Think about it: even though expensive banks may levy as much as £30 per transfer, the actual cost frequently stems from the 'spread' – essentially, the price you pay for the exchange rate.

A 3% spread on a £200,000 transfer is £6,000 of direct, avoidable, cost.

In other words, if you’re looking for the cheapest way to send money abroad, your focus should be on securing the best exchange rates (and it just so happens that the ones providing the best rates usually don’t charge wire fees).

Best Rates vs Best Service

It doesn't always mean these are the best money transfer companies around, or the best way to send the money, but oftentimes, it means the same.

That's what I built this guide for - explaining how currency rates work, how to calculate them, and how to find the best ones.

If you are actually looking for a more well round answer click on some of the links I included.

Understanding fx rates

Many people simply don’t grasp the idea of an exchange rate spread.

I’ll try to simplify that.

Think of your local shop.

You know it is buying certain products for a certain price and then selling it to the customer at a higher price, right?

The same thing goes with currencies.

Banks pay a certain amount for a currency but they sell you the currency for a completely different rate (often 2% to 5% worse than what they’re paying).

Example exchange rate margin

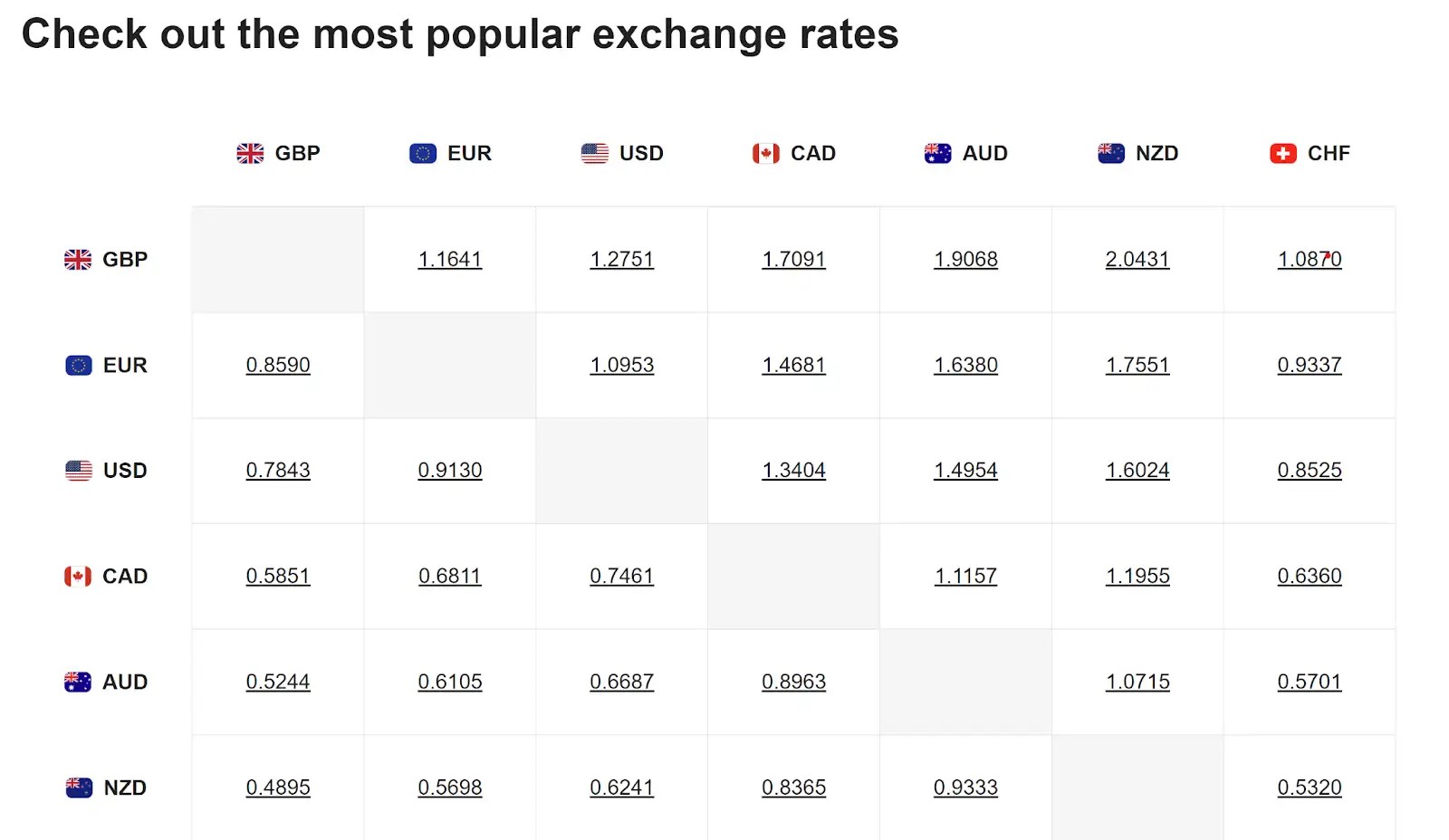

If we look at rates at the time of writing, January 14, 2024:

We see that, for example, the official price for the GBPEUR is 1.1641.

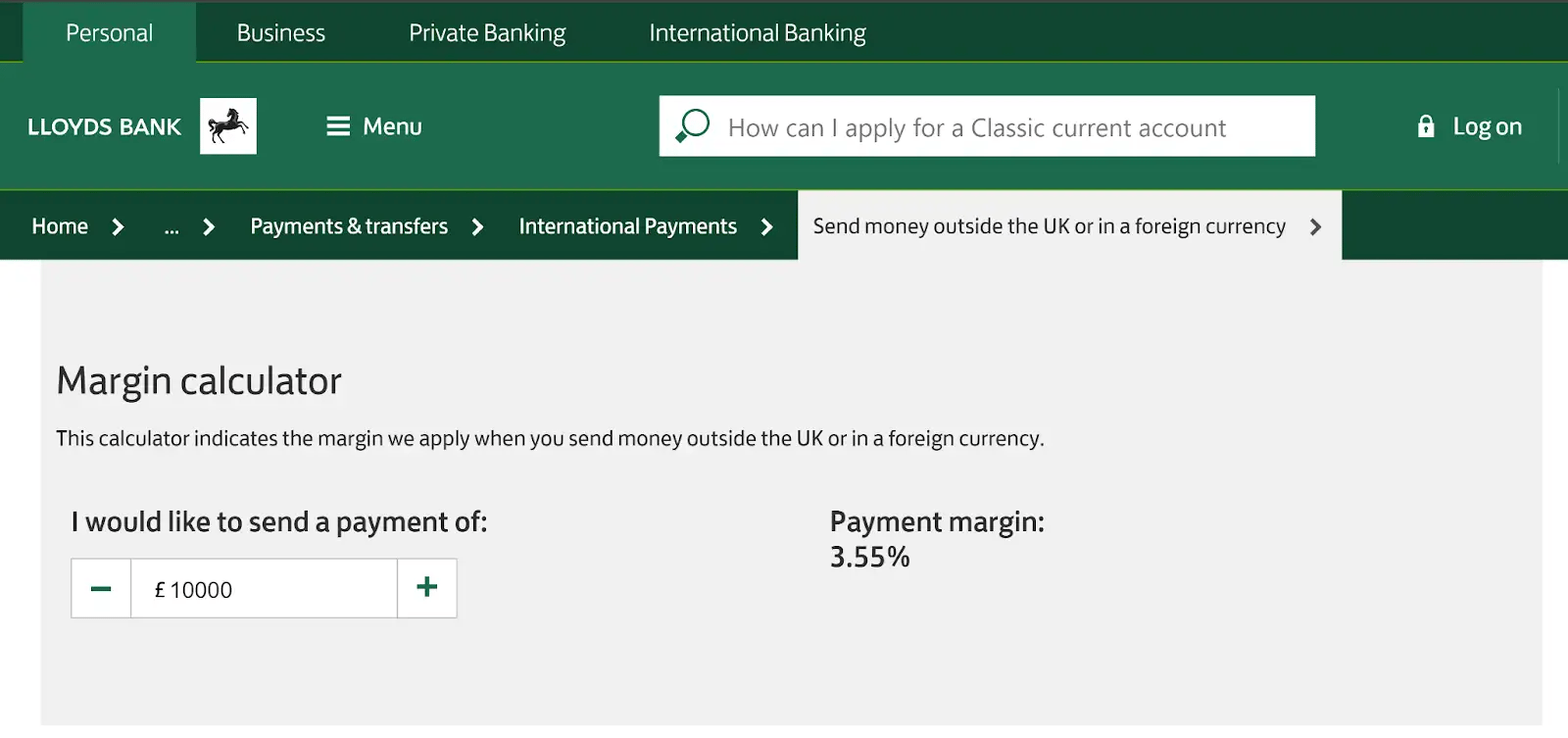

If I go over to Lloyd’s site (kudos to them for their transparency) we can see that if I try to transfer £10,000, the margin charge is 3.55%:

So, the rate provided by Lloyd’s is 3.55% lower than the official rate, or in other words 1.1239. It means that if you were to send £10,000 you’d be paying £355 in exchange rate fees alone (plus their £9.50 wire fee).

