Sometimes, this currency conversion is simply not necessary.

Fortunately, there are a growing number of options which allow you to open accounts in multiple currencies.

Banks are one option, but they’ll still probably charge you the most in fees and currency markup.

With a specialist multi-currency bank account, you can get a much better rate of exchange and pay minimal fees.

Perhaps most importantly, you can also open overseas accounts, allowing you to make and receive transfers like a local.

In this article, I’ll give you our top 5 multi-currency account providers with their pros and cons.

I’ll talk about their safety, rates and features and what to look out for with a multi-currency account.

Some are geared towards business money transfers, and others accept both private and business clients.

Quick Look: My Top 5 Multi-Currency Accounts

For Business -

OFX is the best multi-currency solution for small businesses and solopreneurs. It supports a wide range of currencies, offers more local accounts than Revolut, and boasts an excellent business foreign exchange department. They offer a full array of hedging tools, rate alerts, and personalised account management by business FX experts.

If you are looking for a personal usage multi-currency account, or have different needs -

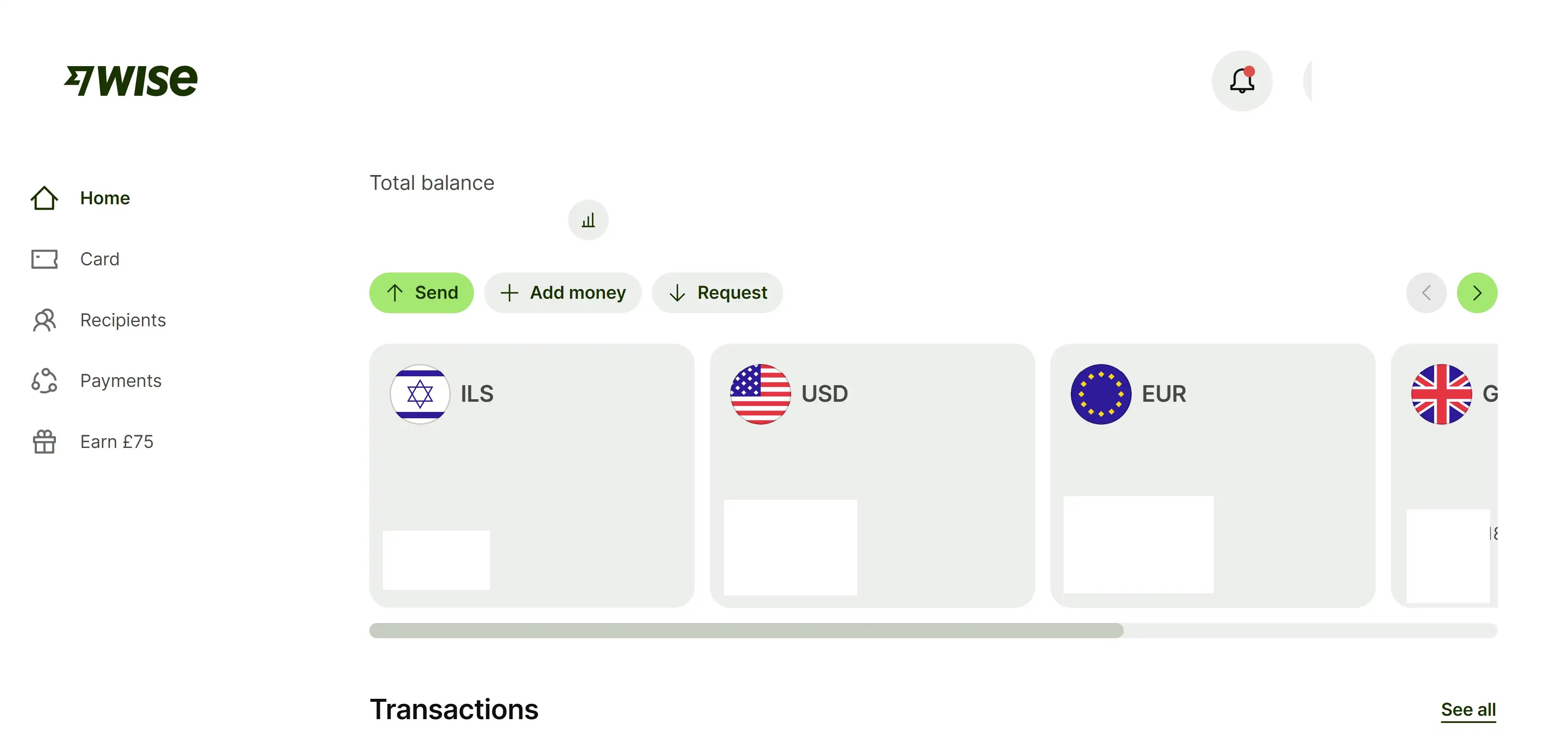

Wise is the best solution for private clients looking for a current foreign exchange account.

