No doubt you’re already familiar with the banking giant, but just how well poised are they to assist you with a complete international financial solution?

What happens if you live outside the UK, or aren’t a British national at all? (teaser: HSBC Expat can still help you).

In this guide, I’ll delve into whether HSBC expat is the best option for your international financial needs, looking at things like multi-currency accounts, international investments, borrowing, and of course international transfers.

I’ll also demonstrate how HSBC Expat differs from HSBC’s ordinary services, and how it differs from digital money transfer providers, currency brokers, and other banks.

To round off, I’ll explain when HSBC Expat is a good fit and when an alternative would be better suited.

Minimum deposit requirements / special promotion

The first thing you need to know about HSBC Expat is that it’s made for people who have substantial financial resources, or high income.

If you thought this was an initiative to bank the unbanked - think again. There is usually a £50,000 minimum deposit (or €60,000 / $60,000).

However, if you register with HSBC Expat through this link, then you could qualify with a significantly lower deposit of £15,000, or a salary of at least £100,000 a year.

What is HSBC Expat?

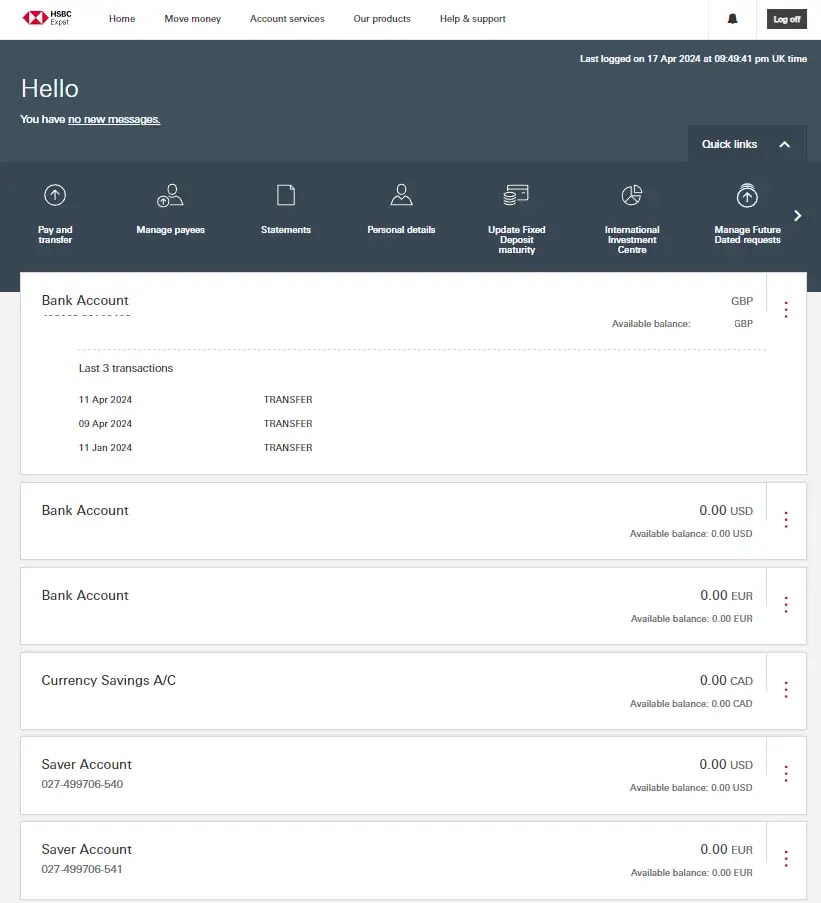

HSBC Expat, also known as HSBC Jersey, is a specialised division of HSBC that caters specifically to the unique banking needs of expatriates and international clients.

It primarily serves as an international bank account held in Jersey, Channel Islands.

