Cost saving on international transfers is not nearly as complicated as it was just a few years ago.

It requires only a tiny bit of research and understanding of the fee breakdown.

Once you’ve determined these factors:

- The currency you are sending and receiving

- The country you are sending money to

- The amount you are sending

- The type of transfer you require (bank transfer, cash, mobile money etc.)

Then you can then find the cheapest international money transfer for your specific situation.

In this guide, I’ll provide advice on the cheapest solution for a variety of scenarios, covering all four of these factors.

I’ll also talk about the different types of costs for international transfers, so you’ll know how to avoid transfer fees, and understand the importance of getting the best exchange rate for it.

Quick Look: Cheapest Money Transfer Companies in 2024

Footnotes:

By small or large transfers, I mean under £5000 worth or over.

If a company has a tick under small transfers, that means they are generally cheapest for transfers under £5000.

And vice versa with a tick under large transfers.

This small/large differential applies to most major currencies.

If you’re sending a lesser-known currency, you may be forced into using a more expensive remittance company.

What is the cheapest way to transfer money?

In a nutshell, the cheapest methods are:

Both types of companies provide low cost international transfers.

This is in the form of low, or zero transfer fees and great exchange rates.

However, they each provide very different experiences for the customer.

You’ll have to work out which type is right for you.

Essentially, currency brokers provide an over-the-phone, dedicated account management service.

Money transfer apps on the other hand, make you do all the work yourself on an app.

When choosing a provider for an international transfer, there is often one key cost that is overlooked.

This is the "opportunity cost".

Only Currency Brokers can help with this.

I’ll explain what this means later, and why it’s very important.

Further down, I’ll also explain why you definitely should not use your bank if cost is your primary concern.

In short, the cheapest way to transfer under £5000 is usually a money transfer app.

The cheapest way to transfer over £5000 is usually a currency broker.

Finding the cheapest way to send money overseas by currency pair and amount

Not all providers cover all currency routes and destinations.

For example, a company like XE lets you send over 100 currencies to over 200 countries.

Whereas Wise lets you send around 50 currencies, and Atlantic Money is even less with 10.

By using our currency exchange rate calculator, you’ll get specific results for the providers that can handle your currency pair.

We list the cheapest way to send money at the top and then show all the other provider’s that can help you with a transfer involving your currency pair.

Try our calculator now:

What are the costs of an international transfer?

By understanding the different costs that are involved in international transfers you’ll be able to identify cheap money transfers from expensive ones.

Let’s take a look at them now.

Transfer Fees

This is pretty self explanatory.

You pay a fee per transfer, which is either a fixed amount or a % of the transfer.

Most currency brokers, like Currencies Direct and Key Currency, won’t charge a transfer fee.

Meanwhile, money transfer apps will usually charge a small fee no matter the amount.

Each provider will have a different fee structure.

Here is a list of a few leading UK money transfer apps when it comes to fees:

Even though XE doesn’t charge a fee compared to Wise, they might be more expensive on smaller amounts.

This is because of the exchange rates they provide.

Exchange Rates

This is where providers make their money and you stand to lose the most.

For any currency pair, e.g. GBP/EUR, there is one central rate, called the interbank rate.

This is the best possible rate you can get at any one time.

Except, you can’t get it. Only banks can.

Not even brokers can buy at the interbank rate.

Instead, banks will sell currency to the providers at slightly below the interbank rate.

This rate is called the “wholesale rate”.

The banks will then pocket the difference between the two rates as profit.

The money transfer providers will then set their own rates for customers, the “retail rate”.

The bigger the difference between the wholesale rate and the retail rate, the more money the company makes.

And therefore, the more it’s costing you.

You will never be offered the interbank rate as a customer.

So, you’ll have to compare the different retail rates you get with other providers to see who comes out on top.

On large transfers you could stand to lose thousands, and the fact the cost is hidden in the exchange rate, you may not even know.

Even UK finance expert Martin Lewis has been fooled by recommending HSBC as the cheapest way to send money abroad for their ‘no transfer fee’ policy to other HSBC accounts.

Sure, there might not be a transfer fee, but exchange rates offered by HSBC to retail customers are 1.5% to 3% worse than the interbank rate.

Wise and Atlantic Money are two money transfer apps that will actually pass on their “wholesale rate” to you as the customer, and then add different fees after. More on this later.

Opportunity Cost

As I mentioned before, this is often overlooked.

Basically, it’s the cost of youtiming your exchange poorly.

All exchange rates move every 3 seconds.

Like any market, supply and demand are what affect the strength of a particular currency.

Positive financial data or economic news will drive the demand for a currency, while negative releases will have the opposite effect.

Likewise, increasing the supply of a particular currency (also known as quantitative easing) will weaken it.