This was just one example.

It’s the same story if you look into the GBPUSD route.

Current rate $0.7843 per pound, on Jan 14.

Lloyds rate is 3.55% worse, and hence the rate provided would be $0.7572.

Again, you’d lose out on £355 for each £10,000 transferred.

To view today’s live exchange rate, use our currency converter:

“Fair” exchange rates

You could say - that’s understandable, like any business, banks are trying to make a buck.

I mean, you wouldn’t expect your local shop to be selling you products for the exact same price they’ve paid for them, right?

It’s correct, but still - some margins are acceptable and some are simply excessive.

In the example I’ve provided, Lloyds are charging a substantial amount for that transfer.

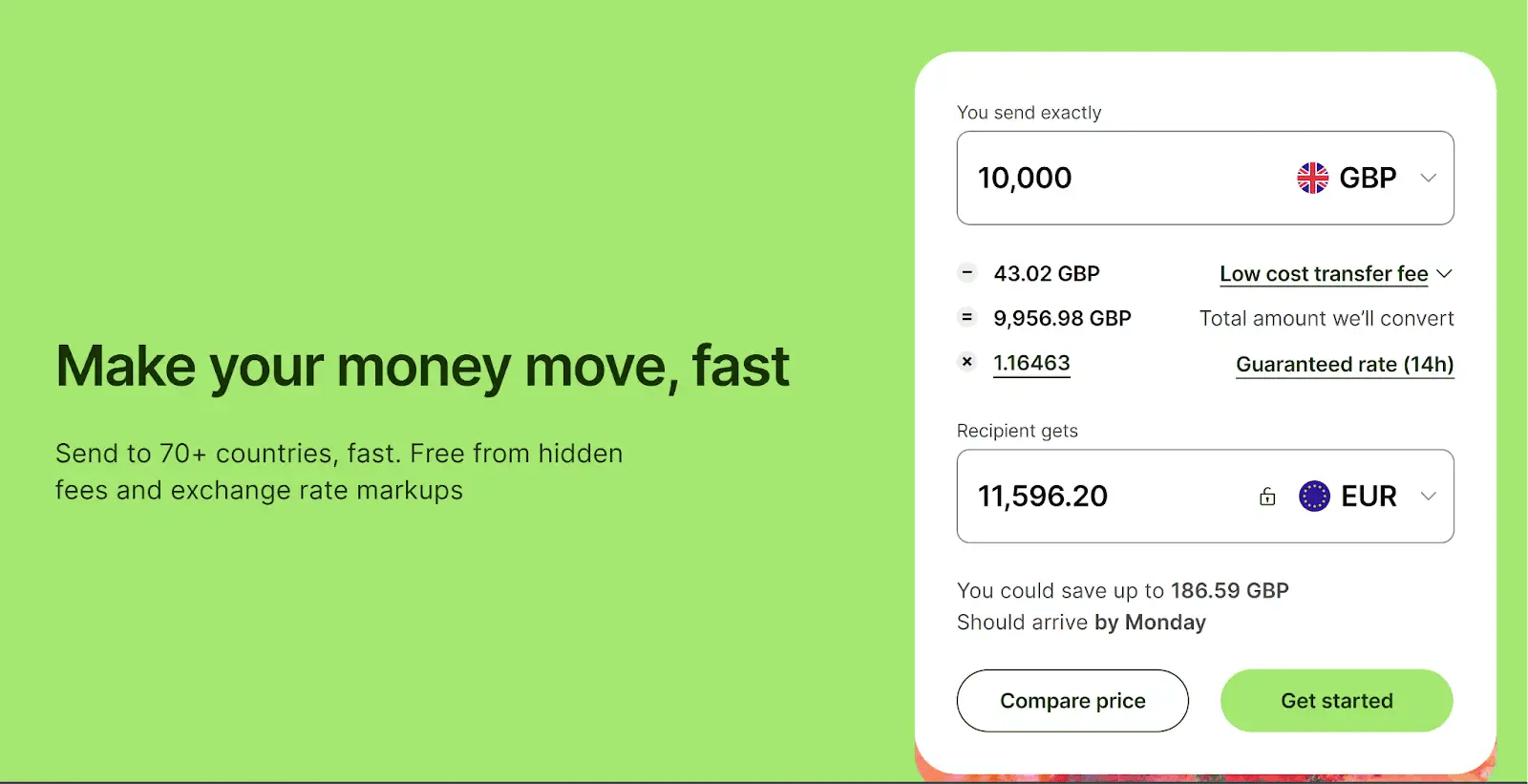

It could have been completed with Wise for about 90% less cost, and a margin of 0.43% instead of 3.55%.

Take a look:

In spite of a much lower margin than banks take…

Wise is still a profitable company which is doing well.

Just perhaps not as well as Lloyd’s, is all.

In summary, while all banks and money transfer providers charge a certain margin or fee, the best exchange rate should consist of a margin that’s no more than 1%.

Not 2% to 5% like banks do.

How to calculate the spread?

In some cases where the provider or bank is less transparent, you will need to calculate the spread yourself.

It’s easy to do, so don’t worry.

What you need to see is how much you are being quoted, and then compare it to the official rate (a simple google rate).

