Wondering if offshore banking could work for you and what it takes to open an account?

This guide covers everything you need to know, including what offshore accounts are, how to open one, their key benefits, and potential downsides.

What is an Offshore Bank Account?

By definition, an offshore bank account is any account held in a country outside of your residence.

Typically, offshore accounts allow you to hold balances in multiple currencies and make and receive international transfers.

All of the usual account types are available offshore, including current accounts, offshore savings accounts and investment accounts.

Offshore business bank accounts are popular too.

I’m going to focus primarily on accounts held in traditional "offshore" jurisdictions like Jersey.

These jurisdictions are renowned for their financial services and appeal to individuals looking for specific benefits like tax efficiency or increased privacy.

I’ll also give options for businesses seeking overseas business bank accounts when they launch into new markets, and multi-currency account solutions for individuals when they’re moving abroad.

If you need hands-on assistance on finding things like a secondary citizenship alongside off-shore investing then you can go here.

Best Offshore Bank Accounts

Most of the UK’s major high street banks offer an ‘islands’ solution, i.e. offshore accounts held in one of Jersey, Guernsey or the Isle of Man.

Here’s my pick of the top 3.

Best Offshore Bank Account: HSBC Expat Account

Maintenance Fees: None

Location: Jersey

Minimum Criteria: Minimum deposit of £50,000 or pay in an annual salary of £120,000

My favourite offshore account is the HSBC Expat Account.

First of all, providing you meet the eligibility criteria, there are no ongoing account fees. That’s quite unusual for an offshore account.

I use this account myself for storing larger sums of money (protected up to £50,000 with the Jersey depositors scheme) and for making long-term investments.

I just prefer doing these activities with one of the world’s largest banks that’s about as safe as they come when it comes to storing your money.

Minimum deposit requirements / special promotion

The first thing you need to know about HSBC Expat is that it’s made for people who have substantial financial resources, or high income.

If you thought this was an initiative to bank the unbanked - think again. There is usually a £50,000 minimum deposit (or €60,000 / $60,000).

However, if you register with HSBC Expat through this link, then you could qualify with a significantly lower deposit of £15,000, or a salary of at least £100,000 a year.

NatWest International Account

Maintenance Fees: £8 per month

Location: Jersey, Guernsey or Isle of Man

Minimum Criteria: Minimum deposit of £25,000 or pay in a mandated salary of £40,000

The NatWest International Select Account caters to those looking for straightforward offshore banking.

Features include fee-free international transfers, online banking, and multi-currency support.

NatWest offers 24/7 customer support and a range of tools to help manage your money abroad.

Lloyds Offshore Account (Current/Premier)

Maintenance Fees: £7.50 per month/none

Location: Jersey, Guernsey or Isle of Man

Minimum Criteria: Minimum deposit of £25,000/minimum deposit of £100,000

Lloyds offers a range of offshore banking services through its Islands division.

The Lloyds Offshore Account provides flexibility with multi-currency options and is backed by Lloyds’ reputation for reliability and customer service.

It’s a solid choice for both individuals and businesses. Additional benefits include competitive interest rates and tailored solutions for expats.

HSBC International Bank Account vs HSBC Expat Account

Don’t confuse HSBC’s Expat account with HSBC’s ‘international services’.

HSBC’s international services allow you to open an overseas account in a new country when you move abroad.

From Bangladesh to Australia, the world’s local bank can assist you with opening an account in a significant number of countries worldwide.

It’s a great offering, but it’s only the ‘HSBC Expat Account’ which is physically held in the secure offshore jurisdiction of Jersey.

That doesn’t mean you have to be a resident of Jersey in order to apply.

Out of all the HSBC accounts, the Expat Account is the most international bank account of them all.

You can hold balances in 19 different currencies and residents from the vast majority of countries worldwide can apply.

Why Open an Offshore Account?

Offshore accounts provide a number of financial solutions, including:

- Managing your finances while living abroad

- Diversifying assets across multiple currencies

- Accessing investment opportunities in international markets

- Safeguarding wealth from politically or economically unstable regions

- Simplifying your estate planning and wealth transfer

However, it doesn’t stop there.

You’ll likely have your own very unique experience that’s taking your life international and a need for an overseas bank account.