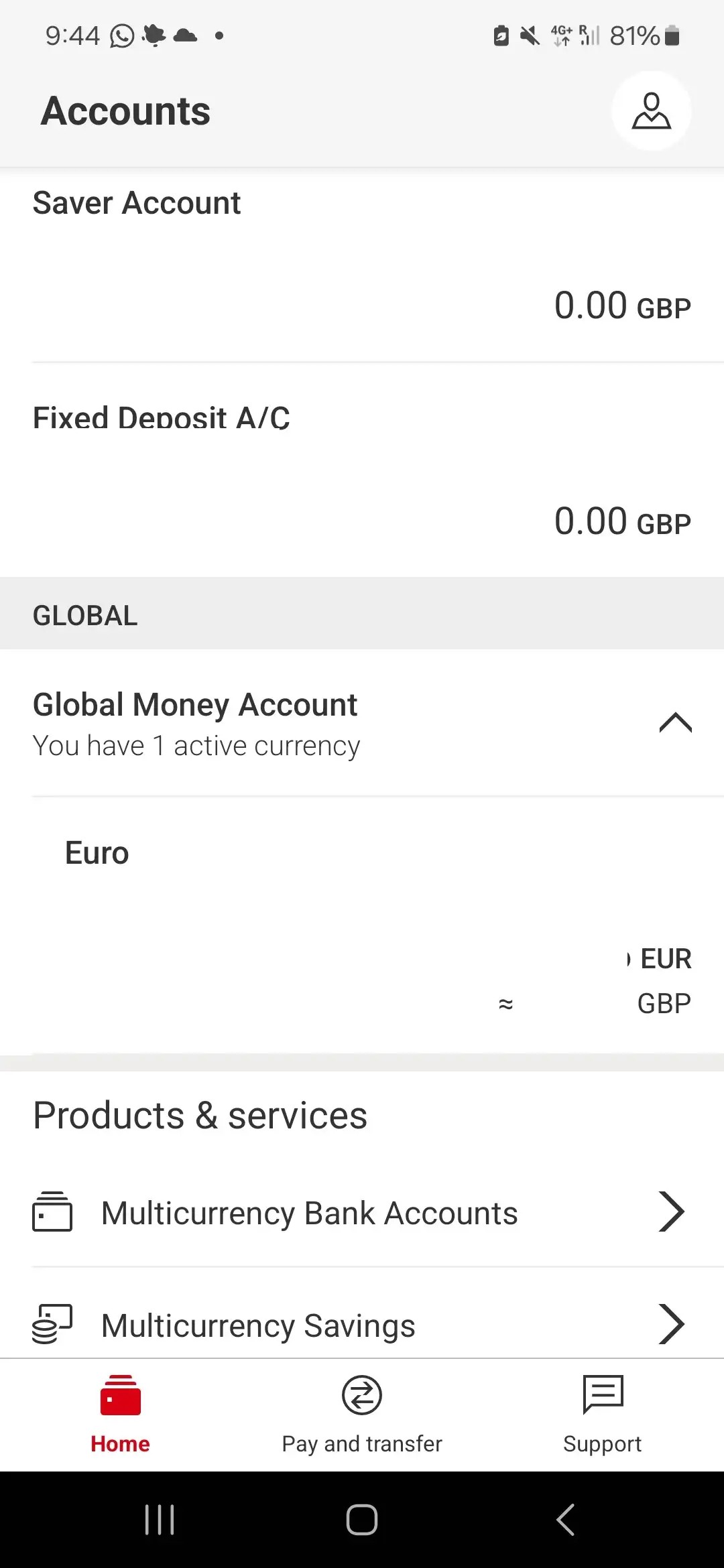

And HSBC Expat is the best "fully functional banking solution" for internationals.

... I personally use HSBC Expat for large payments and storing significant sums of money in foreign currencies, in conjunction with Wise for some of the payments.

I like do like the HSBC offer best, because I like to keep large sums in a bank rather than a Fintech, and because I can invest/save my money through them, as opposed to Wise.

I would also recommend looking into currency brokers if you are moving significant volumes of money, and would like help from an expert. That’s one of the major benefits in using OFX.

Overview of the Top 5

Multi-Currency Account Reviews

What do I mean by local accounts?

Local accounts are accounts held in the country of their respective currency.

That means you can make and receive transfers like a local, within the country.

An IBAN, or international bank account number, allows you to make and receive international transfers.

When I refer to "international IBAN" it means you can receive funds in this currency, but not locally.

For example, an Australian Dollar account with Wise allows you to make and receive local transfers within Australia.

That is due to the fact that Wise enables customers to open an AUD bank account located in Australia.

An opposite example is that the Argentine Peso account with Wise, is held in London (and not in Argentina).

So, to receive Argentinian Pesos, you would have to receive an international payment (from Argentina into your peso account with Wise in London).

What is a multi-currency account?

A multi-currency account offers the flexibility to hold, manage, and exchange money in various currencies within a single account.

Multi-currency accounts mainly come in three varieties:

- eWallets

- International bank multi-currency accounts

- Digital multi-currency accounts

Electronic wallet Multi-Currency Function

eWallets, like PayPal, allow you to easily manage a number of currencies.

