When a transfer is international, it usually means your transfer will pass through a team of banks working together to move your funds to the intended recipient.

This tends to have two undesirable effects, and one potential drawback:

- Your transfer takes longer

- You, or the beneficiary, has to pay extra fees

- If you haven't clearly stated that you’ll pay the extra fees, the amount received will be lower than anticipated

In general, if it's a possibility, you want to avoid using correspondent banks for international transfers.

To do this, it helps to develop your expertise in the domain.

I’ve already explained just exactly what a SWIFT transfer is.

In this guide, I’ll be getting under the hood of the SWIFT network, providing actual examples of the routes, and banks, that transfers pass through.

I’ll then explain how and when you can bypass the SWIFT network, allowing you to save on both time and fees.

I won’t go too deep into the actual fees taken as receiving fees or intermediate fees, because these vary from bank to bank, but I will provide a few examples of UK banks.

Correspondent banks vs Intermediary banks

These two terms are often used interchangeably, but that suggests a slight misunderstanding in exactly what they are.

Understanding the different roles they play will help you understand why they’re necessary in a SWIFT transfer.

I’ll explain it the same way I was taught the difference (during my first banking job).

Correspondent banks

A correspondent bank handles international services on behalf of another bank, usually for the purpose of clearing financial transactions. They work in a different currency to that of the issuing bank.

Your bank or payment provider will work with a vast number of correspondent banks around the world to clear the various currencies they offer to customers.

When correspondent banks form a banking relationship, they open up a bank account for the other.

Your transfer then moves between these accounts.

To clear the transfer, the correspondent bank will check the details are correct and ensure it complies with local regulations.

That’s why the correspondent bank usually operates in the country of the currency that you’re making the payment.

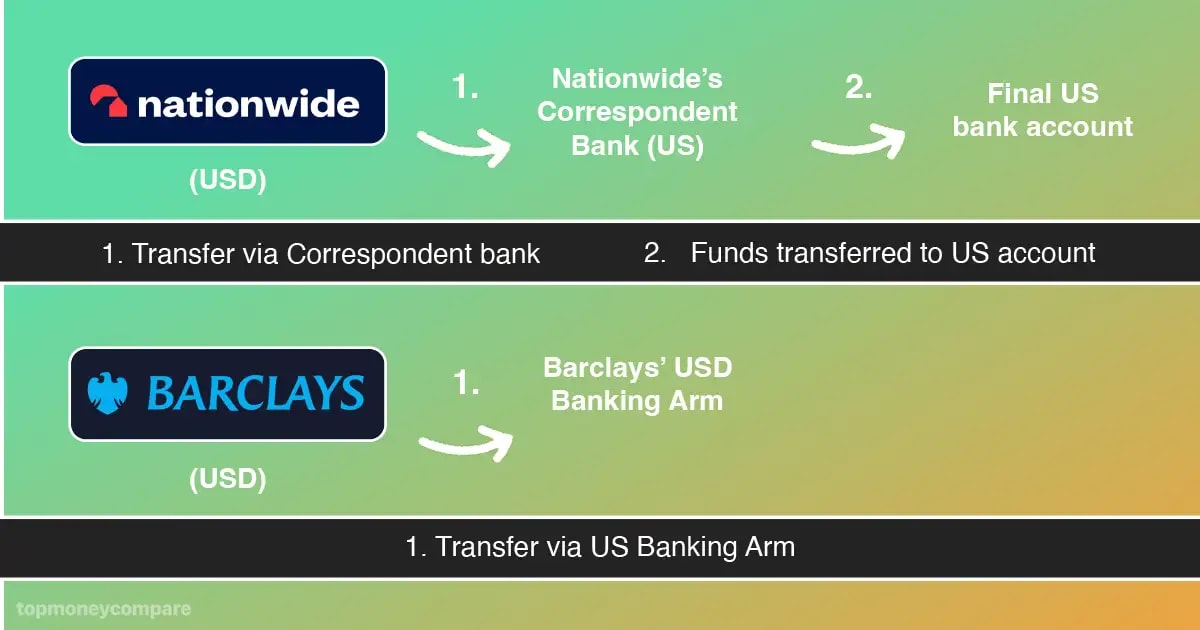

For example, make a transfer from Nationwide in USD and Nationwide will use its correspondent bank in the US to clear the payment.

