating of 4.9/5, with over 6000 reviews.

91% of their reviews are 5 stars.

As I’ve mentioned, TorFX focuses on providing the best service possible.

This is evident in their high rating.

Most other money transfer companies are around 85% 5 star reviews.

For their great rating, I scored TorFX a 4.9/5 for customer satisfaction.

TorFX positive reviews

Here’s some positive comments that customers have left:

- Great service, a “human touch” compared to modern day apps

- Account managers were great communicators and made the process smooth

- Saved a lot of money compared to the banks

These comments match my own review thus far.

Customers love their service and great rates.

TorFX negative reviews

All companies have unhappy customers.

Here are some negative comments about TorFX:

- Compliance department was tricky and unwilling to open some accounts

- “Interrogation-like” questions from account managers

- Intermediary fees

I would say that all of these are unpreventable.

As an FCA-authorised institution, TorFX has high standards and regulations to adhere to, in order to prevent things like money laundering.

TorFX won’t open an account if it’s deemed too risky.

They might also ask additional questions to determine the risk level of a transaction.

At the end of the day, these are all conditions of having the FCA badge and the safety it brings to all customers.

With intermediary fees, these are out of the control of TorFX.

Sometimes, intermediary banks are required to process an international transfer.

This small fee is taken by the bank in between TorFX and the bank who receives the transfer. This is standard practice across the industry.

TorFX service, features and availability

TorFX is primarily an over-the-phone currency brokerage.

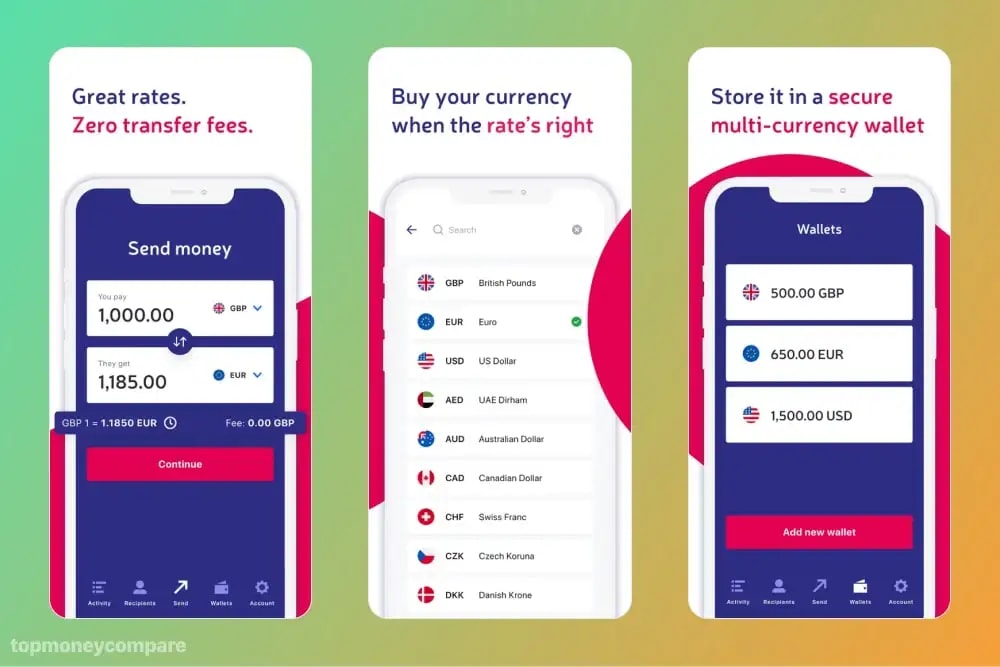

However, they do have an online platform and mobile app which you can use to make transfers.

This allows them to service those who want to speak to someone, and the others who only want to do it themself online.

This is unlike Key Currency, who only provides a telephone service, and Wise, who only provides an app.

Here are the features and services on offer with TorFX:

- Spot contracts

- Forward contracts

- Limit orders

- Stop losses

- Rate alerts

- Market analysis

- Online platform

- Mobile app

It’s a standard, solid offering among currency brokers.

Tools such as forward contracts and limit orders can be very helpful indeed.

Especially if you're sending a lot of money.

Using these tools appropriately can shield you when rates aren't favourable and benefit you when they swing your way.

This means you could end up with more currency at the other end of your transfer.

At the end of the day, TorFX provides all you need to get a bank-beating rate, with quality service.

I scored TorFX a 4.5/5 for services, features and availability.

Which types of transfers does TorFX offer?

The only way to send money to TorFX is via a bank transfer.