It's easy to register, and transfers are instant.

The catch is, you can only send or receive money to your wallet with other users in the PayPal ecosystem.

To get money out, you then need to convert foreign currencies to your base currency and make a withdrawal.

I’ve received money through PayPal myself and lost 8-10% in fees.

International Foreign Currency Accounts

International banks, like HSBC and Chase, offer multi-currency accounts of their own.

Their solutions are the closest to fully-fledged bank accounts.

But, they typically have higher maintenance requirements and are more expensive to run.

Their exchange rates are usually quite bad, averaging a 2%+ markup, per transfer.

Plus, the accounts tend to be opened all in one country, so you don’t get the benefit of local transfers.

Quasi-Banks (Digital Providers)

Digital multi-currency accounts, like OFX, Revolut and Wise, offer competitive exchange rates and low fees.

They’re similar to fully fledged accounts but you can’t pay cheques into them.

You can however, set up things like direct debits.

In some cases, based on your nationality, you can even get a multi-currency debit card too.

For payments, the major plus of some digital accounts is the fact they’re local to the currency they represent.

If you’re travelling to, or doing business in, a foreign country, a local account is a game changer.

The downside is you download an app, sign up, and have to do everything yourself.

Why you should use a specialist multi-currency account (and not your bank)

Essentially, banks offer little in way of advantages over specialist providers.

A fully-fledged current account in the countries you plan to visit, live or trade?

Sure, that would have a lot of benefits.

But, opening a full bank account overseas is difficult.

It might be next to impossible without having a local address.

If you’re a business, you might even have to register a local entity.

Some of the easier solutions to access, like the HSBC Expat bank account, still require a £50,000 deposit and all of your accounts are located in Jersey.

In essence, a multi-currency account with a bank will see all of your currency accounts located in one country.

Online "Fintech" currency accounts are easier to set up

A digital currency account through a specialist provider requires no local address.

You do need to provide some documentation, depending on your transfer volume, but you do not need a local address in the country where you need a bank account in.

For example, providing Wise can onboard customers from your country (say the UK), then you can then open a local currency account in any of the ten countries they offer them.

Opening a local account in Europe, USA or Australia becomes hassle-free.

And, as stated above, many of these accounts will be local making it easy to receive money locally, and set up functions like a direct debit.

The costs are (much) lower

Generally, you don’t get the flexibility to open local currency accounts with banks.

That means you have to pay more expensive international payment and international receiving fees, and it becomes much less convenient for other parties to pay you (compared to a local account).

More important is the markup on the currency exchange, whether that be for making or receiving payments, or when you’re spending with a debit card and making cash withdrawals abroad.

Banks tend to charge 2-5% in currency exchange markup. Wise charges around 0.5%.

If you’re opening a foreign currency bank account to move substantial amounts, then it will make a huge difference.

Paying suppliers $10,000 each month will cost you approximately £3,000 in fees per year with a bank.

Safe, but not insured

One advantage that banks in the UK do offer is the Financial Services Compensation Scheme (FSCS).

If your bank were to go bust, your money is guaranteed up to £85k.

Other countries have similar schemes which provide a guarantee on your money, up to a certain value.

Specialist money transfer companies and digital account providers don’t lend your money so they don’t participate in the FSCS.

Instead, in the UK, digital account providers must hold an e-money licence with the Financial Conduct Authority (FCA).

When your money is held with an e-money institution, it’s protected under the safeguarding scheme.

I’ll explain more about the protections that safeguarding offers later.