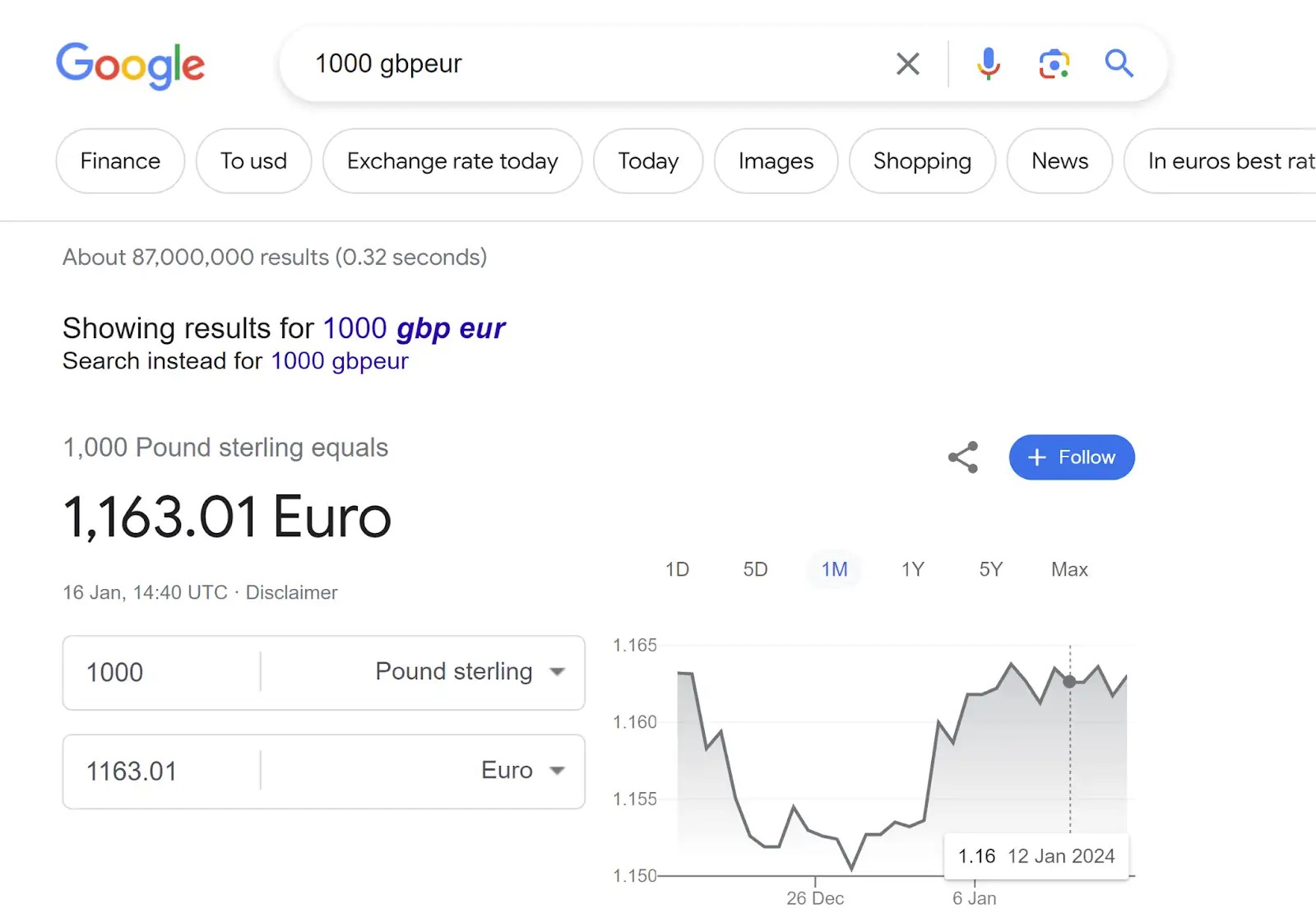

For example, if we look at the GBPEUR exchange rate on January 16, 2024, at 14-41 UK time we see this result:

Then we go to a random provider, and look at the rate they’re offering:

In this case, CurrencyFair offers 1.154 against the real rate 1.163.

So the spread is 0.013 Euros.

In percentages, it comes down to 0.77% (0.013 divided by the rate which is 1.163).

Currency liquidity

Some currencies are inherently more costly than others due to a concept called FX liquidity.

That concept essentially dictates that "rarer" currencies which are less use (called "exotic") will be less available than popular ("major") currencies like the USD, EUR, GBP or AUD.

That means that it can be more expensive for the service provider to buy them, which then rolls onto the client.

This is an important concept to consider when deciphering the ins and outs of your transfer's cost and the exchange rate you have been provided with.

Match your expectations with the liquidity of the currency that you are trading, not all currencies with the same provider will have the same margin.

The best foreign exchange rates for a bank transfer

You would normally find the best foreign exchange rates outside of banks.

Money transfer companies: digital apps and brokerages, specialise in offering wholesale rates. The best international money transfer options also don't charge fixed fees.

You just need to know which one to choose for your requirements.

Some service providers are cheaper for certain currencies, or certain amounts, than others.

The best money transfer services are a combination of digital providers alongside bespoke brokerages.

I’ll explain both of these below, but I'll start by showing the approximate markups by UK banks.

Bank exchange rates

Natwest Exchange Rates

Natwest provides clear but unfavourable exchange rates.

The margin for currencies like US Dollars, Australian Dollars, and Euros appears to be as high as 4.6%.