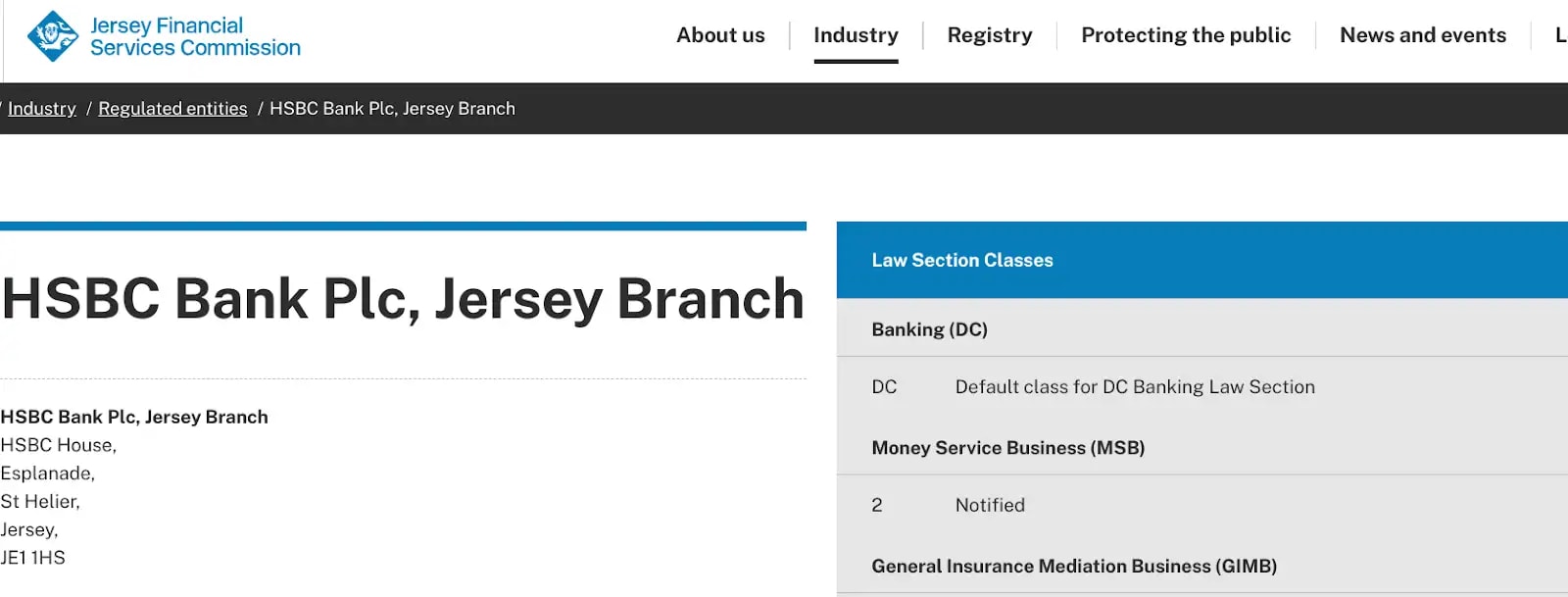

Jersey is a secure offshore jurisdiction that’s regarded as one of the world's leading and best-regulated international finance centres by the OECD.

Everyday current accounts are available in GBP, EUR & USD, with a further 16 currency accounts also available to make and receive transfers.

HSBC Expat offers a range of additional international financial services including savings accounts, international mortgages and investment products.

HSBC expat is not to be confused with HSBC UK, or HSBC’s local services in other countries.

I’ve already written a piece about HSBC UK’s international transfer capabilities here.

What are the benefits of an offshore bank account?

One of the primary benefits of using an offshore bank account is of course the tax benefits for expats.

For example, account holders in Jersey can receive interest on their savings without paying tax on it.

The exact benefits will, however, depend on your personal situation and country of residence.

Other benefits include offshore investing and access to overseas mortgages.

Convenience is a big factor too. You can keep the same bank account no matter where you move. Plus, multi-currency offshore accounts like that offered by HSBC expat make it easy to hold money, make and receive payments in multiple currencies.

Perhaps the biggest benefit here is that HSBC expat offers a unique opportunity to people of all nations to become an HSBC client, without any geolocation requirements.

That means that soon-to-be expats could open up a foreign currency account in advance of their move.

In fact, you don’t even have to be an expat to become eligible for account opening. So a lot of wealthy individuals use it as a secondary bank account.