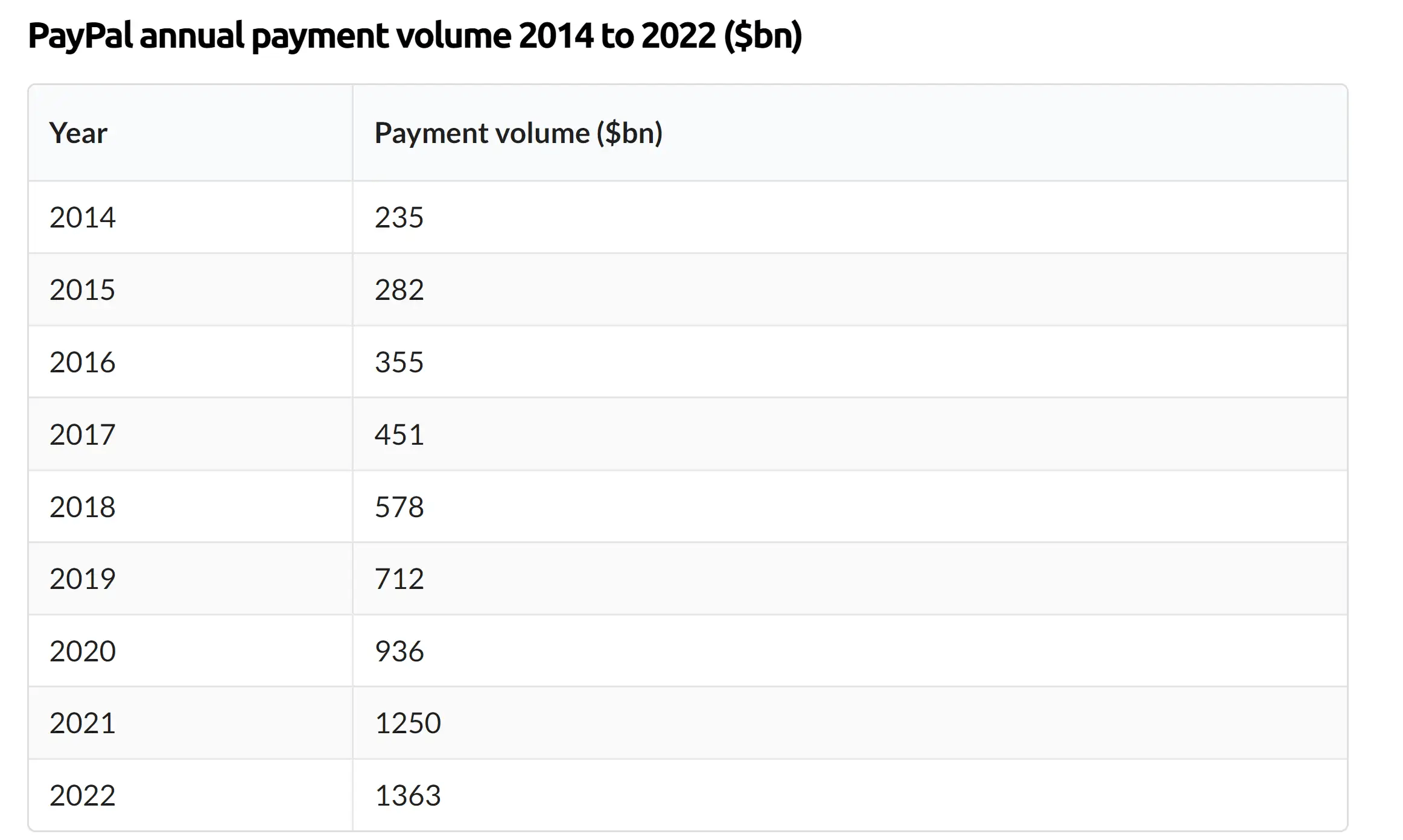

Who is the largest multi-currency account provider?

In terms of company size and value, PayPal is the largest provider.

However, they don’t actually provide you with an account you can use in the ‘real world’.

Being honest, I wouldn’t recommend them to you regardless.

Not for international transfers anyway. They’re a great option for domestic transfers (free in the UK) but simply too expensive for international transfers.

You’ll get some of the worst exchange rates on the market.

Out of the companies I’d recommend, Wise is the largest.

They’re valued at over £8.5bn and they hold some £12.3bn in customer deposits in their multi-currency accounts.

What to look for in a multi-currency bank account

The five most important considerations

When choosing a provider, consider these key metrics and decide which is most important to you.

Then, compare each one and rank them to your needs accordingly.

Security

As I said before, any provider you work with should be regulated by the FCA or their countries' equivalent.

But, you still need to check.

If you go with a company that isn’t regulated, there’s no recourse if any issues arise.

Just take a look at the bottom of their website for regulatory info and, if necessary, check the FCA register to be doubly sure.

When you hold money with an e-money institution it's protected under the safeguarding scheme.

That means your money is kept separate from company funds and readily accessible whenever you need it.

If the provider were to go bust, your money cannot be used to pay off the company's own debts or that of any other creditors.

Plus, there’s no limit on the amount you can get back under the safeguarding scheme.

There’s just one scenario where your money could be jeopardised.

If the liquidator's costs of redistributing client money exceeds the cash held by the provider, they’re entitled to recoup this cost from the pool of client money.

Cost

There are a few fees to consider when it comes to multi-currency bank accounts.

Firstly, there’s the accounts themselves. Are there any costs to open a new currency account and are you charged a monthly or annual fee to keep it open?

With Wise, there are no fees for opening a new account as a personal customer but businesses are charged a one-off £60 fee per account (up from £45 in the last year).

With HSBC, there are no fees for personal customers but businesses are charged an annual fee ranging from £96 to £180 per account, depending on the size of the business.

If you’re a business that wants a free solution to open and manage currency accounts, use OFX.

However, keep in mind, there are more important costs to consider.

That’s the costs for making and receiving payments, and for using your debit card to spend overseas or withdraw cash from an ATM.

Out of all multi-currency account providers, Wise offers the best rates on the market.

Revolut also offers good exchange rates, as do OFX.

HSBC exchange rates are quite a bit worse and from my experience, tend to be between 2% and 3% of your total transfer amount.

Availability

When I say availability, I mean transfer options and available destinations.

If a company cannot open the currency account you require, then obviously they aren’t suitable.

If you can’t open a local currency account then an international currency account held in the UK is better than nothing.

The relatively new fintech Airwallex offers the highest number of local currency accounts on the market, but the service is for businesses only.