If you want to use a debit card to pay, you might have to look at using Currencies Direct or OFX.

Bear in mind, using a card takes longer and is more expensive.

TorFX can transfer your money anywhere around the world, except ‘extremely high-risk’ countries.

These are including but aren’t limited to:

- Syria

- Iran

- North Korea

- Somalia

To send your funds, TorFX will use the standard methods pertaining to the currency and country.

This includes CHAPS for GBP to UK accounts and SEPA for EUR to accounts in Europe.

Payments in other currencies or to other countries are usually routed as a SWIFT transfer.

Does TorFX have an online platform or mobile app?

TorFX has developed both an online platform and a mobile app, free to use for their registered clients.

You can use the app to do the following:

- Process and track transfers

- Manage beneficiaries

- Forward buys

- Rate alerts and notifications

- Market updates and analysis

They also released a new feature in 2023, allowing users to hold and store currencies in a wallet.

You can download their app from the App Store or Google Play store.

Does TorFX accept international clients?

TorFX accepts clients globally, with a few exceptions.

They might require documents to prove that you live where you say you live and are who you say you are.

A proof of address and identity will usually suffice.

You may struggle to open an account if you only have residence within a ‘high-risk’ country.

This is simply because their banking partners won’t allow it.

Due to regulatory laws and difficult logistics, TorFX is unable to accept clients in the USA.

If you are based in the United States and don’t have a residence elsewhere, Key Currency may be able to assist you.

If you are unsure, you can always call through and ask to find out if you’re eligible for an account.

1. Check TorFX’s rates compared to competitors

Using TopMoneyCompare’s comparison engine, you can check just how good TorFX’s rates are compared to other providers.

You can see the amount and rate received, transfer fees and speed.

This way, you can get an idea on how they compare and if they’re right for you.

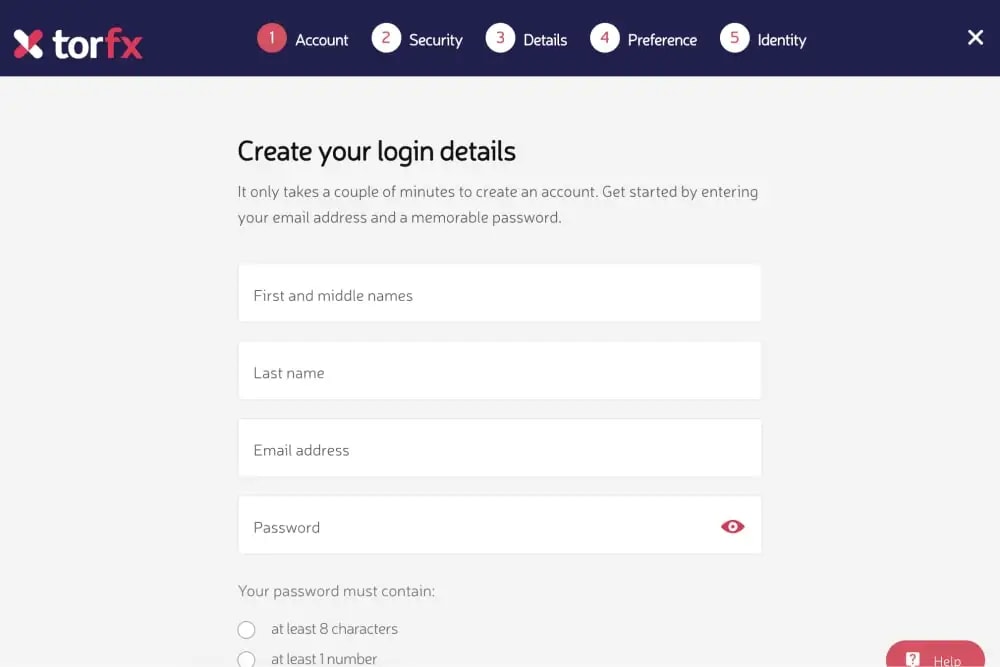

2. Sign up for an account with TorFX

If you want to use TorFX for your money transfer, the next step is to sign up.

Click here to open a TorFX account (opens in a new tab).

Fill out all of your details and submit the form, and someone will be in contact to finalise your application.

You may need to complete some additional checks if they can’t verify your details.

This would include sending over some documents to prove that you are who you say you are.

This is to comply with anti-money laundering procedures.

3. Lock in your exchange rate and transfer your funds

Once your account is open, your account manager will discuss rates with you and the best times to transfer.

When you’re ready, they’ll read a verbal script to lock in the rate.

