Broadly, the main four methods for transferring money internationally (in no particular order) are:

Which one you should choose depends on your situation.

Each option has its pros, cons and reasons to use, or avoid.

Keep reading to find out what the best ways to transfer money abroad are in your situation.

Which is the cheapest way?

I have written an entire guide about finding the cheapest international transfer fees , but due to an overwhelming demand, this is the first part I'll tackle by giving you the lowdown.

- Currency brokers are potentially the cheapest way for large transfers.

- Money transfer apps are a cheap method regardless of transfer size, but less bespoke.

Finding the best international money transfer service is key to obtaining the best rates.

Another possible method is to follow through our comparison, where we show estimated rates with various providers per transfer size and currency.

Here is how it looks: (click to enter the widget)

The problem with the above is that these guides and tools are focused on bank-to-bank transfers, and that is not always the case.

How to find the most suitable way?

This guide is more comprehensive in exploring the various ways that you could send money internationally, showing the best method per each scenario.

Firstly, I will review the process of learning your needs, cover the 4 main methods, and then I will being looking into specific scenarios.

If you don't feel like reading through this very extensive guide top-to-bottom and just jump ahead to the relevant scenario, then use this navigational summary below:

What do you need to consider when choosing a method of transfer?

As always, doing your own research will lead you down the right path.

The best way to send money overseas is totally dependent on your needs and aspirations.

On a basic level, I would ask myself these questions:

Some methods can handle certain types of transfers, and others can’t. Some provider’s are better for smaller volumes and some are better for large transfers. Some services are able to cater for your needs while others don't. Some companies are able to accept you as a customer, while other would reject you. Some support your desired currency, some won't.

Unless you are sending money to a bank account abroad, finding the best way may prove more difficult.

If you ARE sending money to a bank account, like most people, these are your options.

4 most popular ways to transfer money in 2024

Your Bank

Banks are the most commonly used method for transferring funds abroad.

On top of that, the service provided isn’t the best.

I’d say that the only reason to use your bank is if you’re in a big rush.

I’m talking hours, not days or weeks.

This is because there isn’t a sign up process with your bank.

If you already have an account, you can freely make transfers whenever.

However, when signing up with a new company, the process might take a few hours or even days.

You’re probably worried about safety, too.

Bear in mind that most other providers are regulated by the Financial Conduct Authority.

This provides a similar level of protection as using a bank.

I’ll talk about the safety of your funds near the end of the article.

When is a bank the best way to send money overseas?

✔ You want to send an international cheque or bank draft

✔ You don’t have time to register with a new provider

✔ Safety is important and you don’t mind paying a big premium for it

Remittance Companies

Remittance companies specialise in cash transfers.

The recipient doesn’t need a bank account.

Once you’ve paid for the transfer, they can just pick up the cash from the designated pickup point.

It’s usually pretty quick, too. Sometimes the cash can be collected instantly.

This is because the money doesn’t have to pass through the banking system first.

However, there’s usually a limit to how much you can send in one time and over a period of time.

For example, Xoom implements a limit of €500 per day, and a €15000 lifetime limit.

You have to contact them to up the limit, and it’s not guaranteed either.

I personally wouldn’t send more than £2000 using a remittance company.

They’re one of the more costly methods, so transferring high amounts would get expensive.

Their exchange rates are usually uncompetitive and there may be a fee, too.

However, you might not have a choice if the recipient requires physical cash.

Use cases include:

- Sending cash quickly to family and friends abroad

- Paying for small goods or services abroad using cash

Here are some remittance companies you can look at:

- Western Union

- Moneygram

- WorldRemit

- Remitly

When is a remittance company the best way to send money overseas?