This means a £100,000 transfer would cost £4,600 in exchange rate charges.

This high margin is consistent across other currencies, underscoring the importance of shopping around for better rates.

HSBC Exchange Rates

HSBC requires back and froth through multiple pages on its website to find exact exchange rates.

The exchange rate margin for Pound Sterling to the US Dollar is 2.321%, meaning a £100,000 transfer would cost £2,321.00.

Margins vary with currency, with Australian Dollars at 2.916% and Euros at 3.132%.

Both very high especially for a bank that prides its to be international and appeal to expats.

Lloyds Exchange Rates

Lloyds Bank offers different tiers for money transfer services, with exchange rate costs depending on the transferred amount.

For a £10,000 transfer, the charge is 3.2% (£320), and for £100,000, it's 2.4% (£2,400).

Santander Exchange Rates

Santander's exchange rate for international transfers varies with the transfer size, but exact rates are hard to find without a quote.

The currency exchange calculator on their website does not reflect the rates for international transfers, which are subject to margins between 2%-4% as per online resources.

For transfers below £100,000, the margin is likely lower.

Barclays Exchange Rates

Barclays, one of the UK's oldest and part of the "Big 4" banks, has an average markup is around 2.75% (varies based on volume).

Barclays does not offer a direct exchange rate calculator online, and all displayed rates are indicative.

For a £10,000 international transfer, this means £275 in exchange rate costs, and for £100,000, the costs would be £2,750.

Nationwide Exchange Rates

Nationwide offers a list of indicative exchange rates, but calculating the margin, which is 2.3% across all transfers, can be challenging.

This means a £100,000 transaction would cost £2,300.

Digital provider's rates

Digital providers usually have a clear set margin applied per currency route, sometimes modified to the amount transferred.

