There are better alternatives for business transfers than banks, in the form of money transfer companies.

These specialised financial service providers offer cheaper business money transfers at much better exchange rates.

Some companies also offer tailored guidance, hedging functionalities, API integrations, and mass payment functions.

In this article, I will explain what business money transfers are, how they work, how long they take, and how to compare your business money transfers options.

What are business money transfers?

International business money transfers refer to all payments made by a business, to a business. In professional lingo, they are called cross-border B2B payments.

Some people will ask themselves “do I, as a sole proprietor, qualify as a business”.

The answer is a “YES”.

The solutions I recommend take on businesses of all sizes.

Whether you employ 1,000 people or have no employees at all, you qualify.

Moreover, most of these money transfer companies (predominantly, currency brokers) are able to onboard private clients.

So if you need to send money abroad for any personal matters, whether for overseas investment or remitting smaller amounts, you’re covered.

Quick Look: My Best Business Money Transfers

Here are the six companies I deemed best for handling business money transfers.

You can get a quick snapshot of the functionalities they offer in the comparison below:

As you can see, all featured recommendations except Wise offer bespoke guidance, which is generally a very important factor for business owners and finance departments.

Read on to learn more about business-specific money transfer solutions and why these companies were chosen as the best way to make international business payments.

How do business payments work?

For the most part, business money transfers are the same as individual transfers.

As a business, always insist on an invoice and receipt of payment.

Foreign invoices should include all the information you need to format an international business transfer.

Whether using a bank or money transfer company, you’ll need to input the relevant information for the receiving country,

Typically, this involves the full name of the business you are paying, their address, and their account details (often in an IBAN format).

SEPA transfers are used for 99% of all business money transfers in Europe.

Transfers to the rest of the world are usually made over SWIFT.

International business money transfers tend to take anywhere from 1-4 working days.

Speak to your provider to understand how long transfers take to specific countries.

Be sure to allow extra time when making international business money transfers. Particularly if you’re paying a beneficiary for the first time or sending money to a country you haven’t before.

How to make international business payments

The three types of institutions that transfer money for business are:

- Banks

- Money transfer apps

- Currency brokers

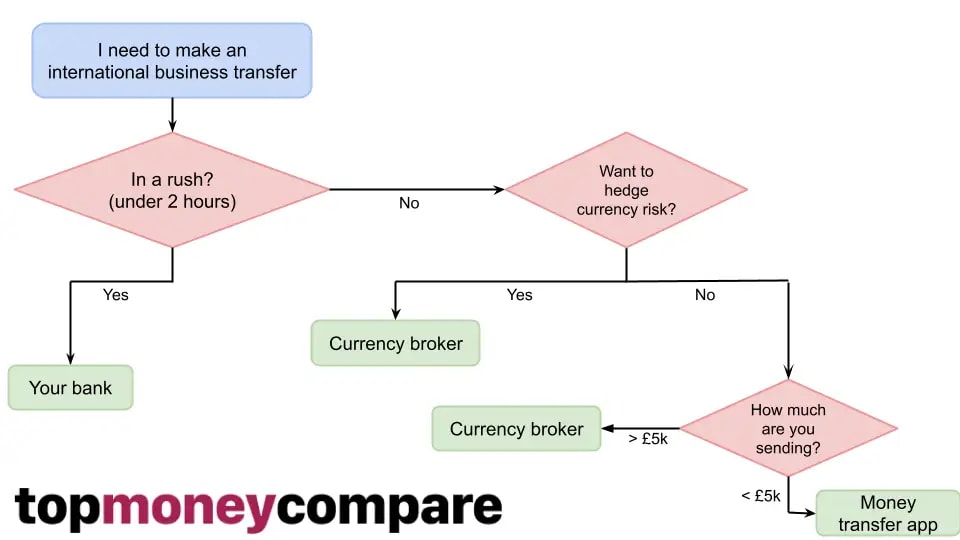

Which one you choose depends on the specific requirements of your business.

Every alternative offers its advantages, disadvantages, and justifications for selection.

As with any decision, gaining clarity on your specific requirements will steer you in the correct direction.

These are the most important considerations to make prior to choosing how to make an international business transfer:

Frequency: How frequently does my business transfer money abroad?

Volume: How much does my business send per payment and on an annual basis?

Corridors: What countries/currencies are involved?

Hedging: Do I want protection against currency movements?

Receiving Accounts: Do I need to receive business payments from abroad as well? Do I need to hold foreign currency for future payments?

It’s important to ask questions because some providers are equipped to manage specific kinds of transfers, while others are better for another.