Offshore accounts are also sought after by businesses looking to establish a financial presence in different markets or hedge against currency risks.

Top Offshore Banking Destinations and Their Strengths

Choosing the right offshore jurisdiction is critical to achieving your financial goals.

Here are eight popular offshore banking destinations and what they are known for:

1. Jersey

Renowned for financial stability and a strong regulatory framework, Jersey offers a highly secure environment for asset protection.

As you can imagine, it’s especially popular with UK residents.

In a recent survey of 400 wealth advisors by the Scorpio Partnership, Jersey was rated the 6th best business and financial centre for “mobile wealthy” people to live in.

Unlike the UK, there is no capital gains tax and no inheritance tax for Jersey residents.

Income Tax Rate: Capped at 20%

Capital Gains Tax: None

Inheritance Tax: None

2. Guernsey

Similar to Jersey, Guernsey is known for its tax-neutral policies and robust financial services sector.

It’s another top choice for individuals seeking high levels of confidentiality and security.

Like Jersey, there is no capital gains tax and no inheritance tax for residents of Guernsey.

Income Tax Rate: Capped at 20%

Capital Gains Tax: None

Inheritance Tax: None

3. Isle of Man

The Isle of Man stands out for its high levels of investor protection and a well-regulated financial system.

It’s particularly attractive for those interested in family estate planning and trust services.

Like Jersey and Guernsey, there is no capital gains tax and no inheritance tax for Isle of Man residents.

Income Tax Rate: Capped at 20%

Capital Gains Tax: None

Inheritance Tax: None

4. Switzerland

Famous for its banking secrecy and stability, Switzerland remains a top offshore banking destination for privacy and wealth preservation.

Swiss banks offer an almost unparalleled expertise in private banking and asset management, though recent global transparency efforts have slightly reduced its confidentiality.

Federal income tax is low, but tax at a state or ‘canton’ level can bring the overall level of income tax to around 36%.

Income Tax Rate: 11.5%

Capital Gains Tax: Applicable on non-movable assets

Inheritance Tax: Not federal but rates vary per canton

5. Singapore

A global financial hub, Singapore offers a combination of low taxes, excellent financial services, and strong political stability.

Its banking sector is particularly attractive for Asian market investments and offers multi-currency account options.

Income Tax Rate: Staggered from 0% to 24% depending on income

Capital Gains Tax: None, except for certain real estate scenarios

Inheritance Tax: None

6. Hong Kong

Hong Kong is a well-known financial hub that’s ideal for investors looking to access Asian markets.

Given Hong Kong’s close proximity to China, it’s a preferred choice for businesses engaged in international trade with the country.