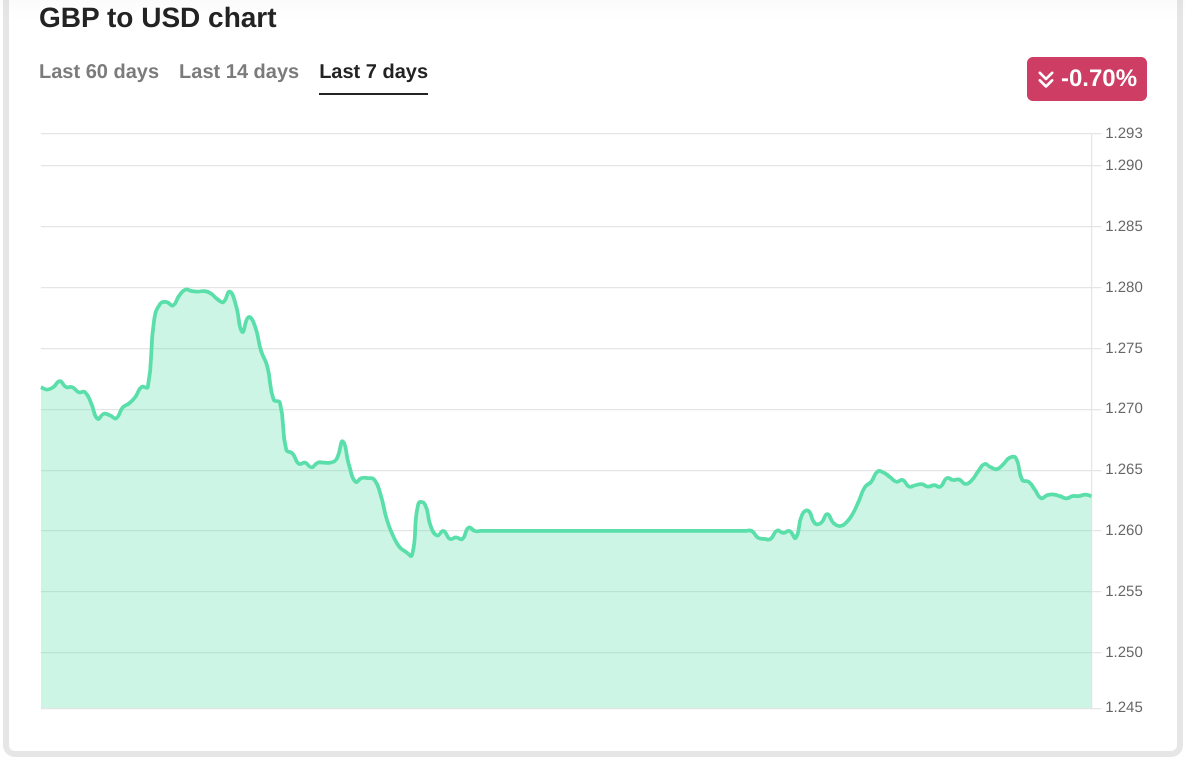

Let's take a look at the GBP/USD exchange rate on March 21st 2024, and what caused it to drop from 1.28 to 1.26.

This was because the Bank of England announced it was to hold interest rates at their current level.

This signals that interest rates may have peaked in the UK and increases the likelihood of a rate cut later in the year, meaning investors will see smaller returns from their GBP savings and investments.

Thus, investors lost confidence in the pound and sold their holdings, weakening the rate.

This is one example of financial news moving the markets.

It happens multiple times a day across all currencies.

Keeping an eye out for any upcoming announcements or news can help you get an idea on how the rate will move in the future.

This gives you a better opportunity to time your exchange better, and get the most for your money.

But let’s be honest, who has the time or the interest to be watching the financial news like that?

This is where currency brokers come in. They will do it all for you.

They watch the news and markets all day every day.

They’ll keep you up to date and give you a call when it’s the best time to make the exchange.

This is something that money transfer apps can’t do, as there’s no one to speak to.

Cheapest ways to transfer money internationally

Let’s go into some detail about what these methods are and if they’re right for you.

Money Transfer Apps

As technology advances, so do your options for money transfers.

These kinds of apps are still new to the market.

For example, Wise (formerly TransferWise) was only founded in 2010. It’s now arguably the most recognisable name across the entire industry.

Here’s how it works: you sign up online and log in to either an online platform or mobile app to book your transfers.

There is no one to speak to for immediate help.

And even then, these types of companies aren’t known for their cutting edge customer support.

When sending large amounts abroad, it’s important to have someone there to speak to.

That’s why I wouldn’t send more than £5000 with a money transfer app.

However, the technology they provide is excellent.

They’re a great modern solution for small payments.

If I had a small transfer to make, I wouldn’t hesitate to use an app like Wise, Atlantic Money or XE.

You’ll get a great rate of exchange, and low fees (if any).

What makes them cheap?

- Some of the best rates

- Low to zero transfer fees

Plus, unlike banks, they’re usually very transparent with their fees.

You should be able to easily identify how much you have to pay, prior to agreeing to the trade.

I’ve found the two cheapest money transfer apps to be Wise and Atlantic Money.

Let’s compare their fees side-by-side on different size GBPEUR transfers.