✔ The recipient does not have a bank account

✔ The beneficiary needs to collect the cash instantly

✔ If you can’t pass KYC checks to make a bank-to-bank transfer

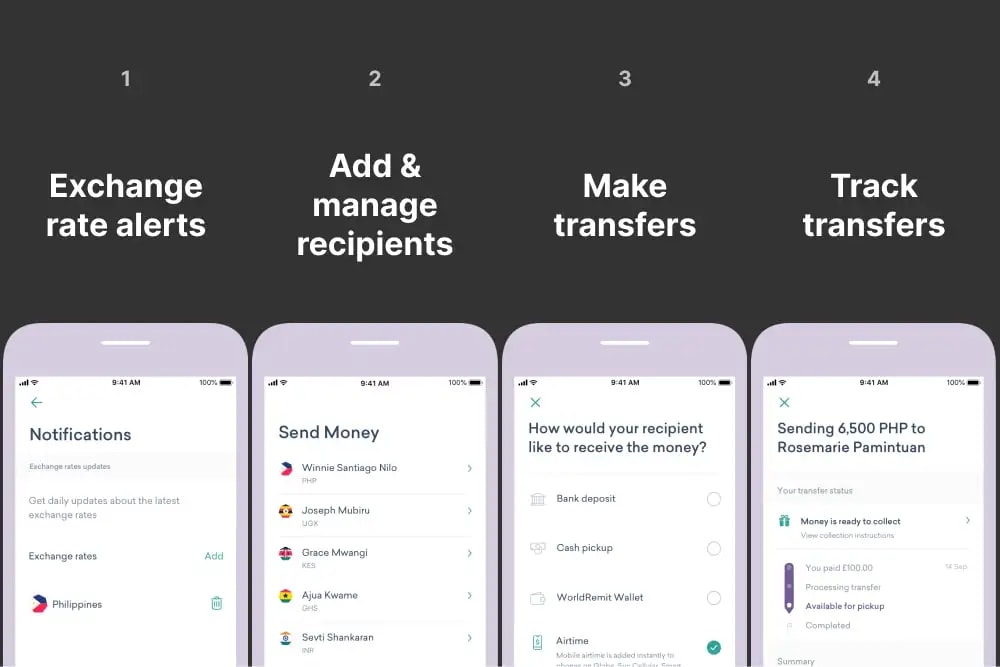

Money Transfer Apps

Money transfer apps are a new type of payment company.

They’re often described as “FinTech” companies.

The likes of Wise and Remitly are already publicly traded on the stock exchange.

You do all the work yourself on an online platform or mobile app.

The caveat is that you can’t speak to anyone.

Or if you can, you’ll probably be waiting a while.

You’ll usually be pushed onto the webchat or email function instead.

When sending large amounts abroad, it’s important to have someone there to speak to.

That’s why I wouldn’t send more than £5000 with a money transfer app.

Simply because if anything goes wrong, it’s a lot of money to be worried about.

You would need problems to be solved quickly, which you just won’t get with money transfer apps.

Don’t get me wrong though, they’re a great modern solution for small payments.

They usually offer some of the most competitive rates, too.

Some use cases include:

- Sending payments to family and friends abroad

- Loading up a debit card for travelling

- Sending business payments for goods or services

- Repatriating salary

When is a money transfer app the best way to send money overseas?

✔ If you’re sending under £5000

✔ If apps and mobile banking are your thing

✔ If you’re a digital nomad getting paid from overseas

Currency Brokers

Currency brokers provide a personalised service over the phone.

They’re best for larger transfers, for example if you’re buying a house abroad.

Sending large amounts of money without speaking to a human is scary.

That’s where currency brokers come in.

If there’s an issue with your transfer, there’ll always be someone there to help you out.

Some brokers offer the best exchange rates, with zero fees.

Your broker can give you information on the markets and help you time your exchange.

This way, you can get the most for your money.

This kind of service isn’t offered by other types of money transfer providers.

However, most brokers won't let you transfer less than £5000.

Or if they do, it’ll cost you more.

Some use cases include:

- Buying a house abroad

- Repatriating funds from a house sale abroad

- Converting funds from the sale of a business

- Purchasing goods or services abroad in large amounts

- Sending living funds

For more info, read my guide about the best currency brokers in the UK.

When is a currency broker the best way to send money overseas?

✔ If you’re sending over £5000

✔ If negotiating rates is your thing

✔ You need guidance through the process

✔ You want to hedge against currency risk

✔ Personal service and old school values are important to you

Is your money safe?

I would say the safety of you and your funds is a vital component in selecting the best method to send money abroad.

That’s why a lot of people choose to use their bank for money transfers.

However, banks are far from the only safe option.

If a money transfer provider is regulated by the FCA, they are regulated as either an electronic money institution (allowing you to hold money in digital currency accounts) or an authorised payment institution.

To keep their licence under either type of regulation, money transfer providers must be able to demonstrate they keep your money separate from company funds, and in ring-fenced safeguarded client accounts.

Now let’s see how this stacks up against banks.

If you hold money with a bank and they go bust, you are guaranteed to be able to recover up to £85k.

This is part of the FSCS scheme that banks offer.

The FSCS only offers up to £85k back if your bank went bust.

However, with an app or broker, there is no limit on the amount you can get back.

