In this article, I'll delve into the concept of currency liquidity, explain the mechanisms behind it, highlight which currencies are considered liquid and which aren't, and explore how it impacts the costs of your international transactions.

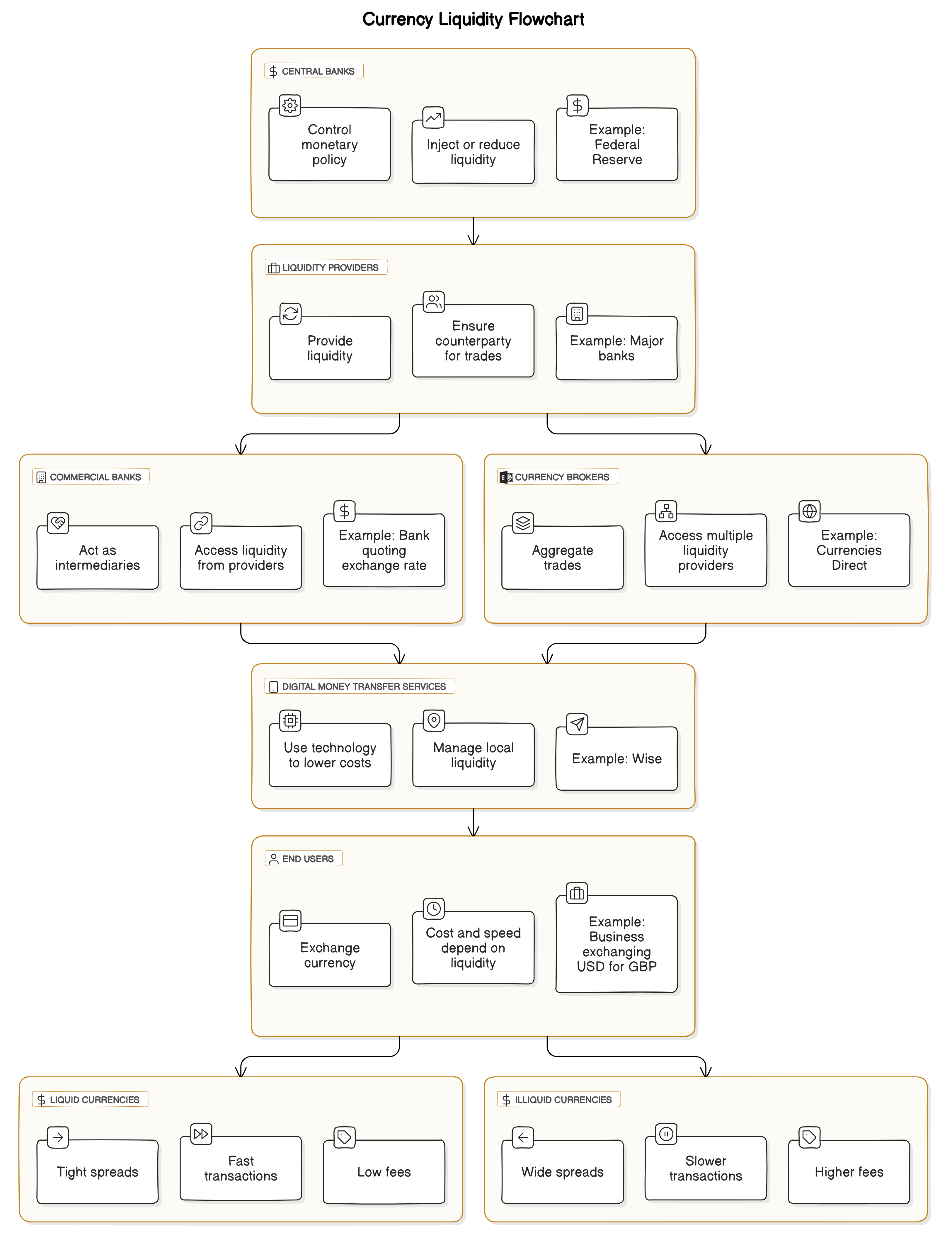

I'll also shed light on the ‘currency food chain’ connecting central banks, liquidity providers, banks, currency brokers and digital money transfer companies like Wise.

Understanding currency liquidity

Liquidity refers to how easily financial assets can be sold at a price that closely matches their current market value.