Long and short of it, you can’t negotiate with a digital provider for a rate better than the one already offered to you.

Atlantic Money

Perhaps surprisingly, the company that offers the best exchange rates in the business is Atlantic Money.

You wouldn’t necessarily expect a brand new startup to be providing better rates than other, established, competitors, but they do.

Their only transfer charge is a fixed amount of £3 per transfer while applying the current interbank exchange rates.

In other words - no spread of any sort.

Does this mean I would necessarily use them? No, I wouldn’t. They score only 3.9/5 in my Atlantic Money review.

Wise

Wise have changed the game of international money transfers.

They were the first company to offer a transparent way to understand their spreads.

With fees ranging from 0.35% to 0.6% depending on currencies used and amounts, they offer the best exchange rate out of the bigger companies in this space.

WorldRemit

WorldRemit offers good exchange rates with a spread of 1% to 2% on average.

Not as cheap as Wise’s but there is a bigger selection of currencies and in many of their routes, there are no cheaper alternatives.

Xe

Originally famed for its currency calculator and historic currency charts, Xe entered the money transfer space in the early 2000’s.

Their rates have a spread of between 1% to 2% and should get better the more you send (they are a cross between digital and broker).

CurrencyFair

CurrencyFair was an online peer-to-peer currency exchange marketplace but now only offers transfers in the usual manner, as a ‘wholesaler’.

They’re not as popular as others but they have good rates.

Usually, the markup lands somewhere between 0.35% to 0.85% and payment fees are small.

Remitly

Remitly is another remittance-based company that operates in many corridors.

Their exchange rate spreads vary based on currencies and could be as low as 0.9% (on USDCAD) and as high as 5.5% (on SEKEUR).

In some cases, they could be the cheapest or one of the cheapest options, in others they would be among the most expensive ones.

It’s important to be vigilant with a company like that, and check what’s the spread they’re taking on each and every transfer (view my instruction above on how to calculate margins).

Xoom

Xoom is a PayPal-owned online money transfer and remittance service. This means you can send bank transfers, pay international bills and even arrange a cash delivery.

Take note as exchange rates can vary depending on how it is you’re sending money.

For online transfers, their exchange rates are better than PayPal but are still at the higher end of the market. You’re looking at a markup of between roughly 1.5% to 3%, plus a small fee of around £2.99.

Revolut

Revolut is one of the fastest growing companies of the 21st century.

Their multifunctional app covers a broad range of financial services but international money transfers, with much-better-than-bank exchange rates, was one of their original products.

The revolut exchange rate is roughly 0.15% - 0.75% off the mid-market rate, depending on the currencies involved.

Other fees can then apply depending on if you have a free or paid account, and for a few exotic currencies.

Instarem

Instarem is the online money transfer platform owned by Nium, a Singapore-headquartered cross-border payments company.

With rates between 0.7% and 1%, they’re generally pretty good, particularly for transfers to remote destinations.

OrbitRemit

OrbitRemit is an online remittance service headquartered in New Zealand, with offices also in Australia. Unfortunately, they are only available in these two territories.

They work on a flat fee structure but do not disclose their exchange rate spread.

When you calculate rates against the mid-market, there looks to be a markup of about 0.7% to 2%, depending on the currencies involved.

Brokers

Currency brokers don’t have the same set margins that digital providers have.

They rely on direct interaction with a client to understand their needs, volumes, and honestly - willingness to haggle over the rates.

That means brokers could be significantly more expensive than some digital providers if you use their “default rate” but also significantly cheaper if you speak to them and negotiate a better rate.

Hence, in order to achieve the best possible exchange rate for your transfer, it is recommended to register with multiple (trusted) brokers and have them compete over your business.

It’s very possible that you can get a broker to beat Wise’s rates on a large transfer.

In our listings here at TopMoneyCompare, because it was difficult to compare brokers and their fluid margins, I just used the lowest sampled margin per broker.

For example, Key Currency, our #1 broker is listed with a margin of 0.23% because this is the lowest spread I’ve observed that was used on a transfer.

For Third World Countries, Exchange Rates Makes All the Difference

It's important to get the best exchange rate to save money on international transfers, in order to save money.

For many people who are remitting money from abroad, the fees and exchange rates could be a matter of life and death.

So much that the U.N has set this as one of its goals.

For some destinations, customers could be paying as much as 10% in exchange rate markups against the real rate.

