Perhaps you own property abroad, invoice clients overseas, expect to receive a payment in foreign currency, or have several international investments.

Whatever the case, you can likely benefit from using the right currency tools and deploying appropriate strategies.

Below are my top 5 tips for managing finances in multiple currencies.

1. Get a multi-currency account

First and foremost, when you’re managing finances across multiple countries, a multi-currency account is a necessity.

This allows you to hold all of your foreign currencies under the umbrella of one platform and one login.

Without one, you’re constantly converting currencies each time you want to make a new international investment, or repatriate overseas income.

This can be an unnecessary expense and waste of your time.

Most banks are limited when it comes to currency selection, and are notoriously expensive on any currency exchange.

My choices

There are heaps of benefits that a multi-currency account provides. Like the ability to make and receive local transfers, the option to hold currency until the rate swings in your favour, and even good interest-earning potential from the accounts.

I have two clear favourites that I use myself.

That's the HSBC Expat Account, which enables you to save and invest in multiple currencies, and the Wise International Account for sending and receiving payments, with local bank accounts in multiple currencies.

HSBC Expat Account

This account provides you with a fully-fledged offshore bank account in GBP, EUR and USD. Plus, a further 16 digital currency accounts which can be used for making payments, earning interest and spending from a matching debit card.

Once you’re up and running, you’ll gain access to a number of other international investment opportunities with HSBC too.

Just be aware, it’s primarily geared at individuals with a high-net worth. To qualify, you normally need either a £50,000 minimum deposit, or a salary of at least £100,000 a year.

However, if you register with HSBC Expat through this link, you can qualify with a significantly lower deposit of £15,000.

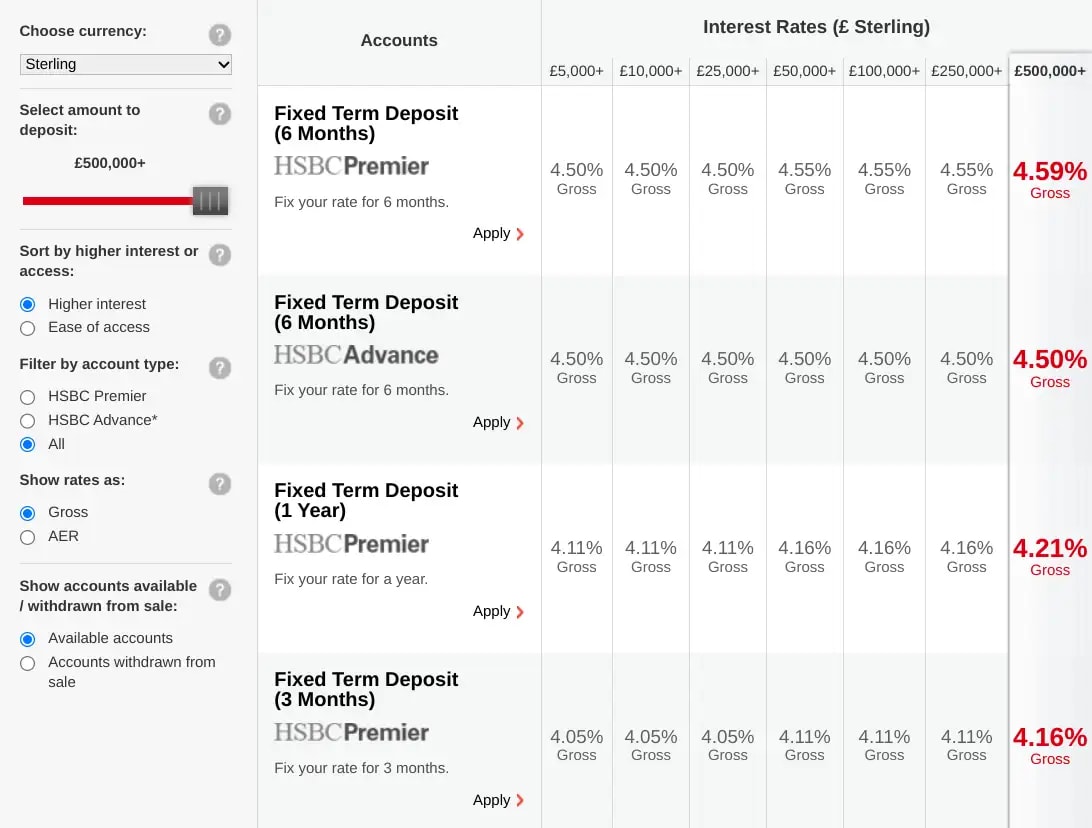

Interest-earning potential

A range of savings options are available, from instant-access accounts through to 1 year fixed-term deposits.