With that in mind, currency liquidity refers to the ease with which a currency can be bought or sold in the FX market at a price close to the going exchange rate.

In simpler terms, it's about how quickly and effortlessly you can convert one currency into another.

A highly liquid currency has a large volume of buyers and sellers, meaning transactions can be completed swiftly with minimal impact on the currency's price.

On the other hand, a currency with low liquidity may be difficult to trade, leading to delays and greater price volatility.

The mechanics behind currency liquidity

To get a complete grasp of how currency liquidity works, it helps to understand the key players and processes in the FX market.

Multiple financial service providers are involved in delivering the currency you require

Central Banks

At the top of the chain are central banks, such as the Bank of England, the Federal Reserve (USA), and the European Central Bank (ECB).

They control monetary policy, set interest rates, and manage currency reserves.

For example, a central bank may increase interest rates to attract foreign investment, boosting demand for its currency and increasing liquidity.

In a more drastic intervention, they may even engage in quantitative easing, increasing the money supply and injecting liquidity into the economy. This tends to devalue a currency.

While central banks may not participate in daily FX trading, their policies and interventions can significantly influence currency liquidity and value.

Liquidity Providers

Liquidity providers are large financial institutions - often major banks and specialised FX dealers - that actively make markets in currencies.

They offer buy and sell prices for currencies, ensuring there's always a counterparty for a trade. By doing so, they inject liquidity into the market.

These institutions have access to large pools of capital and sophisticated trading platforms, allowing them to handle substantial transaction volumes.

They profit from the spread between the bid (buy) and ask (sell) prices.

Banks

Commercial banks play a dual role.

They act as liquidity providers in the interbank market and as intermediaries for their clients, whether that be businesses or individuals needing currency exchange services.

Banks access currency liquidity through their trading desks, dealing directly with other banks or liquidity providers.

When banks trade with each other for liquidity purposes, this is done at what’s known as the ‘interbank rate’, i.e. the actual exchange rate, with no margin added.

For their clients, it’s a different story. They facilitate FX transactions but often add a significant markup to cover costs and generate profit.

Currency Brokers

Currency brokers like Currencies Direct specialise in FX services, especially for businesses and high-net-worth individuals.

They have relationships with multiple liquidity providers and banks, allowing them to source competitive rates.

When you enter into a trade with a currency broker, they tend to make the exact same matching trade with their liquidity provider.

They don’t tend to hold onto excess volumes of currency and usually only buy what their clients require.

As brokers aggregate trades from hundreds or thousands of clients, they achieve better exchange rates than if a client went directly to a bank with a one-off trade.

Currency brokers also provide personalised services, market insights, and risk management tools like forward contracts

Digital Money Transfer Services

Most digital transfer services access liquidity in the same manner as currency brokers.

However, fintech company Wise has transformed the traditional FX landscape by using technology to lower costs and increase transparency.

Although Wise initially launched with a peer-to-peer model, they now operate on a local settlement model.

When you send money through Wise, the funds are deposited into Wise’s local bank account in your country, and an equivalent amount is paid out from their local bank account in the recipient’s country, where possible.

For eligible routes, this approach bypasses the traditional SWIFT system, avoiding cross-border money movement.

By managing their own local liquidity, Wise ensures sufficient currency reserves in various countries, enabling them to offer competitive rates and faster transfers.

Liquid vs illiquid currencies

Understanding which currencies are liquid can help you anticipate costs and processing times.

I’ll provide examples of some of the world’s most liquid currencies and some which you’ll find are a bit harder to trade.

Highly Liquid Currencies

These currencies are widely traded, with substantial daily volumes:

- US Dollar (USD)

- Euro (EUR)

- British Pound (GBP)

- Japanese Yen (JPY)

- Swiss Franc (CHF)

- Canadian Dollar (CAD)

- Australian Dollar (AUD)

- New Zealand Dollar (NZD)

As a result, these currencies benefit from:

- Tight spreads: minimal difference between buy and sell prices.

- High availability: easy to source in large amounts.

- Stable exchange rates: less susceptible to drastic fluctuations.