Income Tax Rate: 2% to 17% depending on income

Capital Gains Tax: None

Inheritance Tax: None

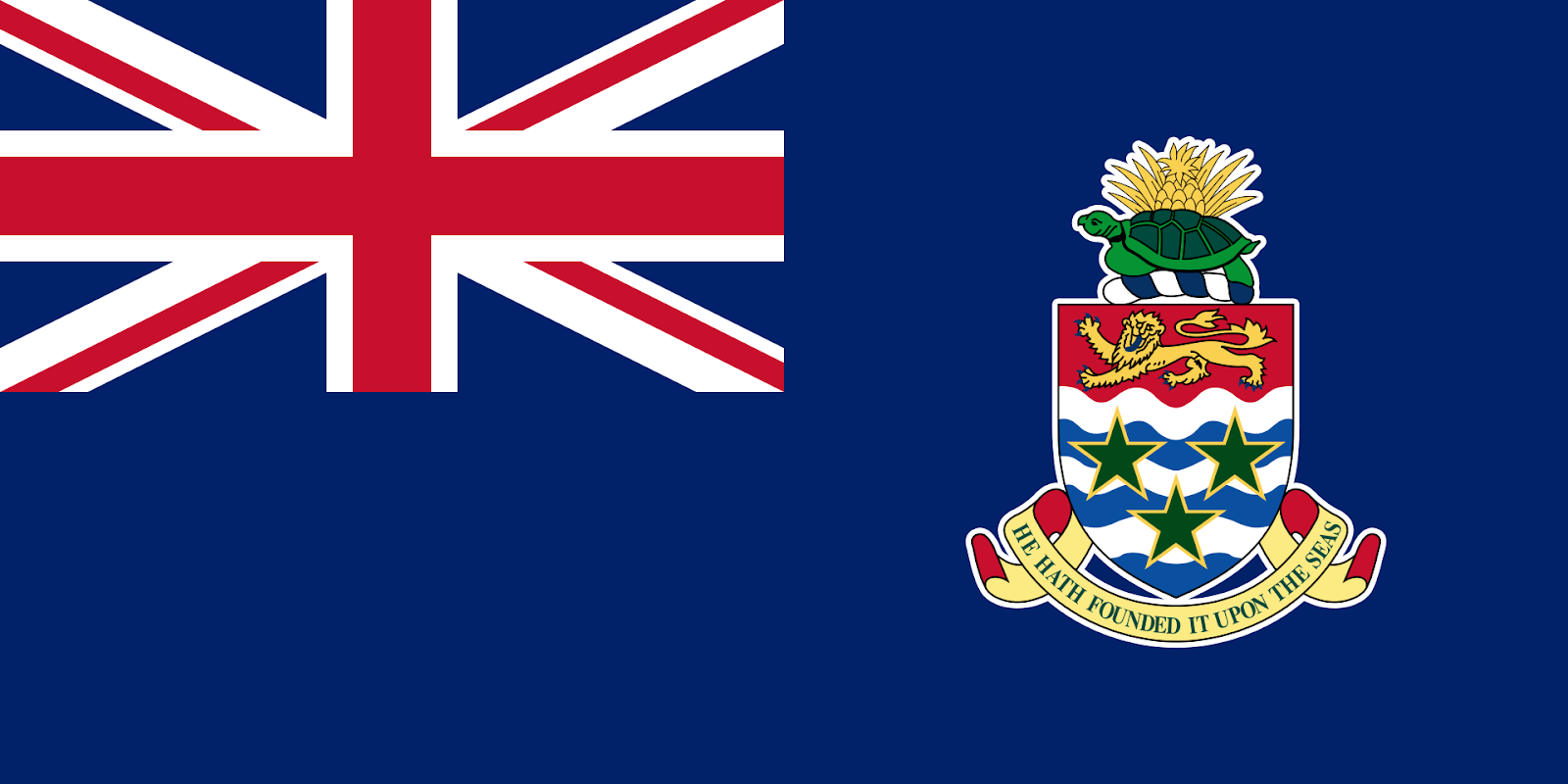

7. Cayman Islands

The Cayman Islands are synonymous with tax efficiency and corporate banking services.

This jurisdiction is a favorite for hedge funds and multinational corporations looking for a tax-neutral environment.

Despite a population of just 70,000, it’s home to roughly 100,000 registered businesses and 300 banks, demonstrating its influence to offshore banking.

Income Tax Rate: None

Capital Gains Tax: None

Inheritance Tax: None

8. Luxembourg

Famous for having the highest GDP per capita of any country in the world, Luxembourg is known for its highly developed financial sector.

Income tax is actually rather high, but it remains appealing for high-net-worth individuals seeking wealth management and EU-based banking solutions.

It has slightly more favourable corporation tax rates than other leading financial centres in Europe.

Income Tax Rate: Staggered from 0% to 24% depending on income

Capital Gains Tax: None, except for certain real estate scenarios

Inheritance Tax: None

Benefits of Offshore Banking

Offshore bank accounts provide several advantages, hence why they continue to be so popular.

Here are just a few of the key benefits:

Access to Multiple Currencies

Offshore accounts often support multiple currencies, allowing you to hold and transact in USD, EUR, GBP, and many more.

This is particularly useful for international businesses or freelancers that deal with multiple currencies regularly.

Various foreign exchange solutions like forward contracts should also be available.

Enhanced Financial Privacy

Offshore banks typically offer higher levels of confidentiality compared to domestic accounts.

This can be beneficial for protecting your financial information from prying eyes, though transparency regulations have tightened globally in recent years.

Some jurisdictions still provide higher privacy protections than others.

Wealth Diversification

Holding funds in an offshore account reduces exposure to risks associated with a single country’s economic instability or currency fluctuations.

Diversification helps secure financial stability in uncertain times.

Tax Efficiency

While offshore accounts are not inherently about avoiding taxes, some countries offer tax-efficient banking solutions.