You can also earn interest in 16 different currencies. I haven’t found another solution with such a wide variety.

HSBC’s most up-to-date savings rates are here.

Currency management

It’s easy to view your balances and convert between your different currencies in the app.

But, you can still trade online or over the phone too.

If your currency volumes are large enough (over $325,000 a year), you’ll also be appointed your own dedicated account manager.

This is then supported by access to a range of currency solutions like forward contracts and limit orders.

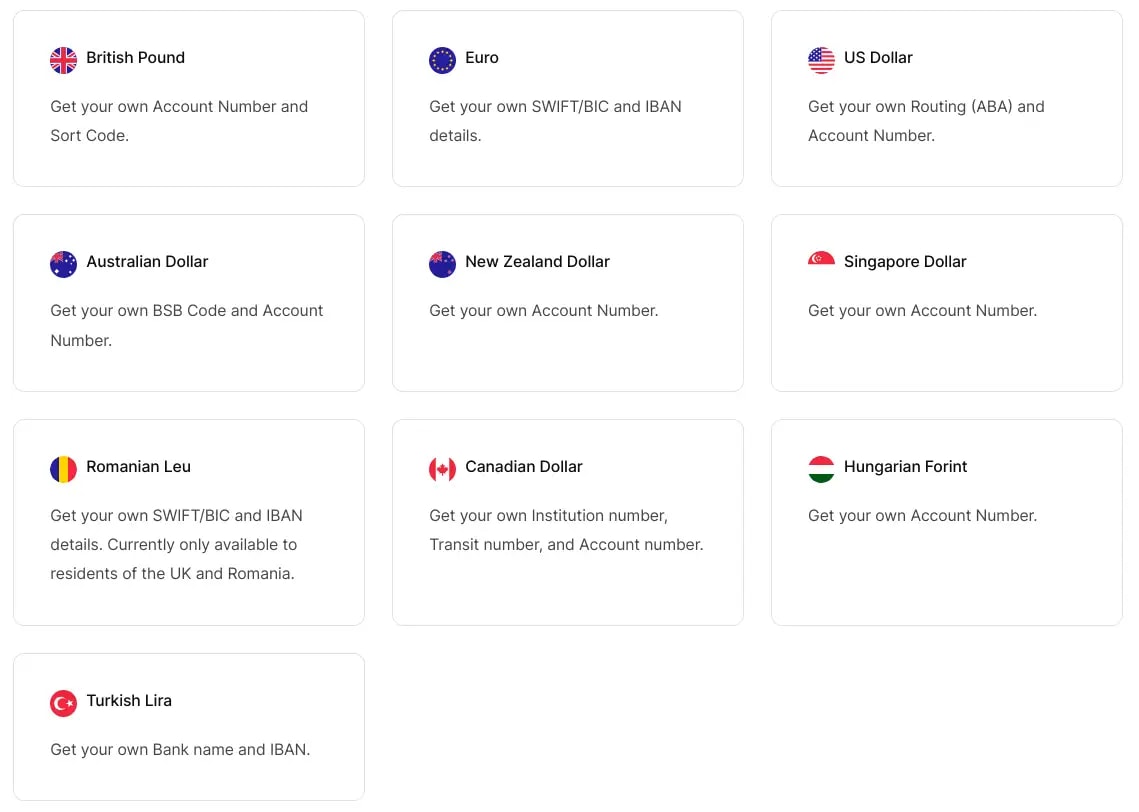

Wise International Account

I’ve been using the Wise International Account for years, and I have to say, it makes managing your currency on the move an absolute breeze.

Wise provides no access to currency hedging tools, but if you want an instant transfer, you can’t go wrong with Wise.

The Wise International Account allows you to hold up 40 different currencies and even offers locally held currency accounts in 10 locations.

For me, this is a game changer.

A local account means you can make and receive local, in-country transfers.

Say you’re paying a friend, or receiving rental yields.

It all gets so much simpler when you have a local account. Cheaper too. No need for payments to go over the cumbersome and expensive SWIFT network.

Interest-earning potential

At the back end of 2022 Wise launched its very own interest product for your balances held in GBP, EUR & USD.

Considering that your funds can be accessed instantly, the returns are excellent.

Wise’s savings rates beat most high-street banks

I like the fact there’s no need to open additional accounts. You simply opt to switch ‘Wise Interest’ on, which then permits Wise to invest your money in an interest-earning fund that holds government-guaranteed assets.

Currency management

With Wise, everything is digital.

Whether you’re opening new currency accounts, making international transfers or converting currency between your balances, it’s all done through the Wise app or online platform.

I rarely use the web platform because everything is so easy on the app.

The downside is there’s no possibility of transacting over the phone, or receiving helpful guidance about when to trade. You’re on your own.