By addressing these inquiries, you can begin narrowing down your choices.

The flowchart below should help you understand which service is most apt to your needs:

Let’s explore each type of provider, looking at their pros, cons and when they’re beneficial.

Comparing money transfer services for business

Banks for business payments

All UK high street banks except Nationwide offer international money transfers for business.

As it stands, banks are still the most popular method for conducting international business payments.

They seem like the obvious choice when you already have a business bank account with them.

But, be aware, it’s very rarely the best option.

Using a bank will almost always be far and away the most expensive method.

They provide SMEs with poor exchange rates, and inflated transfer fees.

In addition, the service provided is almost non-existent unless you’re a large corporate client.

Being honest, I’d really only recommend them on one occasion.

If you’re in a big rush (I’m talking hours) and not days or weeks, it might be worth processing the transfer with a bank.

Simply because your business has already registered and there’s no need to go through a sign-up process.

When you already have an account, you can instantly set up a transfer.

If registering with a new provider, the process might take a few hours or, in the case of business, a few days.

The compliance requirements are generally more extensive when you register as a business and it’s natural to have a bit more back and forth.

Banks are a good choice for safety, too.

But, I’ll explain why other providers are right up there when it comes to safety as well.

Don’t use a bank if you want to actively manage your business’ currency exposure.

Only big ticket customers gain access to the trading desks that allow for the use of currency hedging tools like forward contracts.

Use cases of banks include:

- Making one-off payments to overseas suppliers

- Accepting whatever rate is available when you want to initiate the transfer

Money transfer apps for business payments

Money transfer apps are a modern solution to conduct business money transfers.

You may have heard them referred to as “FinTechs”.

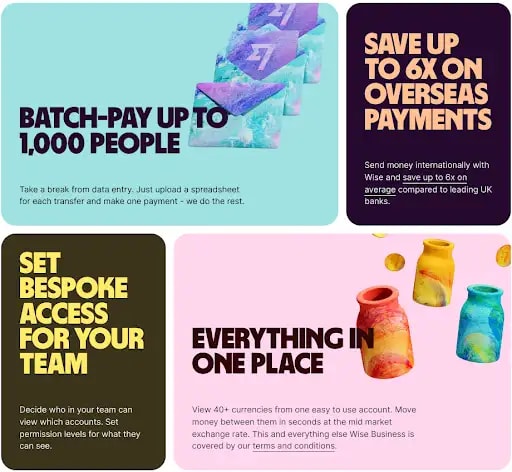

Wise is arguably the most recognisable FinTech. 16 million customers and 300,000 businesses now use Wise to transfer money internationally.

Apps like Wise put the power in your hands to conduct business transfers with transparent and minimal fees.

One nifty feature of Wise are ‘auto conversions’ where Wise will automatically make a trade when a desired rate is met. To use it though, you have to keep enough funds in your Wise account.

To boot, Wise permits you to open digital multi-currency accounts across the globe (more on this later), enabling you to convert, hold, and receive currencies at low cost, just like a local business.

The downside of using Wise is that you have to manage the whole process yourself.

There’s still no possibility of speaking to a currency expert.

As with banks, you also can’t access helpful currency tools like forward contracts.

Given the lack of solutions and limited service, I would only recommend money transfer apps for payments under £5000.

For larger transfers, there's more worry and you’ll want problems to be solved quickly, which you just won’t get with money transfer apps.

If anything were to go wrong with a transfer, it’s important to have someone you can speak to.

You don’t want to be adding unnecessary stress to managing a business.

In spite of this, apps represent a highly innovative solution for making small business international payments.

There are some really good use cases, like:

- Receiving payment as a freelancer/sole trader

- Spending from balances with a matching business debit card

- Setting up trades to automatically convert

- Paying small volumes to suppliers

Currency brokers for business payments

Currency brokers provide a bespoke service.

A good one will take the time to understand your business.

This includes:

- Calculating how much you’re currently paying in currency exchange fees

- Determining how exposed your business is to currency fluctuations

- Working with you to understand the level of risk you’re prepared to take

They’re best for larger transfers, or businesses that frequently need to send or receive money from overseas.

If there’s an issue with a transfer, you have direct access to a dedicated account manager to investigate.

With a currency broker, you’re assigned an account manager to build a proactive currency strategy, rather than being at the mercy of the exchange rate on any given day.

Strategies can be implemented with a range of payment and currency hedging tools like:

- Forward contracts

- Market orders

- Repeat transfers

- Mass payments

- FX options

Your broker can also provide information on the markets and help you time your exchange.

Meaning you can achieve a better rate and keep more money in your business.