This is particularly true for countries in which the "official" exchange rate is very different from the "street" exchange rate.

In Nigeria, the exchange rate offered on the street could be twice as good as the official one.

It has such dire impact on the country as a whole that it was recently forbidden to trade FX in bureaus, just banks are now accepted.

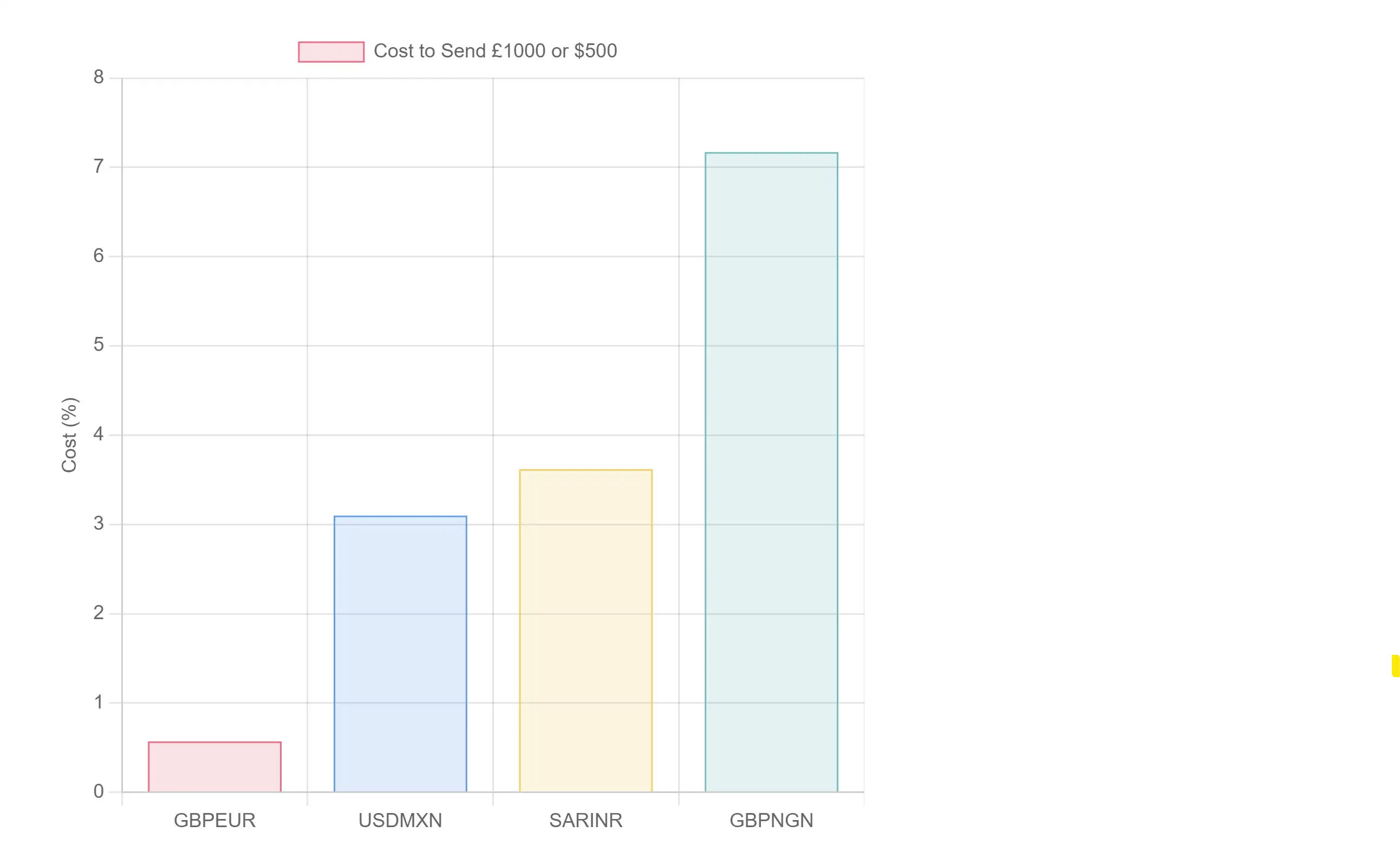

Here are the exchange rate transfer costs for transfers between various destinations:

As you can see, the poorer the country is, the more likely it is that money transfer service providers will abuse its citizens poverty and charge unreasonable rates.

-min.webp)