Who’s eligible for an HSBC expat bank account?

The HSBC expat bank account is open to individuals from the following countries (pretty much all over the world).

View the interactive globe below to see if your country is eligible too.

However, the wealth component of the eligibility criteria is strict.

To qualify, you either need to save or invest at least £50,000 with HSBC Expat within 3 months of opening your account, or have a salary of at least £100,000.

If you’re not from the UK then you can demonstrate that you meet these minimum thresholds in the local currency equivalent.

Using our referral link below, you could qualify for an account with just £15,000 in saving or investing over the first 3 months of opening the account.

Is my money safe with HSBC Expat?

The FSCS does not apply in Jersey. Instead, the Depositors Compensation Scheme (DCS) is operated by an independent Jersey body.

This DCS provides individual depositors with protection for up to £50,000 in the event that a Jersey bank should fail.

Banks covered by the Depositors Compensation Scheme (DCS)

The following Jersey registered banks may hold eligible deposits:

- HSBC Bank Plc, Jersey Branch

- JPMorgan Chase Bank N.A., Jersey Branch

- UBS AG, Jersey Branch

- Barclays Bank plc, Jersey Branch

- BNP Paribas S.A., Jersey Branch

- Royal Bank of Canada (Channel Islands) Limited

- Santander Financial Services plc, Jersey Branch

- Standard Chartered Bank, Jersey Branch

- Lloyds Bank Corporate Markets plc, Jersey Branch

- The Royal Bank of Scotland International Limited

- Nedbank Private Wealth Limited, Jersey Branch

- Investec Bank (Channel Islands) Limited, Jersey Branch

- Butterfield Bank (Jersey) Limited

- SG Kleinwort Hambros Bank Limited, Jersey Branch

- EFG Private Bank Limited, Jersey Branch

- Standard Bank Jersey Limited

- Union Bancaire Privée, UBP SA, Jersey Branch

HSBC is one of the 17 banks covered by the Depositors Compensation Scheme

When you consider the minimum threshold requirements, £50,000 is unlikely to cover the entirety of your funds held with HSBC Expat, but it’s a similar type of guarantee you’d get from the American FDIC covering accounts up to $80,000.

With that being said, you have to consider the chances of HSBC failing in the first place.

HSBC was founded in 1865, is the 8th largest bank in the world, and has a market cap of £130 billion.

As things stand, HSBC has 42 million customers from 62 different countries.

I would venture to say a collapse of HSBC where all assets are being wiped out would probably signal a systematic collapse of the global banking system.

So, in my book, HSBC Expat is very safe.

HSBC Expat international transfers

With HSBC Expat you can send 58 currencies to virtually anywhere in the world.

Let’s take a look at some of the key facets of the service.

How long does it take to transfer money internationally with HSBC Expat?

The standard processing time for international payments through HSBC Expat is 1 to 3 days.

For selected currencies and destinations, faster payment times are available.

Based on the destination and local currency the fastest transfer time will be chosen, and it will be displayed before you make the transfer.

HSBC Expat transfer limits

The transfer limits on an HSBC Expat account are much more reasonable than on a standard HSBC account.

There’s a daily limit of £250,000 for international payments made through the HSBC Expat Mobile Banking app.

To transfer more, just give HSBC Expat a call.

This is a much better offering than standard UK banks, including HSBC UK, which only permits transfers up to £50,000 online and via their app.

HSBC transfer fees

One of the most pleasing aspects about HSBC Expat’s offering is the transfer fees.

Firstly, you’re never charged a fee for transfers between your own HSBC accounts, or when you pay any other HSBC customer, no matter where they are in the world.

For transfers to non-HSBC accounts, there’s also no fee when you make the payment via the app.

This is quite unusual for a bank and a definite plus point.

Another unique feature of HSBC Expat is that they do not charge customers for correspondent bank fees.

I’m not aware of any other money transfer service that covers the correspondent banking fees on behalf of their customers.

However, a fee applies when you make transfers to non-HSBC accounts online and a very steep fee applies when you do this over the phone.