We’ve already established that Wise and Atlantic Money will pass on their “wholesale rate” to you as the customer. This is an excellent rate that’s just a shade worse than the actual interbank rate at the time.

So then it’s just a question of who has the best fees.

Wise charges a variable fee that’s around 0.4% for GBPEUR transfers.

Atlantic Money charges a fixed £3 transfer fee, regardless of the amount you send.

As you can see, there’s a tipping point where Atlantic Money actually becomes cheaper.

Overall, I’d have to say the cheapest money transfer app is Atlantic Money.

Currency Brokers

For anything over £5000, I’d recommend a currency broker instead.

This is because of the customer service they provide.

If you want to make a transfer, you give them a call and they’ll run through it with you.

Some even have their own mobile apps too, so you can get the best of both worlds.

It can get stressful when transferring large amounts.

Imagine having all of that money leave your bank account and having no one to speak to…

In a nutshell, that’s why they’re better for £5k+.

You can pick up the phone and have answers to your queries in minutes.

Compared to “submitting a ticket” or trying to communicate via an online chat portal.

With companies like Key Currency, they’ll answer their phones within 5 seconds.

No holding or wait times.

For me, it’s a game changer.

What makes them cheap?

- Very low exchange rate spreads

- No transfer fees

- They can help you time your exchange

You could of course use companies like Atlantic Money for transfers over £5000 too.

Their flat fees are frankly unparalleled in the industry and they will almost always be the cheapest option to transfer any amount, in the 10 currencies they handle.

The downside is the limited number of currencies, the lack of dedicated support and the fact they are still a very new company (with just 120 reviews and a 3.9/5 rating on Trustpilot).

I will write more about their business model and my lack of comfort to use them for large transfers below.

For me, though, the main thing is that: the money you save by timing your trade correctly can far eclipse the amount you save through transfer fees and exchange rates.

The ‘opportunity cost’ is even greater for larger transfers, and only currency brokers can help in this regard.

Why you shouldn’t use your bank for cheap international transfers

There are lots of reasons:

- Terrible exchange rates (2-5%)*

- High transfer fees**

- Poor customer service

- The operatives often have little knowledge of transfers and markets

* We tested Barclays, Lloyds, Nationwide and Natwest for common currency pairings like GBPEUR and GBPUSD and they charged between 2% and 3.5% in markups. Higher markups for exotic currencies.

** The same banks charge between £5 and £30 for a non-SEPA wire on top of the exchange rates.Most of the time, people don’t often think past their bank and what the other options are.

Then they get stung by the costs and begin to wonder why it’s so expensive.

So the fact that you’re already here reading this article is the first step.

You’ve already saved yourself a lot of money by not using your bank!

If you’re thinking about using your bank because they’re “safe”, or for the “peace of mind”... think carefully.

My opinion?

The cost is just not worth it, and it’s better to seek for a better pricing elsewhere.

Money transfer companies are cheaper than that as a whole, and substantially so.

Most companies out there are fully regulated by the FCA.

This gives you a very high level of protection (though not exactly the same as with banks).

To make it easier for you, all companies reviewed on TopMoneyCompare.com are fully regulated.

How can I reduce the cost of my transfer?

To get the best deal possible, do these two things:

- Time your transfer

- Compare your rates with other providers

Performing your transfer after some positive market movement can net you a lot more money.

Especially if you’re transferring £100k+.

Small percentage increases mean thousands extra for you.

Comparing rates is important, too.

It allows you to find the cheapest provider out there.

Comparing can be the difference between getting charged 3% and getting charged 0.5%.

That’s a difference of £5000 on a transfer of £200k.

On top of a well timed exchange, you’ll be laughing.

Summary

You’re here because you want to know how to send money abroad for cheap.

No money transfer is free. There’ll always be some kind of cost.

The cheapest methods to send money overseas are currency brokers or a money transfer app.

Apps make you do it all on your mobile phone, with no one to speak to.

Money transfer app Atlantic Money is the cheapest money transfer company in 2024.

You can transfer up to £1 million at Atlantic Money’s ‘wholesale rate’ and pay just a small, flat £3 fee.

Quite remarkable really.

However, having worked in the industry, I can’t see how their business model can be profitable.

Combine this with the fact they’ve only been trading for three years and they only have 100 or so Trustpilot reviews, I personally wouldn’t feel comfortable using them for a large transfer.

Brokers provide an over-the-phone service, focused on keeping the customer happy and their money safe.

That’s why I recommend using a broker for transfers bigger than £5k.

You’ll want someone to speak to if you have an issue.

Anything under that amount, use a money transfer app.

They’re a great way of making small, quick and cheap transfers.

Once you’ve picked your provider, you’ll want to get the cheapest exchange possible.

You do that by comparing your rates and timing the exchange.

By combining all of the tips in this article, you’ll get a great deal on your transfer.

On Top Money Compare you can get a quote and compare rates from the industry-leading providers, and find the cheapest option, in real-time. Our listing is already sorted to highlight brokers for larger transfers and digital providers for smaller transfers, as per my recommendations on this article.

-min.webp)