But, make the same payment with Barclays, and they’ll clear the transfer through their own US banking arm.

To make things a little more confusing, the bank that you’re sending money to, will also have its own correspondent bank network.

Intermediary banks

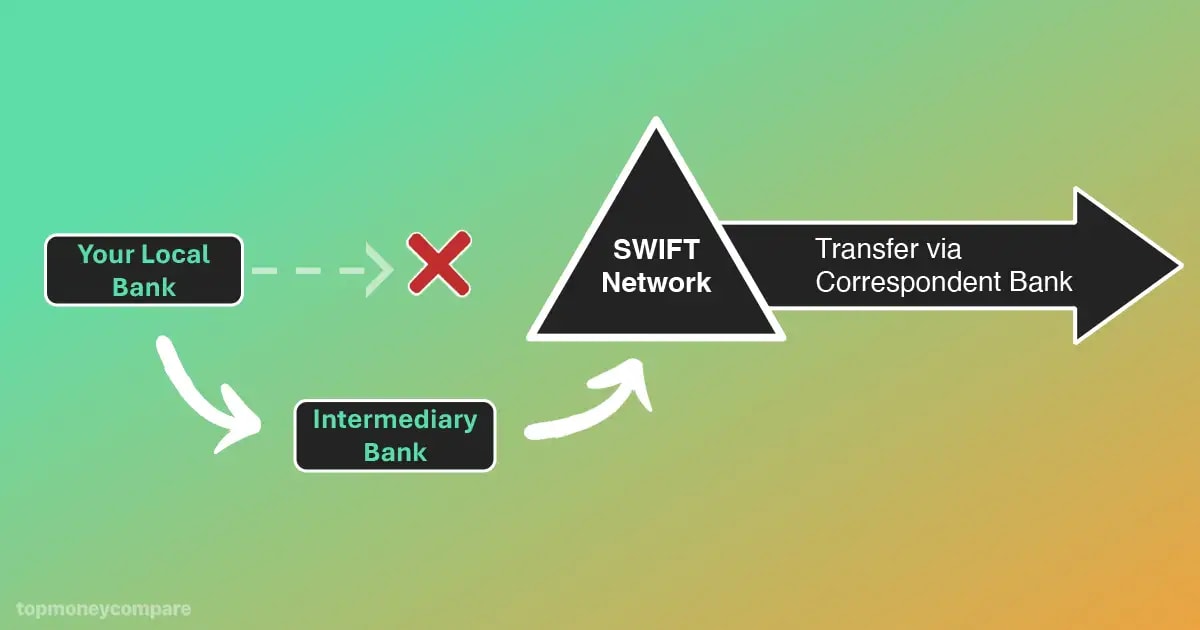

An intermediary bank tends to facilitate transfers in the same currency.

Let’s say your local bank isn't registered on the SWIFT network and cannot process international transfers.

Your local bank may then work with an intermediary bank to make international transfers on their behalf.

That intermediary bank will then initiate the transfer over the SWIFT network and use its own network of correspondent banks to clear the relevant currency.

Nowadays, the use of intermediary banks is less common in the UK, as most banks and building societies are participants in SWIFT.

They’re more common when sending payments from the US.

Local US credit unions tend to work with an intermediary bank if a customer has a requirement to send money overseas.

Then, be aware, there is also a second scenario that the term intermediary bank is used.

That’s when the issuing bank’s correspondent bank and the receiving bank’s correspondent bank do not hold a banking relationship with one another.

When two correspondent banks do not hold a banking relationship with one another, they need to go through an intermediary bank who holds a banking relationship with them both.

In this scenario, the intermediary bank is still working in the same currency.

In short, every payment over the SWIFT network needs to find a trail of connected banks to facilitate a transfer from point A to point B.

It’s cumbersome, but necessary, and does not take away from the safety of the transfer.

SWIFT itself is not a centralised payment network

One of the key things to understand about SWIFT is that it is just a financial messaging network.

It sends secure payment orders between banks using SWIFT codes, but it doesn’t actually transfer funds.

That’s why banks need to have an existing banking relationship.

They can then send and receive money to each other's respective accounts with one another.