Here’s a full breakdown on HSBC Expat transfer fees made online or over the phone:

As you can see, if you’re already a customer of HSBC Private Bank or HSBC Premier (which you will be if you deposit more than £50,000) then online transfers are fee-free.

Even for the basic Expat account, fees for online transfers made to non-HSBC accounts are quite reasonable, but it’s strange that you’re charged for those on the PC, and not when you use the app.

It’s telephone trading where the fees seem excessive, probably to discourage clients from using this option unless they really need it.

If it’s below the £250,000 online limit, you’re charged a hefty £50 fee.

If it’s above the online limit, the fee is either £9 or £14, depending on the exact account you have.

Ultimately, however, for transfers of this size, the payment fees will be dwarfed by the amount you can lose in the exchange rate.

HSBC exchange rates

All international transfers with HSBC Expat are conducted at the ‘HSBC exchange rate’.

That’s their cost rate, plus a foreign currency conversion margin.

From my testing, their markup for basic accounts, between major currencies, is about 1.5%.

Exchange rate margins for HSBC Expat customers are tiered, so better foreign exchange rates are available for higher transfers.

You can also get enhanced pricing if you’ve converted over USD $325,000 or currency equivalent in the previous year.

HSBC Expat Account / Global Money Account

In my view, this is the best bit about the whole offering.

There are two main account types available through HSBC Expat.

That’s the HSBC Expat Account and the HSBC Global Money Account. It’s worth understanding the differences between the two.

HSBC Expat Account

You can open an HSBC Expat Account in either GBP, EUR or USD.

As I’ve already explained, the ‘offshore’ account is held in Jersey and protected under the Jersey Depositors Compensation Scheme.

You should also be eligible for various tax benefits.

Once you've opened your Expat Bank Account, you then have access to all of the other tailored services including international mortgages, investments and savings accounts.

I’ll explain more about these later.

For now, the key is that HSBC Expat Accounts are fully-fledged bank accounts.

This means you can deposit cash and cheques, and apply for things like an overdraft.

A multi-currency account from the likes of Wise or OFX is managed through digital accounts, and can only be used to make and receive digital bank transfers.

That leads us on to HSBC’s complete solution.

HSBC Global Money Account

HSBC Expat also offers the ‘Global Money Account’ which allows you to hold and manage funds in 19 different currencies.

This is much more akin to a traditional multi-currency account.

The account is only accessible through the HSBC Expat Mobile Banking app, and cheques and cash cannot be directly deposited.

You can easily transfer money between your different currency accounts, and spend from these accounts with the matching Global Money debit card.

That’s one card you can use in over 200 countries and regions worldwide.

Before using your card abroad, you can either prefund the balance you require, or let HSBC automatically convert money from your primary GBP balance each time you make an ATM withdrawal or spend on your card.

You can also generate digital cards and add all of your card details to Apple Pay & Google Pay right away, too.

HSBC is the only mainstream bank that I know of to provide this type of account.

Otherwise you have to look at fintech alternatives like Revolut and Wise.

So if cutting-edge technology, supplied by a safe legacy bank is your thing, HSBC Expat could be the way to go.