Wise is not far behind with 9 local currency accounts, all of which are available to personal customers.

They also allow you to hold balances in a whopping 40+ different currencies.

Revolut allows personal customers to open just 2 local accounts - GBP and EUR. Although 37 currencies are available by IBAN for receiving SWIFT transfers (the most of any provider).

Although only GBP is local, Moneycorp allows you to open IBAN accounts in an incredible 120+ different currencies.

Interest-earning potential

With OFX and Moneycorp, there is no potential to earn interest.

At the time of writing, Revolut will pay interest up to 3.81% on GBP balances, 3.70% on USD balances and 2.71% on EUR balances.

Wise will pay interest up to 4.26% on GBP balances, 4.46% on USD balances and 2.99% on EUR balances.

So, depending on whether you’re holding sterling or dollars, either might be the better paying solution.

Crucially, both solutions are offered as instant-access digital accounts, so you can withdraw money whenever you like.

It’s a remarkably good return on this sort of product.

Then, you have HSBC expat which offers a vast array of interest-earning accounts and fixed-term deposits, ranging from instant access through to six-month notice.

Keep in mind interest rates are subject to change at any point.

Additional features

With Wise, Revolut, OFX, and HSBC Expat, you receive a matching debit card to spend from your account balances around the world.

Moneycorp is the only provider in the top five not to offer this functionality.

Aside from money transfers and currency accounts, Wise is a bit more limited in terms of additional features.

Revolut offers a wide range of additional features, including insurance, crypto trading, and investments.

OFX and Moneycorp provide several business-specific features, such as mass payments and accounting software integration.

Since acquiring Paytron, OFX also offers a sophisticated expense management platform.

As expected, HSBC Expat offers by far the most additional features, with virtually all financial services available, ranging from international mortgages to global investments.

How important is it to compare foreign currency accounts?

To put it briefly, it's extremely important.

No two providers are the same.

Each comes with its own set of fees, transfer speeds, services, and coverage.

The differences often hinge on the specific currency requirements, where you’re paying and who you’re receiving money from.

When you take the time to compare different providers, you're not just seeking the most cost-effective option; you're also finding the service that best aligns with your unique requirements.

Take a moment to sit down and create a shortlist of potential companies for a thorough comparison before you finalise your choice.

Top 5 Multi-Currency Accounts

Here is my top 5, complete with some helpful knowledge and pros & cons.

1. Wise

Wise (formerly known as TransferWise), is an online and mobile money transfer app and multi-currency account.

Dubbed ‘the Wise account’ they’re the only real provider to offer an extensive multi-currency account solution for individuals.

They’re known in the industry for being one of the very cheapest there is.

The Wise account is used by individuals, freelancers and businesses across the world to spend on the go and receive money from abroad.

They IPO’d on the London Stock Exchange in 2021, being the first of its kind to do so.

IS WISE SAFE?

Being a publicly traded company, Wise is very safe.

They’re also fully regulated in 14 countries.

Over 200k customers have left reviews for Wise on Trustpilot, and the company enjoys an impressive 4.2/5 rating.

WISE RATES & FEES

Wise is one of the cheapest options for transferring and receiving money from abroad.

This is shown in their prices, only charging 0.33% on some major currencies. Technically, they offer interbank rates with the 0.33% being the fee.

So if you transferred £1000, you’ll be charged roughly £3.30.

There’s no cost for receiving money into your multi-currency account either.

WISE AVAILABILITY

Wise offers a debit card to pair with their multi-currency account.

I’ve personally used this feature and I must say, it is brilliant for travelling.

You can top up any currency at any time, using only one card for all currencies. Wise will know which currency to debit based on where you are in the world.

However, be aware, they don’t offer trading options like forwards or limit orders.

IS WISE FOR ME?

If you’re sending and receiving money digitally, then yes.

If you’re travelling or going on holiday and want your currency on a debit card, then also yes.

If you have a requirement to cash cheques, visit a branch or set up a direct debit, then no.

Wise do not offer that possibility.

For these activities, use a bank instead.

2. OFX

OFX is an international money transfer company headquartered in Sydney, Australia, with roots tracing back to its establishment in 1998 under the name OzForex. The group opened a UK subsidiary in 2004.

Initially launched to simplify foreign exchange services for both individuals and businesses, OFX was a pioneer in offering streamlined online currency exchange services. However, its multi-currency account solution is exclusively for business.

In 2013 the company listed on the Australian Securities Exchange under the ticker symbol "OFX”. This makes the firm one of only a handful of money transfer specialists to be publicly traded.

Today, OFX maintains a significant global presence. Leveraging their global network, they’re the only provider to offer 24/7 customer support .

IS OFX SAFE?

OFX is a well-established and publicly traded company on the Australian Securities Exchange, it is very safe.

They partner with major financial institutions and adhere to strict regulatory standards across various countries.

Historically, OFX is able to demonstrate it’s been safely handling client transfers for longer than virtually all other money transfer specialists.