This type of service isn’t available to SMEs with a bank and simply not available through a money transfer app, period.

Currency brokers offer bank-beating exchange rates that get better the higher the volume your business trades.

From my observation, currency brokers enjoy the highest customer ratings on trusted review platforms like TrustPilot too.

Currencies Direct has been trading for 25+ years and scores an impressive 4.9/5 on the platform.

Relative newcomer Key Currency also scores 4.9/5, higher than any money transfer app or bank.

However, I do find brokers are less useful on smaller transfers.

Their value-adding services simply add less value when the volumes are smaller.

Also, exchange rates on small payments are probably better with money transfer apps.

Use cases of a currency broker include:

- Developing a currency strategy tailored to your business

- Fixing future obligations at today’s exchange rate with a forward contract

- Initiating high value transfers with no maximum limit

- Making multiple payments (like salary transfers) in one go

- Trading over the telephone with guidance from an expert

How to transfer money for business

In short, the process is actually quite straightforward:

- Register

- Go through the verification process

- Set up the trade / lock in the exchange rate

- Settle your transfer

- Await for funds to be converted and sent

The verification process involves sending a few personal and business documents to your provider.

This allows the provider to verify the directors of the business are legitimate and there are no links to financial crime.

Once approved, make payments online or, if you’re working with a currency broker, you can do this over the phone.

As a business, you may also want to grant different user permissions and multi-user approval when making payments through an online platform.

You should be able to do this with any good bank, money transfer app or currency broker.

This ensures you can implement treasury policies which keep your business’ money safe.

Once you’ve agreed to the trade, you can settle the deal via bank transfer or debit card, depending on what’s offered.

Keep track of your business’ international transfers via the online platform.

Which features are more important for business money transfers?

As I’ve already explained, access to various currency hedging and payment tools is crucial for proactively managing currency risk, and streamlining operations within your business.

Let’s cover some of these tools now and how they can be used.

Forward Contracts

A forward contract is a financial agreement between two parties to buy or sell a set amount of a currency at a specified exchange rate on a future date.

Essentially, it's a way to lock in the current exchange rate before the actual currency conversion is to take place.

If you know your business needs to exchange money in the future but are worried the rates might move against you, a forward contract provides certainty about what you'll end up paying.

This makes it easier for your business to budget and keep a consistent profit margin.

You can place forward contracts with a currency broker. It’s not possible via a money transfer app and it’s only possible with a bank if you’re a large business.

Limit Orders / Stop-Loss Orders

A limit order is an instruction to automatically buy or sell a currency at a specified price.

A limit order will only be executed if the market reaches the price you've set. This allows you to set a target exchange rate for your currency transaction and benefit if the rate improves.

A stop-loss order works in the exact same way, it’s just the term used when you set an order to trade if it falls to a specified price. This can protect you from big downward swings in the exchange rate.

Limit orders and stop-loss orders are again very useful for ensuring your business stays within budget and even save costs where possible.

You can make these trades with a currency broker. Money transfer apps tend to have a similar solution.

You aren't necessarily have to even book a trade, currency brokers are happy to supply "rate alerts" which will notify you if a certain rate has been reached. This will enables you to maximise your trades without committing to one, like with a limit order.

FX Options

FX options are a type of financial derivative that give the buyer the right, but not the obligation, to exchange money at a pre-agreed exchange rate on a specific date in the future.

Be warned, the buyer has to pay a premium to the seller for this right.

Businesses can trade options with a currency broker. Banks reserve these for large corporations only.

Mass Payments

Mass payments provide the ability to send multiple business money transfers to different recipients in one batch.

This is particularly useful for businesses that need to make regular payments to international suppliers, employees, or partners in various currencies and countries.

Instead of processing each payment individually, which can be time-consuming and prone to error, a company can use mass payments to streamline the process.

Mass payments are a popular solution for conducting international payroll.

Simply upload one file and process tens, hundreds, or even thousands of payments at once.

Multi-Currency Accounts

Expanding into a new territory and need to open an account in a specific currency? Look no further than OFX or Wise.

A multi-currency account allows you to hold, manage, and exchange money in various currencies, all via one login.

One crucial difference between the accounts offered by Wise and OFX, compared to other money transfer providers and banks, is that their currency accounts are held locally to their respective countries.

Let’s say you have suppliers and/or customers in the US. Opening an account with a US bank would require you to first register a local US entity, with a local US address.

Expensive and time consuming.

OFX and Wise allow you to open a local US account without any of this. Provided you’re from one of their permitted jurisdictions, you can access any of their local currency accounts.