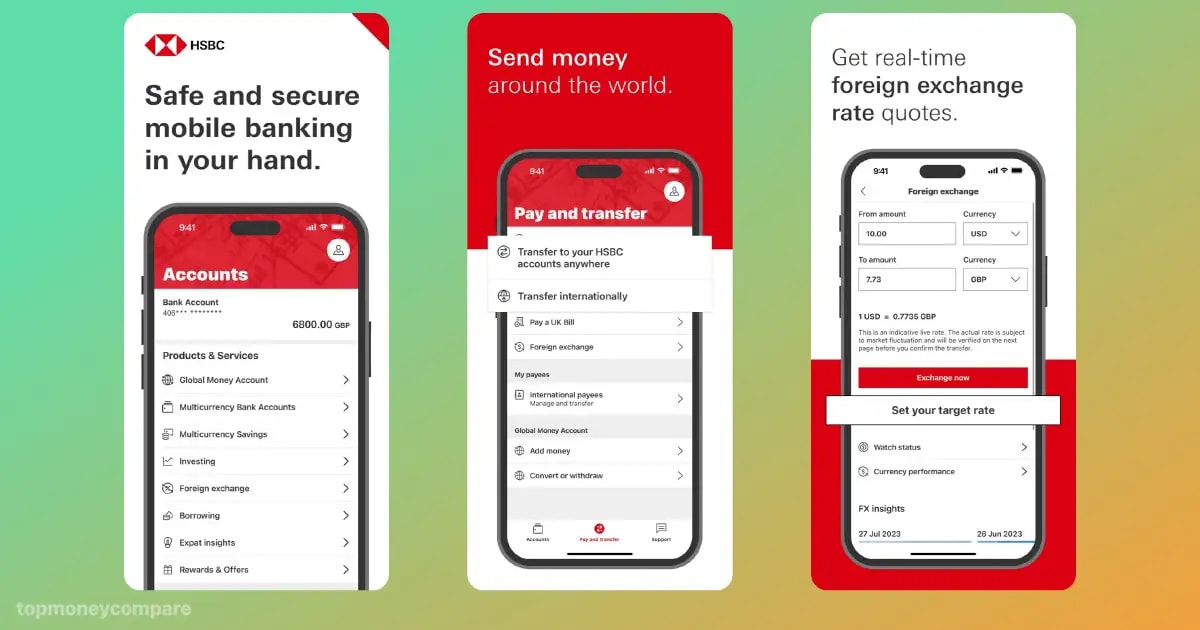

HSBC Expat app

The HSBC Expat app provides a quick and convenient way to manage your accounts on the move.

Key features include the ability to:

- View and manage your multi-currency accounts from anywhere

- Easily initiate and track international money transfers

- Get up-to-date exchange rate information to make informed transfer decisions

- Manage your Global Money debit card for added security

I’ve taken a look at a variety of HSBC Expat reviews on both Android and Apple, and it seems customers are very happy with the app functionality and UI.

What other services can you access through HSBC Expat?

Once your HSBC Expat account is up and running, you gain access to a range of oher international solutions.

A sample of these include:

International Mortgages

Whether you're planning to invest in property or secure a home for yourself and your family, HSBC Expat's international mortgage services can help facilitate the process.

HSBC will leverage their global network of local HSBC mortgage teams to connect you to the right person, in the right country.

Investment Products

HSBC Expat provides access to a range of investment products through their International Investment Centre.

This includes portfolio investment funds, single asset class funds, and discretionary investment management.

The costs vary on a per-plan basis.

As a guide, funds has an annual management fee of around 1%, while investing in equities normally has a flat rate (e.g. £14.95 for UK equities).

Savings Accounts

A variety of savings accounts are on offer, including standard saver accounts, through to quarterly bonus accounts, which reward you if no withdrawals are made in the prior three months.

You can also earn interest in 16 different currencies.

This is quite a bit more than the three currency savings accounts available through Wise and two through Revolut.

Interest rates are better than those of mainstream banks, and the more money you deposit, the better the rate is.

When is HSBC Expat a good fit?

HSBC Expat is an excellent fit for individuals who:

- Meet the eligibility criteria of saving or investing £15,000 or having a salary of £100,000

- Are seeking an offshore banking solution

- Need a multi-currency account that’s supported by full bank accounts in GBP, EUR & USD

- Want multiple financial solutions that include investing and borrowing all in one place

- Value the security and reputation of banking with one of the world's largest financial institutions

When might an alternative be better?

While HSBC Expat offers many benefits, it might not be the best fit for everyone.

Consider alternative options if:

- You do not meet the minimum eligibility criteria

- You need higher deposit protection limits than what the Jersey Depositors Compensation Scheme offers

- You prefer lower fees for international transactions or alternative investment opportunities

Summary

HSBC Expat is a robust but flexible banking solution for expats, offering multi-currency accounts, international mortgages, and investment products.

It’s the only real hybrid solution I’ve found that offers the benefits usually associated with fintechs but provided by a secure banking giant.

Assuming you meet the minimum criteria, HSBC Expat is well worth consideration.

-min.webp)