You then need to make a bank transfer of the quoted amount to TorFX.

TorFX may ask you to transfer the funds before they lock in the rate.

Alternatively, you can make the transfer using their online platform or mobile app.

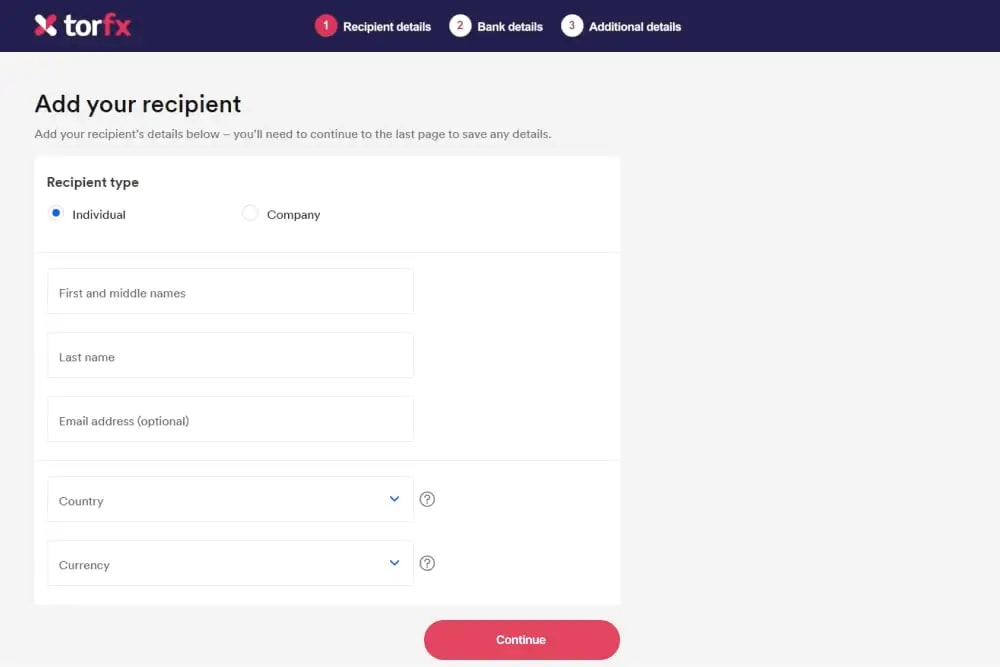

4. Add a beneficiary

The next step is to submit the details of where you want your converted funds transferred to.

The information you’ll need will depend on the receiving country.

Here’s an idea of what you might need:

- UK - account number and sort code

- Europe - IBAN and BIC

- USA - account number and routing number

- Australia / New Zealand - account number and BSB

Other countries might require different details.

If in doubt, ask your account manager. They’ll know what you need.

5. Funds transferred and transaction complete

Once TorFX has received your funds and the rate locked in, they’ll then make the transfer to your chosen beneficiary(s).

Is TorFX for me?

TorFX is an established company and one of the better options out there.

However, they might not be right for you and your requirements.

When TorFX works

If you match any of the below, TorFX is a great option for you:

- You’re transferring over £25,000 (or equivalent)

- You like a personal service (i.e., a personal account manager)

- You want help timing your exchange

- You want the option of using a platform or mobile app

When TorFX doesn’t work

There are some cases where you might need an alternative instead:

- You’re transferring under £25,000 (or equivalent)

- You want to achieve the best rate on the market

- You need an exotic currency

- You’re a US citizen with no links to other countries

TorFX alternatives

I recommend using a money transfer app for transfers of under £25,000.

Brokerages like TorFX specialise in high-volume transfers, so their rates can get worse for smaller amounts.

In comparison, apps like Wise and Atlantic Money provide great rates for small amounts.

However, you don’t get anywhere near the same level of service.

Even with larger amounts, TorFX’s rates aren’t market leading.

Don’t get me wrong, they’re still great and you’ll definitely get better than your bank, but there are companies out there that provide better.

Such as Key Currency and OFX.

If you need to transfer a more exotic currency, you may find that TorFX is unable to assist.

They mostly deal with the more vanilla, frequently traded currencies.

Companies like WorldRemit and Remitly are your best bet for exotic currencies.

Check with an advisor to see if they provide your required currency.

If you’re a US citizen without a foreign address or passport, TorFX won’t be able to assist you.

This is due to tax and reporting laws over there that make it a logistical nightmare.

However, they will refer you to their sister company, Currencies Direct, who have a good setup for US clients.

So, to save you wasting your time, just go straight to them instead

-min.webp)