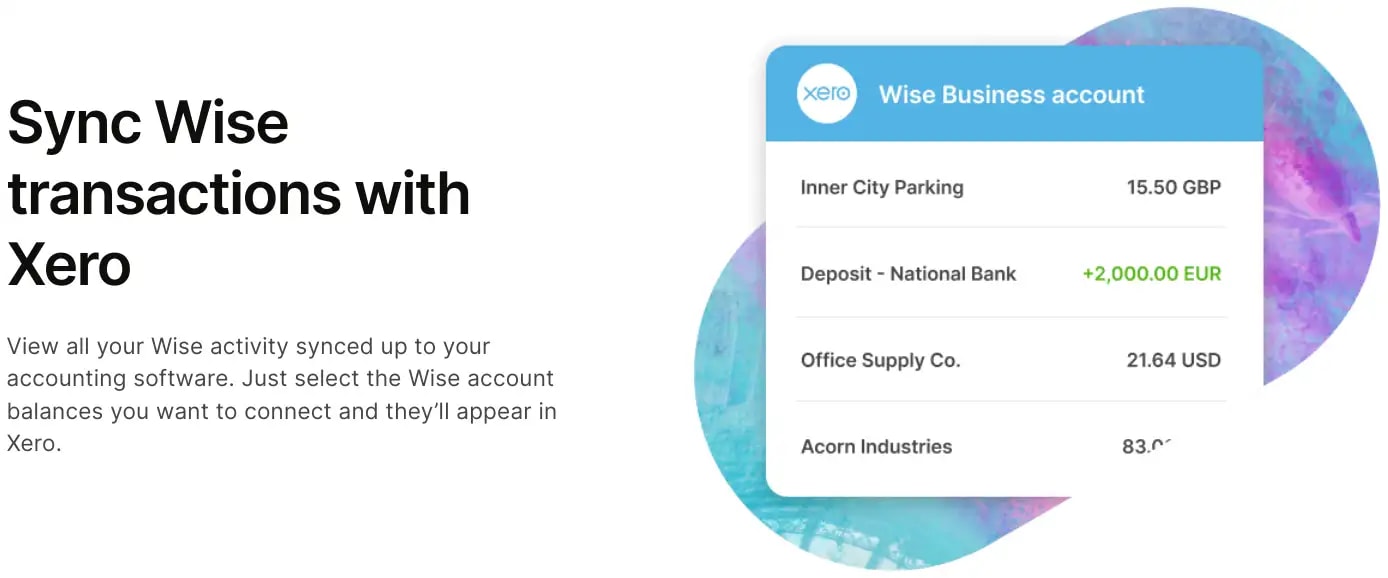

API Integration

The majority of established money transfer providers allow you to synchronise their trading software with market-leading accounting software like Xero.

Or, you can even custom integrate your own business software with access to all relevant API keys.

You can sync most leading money transfer software with major accounting platforms

For example, integrate Xero with Wise and you can:

- Import bills

- Automatically mark bills as paid in Xero

- Synchronise bank feeds

- Allow attachments to be pushed to Xero

Is Your Money Safe?

The safety of your business funds is of paramount importance.

It’s one of the few benefits to keeping your cash, and processing business money transfers, with a mainstream bank.

However, there’s actually an argument that established currency brokers and money transfer apps are just as safe as, if not safer than, banks.

You might be wondering just how this is the case?

When your business holds money with a bank, your funds are covered up to £85k across all accounts held with that institution.

This is part of the Financial Services Compensation Scheme (FSCS) that banks offer.

If an FCA regulated app or broker goes bust, there is no limit on the amount which can be recovered.

This is because the FCA requires these companies to “safeguard” client money. This basically means keeping your money in a separate account to their own money.

Clients are the first priority creditor, meaning no other creditor can be paid with client funds.

There is just one event that may put client funds at risk.

If the liquidators own costs exceed the cash held at the payment company, they are entitled to recover their costs from client funds.

Depending on how you view this will determine which you believe to be safer.

To make things easier, all payment companies listed on TopMoneyCompare are fully regulated by the FCA.

You can learn about the extensive safety profiles of the most reputable and long-standing brokers through our money transfer reviews.

Summary

Business money transfers might initially seem like a complex and lengthy endeavour.

Yet, in this day and age, the majority of brokers and apps actually make it rather easy.

There are more things to consider when conducting an international money transfer for business as it’s crucial that activities remain in-budget and profitable.

Your decision comes down to using your bank, an app, or a currency broker.

All these avenues have their unique benefits, drawbacks, and intended uses, but it’s currency brokers that offer the most comprehensive suite of tools for international business transfers.

-min.webp)