Remember, it’s essential to comply with tax regulations in your home country to avoid legal issues.

Professional tax advisors can help you leverage these benefits responsibly.

Global Access and Convenience

With international banking solutions, you can easily manage your account from anywhere in the world, often via advanced online banking platforms.

These platforms often come with multi-language support and robust security features.

Considerations and Potential Drawbacks

While offshore banking has its perks, there are some downsides you’ll want to consider:

Regulatory Compliance

Many governments require citizens to report offshore accounts and pay taxes on income earned abroad.

Failing to comply with these regulations can result in severe penalties. Staying informed about changes in international banking laws is crucial.

High Eligibility Criteria

Offshore accounts often come with minimum balance requirements or minimum salary requirements.

This can immediately make them inaccessible to some.

High Fees

Though some accounts have no maintenance fees, you’ll still likely have to pay more expensive international transaction fees, and potentially be subject to worse foreign exchange rates.

In fact, the rates are likely to be quite a bit worse when you compare these to leading money transfer companies.

Complexity

Opening and maintaining an offshore bank account can naturally be more complex than a domestic one.

Working with professionals can simplify the process and save money in the long run.

Seeking guidance on secondary residency, wealth protection or offshore investments?

Through a strong network of established relationships with lawyers and specialists worldwide, Expat Money provides a range of consulting services to help you manage your finances internationally.

Perception and Stigma

Despite their legitimate uses, offshore accounts are sometimes associated with tax evasion and financial secrecy, which can affect public perception.

Transparency and compliance are key to mitigating this stigma.

How to Open an Offshore Bank Account

Opening an offshore bank account involves various steps, which can vary depending on the jurisdiction and the bank.

Here’s a general outline:

Setting up an offshore company?

To open an offshore corporate account you are generally required to incorporate your business in the relevant jurisdiction.

Global Offshore Company is a Singapore-based international service provider that helps businesses with incorporation in 10 offshore jurisdictions. Other services include account opening, outsourced bookkeeping, accounting, taxation, audit & work visas services.

Relocating or Expanding a Business Overseas?

If you or your business is relocating or operating in a new country, you might simply need an overseas bank account in that region.

So instead of focusing on traditional ‘offshore’ accounts, I’ll share a few recommendations tailored to this situation.

Overseas Business Bank Accounts

Opening a business bank account abroad is notoriously difficult.

You tend to require a locally registered business in the country you plan to open the account. This is a huge and costly barrier to most SMEs.

Thankfully, there is a solution to this in 2025.

It comes in the form of digital multi-currency accounts. These platforms allow you to open offshore business bank accounts online, with the click of a button.

So long as the digital multi-currency account provider accepts businesses from your country, there is absolutely no requirement to have a local registered business in the overseas countries that you’re looking to open an account.

For businesses, OFX is my current favourite.

They offer local currency accounts in 7 major financial hubs (GBP, EUR, USD, HKD, SGD, AUD, NZD) and a further 30 currency IBAN accounts to conduct trade internationally.

Making it easy to conduct business money transfers.

Plus, all this is supported by a range of currency hedging solutions and a team of foreign exchange experts that understand international trade.

Personal International Bank Accounts

It can be similarly difficult to open an account in a new country as an individual.

If you’re yet to have a local address, it can be next to impossible.

With that in mind, Wise provides a similar solution to OFX but for individuals.

You can open local currency accounts in 9 different locations, and spend from these accounts with a matching debit card.

A real game changer when it comes to smoothly transitioning into a new life overseas.

Summary

In this article, I’ve provided guidance as to why and how to open an offshore account.

I’ve explained some of the most popular offshore financial hubs and what they’re best known for, and I’ve run through the factors you need to carefully consider before you open an offshore account.

To quickly recap:

- Offshore bank accounts can offer greater financial flexibility, privacy, and access to global markets

- They often have high eligibility criteria and higher transaction fees

- The best country to open an offshore account depends on your circumstances and requirements

- I’d regard the HSBC Expat Account as the best offshore bank account, but there are plenty to meet everyone's needs

- Tax will ultimately depending on your residency, as opposed to just where you have offshore accounts

- Consider a digital multi-currency account if you’re just looking for solution to manage international finances

-min.webp)