If a regulated money transfer provider goes insolvent, client funds are returned back to the underlying clients as first priority to all other creditors.

But be aware, the only exception to this is if the costs associated with liquidation exceed any funds held by the business.

If this is the case, the liquidator can recover their own costs from the pool of client money.

So, both options are safe but to a different degree.

Then, we are going to review a bunch more methods below, and to each its own degree of safety.

Sending cash, mailing a cheque, or dealing with cryptocurrency is less safe, in my opinion, than either using a bank or a money transfer company, but it is not necessarily "unsfae" - that really depends on your individual situation.

Breaking down the best way to send money abroad in 2024

There are a plethora of reasons and personal preferences behind making an international transfer.

In this section, I’ll do my best to cover all scenarios and marry them with the provider that best matches each. You could call these my insider tips.

If you want access to the best rate

Then your best choice is Currency brokers (large) or money transfer apps (small).

If you’re sending a large amount and seeking the absolute best FX rates, negotiating with a currency broker is the way to go. Coupled with personal service and a variety of payment solutions, I’m absolutely sure they’re the best way to send large amounts overseas.

For small amounts, money transfer apps will most likely give you the best rate. Pick a reputable one, and you should find the interface smooth and payments fast.

If you're old school

You better pick Currencies Direct, Key Currency, TorFX, Western Union or a bank.

Western Union was one of the founding pioneers of telegraphic transfers, way back in 1871.

Alongside banks, they are the true "old school" of money transfers.

If you want to make an international transfer face-to-face, you can either visit a bank branch or a Western Union agent. About as archaic as it gets.

However, Western Union and legacy banks are expensive and a bit too old school for my taste. With this in mind, I've listed three other brokerages who offer traditional phone support.

Out of all the brokerage services I’ve tested, Key Currency is the most ‘old school’ of them all. You’re guaranteed a personal touch as it’s only possible to book trades over the phone.

Currencies Direct is my personal favourite as you can book trades with an account manager and then follow up online.

TorFX are business specialists. You can book a face-to-face meeting in their offices in Panenze, Cornwall. Moneycorp is a similar, great, option as well.

If you think you're new school

You might pick PayPal, Xe or Wise.

Consumer behaviour in the money transfer industry is changing. Millennials and Gen Z’s are looking to do the entire process, top-to-bottom, online.

PayPal makes sending money easy. It's instant, you don't have to type in any complicated details, and it supports a variety of currencies. The big downside is the cost. It’s far more expensive than using Xe or Wise.

Xe is best for transfers to more remote destinations, while Wise has you covered across all major corridors.

If you're actually new school

Then you must check out Blockchain transfers, RippleNet and theStellar network.

PayPal is now over 25 years old.

Its digital payment offering is about as slick as it gets for payments within a singular ecosystem, but it doesn’t help to send money from one bank account to another.

New technologies are now leading to new payment networks that directly link bank accounts across the world. Rather than relying on intermediary banks and the SWIFT network.

If you really embrace the cutting-edge of financial technology, blockchain transfers on networks like Ripple and Stellar represent the forefront of decentralised banking.

Blockchain transfers offer security and transparency, reducing traditional banking fees and transfer times. You’ll have to see if your payment provider or bank works with either network and avoid the costly, time-consuming SWIFT network.

If you need multi-currency accounts(as an individual)

Then your best way is Wise.

I took a deep dive into the best multi-currency accounts and, in my view, Wise was well ahead of the rest of the pack.

You can hold local currency accounts in 10 countries and hold a further 30+ IBAN currency accounts. Wise provides a cost-effective solution for freelancers, expats, and international businesses.

If you need online and offline international banking

Then HSBC Expat is the way to go.

HSBC Expat is tailored for global citizens who require a robust banking solution both online and offline.

Offering a range of international services and accounts, HSBC Expat facilitates global access to your finances, provides international mortgages, and helps with the complexities of managing money across borders.

If you're in a hurry for your transfer

Then your options are PayPal, your bank, Wise-to-Wise account, Western Union (cash pickup), or Ripple (or another blockchain based method).

When time is of the essence, choosing the right service is crucial.

The absolute fastest way to make an international transfer is to another user within the same payment ecosystem.

What do I mean by this? Companies like PayPal and Wise can onboard customers from all over the world.

If the person you’re paying also has a PayPal or Wise account, you can make a transfer and it will reach the beneficiary almost instantly.

If the beneficiary isn’t registered on the same platform, you could opt for a cash pickup.