OFX RATES & FEES

It’s free to open an OFX account and gain access to any of its 5 local currency accounts and 30+ IBANs.

There are no opening or ongoing fees.

Plus, it’s completely free to receive payments into your OFX account.

OFX charges a margin on the exchange rate for FX transfers, which from my experience can range from 0.2% to 2%, depending on the amount transferred.

OFX AVAILABILITY

OFX is available to both individuals and businesses but its multi-currency account is only available to businesses.

Their global footprint is such that businesses from the UK, Europe, USA and many more countries can open an OFX multi -currency account.

Given their Australian background, OFX is a particularly good option for businesses launching down under.a

OFX holds a smaller number of local currency accounts compared to Wise, but they do offer a greater number of currency accounts overall.

Plus, businesses get access to a dedicated account manager, something Wise doesn't offer.

This, combined with their spend management analytics and mass payment solution, makes them, in my view, a slightly better business account solution.

IS OFX FOR ME?

If you’re a business that’s looking for one of the best multi-currency account solutions on the market, then yes.

If you’re an ecommerce seller and want to get paid directly into your account by online marketplaces, then also yes.

If you're an individual, no. It’s simply not possible to use OFX's multi currency accounts (but you can still use them to transfer money).

3. Revolut

Revolut has been one of the fastest growing companies of the 21st century.

Founded as recently as 2015, they surpassed a mammoth 45 million users worldwide in 2024, with nearly 10 million of these in the UK.

Known as the ‘financial super app’, Revolut has aimed to take on a much broader range of financial services than purely currency exchange.

Nowadays, you can take out insurance with a revolut partner, invest in a select number of stocks and even trade crypto.

Still, it started life as a multi-currency account and travel card service, offering near mid-market exchange rates, and this remains one of its most popular products.

IS REVOLUT SAFE?

Revolut is regulated by the FCA as an electronic money institution, and with millions of users worldwide, plus investors like Visa, Revolut is considered safe.

They also received a $45 billion valuation as recently as August 2024 and have even been approved for a full banking licence in the UK.

In time, that will mean your account balances on select Revolut accounts will be FSCS protected.

But, it’s not all rosy.

The company receives quite a lot of bad press as detailed in our Revolut review.

Saying this, I’ve used Revolut to make local transfers in the US, receive money in the UK, spend throughout Europe and Asia, and never had a problem.

REVOLUT RATES & FEES

Revolut offers 5 types of accounts.

First, there’s the entry-level, no-monthly fee standard account.

Then, there are 4 other paid accounts:

- £3.99 - Plus

- £7.99 - Premium

- £14.99 - Metal

- £45 - Ultra

Naturally, you get more perks the more you pay.

‘Standard’ users get a currency exchange limit of £1,000 per month. Then a 1% fee applies to any additional exchange.

‘Plus’ users get an exchange limit of £3,000 per month. Then a 0.5% fee applies to any additional exchange.

Premium, Metal and Ultra accounts are not capped.

The Revolut exchange rate is very competitive. This is roughly 0.15% - 0.75% off the mid-market rate depending on the currencies involved.

They’re one of the cheapest on the market and it’s worth comparing their rates with Wise to see who comes out on top.

REVOLUT AVAILABILITY

Just like Wise, Revolut offers a debit card to pair with their multi-currency account.

You can also make transfers to some very exotic currencies, practically anywhere in the world.

As for their multi-currency account, you can open 35 IBAN accounts (the most of any provider) but, for individuals, only GBP and EUR accounts are local.

Businesses can also access local USD details.

While EUR is not technically ‘local’- the account is held in the UK - it can be used to make and receive SEPA transfers so I define it as such.

Just watch out for fees at some European banks as they charge more for SEPA transfers with the UK than within the EU.

IS REVOLUT FOR ME?

If you’re travelling or going on holiday and want your currency on a debit card, then yes.

If you’re looking to make and receive international transfers at low fees, then also yes.

If you’re wanting to make and receive local transfers in a number of currencies around the world, then no.

If you have a requirement to cash cheques, visit a branch or set up a direct debit, then also no.

As a personal user, you get more local accounts with Wise.

As a business, you get more local accounts with OFX.

For things like cashing cheques, you need to find a bank.

4. HSBC Expat

As one of the world’s largest banks, HSBC needs little introduction.

They serve some 39 million customers across 62 countries including Europe, Asia, the Middle East and Africa, North America and Latin America.

Of all the legacy banks, they have, in our opinion, the best multi-currency account solution. It’s known as the ‘HSBC foreign currency account’.

IS HSBC EXPAT SAFE?

Valued at north of £120bn, HSBC is estimated to be the seventh largest bank in the world.

When it comes to currency account providers, they’re pretty much as safe as they come.

With HSBC Expat your money is protected under the Jersey Depositors Compensation Scheme up to the value of £50,000.

HSBC EXPAT RATES & FEES

For the currency accounts themselves, there are no fees for personal customers.

Be aware, you’re charged fees to both send and receive money.