This is one of the reasons that international transfers initiated over the SWIFT network can take up to 7 working days to complete.

A new standard for the network, SWIFT GPI, is speeding up transfers, but problems still remain.

I’ll talk about the options you have to circumvent SWIFT later.

SWIFT transfer routes

A SWIFT transfer could pass through anywhere between 2-5 banks, and on very rare occasions, sometimes even more.

Let’s take a look at some real-life examples for international SWIFT transfers issued from leading UK banks.

5 banks: USD transfer, Natwest (UK) to Hipotekarna Bank (Montenegro)

Natwest and Hipotekarna are some of the largest banks in the UK and Montenegro, respectively.

Natwest clears USD transfers through their correspondent bank Chase. The recipient bank Hipotekarna clears USD transfers through the US arm of Raiffeisen Bank.

As these two correspondent banks do not have a direct banking relationship, they have to work with an intermediary bank that does. This could be either Standard Chartered or Citibank.

Therefore, this transfer passes through five different banks.

Chase, Standard Chartered/Citibank, Raiffeisen Bank and Hipotekarna Bank may all add processing fees for their role in the transaction.

4 banks: AED transfer, Natwest (UK) to First Abu Dhabi Bank (UAE)

Natwest and First Abu Dhabi Bank are also some of the largest banks in their respective territories.

This transfer passes through Natwest’s AED correspondent Emirates NBD Bank, then the Central Bank of UAE, before reaching First Abu Dhabi Bank UAE.

Emirates NBD Bank and First Abu Dhabi Bank may add processing fees for their role in the transfer.

3 banks: USD transfer, Barclays (UK) to Banco Pichincha (Ecuador)

Barclays is one of the largest banks in the UK and Banco Pichincha is the largest bank in Ecuador.

The official currency of Ecuador is USD.

As Barclays clear their own USD, this transfer is handled by 3 different banks.

Citi acts as Banco Pichincha’s USD correspondent. Both Citi and Banco Pichincha may add processing fees for their role in the transfer.

2 banks: JPY transfer, HSBC (UK) to Mizuho Bank (Japan)

As one of the world’s largest banks, HSBC has an extensive global footprint and correspondent banking network.

HSBC clears their own JPY in Japan and they hold a direct banking relationship with Mizuho Bank.

Therefore, no external correspondent bank is required and only the issuing bank and recipient bank are involved in the transfer.

In this scenario, Mizuho Bank may still add a fee for receiving money.

Make a transfer to another major bank in Japan and the chances are HSBC will hold a banking relationship with them.

2 banks: TRY transfer, Lloyds (UK) to Yapı Kredi Bankası (Turkey)

Lloyds Bank and Yapı Kredi Bankası are two major banking players in their native countries.

It just so happens that Lloyds clear their TRY transfers through Yapı Kredi Bankası, so a transfer to an account holder at this bank, means only these two banks are involved.

Yapı Kredi Bankası may still apply a fee for receiving an international transfer.

Keep in mind, a transfer from Lloyds to any other Turkish bank would, however, require Yapı Kredi Bankası to act as the correspondent and means at least three banks are involved.

As you can see, it’s difficult to gauge how many correspondent or intermediary banks are required for any given transfer.

You don’t know who your bank, or the recipient bank, uses as their correspondents.

Plus, you don’t know if these correspondents will even have a direct relationship with one another.

Correspondent bank fees

When a correspondent or intermediary bank is required in the transfer process, they charge a fee.

The size of the correspondent bank fee will depend on the currency involved, the banks involved, and the location of the recipient bank.

Unfortunately, there’s no hard and fast rule to determine how much you’ll be charged.

In fact, it’s usually very opaque and you simply won’t know how much you’ll be charged until you make the transfer.

The fees are then just deducted from your account balance.

One thing is for sure, the more banks that are involved, the more the correspondent fees will add up.

Large correspondent banks like Barclays and Citi may charge lower fees to each other, given they both process a number of transactions on each other's behalf.

But, as you’ll never really know which correspondents are involved, it makes it difficult to predict the potential fees.