Illiquid Currencies

These include currencies from emerging or smaller economies and a sample include:

- Vietnamese Dong (VND)

- Nigerian Naira (NGN)

- Argentine Peso (ARS)

- Sri Lankan Rupee (LKR)

- Nepalese Rupee (NPR)

Challenges with illiquid currencies can be:

- Wide spreads: larger difference between buy and sell prices.

- Limited availability: harder to source, especially in large amounts.

- Volatility: prone to significant exchange rate movements.

Impact on currency exchange margins

As you’d have gathered from my liquid vs illiquid currency comparison, the liquidity of a currency directly influences the cost of exchanging it.

In highly liquid currency markets, lower margins are the norm.

This is largely due to the high trading volumes and intense competition among banks, brokers, and other financial institutions. With so many participants actively trading, the cost of buying and selling currencies is driven down, resulting in slimmer margins for the providers.

As a result, both banks and brokers can offer more competitive exchange rates, passing on some of these savings to their customers.

Additionally, the high liquidity reduces the overall processing costs, allowing providers to charge lower fees for transactions.

On the other hand, illiquid currencies present a different scenario.

These currencies are traded less frequently, and fewer market participants are involved. This creates higher risk and difficulty in sourcing the currency, prompting providers to charge higher margins to offset that risk.

With fewer players in the market, the rates offered are generally less competitive, meaning customers face less favourable exchange rates.

The limited availability and the complexity of trading illiquid currencies drive up costs, both in terms of the margins and the fees, making transactions involving these currencies more expensive.

Understanding the journey of your international transfer (from a liquidity perspective)

To visualise how currency liquidity affects your transfer, we can map out the journey of sending money abroad.

Keep in mind that how your purchasing currency is sourced is different from the payment network your money will be sent through (such as SWIFT or SEPA).

1. Initiation

You request a transfer from your bank, currency broker, or digital service.

2. Rate Quotation

The provider checks current exchange rates. For liquid currencies, rates are readily available with tight spreads. For illiquid currencies, rates may need to be sourced from multiple liquidity providers, leading to wider spreads.

3. Accessing Liquidity

Banks: access the interbank market or liquidity providers, adding their margin.

Currency brokers: source rates from various providers, aiming for the best rate then adding their margin.

Wise: use local reserves where possible to minimise conversion costs.

4. Execution

The currency is then bought or exchanged. For liquid currencies, this happens almost instantly. For illiquid currencies, it may take longer due to limited availability.

5. Settlement

Funds are delivered to the recipient's account. Delays can occur if intermediary banks are involved, especially with illiquid currencies.

As you can see, in addition to wide spreads, processing times for illiquid currencies will likely be longer. Sourcing these currencies can take extra time, and regulatory hurdles in certain countries can introduce further delays.

For example, Nigeria recently lifted an eight-year restriction on access to foreign currency for things like rice and cement. Importers of these goods can now freely purchase foreign currency in the open FX market, making transfers more liquid and faster than before.

Strategies to minimise costs

I’ve outlined five strategies to ensure that cheaper liquidity access benefits you as the end client.

1. Use Specialised Currency Brokers

Brokers access ‘wholesale rates’ from banks and other liquidity providers due to the significant volumes they purchase, and will pass on a better rate to you than if you went directly to the bank yourself.

2. Consider Wise for Small Volumes

For low value payments in major currencies, Wise provides excellent rates. Their innovative models reduce reliance on traditional liquidity chains.

3. Plan Ahead

For large transfers, monitor exchange rates and consider using forward contracts to lock in an exchange rate. Forward contracts are a less liquid market but you’ll still get value if you trade when the rate is in your favour.

4. Consolidate Transfers

Purchasing larger volumes of currency means cheaper liquidity. If possible, combine multiple transfers to reduce fees.

5. Stay Informed

Be aware of market conditions affecting currency liquidity. Keep an eye on economic indicators and central bank policies.

Summary

By understanding the mechanisms behind currency liquidity and the roles of market participants, you can make more informed decisions ahead of your next transfer.

Banks provide liquidity for each other at the interbank rate, but provide a rate that is much worse than this for end clients.

For everyday transactions in liquid currencies, digital money transfer services like Wise offer convenience and cost savings.

When dealing with large amounts or illiquid currencies, partnering with a currency broker can provide access to better rates and specialised services. However, expect to have less options at your disposal and understand that margins will naturally be higher.

.png)

-min.webp)