For example, there’s a $7 fee to make a USD transfer, and there’s a $7 fee to receive a USD transfer. Check HSBC’s fee information documents for a description of charges per currency account.

HSBC exchange rates are not the best, with a markup between 1% and 3%, but thee are better rates for larger transfers.

HSBC EXPAT AVAILABILITY

HSBC has branches in 62 countries but they don’t offer the same products around the world.

The account we’re talking about here is offered out of Jersey.

The 15 currency accounts on offer (if you include GBP) is pretty good, but you have to bear in mind they’re all run out of Jersey.

You aren’t actually accessing local currency accounts.

The process of opening an account in another country with HSBC is much more complicated.

This is where you’d need a local address or local business to do so.

A huge barrier for most.

IS HSBC EXPAT FOR ME?

If you like the security of a mainstream bank and aren’t too worried about cost, then yes.

If you’re seeking a complete offshore banking solution, then absolutely yes.

If you want to have local currency accounts which allow for local settlement, then no.

Again, Wise tends to be the best for individuals and OFX the best for businesses.

5. Moneycorp

Moneycorp is a long-standing provider of foreign exchange and payment services, offering tailored solutions for businesses and individuals.

Established in 1979, it has grown into one of the most trusted names in international payments, with a unique multi-currency account solution that’s only available for businesses.

IS MONEYCORP SAFE?

Moneycorp is highly regulated, with oversight from the FCA in the UK and other global financial authorities.

With over four decades of experience, partnerships with leading banks, and a reputation for secure transactions, it is a very safe and reliable option for managing international finances.

MONEYCORP RATES & FEES

Moneycorp offers competitive exchange rates, better than traditional banks, and its multi-currency accounts come with no monthly maintenance fees.

However, transaction fees may apply for certain types of payments, so it's worth checking their pricing structure based on your needs.

MONEYCORP AVAILABILITY

The Moneycorp multi-currency account sees all of your accounts held in the UK.

This means it’s possible to make local GBP transfers and, in effect, ‘local’ EUR transfers, i.e. made over SEPA which the UK remains a member of.

Though this is somewhat restraining, the account deserves a special mention in our top 5 for supporting over a whopping 120 currencies.

This makes it a standout choice for businesses wanting to hold balances in more exotic currencies.

IS MONEYCORP FOR ME?

If you’re a business dealing with exotic currencies and don’t require local currency accounts, then yes

If you’re looking for a one-stop shop for a range of other currency solutions, then also yes.

However, if your business requires local currency accounts, then no.

Likewise, if you’re an individual seeking currency accounts, no you’ll need to look elsewhere.

More multi-currency bank accounts

Keep an eye on these other top-rated multi-currency solutions.

WorldFirst

WorldFirst, founded in 2004 and headquartered in the UK, has evolved from a traditional currency broker to a global fintech.

It specialises in currency exchange and multi-currency accounts for ecommerce businesses and SMEs.

In fact, it was pretty much the first non-bank provider in the market to launch a digital currency account solution.

Receiving payments from online marketplaces is easy but it’s similarly easy to get paid by international customers, particularly when it’s B2B.

Asia & Oceania is a big focus for the firm, and in 2019, WorldFirst was sold to Chinese conglomerate Ant Financial for $700m.

IS WORLDFIRST SAFE?

WorldFirst has been in the money transfer business for 20 years.

They used to be a reliable firm and one of the largest money transfer companies in the UK and globally.

However, once acquired by Ant Financial, they lost a substantial amount of their staff, the service worsened, and I personally lost trust.

WORLDFIRST RATES & FEES

Opening any of WorldFirst’s currency accounts is free, and there are no ongoing fees.

Major currencies like USD, GBP, AUD, HKD and SGD are traded at a maximum of 0.5%, and cross-currency transfers over £5,000 are fee-free.

A £4 fee applies to cross-currency transfers under this amount and international transfers made in the same currency.

A £0.30 fee applies to domestic payments.

WORLDFIRST AVAILABILITY

Firstly, WorldFirst is only available to registered businesses.

With 11 local accounts, they offer more local settlement options than any other provider.

Given their footprint and currency capabilities, they’re a particularly good option for businesses trading in China, Hong Kong and wider Asia.

Besides currency accounts, businesses can also book forward contracts and other currency hedging instruments.

IS WORLDFIRST FOR ME?

If you’re a business that wants a cheap and comprehensive local currency account solution on the market, and willing to prioritise that over what I deem as safety - then WorldFirst is for you.

If your business also wants to hedge their currency risk with tools like forward contracts, then also yes, but again there are safer choices.

If you’re a business in need of a matching corporate card, then no, you’d need to use OFX.

If you’re an individual, or an American business, then no, you can’t access WorldFirst. You only really have an option between Wise and Revolut.

Airwallex

Airwallex is a rapidly growing fintech company offering innovative financial solutions for businesses, particularly SMEs and eCommerce merchants.

Established in 2015, the company provides global business accounts, corporate cards, and a range of payment services designed to simplify international trade and financial management.

IS AIRWALLEX SAFE?