Charging options

There are usually three fee options you can choose from when you initiate a SWIFT transfer:

- OUR: You pay the correspondent bank fees upfront, so, chances are, the full amount reaches the beneficiary. This option tends to ensure there are no nasty surprises, but the recipient bank may still charge its customer a fee for receiving money from abroad.

- BEN: The beneficiary will cover all correspondent bank fees, meaning they get deducted from the value of the payment. This will very likely lead to a reduction in the amount the beneficiary receives.

- SHA: The fees are split. Some you pay upfront, and some are deducted from the transfer. This could also result in a short payment to the beneficiary.

“OUR” stands for ‘our’, “BEN” stands for ‘beneficiary’ and “SHA” stands for ‘share’.

Should you choose, you can generally cover all of the correspondent bank fees as the sender, but not the recipient bank fees.

They tend to always fall on the beneficiary.

How much do correspondent banks charge?

Most of the UK’s leading banks simply pass on whatever fee they’re charged by the correspondents on a case-by-case basis.

That’s why you’ll never know the exact fees that are involved.

From my experience, it can be anywhere from £5 to £40.

Lloyds operate a little differently.

They keep things simple and charge a flat £12 correspondent fee for transfers to Canada, USA & Europe (non-SEPA) and £20 to the rest of the world.

On the plus side, you’ll know exactly how much you’ll be charged, but, on the downside, you might end up overpaying, depending on your route.

HSBC Expat is the only service I’m aware of that will pay correspondent bank fees on behalf of you and the beneficiary.

But, keep in mind, you’re still subject to their payment fees and FX markup.

As I always recommend, you’re better off skipping the banks, and if possible, the SWIFT network entirely.

Wise and other fintechs

If we look into one of the most successful international payment platforms, Wise, we see an excellent example of fast payments and minimal correspondent banking fees.

They work with over 90 banking partners worldwide, and directly connect to five local payment networks themselves.

Then, in a number of the countries where they lack a connection to the local payment network, they work with a bank that does.

So rather than relying on the correspondent banking relationships of one bank, opt for Wise and you gain access to nearly a hundred.

Take these transfers for example.

AUD transfer, Wise (UK) to National Australia Bank (Australia)

Wise is directly connected to the ‘Faster Payments Scheme’ in the UK and the ‘New Payments Platform’ in Australia, both of which offer real-time settlement.

This means you can fund a Wise transfer instantly using a debit/credit card, a connected bank account (via API integration), Google/Apple Pay, or a faster payment over the Faster Payments Scheme.

Then, onc Wise receives your money, they can initiate a transfer from their local Australian account via the New Payments Platform to National Australia Bank.

No banks required to act as middlemen = no correspondent banking fees.

What’s more, the very same would apply if you made the transfer in reverse from Australia to the UK.

Wise also has direct connections to payment systems in the EU, Brazil and Singapore.

INR transfer, Wise (UK) to HDFC Bank (India)

In this scenario, you’re able to fund your Wise transfer via any of the aforementioned settlement methods, so again, it’s practically instant.

Now, here’s the thing, Wise doesn’t have a direct connection to any of the real-time payment networks in India, whether that be the Immediate Payment Service or Real Time Gross Settlement System.

But, I know from having done an INR transfer with Wise to India myself, it only took a matter of minutes to reach the beneficiary.

My hunch is they leverage their relationship with Barclays, who are a member of both real-time payment systems in India.

Wise can then initiate a local INR transfer from their account with Barclays through one of the real-time payment networks.

If it’s not Barclays, they simply do this process with a different bank.

Whichever bank Wise uses, no correspondent bank fees are added.

Wise’s banking costs are covered in their own upfront, transparent payment fee (currently £0.71 for GBPINR transfers).

Summary

Understanding the complexities of SWIFT can be challenging, but getting to know how the system works, and the viable alternatives, will help you decide when a SWIFT transfer is the best option, or when it’s better to go elsewhere.

It's important to remember that SWIFT itself is not a payment processor.

SWIFT acts as a secure messaging service that sends payment instructions between financial institutions.

Because of this, banks must rely on a network of correspondent banks to actually move the funds, which can lead to delays and extra fees

Progress is being made around the world, which is increasingly allowing innovative payment companies to plug into local payment networks, or leverage their banking partners that do.

Whenever possible, consider using a fintech platform to bypass these traditional routes.

-min.webp)