Multi-currency accounts will help you out when you have both an income stream and liabilities in the same foreign currency too. Bringing me to my next point.

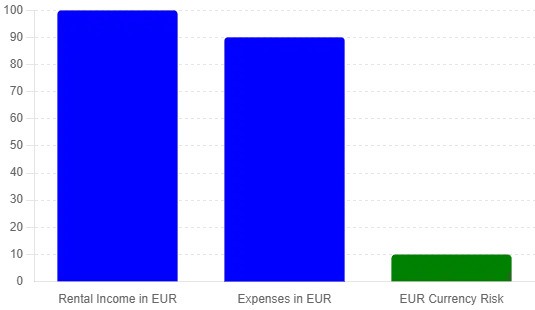

2. Use a natural currency hedge when possible

If you have both income and expenses in the same foreign currency, you can benefit from a natural currency hedge.

Let’s say you own a vacation home in Spain and receive rental income in euros.

To cover your property maintenance costs, which are also in euros, you can use the rental income directly, minimising the need to convert currencies and reducing exposure to exchange rate fluctuations.

There was no need to use any costly financial derivatives, and you managed to reduce the impact of currency fluctuations.

Likewise, if you have a number of international properties, it might pay to retain a balance in each of the currencies you have them. Swings in exchange rates might adversely impact the value of one of the currenes you hold, but improve the value of another.

It pays to diversify when you’re dealing internationally.

3. Don’t hedge long-term international investments

When you’re dealing with foreign investments denominated in a foreign currency, and there is no natural hedge in place, then hedging through financial instruments like forward contracts are a consideration.

Forward contacts are an agreement to buy a certain amount of currency at a specified date in the future fixing today's rate.

This eliminates all currency risk and, depending on several factors, can be inexpensive to buy, with as low as 10% upfront deposit.

Forwards are mostly used in business foreign exchange but are becoming more popular with private clients through currency brokers.

Whether to actually use “active” hedging comes down to a number of factors, like the diversification of your international portfolio, the currencies involved, and the type of assets you hold (but is generally not recommended).

Taking in advice from the likes of Vanguard and wealth manager AES, we can say that the best course of action for international investors is to hold investments in the long term and/or buy hedged assets.

In general, long-term investing is the most recommended strategy to begin with.

It’s just another perk that holding investments for the long run also tends to counter the impact of currency volatility.

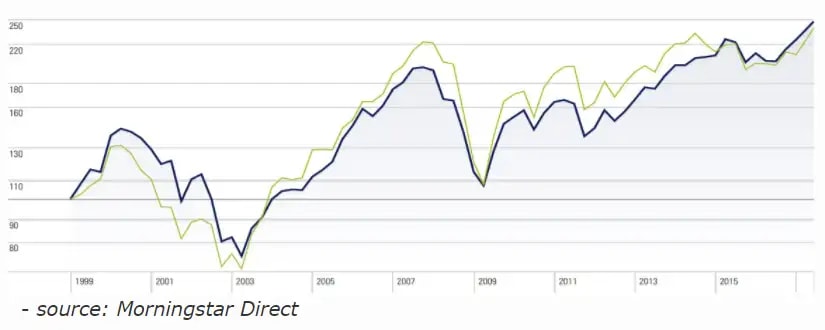

The following diagram from Morningstar clearly shows that over time, hedged and unhedged portfolios in CAD/USD balance out:

If you plan to invest for shorter horizons, or are unable to accommodate large fluctuations in your portfolio based on potential currency swings, then you can find local investments in your base currency that provide hedged returns.

For example, a Canadian investor who wants to invest in the S&P 500 in CAD can simply buy iShare SXP.

This is a better method than making an S&P 500 investment and buying a forward contract, because a forward contract forces you to deposit 10% of the amount upfront.

Assuming you buy a 2-year CADUSD forward on a $100,000 S&P 500 investment, you’d have to put down $10,000 as a deposit (which does not incur interest).

It would have been better to put that $10,000 to use and invested $110,000 into the SXP ETF.

4. Work with a currency broker

When you’re dealing with international currencies, it pays to have an expert on your side whose job it is to monitor the currency markets.

This is exactly what a currency broker does.

Register with a credible currency broker and you'll be assigned your own personal account manager who will get to understand your own currency requirements and risk profile.

They’ll be on hand to notify you when rates move for or against you, or of upcoming economic and political events that could impact your currency pairs.

If you’re trading anywhere above £50,000 per annum, I’d say you’d have an engaged and proactive account manager that will keep in touch with you regularly.

They’ll work with you to design an appropriate currency strategy, and you’ll be able to mitigate your currency risk with various financial products.