Airwallex is regulated in multiple jurisdictions, including the FCA in the UK and ASIC in Australia, ensuring compliance with strict financial standards.

With high-profile investors like Salesforce and Mastercard, it has built a strong reputation as a trustworthy platform for global businesses.

AIRWALLEX RATES & FEES

Airwallex exchange rates come with a small margin, often cheaper than traditional banks.

There are no fees for opening or maintaining individual accounts, but businesses are charged a monthly subscription fee that varies depending on their plan.

AIRWALLEX AVAILABILITY

Airwallex’s business accounts allow you to hold and transact in over 11 currencies, with the ability to open local accounts in key regions like the US, UK, Europe, and Australia.

It also offers multi-currency corporate cards, which integrate with your global account, enabling seamless expense management and spending across currencies.

IS AIRWALLEX FOR ME?

If you’re a business looking for a global account solution with integrated corporate cards and online payment acceptance, then yes Airwallex is a great option.

However, if your business has offline banking needs, like cash or cheque handling then no.

If you’re an individual, then also no.

Payoneer

Payoneer is a global fintech company headquartered in New York, with a history dating back to its founding in 2005 by Yuval Tal and other private investors.

It’s probably the only provider listed here that started with the aim of making it easier to receive money as opposed to just sending.

They’re a well-known name and have partnered with companies like eBay and Mastercard.

Payoneer's global presence has grown significantly, and today they provide solutions to businesses and individuals worldwide.

IS PAYONEER SAFE?

Payoneer is a publicly traded company with a market valuation of around $1.8bn, it is very safe.

They also partner with some of the world’s largest financial services companies like Mastercard.

Once upon a time, there were a few question marks raised about Payoneer’s onboarding policies but as the firm grew and went public these dissipated.

PAYONEER RATES & FEES

It’s free to open a Payoneer account and gain access to any of its 9 local currency accounts.

There’s no ongoing fees, provided you use the account, but an annual fee of $29.95 applies if it’s not utilised.

It’s free to receive payments from other Payoneer accounts and free to receive local wires (for example an Australian customer sending you AUD).

There’s a 3% fee if your customer pays you by credit card and a 1% fee applies if customers pay by ACH debit in the US.

Currency transfers are quite expensive and can be anywhere up to 3%.

PAYONEER AVAILABILITY

Payoneer is predominantly a business offering but sole traders can also register providing they want to get paid by clients.

However, if you’re receiving a bank transfer from someone new for the first time, you have to get them approved with Payoneer first.

You don’t have to go through this extra hassle with Wise or Revolut.

One positive, completely unique to Payoneer, is that you can receive credit card transactions into your account.

You can’t do this with any other digital currency account provider.

IS PAYONEER FOR ME?

If you’re a business or sole trader that’s primarily looking for a solution to get paid, as opposed to making payments, then yes.

If you’re an ecommerce seller and want to get paid directly into your account by credit card, then also yes.

If you want to make payments from your account, there are better solutions out there.

Maximising Your Multi-Currency Financial Strategy

1. Apply a Multi-Faceted Approach

To effectively manage finances across multiple currencies, it's essential to combine the right tools.

I personally use a multi-currency account like Wise for everyday transactions and holding various currencies.

It offers competitive exchange rates and the convenience of managing everything in one place.

However, when dealing with larger sums or more complex needs, I turn to a reputable currency broker.

Currency brokers can provide better rates for significant transfers and offer services like forward contracts to lock in favourable rates.

By using both a multi-currency account and a currency broker, you can optimise your currency exchanges and protect against market fluctuations.

It's all about finding the right balance to minimise costs and maximise the value of your money.

With the right approach, managing your international finances becomes straightforward and efficient.

2. Use Natural Currency Hedging When Possible

If you have income and expenses in the same foreign currency, you can benefit from a natural currency hedge.

For example, if you're receiving rental income in euros and have euro-denominated expenses, keeping the funds in euros avoids unnecessary currency exchanges.

This not only saves on fees but also shields you from exchange rate fluctuations.

It's a simple yet effective way to manage your finances without getting caught up in the complexities of the currency markets.

3. Avoid Excessive Currency Exchanges and Market Forecasting

Constantly converting currencies can be costly and counterproductive, even if you have the world's greatest and cheapest multi-currency account.

Each exchange STILL comes with fees and the risk of unfavourable rates.

Trying to time the market or predict future exchange rates often leads to more stress and potential losses.

What's more, speculation often goes against the usage policies of digital currency account providers.

Instead, focus on holding currencies that match your financial commitments.

Learn more with my guide to managing your finances in multiple currencies.

Summary

In this article, I’ve given you some helpful advice on the different types of multi-currency bank accounts and how to choose the best provider for your needs.

Then, I’ve listed my top 5 multi-currency account providers.

In short:

- Using your bank will most likely cost you quite a bit more

- Fintechs provide a digital currency account alternative to normal accounts

- Having a local account is generally advantageous

- Wise has the best multi-currency account for individuals

- OFX is best for businesses

- HSBC is best for saving and investments

-min.webp)