Western Union offers a very reliable service and the recipient should be able to collect cash as soon as you’ve initiated it (being cash, there’s no need for the money to move across a digital network).

As I’ve already touched on, Ripple is also a fast option for international transfers, harnessing the speed of blockchain technology.

If you can't pass KYC with a money transfer provider

Then you will opt for Bitcoin, cash delivery services, or your existing bank (if you have one).

If you face difficulties with Know Your Customer (KYC) checks, Bitcoin offers anonymity and global accessibility without some of the traditional banking hurdles (although even this is changing).

Cash delivery services also have a reduced set of financial institution checks, but you'll be limited on the amount you can send.

If you have a bank account, you can always use your bank to send money overseas. It will be costly, but at least you don’t have to worry about new KYC checks.

If you’re really old school and want to send a cheque internationally

Then your options are a bank or international money orders.

For the traditionalists out there, you could always send an international cheque.

Just be aware this method can take up to 12 weeks for the funds to credit the recipient's account.

Plus, it’s subject to additional fees, levied by your own bank and the overseas bank. On the currency exchange itself, you’re looking at 8% or more of the amount lost.

International money orders are another type of paper document that you can use to move small amounts across borders. However, the fees are similarly high and you’re usually limited to sending hundreds, rather than thousands of pounds.

If the beneficiary is unbanked

Then you are forced to choose Western Union cash pickup, mobile money (like M-Pesa), or the Hawala system.

For recipients without bank accounts, Western Union’s cash pickup service is present in virtually every country worldwide.

Mobile money services like M-Pesa provide a mobile-based money transfer and finance platform, especially popular in a number of African countries with low banking penetration.

The Hawala system, an informal method of transferring money, relies on a network of brokers for efficient and private transactions. It’s an excellent way for legitimate expats to send money home, but it’s also a form of underground banking.

If you're a digital nomad

Then some of your options to transfer and store money are N26, Revolut, Wise, and PayPal.

As a digital nomad you need flexible and mobile banking solutions.

N26 and Revolut provide a comprehensive banking package that includes insurance options and crypto trading, while Wise offers multi-currency accounts and currency transfers at the real exchange rate.

With all three providers it’s easy to get paid into your account, hold balances, and spend from these balances around the world with a linked debit card.

PayPal facilitates easy online payments across different currencies. It’s a very expensive method to get paid internationally (you could lose 8-10% of the transfer total), but a reliable one.

If you only trust the giants of the financial world

Your options are pretty much banks like JPMorgan Chase, Bank of America, and HSBC (there are other major international banks of course).

For those who prefer established financial institutions, JPMorgan Chase, Bank of America and HSBC are the three largest banks outside of China. From a retail perspective, HSBC is the most global of all. It’s why I decided to review HSBC international transfers to see just how they compare to specialist providers and other banks.

While better deals, and better services are certainly available, these banks offer robust security measures and widespread international networks.

If you're sending gifts across borders

You can choose Amazon gift cards and gift cards from international brands.

Sending gifts internationally is easy with gift cards from major international brands. Plus, there’s little in the way of admin and compliance checks.

Amazon gift cards can be used to purchase millions of eligible goods and services.

If you need to pay international freelancers

One of the most recommended ways is to use Payoneer.

Payoneer’s payment platform provides access to new markets, allows you to make and receive payments in multiple currencies, and comply with local regulations. All while simplifying the payment experience for you and your international team of freelancers.

If you enjoy a little privacy

You can use Anonymous prepaid cards, cryptocurrencies like Monero, and send cash via mail.

For those who value privacy in their transactions, anonymous prepaid cards, privacy-focused cryptocurrencies like Monero, and sending cash via mail offer ways to move money discreetly without leaving a digital footprint.

If you do opt to send cash, be aware that there’ll probably be a limit and you must comply with the relevant laws of the countries involved.

Summary

Nowadays, most brokers and apps make it really easy to send money abroad.

There are different methods of money transfers, of which you need to pick the one that suits you.

As mentioned, I would pick between your bank, a remittance company, an app or a currency broker.

Each one has its pros, cons and specific uses.

I’ve explained the benefits and drawbacks of each type of company, and exactly when they are the best fit.

I’ve also worked back from a number of different scenarios and immediately highlighted the provider that best aligns with each scenario.

Just keep in mind, the best way to send money overseas will depend on exactly why you’re sending money overseas and the type of services and functionalities that tickle you require.

-min.webp)