These include:

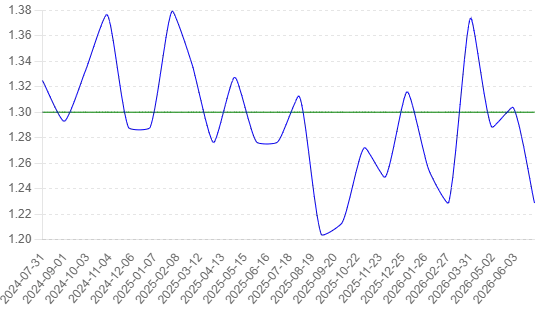

Forward contracts

Forward Contracts allow you to lock-in an exchange rate for up to 2 years in the future.

While I explained how forwards are often the wrong choice for investing in overseas shares, they are often a very useful tool in other scenarios.

For example, USD hit a near 40-year high against GBP at the end of 2022 and has since had a circa 10% drop.

If you had a salary, or rental yield in USD, it would have been worth locking future earnings in with a forward contract.

This would have ensured the amount you sent home remained stable, and exchanged at a near 40-year peak. Ultimately getting you more pounds at the end of your trade.

Limit orders and stop-loss orders

I’ve already spoken of Wise being a good option for when you want to trade currency instantaneously, at the current exchange rate.

This type of trade is also known as placing a market order.

You can place a market order through a currency broker, or you can choose to make a limit or stop-loss order instead.

A limit order in the FX market is an order to buy a currency at a better exchange rate than the prevailing rate at the time. Once that rate is met, the currency is automatically purchased.

A stop-loss order does the opposite, and will minimise any potential losses instead. A stop loss is set below the prevailing rate at the time, and will be executed if the stop price is reached.

Let’s say you’re buying a house in Spain for €300,000 and you think the rate might improve in your favour, but you also want to be absolutely sure you remain on budget.

You could opt to set up both a limit and stop-loss order at the same time.

Suppose the current GBPEUR exchange rate is 1.15, let’s look at how these tools could be used and the value you’d achieve.

As you can see, the difference in value is stark. If you have time on your hands, it can pay to make the most of different order types.

Just keep in mind, if the rate is never met, the trade won’t execute. Likewise, when the rate is met, the trade will automatically execute. So if the rate dipped to 1.10 before reaching 1.20, you’d have missed out on the upside.

Choosing a broker

I’ve registered for countless services and reviewed a number of money transfer companies.

Of all the brokers, I’d recommend Currencies Direct.

They’ve been safely handling client money since 1996, have an excellent reputation and provide a very professional account management service.

Other than their top-notch service and currency hedging solutions, they are able to offer highly competitive rates for large currency exchanges.

5. Factor in the costs of overseas investments

When considering whether to invest abroad, you must account for the additional costs and overheads involved.

Some of these include:

- The cost of exchanging currency

- The hassle of opening a new bank or currency account

- Local taxes, which can be expensive, particularly for expats or foreign investors

- Cumbersome regulations for foreign investors (e.g. in Dubai and China, a foreigner cannot own a majority of a business; in Thailand, a foreigner cannot own property outright)

- The expense of overseas service providers for legal, accounting, and financial advice

- Going through KYC and compliance processes with multiple companies, requiring extensive documentation

- The inherent risk of investing abroad, which is higher than investing in your local market

To mitigate these additional costs and complexities, you can treat potential returns as if they are discounted by a certain percentage (e.g. 10%) compared to equivalent domestic opportunities.

Summary

Having a well-thought-out currency strategy is essential for financial success.

By leveraging the strategies and tools I’ve outlined in this guide, you can manage your international finances more effectively, save on unnecessary costs, and reduce the stress associated with currency volatility.

Some natural hedging opportunities may present themselves, but also think carefully about when you want to take a more proactive approach.

Whether you opt for more of a DIY service to keep costs to an absolute minimum, or pay a bit extra for a managed service, the costs you incur through these providers can be dwarfed by the cost of significant currency swings if you do nothing.

There’s only one provider out there that offers absolutely all of the aforementioned services in this guide.

That’s HSBC Expat.

If safety and convenience are your thing then you can’t get much safer than HSBC, and they provide a one-stop shop for multi-currency accounts, international investing and currency hedging.

Just keep in mind, you’ll need to deposit £15,000 to open an account with them.

Plus, they’re also more expensive than if you were to use a combination of fintech multi-currency accounts from Wise, a trading app like eToro, and a currency broker such as Currencies Direct.

With any of these services, there are no minimum eligibility requirements, you’re saving greatly versus using a bank, and you’re still receiving a top-notch service.

Revolut is worth cosidering too. They provide a somewhat universal solution for international currency needs. FX transaction fees are low, they have a multi-currency account, and it’s possible to trade around 2,000 different stocks.

-min.webp)